Intraday Market Thoughts Archives

Displaying results for week of Nov 26, 2017CAD Data & Senate Vote Next

Four days of gains leaves USD/CAD a handful of pips away from the July highs in a potential breakout with major economic data to come. Sterling was the top performer once again while the New Zealand dollar lagged. Crucial CAD figures are due at 8:30 ET, 13:30 London -- Canada Nov jobs report and Canada's Sep GDP figures. US manuf ISM folows 90 mins later. The Premium FTSE100 short was closed at 7290 for 210 pts.

USD/CAD touched 1.2909 on Thursday, just below the October high of 1.2917. That will be a critical level to watch in the day ahead with Canada releasing the first look at Q3 GDP and November employment. A slight bit of good news for the GDP report on Thursday as the current account deficit for Q3 was about $0.65B below the $20B expected, despite being the third-worst report on record, in large part due to a CAD-driven drop in exports in Q3. The imbalance represented 36 straight quarters of current account deficits in a reminder of the long-term headwinds for Canada and the loonie.

In the US, the Senate hopes to pass the tax bill today as Republicans find difficulty in keeping the number of their Naysayers at no more than 2. The Fed's Mester and Kaplan both said they don't expect it to add to growth but offshore flows returning home could be USD-positive.

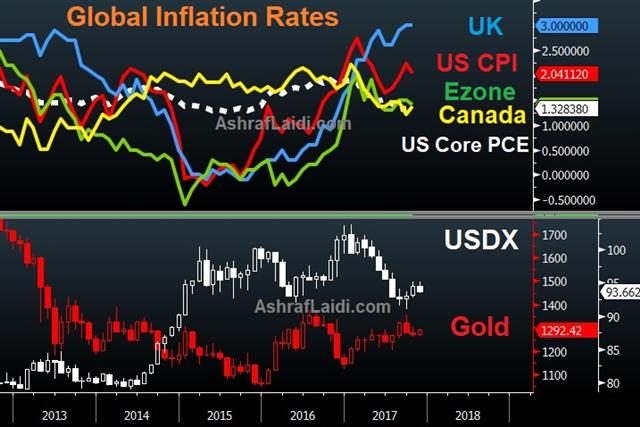

The dollar was volatile on the day, dropping early and then storming back as the 10-year Treasury yield climbed above 2.40%. The PCE report was a touch high on overall inflation but in-line on core. Personal income improved more than expected but spending was light.

In other news, OPEC extended production curbs through 2018. The nine-month extension was generally expected. Libya and Nigeria also agreed to cap production at 2017 maximums. The crude market was choppy on the headlines but finished flat on the day.

Looking ahead,

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Current Account | |||

| -19.3B | -20.0B | -15.6B | Nov 30 13:30 |

فيديو الاسترليني مقابل الاميركي و النيوزلندي

هل سيتم تمرير قانون الاصلاح الضريبي من مجلس الشيوخ ؟ وكيف ستكون ردة فعل الورقة الخضراء ؟ هل يواصل الجنيه #الأسترليني رحلة الصعود , و ماذا عن فاتورة الخروج البريطاني ؟ الفيديو الكامل

From Eurozone CPI to US PCE

Aside from the news of Bitcoin rocketing to $11,434 before plunging back to $9007, markets are focusing on GBP's prolonged gains, boosted by talk of an pending deal on the Brexit bill and resolution on the Irish border. Markets turn next to US October core PCE index, the Fed's favourite inflation gauge, expected +1.4% from 1.3%. Earlier, Eurozone preliminary Nov CPI rose to 1.5% from 1.4%, undershooting expectations of 1.6%. The Premium Insights service took 150-pip gain in GBPUSD. A new trade will be posted before start of the US opening bell.

Bitcoin was gripped by the FOMO phase over the past month and that led to an incredible run that attracted more and more buying. It continued through $10,000 on Wednesday until a wave of profit taking turned into a 20% correction over the course of a few hours. Later, it rebounded to $10,200 but some exchanges were having difficulty.

The volatility created a massive indecisive candle on the chart and that could be a warning sign. However, all the attention and volatility hasn't been a negative up to this point so it's no reason to expect a drop just yet.

In financial markets, the main story on the day was a rise in global bond yields. German and US 10-year yields rose 5-6 bps and that was a reason to buy yen crosses. USD/JPY rebounded for the second day and hit 112.00. The gains came after some upbeat comments from Fed Chair Yellen. She said growth was becoming more broad based. The second look at Q3 GDP was also revised to +3.3% from +3.2% in part due to strong business investment.

The most-solid trend at the moment in FX is sterling's climb. It's risen in 10 of the past 12 sessions and is trading at the best since Oct 2. Ashraf pointed out in the video that the 7 consecutive daily gains were the longest string of advances since April 2015. Signs of progress on Brexit negotiations continue to mount and that's helping the pound to rebound from depressed levels.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone CPI Flash Estimate (y/y) | |||

| 1.5% | 1.6% | 1.4% | Nov 30 10:00 |

| Prelim GDP (q/q) [P] | |||

| 3.3% | 3.3% | 3.0% | Nov 29 13:30 |

ماذا يعني 1.38 للجنيه الإسترليني؟

هل سيتعافى الجنيه الإسترليني فوق مستوى 1.50 دولار أمريكي في العام المقبل أم أن ديناميكية بريكسيت تجبر العملة مرة أخرى تحت 1.20 دولار أمريكي؟ في هذه القطعة، سأركز على القوى الفنية التي تشكل زوج الجنيه الإسترليني مقابل الدولار الأمريكي التحليل الكامل

The Meaning of 1.38

After crashing last year to $1.1840, a 31-year low (some prices suggest $1.1500), GBP is now up by 12%. The pound is the only currency in G10 FX to rise against the US dollar over the past 3 months. Will the pound recover above the $1.50 level next year? Full analysis here.

ندوة مساء اليوم مع اشرف العايدي

قدرة دمج التحليل الأساسي ليتوافق مع التحليل الفني و مخططات الرسم البياني محور ندوتنا الإلكترونية القادمة قبل أسبوعين من موعد صدور قرارات الاحتياطي الفيدرالي و المركزي الاوروبي احجز مقعدك

Cable Has a Catalyst

Separate reports suggested UK PM Theresa May's government is close to a breakthrough on negotiations around the Brexit bill. Cable jumped on the headlines and was the top performer on the day while the euro lagged. Japanese retail sales are due up next. 2nd EURUSD trade has been issued. Tomorrow marks Janet Yellen's final testimony to Congress' joint economic committee. The video for Premium subscribers is posted below, highlighting the existing and future trades.

It was a lively day of trading that included heavy newsflow. The pound suffered early and cable was down more than a cent when a Telegraph report said a deal was largely done that would put the exit bill at 45-55B euros. Cable jumped more than 120 pips then fell back down when a government spokesman denied it. A second report, this time from the FT, added more detail, indicating the deal could be part of a broader deal on the Ireland border and EU citizen's rights. That sent cable near 1.3400 from as low as 1.3220 on the day.

More importantly, it's a fresh catalyst for cable. If confirmed, it's a sign that negotiations are bearing fruit and progressing towards some sort of a deal. At this point, nearly any kind of resolution or progress is good for sterling.

Across the Atlantic, the US dollar was buoyed by economic data as consumer confidence rose to the best level since 2000 and the Richmond Fed hit an all-time high. New home sales also beat expectations, but trade and inventory reports led to downgrades of Q4 growth estimates.

The tax plan also made progress but once again that buoyed stock markets while leaving the US dollar behind. The S&P 500 surged 26 points to a record 2627.

In geopolitical news, North Korea tested a missile but the dip was merely a buying opportunity in USD/JPY and stock markets.

Amidst all that, Fed chair nominee Powell was grilled in his confirmation hearing but most of the time was eaten up trying to score political points on the tax plan. On monetary policy, he did his best Yellen impression and said gradual rate hikes was the best path forward. At the same time, he struck a few dovish notes by warning on low wage inflation and some signs of slack.

Looking ahead, we will continue to monitor the North Korea fallout but also watch for retail sales from Japan at 2350 GMT. The consensus is for a +0.2% m/m rise after a 0.8% m/m jump in Sept. Comments from the BOJ's Nakaso are also due at 0700 GMT.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (y/y) | |||

| 0.1% | 2.3% | Nov 28 23:50 | |

| Fed Chair Yellen Testifies | |||

| Nov 29 15:00 | |||

| Richmond Manufacturing Index | |||

| 30 | 14 | 12 | Nov 28 14:59 |

| CB Consumer Confidence | |||

| 129.5 | 123.9 | 126.2 | Nov 28 15:00 |

Powell Expects Further Hikes

The Fed's Powell hinted at a continuation of Yellen-era gradual rate hikes in the text of his confirmation statement. Trump lifted the USD via a tweet, expressing his optimism on a tax deal in Congress. The yen and kiwi were the top performers while the Canadian dollar lagged. More Fedspeak is due in the hours ahead. A new USD trade was issued for Premium subscribers. DOW short was stopped out, leaving one index trade in progress and in the green.

تداول التصحيح الإيجابي (فيديو للمشتركين فقط)

Powell faces questions on Wednesday from Senators on his economic and regulator leanings as part of his confirmation process. His opening statement was released late Tuesday and said he expects interest rates to rise 'somewhat further.' He also hinted at lightening the regulatory burden facing banks while maintaining the core reforms. For the most part, the published comments were the usual platitudes about independence and the dual mandate.

The big question is how the Fed will proceed in the months ahead if inflation moves up only slowly. A hike in December is seen as a slam dunk but March and beyond will depend on progress in the economy and inflation. What remains a mystery is the where the Fed's minimal inflation threshold lies and if there is eventually a point where they will hit the pause button until prices near 2% growth.

Dallas Fed President Kaplan hinted at growing confidence and hawkishness. He said he was beginning to worry about an overheating jobs market and signaled that gradual hikes are likely necessary. He isn't a voter next year but is generally a good barometer for the core of the FOMC.

One issue the Fed may have to confront in the years ahead is housing. New home sales in October were at a 685K annual pace compared to 625K expected. It was the second month in a row of strong numbers.

In terms of market moves, the US dollar bounced to start the week but only recovered a small portion of last week's drop. The yen remained red hot and was boosted in part on a report that North Korea is preparing another missile launch.

The Asia-Pacific calendar is light in the day ahead but Chinese stock markets are increasingly in focus. The Shanghai Composite fell 0.9% to start the week and is at the lowest since August on signs the government will tighten liquidity.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +95K vs +84K prior GBP -1vs -4K prior JPY -123K vs -147K prior CHF -30K vs -28K prior CAD +45K vs +47K prior AUD +40K vs +44K prior NZD -14K vs -12K prior

The extreme yen short was trimmed but still remains in a highly vulnerable spot given the steady declines in USD/JPY and yen crosses. A washout could come any time.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed Chair Designate Powell Speaks | |||

| Nov 28 14:45 | |||

| FOMC's Harker Speaks | |||

| Nov 28 15:15 | |||

| Treasury Sec Mnuchin Speaks | |||

| Nov 28 20:45 | |||

| New Home Sales | |||

| 685K | 627K | 645K | Nov 27 15:00 |