Intraday Market Thoughts Archives

Displaying results for week of May 28, 2017Jobs Raise Questions for H2

The 138K in May non-farm payrolls is not necessarily bad when it is not viewed against forecast of 183K and the previous 174K figure. It is also a decent figure when accompanied by a 16-year low in the unemployment rate at 4.3%. But when the rest of the report contains prolonged slowdown in earnings growth to 2.5% y/y down from a cycle high of 2.9%, the labour participation rate dipping to 5-month lows of 62.7% and the prior 2 month revisions amount to a net -66K, then serious questions are raised over the warnings of full employment economy.

We are told that when the jobless claims and unemployment rate reach decade lows, hiring becomes more challenging. Growing narratives of companies facing difficulty in finding qualified staff are not consistent with the weak pay growth. Could it be that the reported hourly earnings for blue collar staff and/or low skill workers overwhelm the pay figures for talented staff? The Employment Cost Index data shows steady pay growth. But not enough to maintain the case for further Fed hikes in Q3 and Q4. The inability for the 10-year yield to regain 2.35% and real yields to regain 1.0% is becoming hard to miss among Fed watchers and even non-dovish Fed members.

It does not matter whether the probability of June Fed hike fell to 90% from 100%. FX markets are more concerned with the 2nd half of the year. The US dollar index has now completed its 180° turn since Trump's election victory, but more declines could be in store as the ECB mulls reducing stimulus. Our Premium short in the DOW30 was stopped out yesterday, while the EURUSD long was closed for 290-pip gain. Analysis for the next course of action in both follows next week.

My Tuesday Webinar

The ECB decision and UK election are on 8th June, and the FOMC decision is on 14th June, all of which expected to bring significant volatility to the Forex, Indices and Gold. Are your strategies prepared for the potential volatility and do you know how you could trade it?

That's why I've teamed up with XTB to present a Special Live Webinar Event - How to Trade the UK Election - on Tuesday 6th June at 8pm.

Special XTB Webinar: UK Election & FOMC Trade Ideas feat. Ashraf Laidi Tuesday 6th June, 8pm

- Live market analysis

- What a Conservative victory could do to the markets

- My Top Trade Ideas for the UK Election

- Will the Fed hike rates and the potential impact in USD crosses

The Five Great Debates

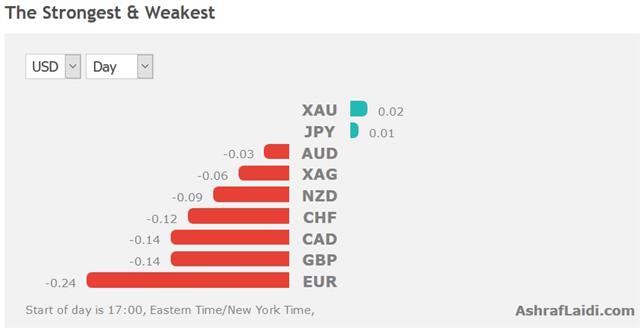

No single theme is dominating markets right now so today we take a look at five fundamental drivers and where we stand. In May, the New Zealand dollar was the top performer while AUD lagged in a major antipodean divergence. 2 new Premium trades have been added; 1 in FX and 1 in a major European index.

الإسترليني و رقصة استطلاعات الرأي (للمشتركين فقط)

The UK election debate scheduled for today is a dud. While the polls continue to drive GBP, we look at five bigger debates elsewhere.

1) The Fed debate

The market is juggling with three options: Here they are with the probabilities in parentheses: No hike on June 14 (10%). It would take a string of weak data between then and now; A hike with similarly hawkish bias (35%). Fed officials have begun to worry about the data; A hike with a dovish bias (55%). The market is shifting towards this option and that's what is weighing on the US dollar. It would be signaled by something in the statement indicating that the Fed will need to see stronger evidence of growth and inflation before continuing to remove stimulus.

2) The great inflation debate

This feeds into the first theme. Eurozone inflation at 1.4% y/y compared to 1.5% on Wednesday missed expectations. Central banks are divided on whether slightly better growth and a tighter jobs market will producer inflation. The latest buzz phrase in economics circles is 'global overcapacity' which is fancy way of saying that globalization, technology and offshoring can keep prices and wages down. The Fed is holding on tight to models that show a tight domestic economy will mean domestic inflation but they may one day have to rethink it.

3) The China mystery

Yesterday's PMIs were both slightly stronger than expected but the opacity of Chinese policy and the latest drop in metals prices has planted a deep seed of doubt. The latest move is rapid yuan strengthening. Skeptics say it's a government-orchestrated squeeze on shorts designed to improve stability. We're watching closely.

4) The ECB shift debate

A leak on Tuesday indicated the ECB could move to a neutral stance and take away references to doing more as soon as next week. That was followed by today's disappointing eurozone data slate. In the bigger picture, the suspicions is that Draghi wants to setup a September taper announcement but doesn't want to spark EUR/USD strength or excessive run-up in yields.

5) Oil's toils

More Libyan production sent oil sharply lower Wednesday but it bounced on tighter US inventories in the API report. Every oil authority talks about a great inventory balancing that's coming before year end while every analyst has doubts. Russia's deputy finance minister might have tipped his hand Wednesday, saying to expect $40-$50 oil for seven years with risks of prices falling below. We're left with the question: Who or what could boost crude right now?

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Chicago PMI | |||

| 59.4 | 57.0 | 58.3 | May 31 13:45 |

| Final Manufacturing PMI [F] | |||

| 52.5 | 52.5 | Jun 01 13:45 | |

| ISM Manufacturing PMI | |||

| 54.7 | 54.8 | Jun 01 14:00 | |

| PMI Manufacturing | |||

| 56.5 | 57.3 | Jun 01 8:30 | |

| PMI | |||

| 50.2 | 50.3 | Jun 01 1:45 | |

| Eurozone Final PMI Manufacturing [F] | |||

| 57.0 | 57.0 | Jun 01 8:00 | |

Uncertain Fed & Uncertain UK Politics

The Fed's Brainard gave the strongest hint yet that low inflation won't dissuade a June hike but at the same time warned the Fed may pause afterwards. The New Zealand dollar led the way, while the Canadian dollar lagged. A UK election polls sent the pound plunging in early Asia-Pacific trade. The latest video for Premium subscribers is found below.

The April PCE report had something for everyone. The dollar initially rallied on the headlines because core PCE rose 0.2% m/m, slightly more than the +0.1% consensus. USD/JPY ticked 25 pips higher to 111.20 but that was the high for US trading.

Weighing on the dollar was a decline in year-over-year core inflation to 1.5% from 1.6%. It was expected but it extends the trend of slipping core inflation. Downward revisions to personal income also weighed but were balanced by rosy numbers on rising service sector salaries.

The change of a June hike rose to 88% from 84% according to the CME's Fedwatch measure but the dollar later declined. A big reason is because of eroding faith in longer term rate hikes.

Later in the day, the Fed's Brainard warned the FOMC may need to reassess its projected rate hikes. For the moment, she said it was premature to make that call and that's a signal that a June 14 rate rise is coming. But along with that hike, the statement is now more likely to include language that indicates more hikes will only come if inflation rises.

The bond market is now beginning to question whether those hikes will come at all. The 10-year yield fell 3.7 bps to 2.21% and is closing in on the post-election low of 2.16%. The US dollar is following yields lower.

Meanwhile, the pound took a sharp spill briefly below 1.28 in early Asia-Pacific trading. The trigger was a poll from YouGov that modeled the distribution of votes across ridings. It showed Theresa May's Conservatives winning but falling 16 seats short of a majority. That would seriously jeopardize Brexit negotiations and cripple the government.

From here, the focus will shift to China where the official PMIs are due at 0100 GMT. The manufacturing measure is forecast to slip to 51.0 from 51.2. the prior non-manufacturing reading was 54.0.

Note that it's also the final trading day of the month so flows could be a factor.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Chicago PMI | |||

| 57.0 | 58.3 | May 31 13:45 | |

| PMI | |||

| 51.0 | 51.2 | May 31 1:00 | |

Poll-Watching but Euro Move Looms

It's all about the polls as the UK election winds down and the market flirts with the mother of all comebacks. The pound was the top performer in light holiday trading on Monday as it rebounded from Friday's drubbing. CFTC positioning showed a big move in euro shorts. More on the latest drop in the euro below.

Slippage in the euro ensued in eary Pacific trade on reports that Greece may forego the next bailout tranche in case of disagreement among its creditors if with regards to the latest debt relief program. Draghi's comments that "extraordinary" amount of monetary support was is still needed also is said to weigh on the single currency.

A series of campaign missteps left Theresa May vulnerable and voters began to flirt with the idea of voting for Labour. The Manchester attacked added to anxiety and what looked like a sure thing was suddenly in question as some polls on Friday showed her ahead only 6 points.

Those are the kinds of numbers that put her close enough to the margin of error to remind voters of Brexit polls. On Friday, the pound fell more than 150 pips in a broad rout that ensure polls over the final 10 days of the campaign will be market mover.

On Monday, the news was better for the Prime Minister with an ICM poll putting her ahead 46% to 32% against Labour. In response, cable rebounded 40 pips. The rebound may continue Tuesday as Chinese, US and UK traders return.

At the same time, the week ahead features some major economic data points and it begins with Japanese employment and retail sales then is followed with French GDP, German CPI and a critical US PCE report.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +65K vs +38K prior GBP -24K vs -33K prior JPY -52K vs -60K prior CHF -20K vs -21K prior CAD -99K vs -98K prior AUD +3K vs +6K prior NZD -9K vs -12K prior

The euro gradually had become the darling of the currency market. It's been a rapid shift from a large net short over the past month and the net long is now the most extreme since October 2013. The market loves a central bank that's bottomed out and an economy that's outperforming but we've been here before. Is this recovery for real?

Draghi was certainly optimistic in European Parliament on Monday as he continued to underscore the recovery. The ECB is trying to prepare the market for a taper signal in September while keeping the euro in check; it's a tough balancing act but if the data remains strong, a euro rise is inevitable.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (y/y) | |||

| 2.2% | 2.1% | May 29 23:50 | |

| BoJ Core CPI (y/y) | |||

| -0.1% | May 30 5:00 | ||