Intraday Market Thoughts Archives

Displaying results for week of Apr 30, 2017Ahead of Sunday's Elections

Considering that most brokers have raised their margin requirements by 4-5 folds ahead of Sunday's French Elections, here is what (and why) we have decided with regards to our existing trades in EURUSD and GBPUSD. One trade was opened and one was closed at a profit. Access to Premium trades.

Friday's euro gains could disappear in the considerable probability that Macron wins but not by the widely anticipated majority of 62%-38%, currently priced by markets (France-German 10 yr spreads plummeted by 48% from their 5-year highs in February, EURUSD volatility down 45% and EURUSD remains above 200-DMA).

The possibility that Macron wins by a less impressive margin of 8%-15% instead of the anticipated 20% margin could be brought about by large numbers of abstentions, an outcome which would work in favour of Marine Le Pen, or rather, against Macron ahead of the Parliamentary elections next month. Polls suggest that about 40% of those who voted for communist leader Melenchon in the 1st round (he came 4th) plan to abstain as Melenchon refuses to endorse neither Macron nor Le Pen. And in order for Macron to win by a dangerously slim majority -- or for Le Pen to produce a surprise win or a tie (dangerous for the euro and markets) is for voter turnout to be at 50%-55% participation instead of the anticipated 75%

And so as we warned in this evening's Premium trades, we closed one trade and opened another, while sticking with GBPUSD longs in order to lock in existing gains, while allowing for the probability of entering at more attracrive levels on Sunday evening after the whipsaws faded into the time when most trading platforms are open.

Ashraf on BNN about Euro & Elections

My BNN interview ahead of Sunday's French Elections, the euro & European bourses. Watch.

Reflation Flop

A rout in commodities threatens to derail the reflation theme that dominated early 2017 trading .The euro was the top performer Thursday while the Australian dollar lagged. A number of charts broke out. As we near Sunday's final round in the French Elections, the existing EUR trade shall remain open ahead, alongside another EUR trade to be opened on Friday after the US jobs report.

Oil and iron ore were hardest hit in a broad commodity rout on Thursday. Crude finished down nearly 5% and Dalian exchange ore was halted limit down after a 7.3% drop. It didn't stop there with wheat, copper and gold among many raw materials that were hit hard.

The Australian dollar fell to the lowest since January 10 and USD/CAD hit a 14-month high. For USD/CAD, it was the 10th consecutive day of gains.

Aside from terms of trade from exporters, the drop in commodities threatens to undermine the idea that 2017 is the return to the old normal. Oil is back to where it was before the OPEC cut despite the strongest signals yet that an extension is coming. The weakness will be a drag on fuel costs and inflation.

A divide in central banking that doesn't get much attention could be characterized as the Fed-bloc against the ECB-bloc. The Fed believes that inflation early this year was due to economic tightness and that it's sustainable, if not accelerating. The ECB believes it's temporary because of baseline effects from the early-2016 commodity price crunch.

The debate will take time to settle but either way the falls in commodity prices will sap the urgency from the hawks. In the meantime, the US dollar has the most to lose. By embracing reflation, the Fed (and the US dollar) have the most to lose if it fails.

Economic news on Thursday included a disappointing factory orders report but better revisions to durable goods orders and shipments. It also included a narrower US trade deficit, low jobless claims and House Republicans narrowly voting for healthcare reform in what is the first real step towards repealing and replacing Obamacare.

The big story in markets was on the charts. EUR/USD broke the April high and is now testing 1.1000. Oil broke the March low and crashed below. Gold hit the lowest since March 20. AUD and NZD fell below the recent lows. USD/JPY hit the highest since March 16 before reversing to finish lower. That ended a 5-day winning streak.

Asia-Pacific traders will have a chance to digest it all with a light calendar before US nonfarm payrolls and Canadian employment later. One highlight on the calendar is the quarter RBA statement and that could offer some insight on where they see rates headed next.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Factory Orders (m/m) | |||

| 0.2% | 0.6% | 1.2% | May 04 14:00 |

| Eurozone Spanish Unemployment Change | |||

| -129.3K | -78.2K | -48.6K | May 04 7:00 |

| Challenger Job Cuts (y/y) | |||

| -42.9% | -2.0% | May 04 11:30 | |

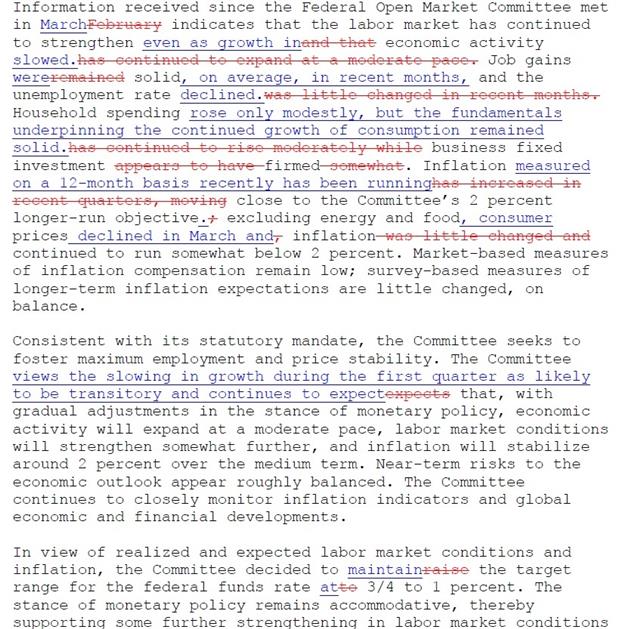

Fed Brushes Off Q1

The Fed brushed off a weak first quarter and that was seen as a signal that Yellen still intends to hike in June. The US dollar led the way while the Australian dollar lagged to a 3-month low. Australian trade balance and comments from Lowe are out next. The Premium long in GBPJPY was closed with a 205-pip gain as a tactical positioning trade ahead of the Fed and the French elections. 7 trades remain progress.

The Fed didn't offer anything new in the way of guidance in Wednesday's statement. The same 'gradual' language remained without committing to a timeline. But that's not how the market took it. The probability of a June hike rose to 93% from 70% after the statement. What the market latched onto was a line saying that the slowdown in Q1 growth was likely to be transitory. The assumption is that the Fed is brushing it off and still wants to hike in June. That may turn out to be true but not if data continues to miss. At 93%, it doesn't leave much room for error.

On the data front – at least on the soft data front – the Fed got some good news. The April ISM non-manufacturing index was at 57.5 vs 55.8 expected. In addition, the new orders component was at the best level in 11 years, jumping to 63.2 from 58.9. That will help convince the Fed that good growth is still right around the corner.

The other main release was ADP employment at 177K compared to 175K expected.

In the bigger picture, we're increasingly convinced that jobs growth and unemployment rates are nearly irrelevant to trading. Yesterday's New Zealand jobs numbers were extremely strong with unemployment falling to 4.9% from 5.2% a great jobs growth overall. The kiwi initially jumped 30 pips but was sold heavily for the remainder of the day in large part because wage growth was disappointing. Expect the market to have the same focus on wages in Friday's non-farm payrolls report.

The principal question is: Can a tight labour market still producer wage growth in a world of offshoring and automation?

The kiwi fell alongside AUD/USD which wiped out three days of gains and fell to the lowest since mid-January. Up next is the 0130 GMT trade balance report; it's expected to show a $A3.25m surplus.

The bigger potential market mover comes at 0310 GMT when Governor Lowe speaks on household debt, housing prices and resilience. That topic sounds ripe for hawkish comments but even if that's the case he will want to jawbone AUD lower at the same time.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance | |||

| 3.33B | 3.57B | May 04 1:30 | |

| ADP Employment Change | |||

| 177K | 178K | 255K | May 03 12:15 |

| RBA Gov Lowe Speaks | |||

| May 04 3:10 | |||

| Employment Change (q/q) | |||

| 1.2% | 0.8% | 0.7% | May 02 22:45 |

Oil Adds to CAD Crunch

Another 2% fall in oil prices on Tuesday contributed to the eighth straight day of USD/CAD gains. The New Zealand dollar led the way while the Canadian dollar lagged again. New Zealand jobs data is up next. The Premium video, focusing on gold, yen, USD & euro is posted below for subscribers. New trades are out ahead of Wednesday's FOMC.

The combination of worries about the housing market and a slump in oil prices sent USD/CAD above 1.37 on Tuesday for the first time in 14 months. The pair touched as high as 1.3758 as oil prices fell below the uptrend that started in November.

Crude oil traders are concerned about more supply after Libya's rival governments announced peace talks. Libya is exempt from quotas and has hundreds of thousands of barrels of idled production that could add to the global glut.

The market also continues to watch the drama surrounding embattled Canadian lender Home Capital and a new foreign buyer tax. Together they're seen as a major test of the red-hot market.

With most of the bad news priced in, the next leg of the USD/CAD trade may come from the US dollar side. The FOMC meeting is Wednesday and economic data continues to lead us to believe that caution will be the signal from the Fed either now or in June. US automakers roundly reported disappointing numbers on Tuesday and total sales fell to a 16.81m pace from 17.1m. It's another example of the divergence between soft and hard data.

Another currency that has been struggling lately is the New Zealand dollar. It touched an 11-month low last week before bouncing yesterday and today but a fresh challenge will come from jobs data to be released at 2245 GMT. The consensus is for unemployment to fall to 5.1% from 5.2% with participation steady at 70.5%. Earnings are expected to rise 0.7% in the quarter.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Employment Change (q/q) | |||

| 0.8% | 0.8% | May 02 22:45 | |

| Eurozone Spanish Unemployment Change | |||

| 21.3K | -48.6K | May 03 7:00 | |

الحوار الأسبوعي مع أشرف العايدي وجورج البتروني

The Great Catch-Down

The ISM manufacturing index on Monday was another sign that soft US economic data is catching down to consistently mediocre hard data. The New Zealand dollar was the top performer on the day while the pound lagged. The RBA decision is next. The Premium video on the existing and future trades will be released ahead of the Tuesday European session.

The April ISM manufacturing index slid to 54.8 compared to 56.5 expected. It's another sentiment survey that's fading after an early-year climb on election optimism. At the same time, hard data continues to show a middling economy. Personal spending was flat in March, missing the +0.2% consensus.

Given the lack of progress on substantive legislation or stimulus in the US, the arc of the sentiment numbers isn't a surprise. The moderation is likely to continue until the administration proves it can turn its rhetoric into action.

Another factor is that the uncertainty on taxes could be encouraging firms to hold off on investments until they have a better idea of the landscape. So even if tax reform comes later this year, it may result in a drag until then.

For all the negative data Monday, the US dollar proved to be resilient. A 30 pip fall in USD/JPY was erased later in the day. That's in part because of rising bond yields after the Treasury said it would increase borrowing.

Up next, we look to the Caixin China manufacturing index at 0145 GMT. The risks are skewed towards a lower number after the decline in the data released on the weekend.

The main event comes at 0430 GMT with the RBA decision. No change from the 1.50% rate is expected and the central bank could moderate its tone given the recent correction in iron ore prices. But for the most part it will be a wait-and-see type statement.

PMIs & ICBMs

Key Chinese sentiment surveys softened on the weekend and North Korea test fired a ballistic missile. The yen is slightly stronger to open the week. CFTC positioning data showed cable shorts narrowing for the second week and CAD shorts increasing. European markets are shut due to May Day, but the US will be open, awaiting the release of the manufacturing ISM. It will be a very busy week with the Fed decision, CPI and NFP. There are 8 trades in progress, 4 in FX, 2 in commodities and 2 in indices.

The official Chinese manufacturing PMI stumbled to 51.2 from 51.8. That's short of the 51.7 consensus estimate as well. One the services side there is no survey of economists but it also fell to 54.0 from 55.1. Worries about China are low at the moment but can flare up quickly so we will be watching for subsequent numbers and keeping an eye on domestic markets in the week ahead.

As has been the theme all year, politics and geopolitics remain top drivers. North Korea tested a ballistic missile late on Friday just hours after Trump warned that a “major, major conflict” was possible. The test appeared to fail but that won't do anything to dampen rhetoric or worries.

The final political football remains Congress. The House struggled to pass a one-week funding bill to avoid a shutdown on Friday and faces another deadline in the week ahead, there is also fresh talk about a healthcare vote.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -21K vs -22K prior GBP -91K vs -99K prior JPY -27K vs -30K prior CHF -17K vs -14K prior CAD -43K vs -33K prior AUD +43K vs +43K prior NZD -15K vs -15K prior

The market is getting increasingly aggressive in selling the Canadian dollar as USD/CAD and others breakout technically.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final Manufacturing PMI [F] | |||

| 52.8 | 52.8 | May 01 13:45 | |

| ISM Manufacturing PMI | |||

| 56.6 | 57.2 | May 01 14:00 | |

| PMI Manufacturing | |||

| 55.5 | May 01 13:30 | ||

| PMI | |||

| 51.4 | 51.2 | May 02 1:45 | |

| Eurozone Spanish PMI Manufacturing | |||

| 54.3 | 53.9 | May 02 7:15 | |

| Eurozone Final PMI Manufacturing [F] | |||

| 56.8 | 56.8 | May 02 8:00 | |