Intraday Market Thoughts Archives

Displaying results for week of Apr 16, 2017Countdown to Sunday's Volatility

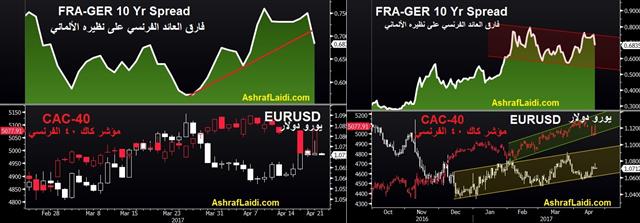

First there was Brexit, then Trump and now it's the French election; or at least that's the narrative playing out in the markets. We take a closer look. The Premium Insights closed the EURCAD long at 1.4495 for a 235-pip gain in order to make a way for a tactical dual EUR trade on Friday ahead of Sunday's French elections.

Polls showed fractional momentum for Macron, helping to boost the CAC-40 in countdown mode to the Sunday's 1st round vote. That uptick may be telling because a large number of voters said they were undecided earlier in the month.

A poll from Harris showed Macron at 24.5%, Le Pen at 21%, Fillon at 20% and Melenchon at 19%. Given the margin of error and other factors like turnout and undecideds, it's conceivable the second round could be the far right candidate Le Pen and the far left candidate Melenchon. Polls show Melenchon would win that contest but German Fin Min Schaeuble called it a 'nightmare scenario' because both are euroskeptics.

What's important to remember is that's a highly unlikely scenario and the only result that could immediately upend the euro. If Macron finishes in the top-two and moves to the runoff, he's heavily favoured against any of the candidates. Fillon would also be a big favorite against Le Pen or Melenchon.

So while the market sees this as a potential redux of Brexit or Trump, it would take a far bigger swing. Brexit polls were close in the days ahead of the vote and Trump lost the popular vote but won the electoral college. In France, it's a national popular vote so polling is simplified.

That said, there is always the risk that voters are playing coy with pollsters again or could swing late. The risks may be even higher after what looked like a terrorist attack on the Champs Elysee late Thursday. That alone could add to jitters Friday.

After talking with many traders and analysts, there is a distinct fear of history repeating itself but those fears (and market pricing) overstate the odds of a major surprise.

Sunday Afternoon Volatility

Watch for exit polls hitting at 8 pm Paris time on Sunday (7 pm London, 2 pm New York), coinciding with the market open in the Pacific.Before that, we'll watch for continue comments from leaders at IMF meetings in Washington and the Japan Nikkei PMI at 0030 GMT. The prior was 52.4.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Flash PMI Manufacturing | |||

| 52.4 | Apr 21 0:30 | ||

| Eurozone Flash PMI Manufacturing | |||

| 56.2 | Apr 21 8:00 | ||

| France Flash PMI Manufacturing | |||

| 53.3 | Apr 21 7:00 | ||

| Germany Flash PMI Manufacturing | |||

| 58.3 | Apr 21 7:30 | ||

Silver, Gold & Broken Records

I may have started to sound like a broken record on this particular topic, but it just hit a new record high. Full piece and charts.

CAD in the Crosshairs

A drop in oil prices and reports that Canadian officials will try to tame the housing market sent USD/CAD close to 1.35 on Wednesday. The US dollar was the top performer while the Australian dollar lagged. New Zealand CPI and Japanese trade balance are up next. The Premium short in the DOW30 was closed for 205-pt gain, leaving another index trade open. There are 2 CAD trades in progress.

The Canadian dollar has been a challenge for traders this year. A series of headfakes, central bank mixed signals and false breakouts have kept the pair confined in a rough 1.30 to 1.35 range. Economic data has been extremely strong lately but the BOC has warned it's a mirage.

Meanwhile, two other factors threaten to break the range: Oil and housing.

Crude fell nearly $2 on Wednesday after the US reported an unexpected build in gasoline supplies, low demand and another rise in production. That final factor will irk OPEC and could scuttle a quota extension at the May 25 meeting.

If that's the case, crude and the Canadian dollar would swan dive in synch. The assumption is that Saudis will suck it up until after the Aramco IPO but that's a dangerous bet.

For the loonie, the wild card is housing. Tomorrow Ontario provincial government – where Toronto is located – will reportedly unveil 10 measures aimed at cooling the housing market. Leaks sound like they could be drastic as they include rent controls, taxes on foreign buyers, levies on speculators and more. Prices around Toronto have risen more than 30% in the past year and have tripled since 2000 so a correction is long overdue but heavy-handed government intervention could turn it into a rout.

The consumer has long been a major driver of Canadian economic strength but if housing wealth evaporates, so will spending (and CAD).

Technically, 1.3500 offered some tough resistance Wednesday even as oil prices were plunging. Beyond that, the March high of 1.3536 and the late-December, no liquidity high of 1.3599 are resistance. Also note that CAD/JPY is at the lowest since November and GBP/CAD is at the highest since September.

The loonie isn't the only commodity currency that's wilting; AUD and NZD are also nearing the lows of the year. A big factor in whether the kiwi gets there will be the Q1 CPI report due at 2245 GMT. The consensus is for a 0.8% q/q rise. That would be a healthy inflation boost and get prices up to 2.0% y/y.

At 2350 GMT, we'll be watching Japanese trade balance. The consensus is for a 608B yen surplus but more important will be trade growth. Exports are forecast to rise 6.2% and imports up 10.0%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.4% | Apr 19 22:45 | ||

| Trade Balance | |||

| 0.68T | Apr 19 23:50 | ||

Scary Mystery Chart

Care to guess this chart? It's the monthly chart of a popular US sector index. As you can see, it failed to break its 7-year channel right at the same level of the 76.4% retracement of the decline from the 2007 high to the 2009 low. The relative strength index may also indicate further declines towards the mid-point of the channel's height, a break of which may drag it to pre-November levels. i.e. erasing the all of the gains from the Trump's victory rally. Again, this is not FX, commodity, bonds or a ratio. Just a straightforward index. It's a big deal when you find out what is.

Cable Soars on UK Snap Election

The UK vote was only just announced but the market already cast a definitive vote for Theresa May in a huge GBP rally Tuesday. The pound was the top performer while the Canadian dollar lagged. A light Asia-Pacific calendar will give markets an opportunity to digest the big moves. The previous GBP short was stopped out. 7 out of the 9 existing trades are in profit, alongside the short FTSE-100. 1 trade missed the fill by 8 pips, awaits.

"تداول الاسترليني و اليورو" (فيديو للمشتركين فقط)

Cable soared to 1.29 from as low as 1.2520 in a perfect storm of news, positioning and technicals on Tuesday. The news was a June 8 snap UK election. With polls showing May's party +20 points ahead and the opposition in disarray, she seized the opportunity to cement her position with a strong mandate. The market is already seeing a May win as a sure thing and is implying it will improve her negotiating position.

In terms of positioning, we have warned for weeks that GBP shorts are dangerously overcrowded. Last week's CFTC data showed cable net shorts were near a record with almost have of the position already underwater. The rally Tuesday was no doubt helped by a squeeze but we're confident there are many more GBP positions to be picked off.

Technically, the rally cascaded through multiple levels. The March high and 200-dma were the first to go, followed by the February high and finally the December high of 1.2775. Shortly after it broke, the pair went into overdrive in a flash trade up to the highs of the day.

Ashraf looks ahead to what's next with his latest Premium trade.

Not to be lost in all the focus on the UK, the Treasury market continues to rally. US 10-year yields fell another 8 bps to 2.17%. While the election story is domestic, we believe the failure of the reflation trade is a global theme with broader consequences. It also raises the stakes for incoming inflation data.

الحوار الأسبوعي بين أشرف العايدي وجورج البتروني

الحوار الأسبوعي بين أشرف العايدي وجورج البتروني يتضمن

صعود الإسترليني عقب إعلان تيرزا ماي الإنتخابات المبكرة توقعات الإسترليني مقابل الدولار والأسباب التي ممكن أن تؤثر برفع الإسترليني على الدولار العوامل الفنية التي من الممكن أن تعرقل الإسترليني الإنتخابات الفرنسية وأسباب إرتفاع اليورو ماهي العملات الاقل خطور في فترة الإنتخابات من اجل التداول

لماذا ارتفع الاسترليني بعد إعلان الانتخابات؟

Soaring Euro Volatility

Euro volatility posted its highest rise since the Brexit vote as the 1st round of French Elections approached with fears that Le Pen and Melenchon will qualify for the final round. The push-and-pull of economic data against government talk was at work on Monday. The pound was the top performer while the yen lagged. Aussie is the biggest loser after the RBA minutes raised emphasis on mounting risks in the housing market. More on managing euro volatility, FX trades and metals positioning in the Premium video below.

USD/JPY has been on the defensive for the past month and after Friday's soft CPI and retail sales data it slumped again. But despite tough talk on North Korea and more soft data on Monday, the pair found support just ahead of the 61.8% retracement of the post-election rally.

The Empire Fed was at +5.2 compared to +15.0 expected and the NAHB housing market index at 68 compared to the 70 consensus. But the market was more interested in what was happening at the White House than the statistics office.

Treasury Secretary Mnuchin stressed the long term benefits of a strong dollar and said he still expects a tax reform deal in 2017. That helped lift the US dollar to 109.10 from 108.55. The dollar strength was broad and the S&P 500 gained 20 points to erase most of last week's decline.

Time and time again this theme has played out but the returns are diminishing. Trump set the dollar and stocks on fire early in the year when he promised a 'phenomenal' tax plan in a few weeks. A huge tax cut is something the market can patiently await but eventually the White House and Congress will need to deliver.

In the meantime, the shape of the data-vs-policy trade is clear: Tentatively sell the dollar on soft numbers but clear out when the spending, deregulation, tax cuts or stimulus talk starts.

In the bigger picture, the reflation story is losing momentum and that's something we will write more about it the days ahead.

In the short-term, the Australian dollar is back in focus with the April RBA meeting minutes due. AUD/USD has made false breaks on either side of the Feb-March range recently and with no bias from Lowe, the bias is muddled.

Turkey Votes, China Beats & US Misses

Turkey voted for 'Yes' in a Constitutional referendum that's another sign of how Europe is fragmenting. The yen was the best performer last week while the US dollar lagged. China's Q1 GDP rose 6.9% y/y, exceeding consensus expectations. Mounting bank and non-bank credit was largely behind the advance in industrial production. CFTC positioning showed shrinking USD/JPY longs.

Turkish President Erdogan won 51.3% of the votes in a broad referendum that will concentrate more power in the executive and seriously jeopardizes Turkey's changes of ever joining the EU. The result was widely expected and means Erdogan could stay in power until 2029. His campaign argued on the need for stability after a coup failed last July.

The EU was quick to respond with a delegate to Turkey saying talks to join the EU will be formally suspended if the Constitutional changes are passed in full.

In the short term, the clear result has led to some early minor TRY strength but in the long-term the result highlights, once again, that Europe is in retreat. Whether the contraction will continue or broaden will depend next on the results of France's election.

Meanwhile, it's the US dollar that's in retreat at the moment. A strong consumer and rising inflation are the backbones of the Fed's hawkish stance. But on Friday, CPI and retail sales both missed estimates.

Much of the world was on holiday Friday so the numbers weren't likely fully factored into the market. In addition, many markets will remain closed Monday.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -19K vs -11K prior JPY -35K vs -46K prior GBP -106K vs -100K prior CHF -10K vs -14K prior AUD +45K vs +50K prior CAD -32K vs -30K prior NZD -15K vs -15K prior

The yen short has been trimmed to the narrowest since December as USD/JPY trades at the lowest since mid-November. The pair slipped on Friday and is nearing the 61.8% retracement of the post-election rally.