Intraday Market Thoughts Archives

Displaying results for week of Jan 22, 2017Lala Land FX Assumptions

The notion that Trump's planned protectionist measures (tariffs and border adjustment tax) will be USD-positive is founded on an unrealistic world –where Mexico, China and other US trading partners would just sit back and watch without any retaliatory action. We're not in the 1980s or 1990s when US trading partners operated in a closed world, unaccountable to any world free trade bodies.

Regarding the chart below: Yes, there were other factors driving the USD in the mid 1980s and early 2002 aside from protectionism. But US trade actions are no longer going unanswered. The most recent example was W Bush having to reverse the 2001 steel tariffs after the EU threatened to target Florida's orange juice and Detroit's autos.

Imagine what the Chinese could do.

Historical reminder: Since the 1990s, currency traders have consistently sold off the US dollar at each occasion the US adopted protectionist measures (Reagan vs Japan in 83-84 and Bush Jr with foreign steel).

Parallels with February 2002

It is no surprise that George W. Bush's war declaration on foreign steel in late 2001 aimed at saving the bankrupt Rust Belt in order to boost his Mid-Term election chances coincided with the peak of the USD bull market in February 2002. By the time the WTO fined the US $2 bn in sanctions, the US dollar had lost 12%, before falling into a 7-year bear market.Next Week: All about the Fed Statement & US Dollar

Considering warnings about USD strength by Trump and Mnuchin, any mention of the USD impact on growth and inflation in next week's FOMC statement could cap the USD's rise and reignite speculation about the end of the strong USD policy.Import Tax Confusion

The surprise of the first working week of Trump's administration was how smooth it went, which was reflected in a record high in stocks, but a Thursday fumble could give the market second thoughts. The dollar played some catch up on the day to lead the way while the yen lagged. Japanese CPI is due up next. The Dow short was stopped out and 4 trades remain in progress (3 in FX and 1 in an index).

The bar for Trump's team was low coming into the week. The spat over inauguration crowd sizes was a poor start but after meetings with executives and market-friendly executive orders, it seemed as though Trump was on his way to fulfilling some of the hopes markets had placed in him since election night.

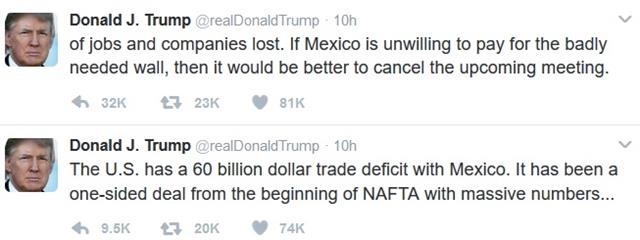

We wrote earlier in the week that the early part of his Presidency will be all about evaluating how well he can stay on message and how smoothly things can run. The early returns were good but it started to unravel on Thursday as the White House team floated an idea about a 20% tax on Mexican imports to pay for the border wall as part of comprehensive tax reform. It didn;t add up. With more than $300 billion in annual imports from Mexico a tariff would generate far more than the cost of a wall. It was compounded by the White House saying Trump favored a 20% import tax on every country in what would be an extreme protectionist policy.

Hours later, Republicans walked back the suggestion, saying it was one of just a buffet of ideas. The process of floating ideas then adjusting, backtracking or changing them was a hallmark of Trump's campaign but it's a reckless way to govern.

Ultimately, the market has shown it will give Trump plenty of rope but fumbles like this will erode market confidence, especially if they're on policies that would crush trade.

Otherwise US trading wasn't overly volatile. New home sales and initial jobless claims were weak but the Markit services PMI and wholesale inventories were high. The latter probably adds 0.2 pp to Friday's advance US GDP reading and some upside risk into Friday USD trading.

Before that comes the December Japanese CPI reading. The 0.2% y/y rise expected will be slower than 0.5% in November and will serve as a reminder that the BOJ remains far from its goals.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Tokyo Core CPI (y/y) | |||

| -0.3% | -0.4% | -0.6% | Jan 26 23:30 |

| BoJ Core CPI (y/y) | |||

| 0.1% | 0.2% | Jan 27 5:00 | |

| New Home Sales | |||

| 536K | 585K | 598K | Jan 26 15:00 |

| Flash Services PMI | |||

| 55.1 | 54.4 | 53.9 | Jan 26 14:45 |

| Advance GDP (q/q) [P] | |||

| 2.1% | 3.5% | Jan 27 13:30 | |

| Unemployment Claims | |||

| 259K | 247K | 237K | Jan 26 13:30 |

Dollar Horse Left Out

The three market horsemen of the Trump election win were rising stocks, rising yields and a rising US dollar but suddenly USD is left out; we look at why. The pound was the top performer Wednesday while the Australian dollar lagged. New Zealand is in focus with CPI out and Wheeler to speak; Australia is closed for holiday. GBPJPY was once again stopped out, leaving 5 Premium trades in progress. We are carefully watching the latest 2 days in gold and silver before a new trade is released.

The market is gaining confidence in Donald Trump's agenda but it isn't materializing into US dollar strength. The S&P 500 hit a record high for a second consecutive day in an 18 point rally to 2298. The Dow also finally broke 20,000. In the bond market, the 10-year yield rose 5 bps to 2.51% after a weak 5-year auction.

That's the sort of recipe that would normally give the US dollar a boost but it was just the opposite. USD/JPY fell a half-cent on the day, while the pound and loonie each gained about a cent against the dollar.

Part of the reason is that US yields haven't risen in a vacuum. Global yields are moving higher with most benchmark yields near the highest in a year. Markets suddenly believe that a new, higher combination of inflation and growth is near. That's mostly based on hope and expectations of government spending because signs in the data are still scant.

What's curious is that the US is undoubtedly on the front end of that trend. The Fed is already in a hiking cycle and fiscal spending in some form is coming. So the dollar should be climbing.

The reason the dollar might be struggling ties back to yesterday's IMT: International confidence. Parts of the market are warming up to Trump but the past two days of S&P 500 gains were on low volume. There is a disbelief in Trump, if not a disgust/exhaustion from international investors. In separate comments on immigration Wednesday he pledged to build a wall and to halt arrivals from parts of the Middle East. At the end of the day, likeability is still a factor.

What we don't want to miss is the short-term upside. Protectionism and wasteful spending are long-term drags but in the short term Trump has some powerful tools to boost growth at home. That's a dollar positive. So while the market is in denial in the short-term, higher rates, stocks and growth will eventually filter through.

At the same time, we remain watchful of data, especially inflation. New Zealand released Q4 numbers early in Asia and the showed a 0.4% q/q price rise compared to 0.3% expected.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.5% | 0.7% | 0.7% | Jan 25 0:30 |

| CPI (q/q) | |||

| 0.4% | 0.3% | 0.3% | Jan 25 21:45 |

Talk and Technicals

Fundamentals and central bankers matter less than ever in the day to day of the markets. They will dominate again in the future but for now, something else is driving markets. The Canadian dollar was the top performer on Tuesday while the yen lagged. Australian CPI is due up next.

كيفية اقتراب صفقات الدولار و اليورو، و الين و الاسترليني (فيديو للمشتركين فقط)

It's mostly about politics now. The ebb and flow of Trump and Brexit are driving the day-to-day and intraday moves. It's a tricky trade because it's not necessarily about the headlines like it was with Grexit. It's more about the sentiment and confidence.

Market currently are trying to figure out if Trump can govern effectively, or at least without any mishaps. The first weekend of the administration was a bit of a mess but the past two days have been gaffe free with some positive highlights. It shined through Tuesday with the S&P 500 hitting a record high and USD/JPY getting back on track.

In Britain, it's a different paradigm but the market wanted to see that May had a plan. Her speech last week showed she was willing to use taxes as leverage and today the Supreme Court didn't throw up any roadblocks.

That takes us back to trading. Alone, it's very tough to trade on political sentiment because it's not headline driven in the same way as data or central bank speeches. Instead it's an ebb and flow that shifts with perception and in more gradual market moves.

That's why combining it with technicals is critical at the moment. There is no data-driven confirmation, it's all in the charts, breakouts and consolidations. Cable is showing some positive signs and the Australian dollar is in that sweet spot where it's not too hot or volatile.

That said, we won't take our eye off of fundamentals either because, ultimately, that will guide markets in the longer term. Up next is the 0030 GMT report on Australian CPI. The market hasn't heard much from Australia so far this year as the southern hemisphere enjoys Summer. The weak jobs report was brushed off but inflation could have a more lasting impact. The consensus is for a 0.7% q/q rise and 1.6% y/y. Watch the trimmed mean, which is expected up 1.6% y/y.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.7% | 0.7% | Jan 25 0:30 | |

Mnuchin Knocks Dollar, Supreme Decision

The US dollar slipped Monday and then sank late after the new Treasury Secretary warned about an excessively strong currency. The pound will be in focus on Tuesday as the Supreme Court delivers a verdict on Brexit. The yen was the top performer on Monday as risk aversion climbed. A new GBP trade has been issued ahead of Tuesday's UK Supreme Court decision. The video for Premium subscribers will be made available at the London Tuesday open.

The US dollar unwound a large part of its gains from late last week as the market raised an eyebrow at some early comments about the administration. The market is clearly focused on finding out how the rhetoric will turn into action.

Trump met with CEOs and called for a huge tax cut but that only led to a momentary rise in USD/JPY to 114.00 from 113.50. It was erased in the following hour and the pair finished at 113.00 before falling once again early in Asian trading after Mnuchin wrote that the dollar was excessively strong and may be an economic negative in the short-term in a letter to Congress. It's premature to speculate on his next moves but the 'excessively strong' language and specifically mentioning the 'short-term' is the kind of language that leaders use when the want to intervene. USD/JPY slumped to 112.45 on the comment.

On that front, the White House wasn't directly asked about labelling China and FX manipulator in the first press briefing but they did say Trump intended to follow through on his Contract with the American Voter, which is where he made the pledge.

The near-term risks kin the FX are political but overseas. The UK Supreme Court is set to rule on whether parliament gets a say in triggering Article 50. The speculation is that they will force a vote but it's tough to say exactly what's priced in. Last week's Brexit speech didn't offer any kind of gamechanger for GBP but it sparked a rally that's extended 500 pips. That's certainly putting a squeeze on shorts and the Supreme Court could add to it.

Why the market might not be all that concerned is because parliament is expected to bow to the will of the referendum anyway. To ignore it would be a political minefield. If the Supreme Court does force a vote, watch for comments from May's government and expect relatively quick action.

Looking to Asia-Pacific trading, the main item on the agenda is the Nikkei Japanese PMI at 0030 GMT. The prior reading was 52.4.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Flash Manufacturing PMI | |||

| 54.6 | 54.3 | Jan 24 14:45 | |

| Flash PMI Manufacturing | |||

| 52.3 | 52.4 | Jan 24 0:30 | |

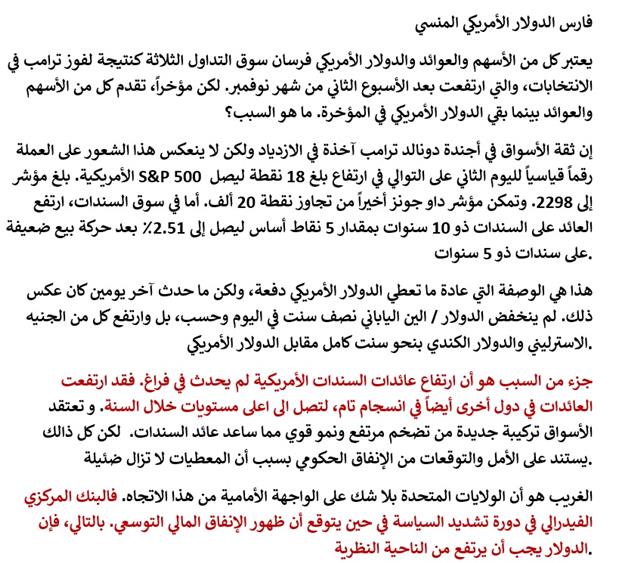

New Gravestone Doji

The chart below shows the start of what could be a massive bearish gravestone doji on the monthly timeframe. The month ends Tuesday of next week, which is one day before the FOMC decision. The last time there was a gravestone doji on this monthly chart, the index went on to lose more than 2.5% before stabilizing in December. Interestingly, the dynamics in the price action as well as the stochastics are increasingly similar to October. A short has already been posted and issued last week to Premium subscribers. Separately, the 2nd leg of the EURUSD has been triggered after the long hit its final target for 155 pips.

أشرف العايدي على قناة العربية

الأحداث الحاسمة لهذا الأسبوع

The Rules are Changing

The temptation in a time of change is to hang on to the old rules and beliefs. A few days into the Trump era, it's abundantly clear that the rules of politics have changed and we can't rule out that the rules of markets and trading will change too. A new GBP Premium trade has been posted and issued, involving a quadruple technical confluence.

There is no pivot. Trump isn't going to act differently as President than he did during the campaign. In his first two days of office, his spokesman made the bizarre claim that crowds were larger at his inauguration than Obama's and he followed that up by saying his well-documented feud with the intelligence community was made up by the media.

Many world leaders have tried to re-write the rulebook and some have succeeded. In some ways Trump is sure to change the conversation and he is definitely not afraid of shaking things up. Aside from the obvious consequences, like volatility, we have to keep an open mind on how to trade his Presidency. The temptation is to focus only on legislation but his communication and diplomatic tactics are undoubtedly part of the story.

International markets will never sideline Trump or punish America like they have to the Turkish lira under Erdogan. America plays by a different set of rules and it's increasingly clear Trump will push the limits but we won't know if he's gone too far.

Taking a closer look at markets, the pound was the top performer last week while CAD lagged. Theresa May will meet with Trump on Friday in what will be a week dominated by politics.

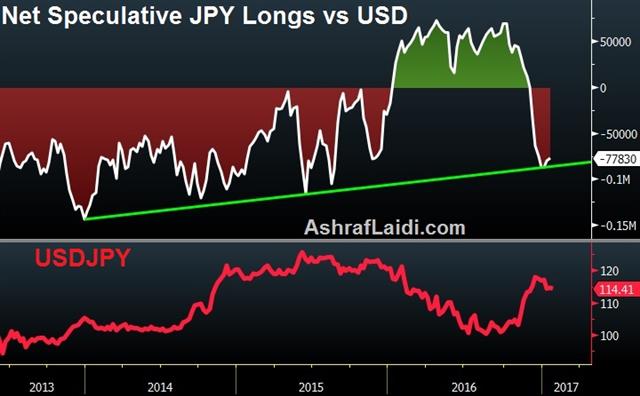

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -67K vs -66K prior JPY -78K vs -80K prior GBP -66K vs -66K prior CHF -14K vs -14K prior AUD -5K vs -2K prior CAD -5K vs -8K prior NZD -12K vs -14K prior

The weekly moves in positioning were minimal as the market takes a cautious approach to change in the White House. Expect rising volatility to spark larger moves in the coming weeks.