Intraday Market Thoughts Archives

Displaying results for week of Mar 26, 2017USD Quarter of Extremes

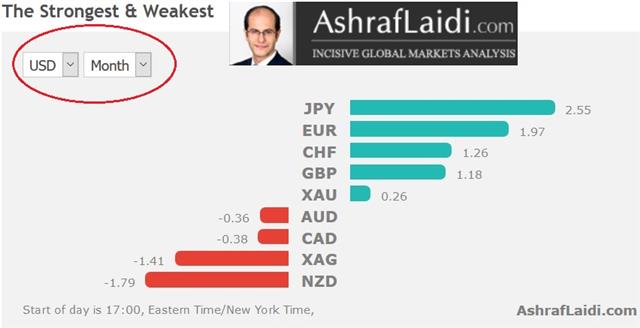

Q1 ends with the US dollar the worst performer against all major currencies, several months after the majority of strategists and analysts competed on who could give the highest USD forecast. While we were mistaken in our USD call post-Trump victory, we rectified the situation in the first week of Q1 2017 by issuing tactical EURUSD trades, which later turned more directional. Our last USDJPY long was issued on Jan 10 and closed it near the March high moments before the release of the Feb jobs report.

The last time all currencies ended higher against the USD was in Q1 2016, with GBP being the exception—the only decliner. With Q4 2016 having seen full USD outperformance and Q1 2017 full USD underperformance, Q2 2017 will prove more complex. USD bulls were favoured by a fresh onslaught of hawkish Fed rhetoric earlier this week, but as long as they do not depart from the 3 hikes forecast, any major USD headway is unlikely. On the other hand, if the likes of NY Fed's Dudley continue making remarks such as further rate hikes are “no great urgency”, then USD shorts will need to be more tactical.

Earlier this afternoon we issued a new USD trade, but the bulk of our FX focus remains in crosses (non-USD pairs), in line with the unfolding risk-appetite picture. There are currently 8 open Premium trades: 4 in FX; 2 in indices and 2 in commodities.

أشرف العايدي في سكاي نيوز عربية

A50 Smooth, Fed Amps up Rhetoric

The long-awaited Article 50 trigger was largely taken in-stride by a market that had months to prepare. Instead, it was the ECB that stole the show on a report that the market had got ahead of itself. In the US, two influential FOMC member offered a hawkish shift. There are 7 Premium trades currently in progress, 3 in FX, 2 in indices and 2 in commodities.

Wednesday's focus was on the pound but it finished just a handful of pips lower. The Australian dollar was the top performer while the euro lagged.

The lack of volatility on the Article 50 trigger shouldn't be a huge surprise. It was an event that was telegraphed for months and politicians on both sides avoid any inflammatory rhetoric. The next phase of GBP trading will be all about the details of negotiations but with EU leaders still getting their mandate organized, the next month may be quiet and that could send some GBP shorts to the exits.

As Article 50 headlines were crossing, the ECB had a surprise of its own. A newswire ECB sources story said markets had over-interpreted the message from the March meeting and that it was meant to convey fewer tail risks, not a change towards a more dovish policy.

The report helped to confirm the false breakout in EUR/USD as it fell more than 50 pips and back into the Dec-Feb range.

What strikes us as odd is that Nowotny and Praet have recently doubled down on the hawkish talk by signaling a potential change in the deposit rate. Perhaps this is some fine tuning by the ECB to signal a tighter corridor but no move higher in the main refi rate any time soon.

In the US, the message was clear from Williams and Rosengren – the risks are to the upside. Rosengren argued for four hikes this year and Williams said it was possible. Both pointed to a tighter labour market and upside risks.

With all the Trump, Brexit and other political jostling this week, we remind readers that ultimately economic data wins out and yesterday's consumer confidence reading was the best in 17 years. On Friday the PCE report is due and next week, the ISMs and non-farm payrolls could easily put the Fed on a more hawkish course and the dollar back in charge.

Dollar Darts Ahead, Article 50 Next

Bull markets rarely end in collapse and the US dollar proved that on Tuesday as it roared back to life. The Australian dollar was the top performer while the pound lagged. Japanese retail sales are up next but the big story in the day ahead will be Article 50. After closing both EURCAD and EURAUD trades at a profit, one of pairs will be re-opened later ahead of the Asia Wednesday session. More on the charts rationale in the Premium video below.

We wrote yesterday about how the US dollar was at a crossroads. On Monday, it tumbled early but instead of continuing to wilt, it bounced and that underscored the indecision in the market.

Today, strong economic data and more signs of renewed political resolve gave the dollar a lift. As the gains mounted, the US dollar erased all of Monday's losses to leave it virtually flat on the week.

What had looked like a breakout in EUR/USD is now a trade wracked with questions.

What's clear is that the US dollar won't seriously stumble so long as economic data is improving. On Tuesday, US consumer confidence jumped to 125.6 compared to 114.0 expected; that's the best in 17 years. The Richmond Fed also hit the best since 2010.

The Fed's Fischer made an appearance but offered little we didn't know. He said two more hikes this year was his baseline and that the risks were balanced.

Two things will keep markets off balance in the days ahead. The first is looming quarter end and Japanese fiscal year end. The second is the UK announcement due on Wednesday.

In theory, the announcement is 100% expected and it should be fully priced in. May will likely make the announcement in parliament at noon and the letter will be delivered to Donald Tusk 30 minutes later.

The danger is that GBP flows accelerate after the announcement. In particular, the net cable position is at the most-short on record and that leaves the pair vulnerable to a squeeze.

Before May takes the spotlight, the economic data to watch in Asia-Pacific trading comes at 2350GMT when Japanese retail is released. The BOJ is showing no signs of easing off the gas pedal but a reading better than the +0.3% m/m expected would be a small step in that direction (albeit still not a JPY mover).

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (y/y) | |||

| 0.7% | 1.0% | Mar 28 23:50 | |

| CB Consumer Confidence | |||

| 125.6 | 113.9 | 116.1 | Mar 28 14:00 |

أشرف العايدي في سكاي نيوز عربية

Dollar Crossroads

In a perfect world, every breakout is clean and steady but on Monday the US dollar fell below some critical levels but bounced instead of wilting. We look at what's coming next. Yellen's speech about labout markets due at 12:50 ET (17:50 London). After closing both EURCAD and EURAUD trades at a profit, one of the traded will be re-opened later this evening. Which one will it be? Find out in the Premium video due up shortly.

Yen is again the best performer. followed by the franc and pound, while Kiwi and Aussie are the worst performers. As the healthcare deal fell apart on Friday, it held together. But on Monday as the Republican party looked like it was straining, the dollar began to crumble.

We have been writing about the burgeoning positive signs in the euro for weeks and on Monday it finally broke out. EUR/USD was the big technical story as it broke the February and December highs as it gapped higher. It continued through the 200-day moving average and 1.09 as levels cascaded.

It was similar in GBP/USD and USD/JPY as important levels were tested. What finally stopped the selling was support at 110.00 in USD/JPY and GBPUSD resistance at 1.2640. That held and then sentiment began to turn. The S&P 500 proved it's a juggernaut once again as it erased a 22-point decline to finish just 2 points lower.

Economic news is light. Fundamentally the focus remains on politics. Talk that Republicans hadn't yet given up on healthcare was perhaps the positive spark but that might be stretching it.

Another factor to note was quarter-end and Japanese fiscal year end. Flows will be lumpy and the market will thin in the days ahead. Ideally, the dollar would break and it would extend but given the politics and calendar, it's not a surprise that the market is tentative. There isn't a screaming reason to sell dollars even if Republicans stumbled further. What we will probably see is a continue paradigm where the US dollar has small gains on good news and large losses on bad news.

The Asia-Pacific calendar is light but we note that Japanese economic minister Ishihara said authorities are closely watching market moves. That's soft jawboning but expect more if USD/JPY breaks 110.00.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Kaplan Speaks | |||

| Mar 28 17:00 | |||

USD Slumps on Republican Infighting

Over $24 bn has been wiped off the FTSE100 and Dow Jones 30 as the indices head for their longest losing streak in over 6 years. Market took the failure of US healthcare reform in stride on Friday but is having second thoughts early in the new trading week as the finger-pointing escalates. The yen was the top performer last week while the Australian dollar lagged. CFTC positioning showed heavy euro short-covering. The long EURCAD Premium trade was closed at 1.4555 for a 205-pip gain until consideration for a renewed entry later in the week.

Healthcare reform wasn't the backbone of the post-election rally. What made the market salivate was the promise of tax cuts and deregulation.

So initially when Republican support for healthcare reform came unglued on Friday, it didn't necessarily put the post-election agenda in jeopardy. But some time to digest and a tweet on Sunday from Trump blaming factions of his own party have sparked a serious case of indigestion at the weekly market open.

The US dollar lost around a half-cent in early trading. USD/JPY is testing last week's lows but the main technical break is in EUR/USD is at breaks above the February high to the best levels of 2017. The euro built on its gap-up in Monday Asia triggered by Angela Merkel's election win in Saarland, a pivotal state for upcoming Federal elections.

What's important to watch now is how Republicans handle the fall out. If different factions of the party begin to turn on each other, expect more worries to wash over markets and the US dollar.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -20K vs -41K prior JPY -67K vs -71K prior GBP -108K vs -107K prior CHF -12K vs -9K prior AUD +45K vs +43K prior CAD +24K vs +21K prior NZD -12K vs -6K prior

In the past two weeks, the euro net short has been pared down from -58K as speculators give up on EUR/USD parity for now. Continued talk about less-dovish policy from the ECB is another factor. We've been noting the huge increases in cable shorts in the prior two weeks. Specs are no longer adding but many are underwater given that half the position was added in the past three weeks.