Intraday Market Thoughts Archives

Displaying results for week of Mar 12, 2017The Big Turn

Reversing a trade like EUR/USD is like turning an ocean liner – it's a slow process. Positive signals continue to trickle in as the euro was one of the top performer along with GBP and EUR on Thursday while the kiwi lagged. The Asia-Pacific calendar is light but expect many comments from finance ministers in the day ahead with the G20 meetings ramping up. A new Premium trade has been added, backed by 3 charts and 6 factors and is considered a partial hedge to Wednesday's trade a synthetic product for a key emerging FX development.

The second day of March madness in financial markets was all about the Bank of England. Forbes delivered a surprise by voting for a rate hike and that gave the pound a lift. In an op-ed, she said Brexit uncertainty has held down wages and that inflation is coming.

But the ECB's Nowotny managed to get our attention. Praet said the outlook is now better than it has been in many years and Nowotny said a rate increase may be on the way. He also said the deposit rate/refi rate corridor could narrow.

In addition, the Dutch election results argue that populism is on the wane and French polls have been steady. Perhaps the most impressive development was the euro's resilience in early March,with EUR/USD gaining despite the concerted hawkishness from Fed talk 3 weeks ago as well as solid US data.

We will be watching the economic data closely in the weeks ahead but we don't see the comments from Nowotny and Praet as a coincidence. They are two of the most-experienced core members of the ECB and they aren't prone to comments that stray from Draghi's thinking.

An extended policy of easing has submarined the euro from 1.60 to 1.06 and even if there is no scope for a full retracement, some stability or a hawkish turn from the ECB could easily mean 1.15 or 1.20.

Another central bank that is overdue for a hawkish comment, or at least a less-dovish one, is the Bank of Japan. That didn't happen Thursday and Kuroda was defiant but the shift in global central banking tone is beginning to look like dominos falling and when the BOJ changes, yen crosses will have a long way to fall.

لماذا سقط الدولار بعد قرار الاحتياطي الفدرالي

Yellen Doesn’t Pre-Commit, More Vol to Come

Expectations for the Fed grew to downright frothy levels in the past two weeks. What had been a low probability of a hike turned into a certainty and talk of four hikes this year was suddenly in vogue. As we warned yesterday, that it's not in Yellen's nature to pre-commit. With this hike she waited until the day of the Fed blackout to tip her hand and it won't surprise us if that's a theme this year.

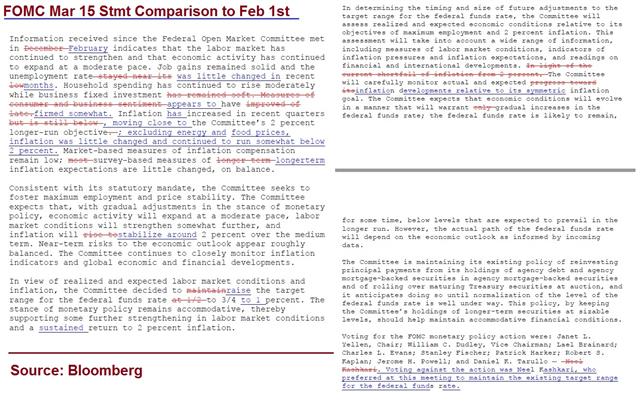

The statement was slightly more constructive and she was more upbeat on the economy in the press conference but it's clear that the FOMC wants to see a steady stream of good data. A June hike is now priced at roughly 50/50.

Technically, the big moves against the dollar highlighted how much of a struggle it's been. It wasn't able to get much traction despite the shift to price in hikes and now those moves have evaporated.

The euro climbed to the highest since February 6 on the Fed news but also on the Dutch election results. According to exit polls, Wilders finished in a three-way tie for second with 19 seats. That was shy of the 22 seats that were anticipated and well behind the Liberal Party with 31 seats. We're cognizant that exit polls were wrong in the US vote and Brexit vote but if confirmed, it may be a sign that populism is waning in Europe.

Up next, we look to New Zealand GDP numbers at 2145 GMT and Australian jobs at 0030 GMT. Both currencies made big gains against the US dollar Wednesday and positive data could send them much higher still.

After that we will look to the central bank decisions from the SNB, BOE and BOJ as the volatility continues.

حوار اشرف العايدي قبل الفدرالي

The Big Day

Market moves on Tuesday reflected some trepidation with so much on the upcoming schedule. The S&P 500 fell 8 points and the yen held a modest bid. The day ahead features the Dutch election, FOMC decision and data on US retail sales and CPI.

The underrated risk might be the US economic numbers. Retail sales have been one of the few soft spots so far in 2017 and anyone betting on 3 or 4 Fed hikes is betting on a pickup. The same goes for inflation, which is forecast to rise 2.2% y/y excluding food and energy.

The Fed decision itself is largely a non-event. They will hike rates but those data points could affect the statement and how Yellen communicates in the press conference. They may also raise concerns in the markets or solidify the excitement about a pickup in growth.

A clue may have come from Tuesday's PPI report. It showed prices up 0.3% m/m compared to 0.1% expected.

One of the focuses in the Fed decision will be the dot plot but it's tough to see how that could be a dollar tailwind. It already shows the median forecasting three hikes in 2017 and we struggle to see how enough members could change their view to push that to four rates rises. Along the same lines, Yellen may be more constructive but it's not in her nature to pre-commit to hikes. Remember that only two weeks ago the market was pricing in only a 35% chance of a rate rise this week.

The main euro risk will be the Dutch vote. Anti-EU populist candidate Wilders' party was leading at the start of the year but has faded. He's now expected to finish in second place with about 22 seats. Whether he does better or worse will drive sentiment on what happens next. All other parties have vowed not to work with him and it's inconceivable he would win the 76 seats needed for a majority. No matter what the outcome, it will be difficult for any party to cobble together a coalition.

But in the day ahead, the euro trade will be guided by Wilders' performance because it will be seen as a signal on which way the wind is blowing in Europe.

As we digest the fallout from those events, we'll be looking forward to the following day when it's New Zealand GDP, Australian jobs, the SNB, the BOE and the BOJ on the schedule.EUR/CHF & Pre-Fed Positioning

The Fed decision, Brexit, the G20, BOJ and Merkel are getting all the attention this week but the whippy moves in EUR/CHF point to Thursday's SNB decision as a main event. The pound is the worst performer so far today (since Monday's NY close) after having outperformed all curencies on Monday. A new video for Premium subscribers has been posted (below) on the Pre-Fed trading regarding USDJPY and the existing EURUSD trade.

So what's going on with the Swiss franc? The euro gained had gained more than 200 pips against the franc since the start of the month but half of that was erased on Monday. The moves have awoken what was a sleepy trade.

That has come in tandem with recent rises in sight deposits, which can indicate intervention. Adding a kink was that Monday's weekly data showed sight deposits down. That was released around the same time that the Swiss stats office bumped its CPI forecast to +0.5% from +0.3%.

The thinking goes that SNB and investors remain worried about the elections--Dutch vote Wednesday and the French elections at the end of April. They could fight back by cutting interest rates but that's a tough argument to make with inflation forecasts rising. It's all a bit headscratching but it has us ready for anything from the SNB. As we wrote yesterday, we're also preparing for the Article 50 trigger. On Monday, parliament voted to give May the final say on the deal with the EU, without seeking parliamentary approval. The vote now goes back to the House of Lords.

There was talk that the clause could be invoked late Tuesday but that's no longer likely. The Independent reports that Article 50 won't be triggered until at least next week, citing a spokesman for the Prime Minister. The pound was perky despite continued talk of a Scottish referendum.

When Article 50 Hits

A big week looms with the Fed decision and SNB getting top billing on the calendar. But the main source of volatility could be the pound. Reports began to circulate over the weekend suggesting that May is targeting a Tuesday evening speech in Parliament to announce that the Brexit timeline has begun. Meanwhile, Scotland will hold another indpendence referendum, possibly next year. There are 5 Premium trades currently in progress. A new tactical USD trade will be among the trades added as we approach the Fed decision.

Triggering Artcile 50 is a unique even but it strikes us as one that's dreaded yet, fully anticipated. Part of the market reaction may depend on the finesse of May's delivery and reception abroad, but it's something that should be entirely priced in.

But as Ashraf mentioned last week, any reiteration of the "Take it or Leave it Stance" from May will not play well for sterling.

Like Friday's jobs report, it could be the kind of thing that sparks a reversal once the headlines hit, or after a quick dip. It's not necessarily an easy trade to anticipate but if the pound begins to rally after an initial dip, it's the kind of thing that could turn into an extended squeeze. And dont forget the Fed's impact on GBPUSD.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -59K vs -58K prior JPY -54K vs -50K prior GBP -81K vs -66K prior CHF -10K vs -9K prior AUD +51K vs +33K prior CAD +29vs +25K prior NZD -4 vs +3K prior

The two big moves were in GBP and AUD. Specs are clearly betting against the pound in anticipation of Article 50. With the trade already so one-sided, that doesn't leave many sellers for when the announcement hits.

Stepping away from the short term, once in awhile we're reminded of how China has the ability to change the world with a virtual wave of the hand of the leadership. The China Daily reports today on plans to build 40,000 football primary and secondary schools by 2020 and train more than 200,000 coaches in the sport. Those are mind-boggling numbers.

Those same sorts of investments are happening all over the business landscape and a reminder that while developed countries are battling for another 0.5 pp of GDP, China is boldly plotting for total dominance. There will be waste, no doubt, but that kind of ambition filters down everyone in the country.