Intraday Market Thoughts Archives

Displaying results for week of Jun 28, 2015Dollar Damaged on Jobs Report

The US dollar headed toward an Independence Day long weekend on a sour note after a disappointing jobs report. Payrolls were just shy of the consensus at 223K but soft wage growth, labor force participation and large negative revisions to the two previous months hurt the dollar.

USD/JPY touched a session high at 123.70 just before the data but plunged down to 123.00 afterwards. Other crosses were more resilient at first but they also began to bleed lower after factory orders contracted 1.0% compared to -0.5% expected. Compounding that soft report was a revision to core durable goods orders to -0.4% from +0.4%.

EUR/USD climbed to 1.1110 from 1.1080 and the Canadian dollar and kiwi rebounded after two days of declines.

Overall, the case for a Fed hike in September is slipping but what happens in Greece will loom large on capital markets. The 'Yes' vote appears to be gaining momentum and that could put an end to Tsipras as PM, although he said if that's the vote, he will put the proposal to parliament.

The Asia-Pacific week wraps up with several notable releases but none bigger than Australian retail sales at 0130 GMT. The consensus is for a 0.5% gain in May after a flat reading in April.

That's followed by the Japan services PMI from Nikkei at 0135 GMT and the China services PMI from HSBC at 0145 GMT. Note that in the months ahead that release will be rebranded, along with the more-important manufacturing PMI.

The larger focus may be Chinese stocks once again and the Australian dollar may also be jarred by iron ore, which fell 6% on Thursday.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Change in Manufacturing Payrolls (JUN) | |||

| 4K | 6K | 7K | Jul 02 12:30 |

| Change in Nonfarm Payrolls (JUN) | |||

| 223K | 233K | 254K | Jul 02 12:30 |

| Change in Private Payrolls (JUN) | |||

| 223K | 225K | 250K | Jul 02 12:30 |

| Factory Orders (MAY) (m/m) | |||

| -1.0% | -0.5% | -0.7% | Jul 02 14:00 |

| Retail Sales (MAY) (m/m) | |||

| 0.5% | 0.0% | Jul 03 1:30 | |

| RBC PMI Manufacturing (JUN) | |||

| 51.3 | 49.8 | Jul 02 13:30 | |

| Markit Services PMI (JUN) | |||

| 51.5 | Jul 03 1:35 | ||

| PMI (JUN) | |||

| 53.8 | 53.5 | Jul 03 1:45 | |

The Dollar-Risk Trade

The US dollar once again demonstrated on Wednesday how interconnected it has growN with the general risk trade. The dollar was the top performer on the day while the Swiss franc lagged. Australian trade data is due later. We issue a new trade on GBPUSD with 3 supporting charts as the existing trade nears our stop.

FX correlations shift over time and sometimes even reverse. Throughout the crisis, the US dollar was the carry funding trade. Rates were at zero and the Fed pinning Treasury yields to the floor.

But the US economy has left the crisis and ECB printing has driven carry trades into funding with euros. The high-yielding commodity currencies are also damaged with the RBA, BOC and RBNZ cutting rates. The dollar also benefits from good news anywhere now as it nudges the Fed towards hiking.

On Wednesday, ADP employment rose 237K compared to 218K expected and the ISM manufacturing report slightly beat expectations. That helped send USD/JPY to 123.21 and the US dollar about a cent higher right across the board.

The Greece story is adding to general market optimism because it's looking like Tsipras overplayed his hand. Referendum polls are showing his 'No' vote trailing or very close. EU finance ministers are now betting that he loses the vote or abandons it and takes the deal. If so, risk trades (and the US dollar) could finish the week strongly.

Asia-Pacific traders will continue to focus on the rock-and-roll Chinese stock market but it will be briefly interrupted but Australian trade balance at 0130 GMT. The consensus is for a A$2.225m deficit. Also, don't forget that non-farm payrolls is coming up in US trading.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ADP Employment Change (JUN) | |||

| 237K | 218K | 203K | Jul 01 12:15 |

| ISM Manufacturing (JUN) | |||

| 53.5 | 53.2 | 52.8 | Jul 01 14:00 |

| ISM Prices Paid (JUN) | |||

| 49.5 | 51.0 | 49.5 | Jul 01 14:00 |

| Trade Balance (MAY) | |||

| -2,200M | -1,322M | Jul 02 1:30 | |

| Nonfarm Payrolls (JUN) | |||

| 230K | 280K | Jul 02 12:30 | |

Bund Yields See no Grexit

The Bunds-Euro relationship remains intact, as both continue to converge along the crucial trendline support since the April bottom. With yet another yields bounce off the support today, bunds are further eliminating Grexit scenario for now as does the single currency.

The initial rise in the euro and bund yields emerged upon PM Tsipras' announced counterproposal to creditors, expressing his acceptance of their conditions along 5 amendments on pensions, VAT, fiscal/structural measures and labour markets. But the euro rally was quickly eroded as soon as German finance minister Schauble and later Chancellor Merkel announced that any counterproposal from Tsipras were considered null as long as Sunday's scheduled referendum was not cancelled.

The “Yes” momentum in favour of creditors' proposals is reportedly on the rise in Greece, which would be fatal to Tsipras' position and political future. Despite the seeming change in public opinion, Germany insists that Tsipras halts the referendum, sensing that it is gaining increased leverage over Syriza's position.

Scrapping Sunday's referendum promises to be an explosive catalyst for bund yields & the euro, since it is a German pre-condition for any negotiations to continue. The speech from Tsipras moments ago re-iterating his stance in favour of holding a referendum dealt a fresh blow to global stocks. As we face further developments/retractions ahead, it's important to keep the above relationship in mind.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone PPI (MAY) (m/m) | |||

| 0.1% | 0.2% | Jul 02 9:00 | |

| Eurozone PPI (MAY) (y/y) | |||

| -2.0% | -2.3% | Jul 02 9:00 | |

Is Canada in Recession Already?

The Greek drama continues but we change gears today and take a closer look at the Canadian dollar after a soft GDP report. We also look at the quarter and Japanese Tankan report due later. On Tuesday, the Aussie was the top performer while its kiwi cousin lagged. A new EUR trade was added to the Premium Insights, with 3 charts supporting the technical case. Our long AUDNZD from 1.1100 is 280 pips in the green and nears its final target.

The market moving news on Tuesday was Canadian GDP. It's April data so it's a bit stale but that didn't stop a more than 120 pip move in the loonie. Growth contracted 0.1% compared to +0.1% expected. That left year-over-year growth at 1.2% compared to 1.5% expected.

USD/CAD was trading at 1.2360 and finished the day at 1.2485, despite a 1% rally in oil prices. The pair closed at the highest since June 3. The move may be overdone given the lag in the data, quarter-end and other flows because Wednesday is a holiday in Canada but worries in Canada are mounting.

The Canadian economy contracted at a 0.6% annualized pace in Q1 and contracting growth in the first month of Q2 raises the chance of a probability and, by extension, a Bank of Canada rate cut. The OIS market went form pricing a 25% chance of a cut by year-end to a 60% likelihood.

BOC Gov Poloz's defining characteristic in the past few months has been optimism about growth but his defining trait throughout his tenure has been the ability to change his mind when he's wrong, sometimes quickly. There isn't enough evidence yet but if Canadian numbers continue to disappoint and oil begins to slide, the loonie could easily be the worst performer in Q3.

Looking at Q2, the pound was the top G10 currency after election nerves were soothed and economic data was strong. The kiwi was the worst performer on the heels of a surprise rate cut. In stock markets, China was tops but the volatility has been extraordinary. The average trading range so far this week is 11%.

Another market that performed well was Japan. That was partially on a weak currency but the economy has also been solid. Today features a critical look at what's next with the Q2 Tankan at 2350 GMT. The large manufacturing index is expected steady at 12 with the outlook improving to 14 from 10. Another spot to watch is the All Large Industry CAPEX metric; it's expected to rise 5.3% in a critical sign of investment from Japanese companies.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (APR) (m/m) | |||

| -0.1% | 0.1% | -0.2% | Jun 30 12:30 |

| GDP (APR) (y/y) | |||

| 1.2% | 1.5% | 1.5% | Jun 30 12:30 |

| AIG Performance of Manufacturing (JUN) | |||

| 52.3 | Jun 30 23:30 | ||

| Tankan Large Manufacturing Index (Q2) | |||

| 12 | 12 | Jun 30 23:50 | |

| Tankan Large Manufacturing Outlook (Q2) | |||

| 12 | 10 | Jun 30 23:50 | |

| Tankan Non - Manufacturing Index (Q2) | |||

| 22 | 19 | Jun 30 23:50 | |

| Tankan Non - Manufacturing Outlook (Q2) | |||

| 23 | 17 | Jun 30 23:50 | |

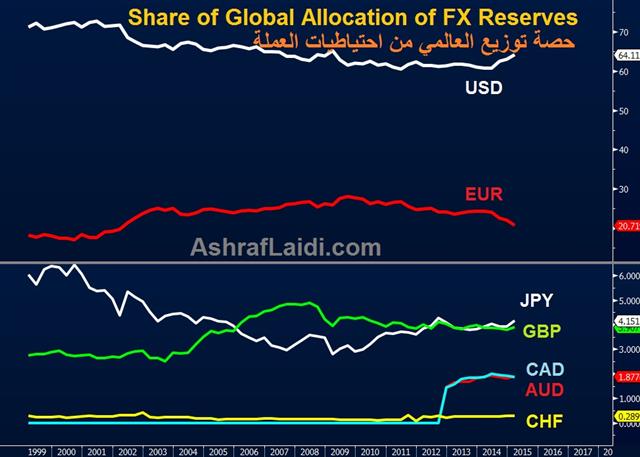

Euro's Falling Share of Reserve Allocation

The IMF's latest quarterly FX reserves figures show central banks' euro share of global official currency reserves fell to 22.1% of total official reserve allocation in Q1, the lowest level since 2002. The US dollar's share of disclosed currency holdings rose to 64.1%, the highest since March 2009, which is the peak of the USD's rise during the global financial crisis.

The IMF notes these figures are a reflection of “allocated” reserves, defined as those identified by central banks as their specified currency holdings. There is no disclosure from the People's Bank of China –-the world's biggest holder of FX reserves, nor on the Chinese yuan.

The Role of Valuation

Notably, central bank allocation of foreign exchange reserves is largely determined by the overall change in the value of a currency, which explains the rise in USD allocation from Q3 2014 occurring simultaneously with the gain in the USD bull market during the same period. Similarly, the euro's fall accelerated in mid Q1, which occurred parallel to the decline in reported euro allocation.This also explains the rise in allocation to the Aussie and Canadian dollar in late of 2012-early 2013, in line with the rally in these commodity currencies following the Federal Reserve's renewal of QE.

Allocation to both GBP and JPY remain similar at about 4% of reported allocation. Interestingly, the rise in JPY allocation occurred despite the Bank of Japan's increase of its monthly asset purchases in October 2014. This phenomenon goes in line with the yen's appreciation of recent days during the Greece-triggered losses in global equities, which continues to emerge as a result of unwinding of the oldest carry trade in the FX market.

Euro Reversal a Powerful Signal

A rout in the euro turned into a rally in an impressive reversal Monday. Global stocks were beaten up as the yen led the way and loonie lagged. Japanese housing and wage inflation data is due later but the focus will remain on Chinese stocks. Despite the initial plunge in the euro, the currency closed Monday about 40 pips above Friday's close. 4 of the Premium trades are in progress, including EURCAD. EURJPY was stopped out, before returning to the initial entry level.

The euro reaction to bad news on Greece over the past month has been tough to reconcile. We highlighted skews in bunds and carry trades that made it a tricky trade. The price action on Monday confirmed it.

A nearly 200 pip gap down at the open in EUR/USD was filled and that was followed by a squeeze to 1.1270. The chart is daunting and shows an enormous bullish engulfing candle. It may finally set the stage for a breakout above 1.1450 but most traders are rightfully gunshy of the euro at the moment.

The more straight-forward trade has been in the yen as risk aversion dominates. Stocks in Europe fell 3-5% and the S&P 500 fell 2.1% to wipe out the year-to-date gain. The yen remained well-bid throughout the day and the close in USD/JPY was the lowest in a month. With US and Chinese stocks breaking down, along with continued uncertainty in Greece, the yen may continue to find bids as a safe harbor.

Looking ahead, the Japanese labor cash earnings report is expected to show a 0.7% y/y rise in May. It's due at 0130 GMT and followed by housing starts at 0500 GMT. The pace of home construction is expected to rise to 0.915m from 0.913m.

The Japanese data will probably have little effect on markets. Instead, the focus will be China where shares fell 3.3% Monday after an initial 2.7% rally at the start of the day. The drop broke below the May lows and will no-doubt concern the PBOC.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Labor Cash Earnings (MAY) (y/y) | |||

| 0.7% | 0.7% | Jun 30 1:30 | |

| Housing Starts (MAY) | |||

| 0.913M | Jun 30 5:00 | ||

| Housing Starts (MAY) (y/y) | |||

| 5.8% | 0.4% | Jun 30 5:00 | |

عودة اليورو بعد الضجيج والمخاوف

الاحتمالات أن الشعب اليوناني سيرفض المقترحات الدائنين في استفتاء يوم الاحد عن طريق "لا" تعني أن اليونان ستأخذ خطوة أقرب نحو الخروج من اليورو. قد لا يزال البنك المركزي الأوروبي الحفظ على مساعدات طارئة للبنوك اليونانية.

أتوقع أن النقد الدولي / الاتحاد الاوروبي / البنك المركزي الأوروبي سوف يصلون إلى حل أوسط يجمع بين التسوية السياسية والاقتصادية تجاه اليونان.

أما في حالة التصويت ب "نعم"، فإننا نتوقع سيناريوهين: 1) تنحي رئيس الوزراء اليوناني تسيبراس ، أو؛ 2) سيبقى تسيبراس في السلطة ويُجبرعلى قبول مطالب الدائنين. ومن المثير للاهتمام، في حالة "نعم"، من المحتمل الشعب اليوناني قد لا يزال يريد بقاء تسيبراس في السلطة.و إذا غادر تسيبراس المسرح، فمن الممكن أن النواب الغير متطرفين في حزب سيريزا أن ينضمو مع نواب من حزب باسوك, بوتامي أو الدمقراطية الجديدة لتشكيل ائتلاف سياسي. يُعتبرهذا السيناريو أكثر مساندتآ لمتطلبات الدائنين مما سيُؤدي الى دفعة هائلة في العملة الموحدة.

و الرسم البياني يؤكد أن ما زالت العلاقة قائمة بين إرتفاع اليورو، الدعم في عوائد السندات الألمانية و الهبوط في مؤشر الداكس على الرغم من "ضجيج" الساعات ال 10 الأخيرة. و لإستيعاب العلاقة افضل, الرجاء مشاهدة هذه المقابلة.

Click To Enlarge

Euro Plunges, Greece Into The Abyss

Greece called a referendum and the ECB pulled the plug on emergency funding in a dramatic weekend. EUR/JPY is nearly 400 pips lower as risk aversion grips markets in what will be a historic week. CFTC positioning data showed fresh US dollar buying. The Premium EURJPY short was stopped out, while the remaining 4 trades remain in progress.

It's fireworks at the open as EUR/USD falls 185 pips to 1.0980 in thin, early trading. The yen is massively bid across the board.

Greece called a referendum for July 5 on the bailout proposal but the deadline to pay the IMF is June 30. After the snap referendum, the Troika opted not to extend bailout operations, including the ELA. Capping that program at current levels means it will be very tough for Greek banks to get cash and they will be closed on Monday. The Greek stock market will also be closed Monday and it could remain that way all week.

What next? These is no easy way out. Even if the public votes to accept the bailout extension terms, it's not even clear they're still on the table. If the deal is rejected, it will solidify the Greek default and assure an extended period of capital controls.

The week ahead features a raft of top-tier economic data but suddenly the most important news of all will be referendum polls. Volatility will be extremely high and sentiment shifts will be rapid.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -99K vs -89K prior JPY -88K vs -80K prior GBP -22K vs -25K prior AUD -9K vs -4K prior CAD -18K vs -12K prior CHF +7K vs +5K prior

The market dipped into US dollar longs after the dust cleared from the Fed. The euro short trade isn't as crowded as it was a month ago, but it will be in next week's data.