Intraday Market Thoughts Archives

Displaying results for week of Jul 16, 2017DAX Boxed in by Draghi

The before-and-after DAX30 charts from Monday and today highlight the straightforward nature of technical formations in translating into anticipated outcomes. You may recall we posted this as our Monday mystery chart and issued it as a short for our Premium subscribers to enter at 12550 and exit today at 12205. Other index trades are kept open into the weekend alongside 2 FX and 2 metals trades.

DAX30 is set to complete its 2nd monthly decline after an uninterrupted 6-month rally, which was the longest since the June 2012-Jan 2013 advance, following the Italy/Spain debt resolution of summer 2012. The ECB's inevitable start of effective tapering (not meaningless tapering seen in March when duration was extended and size curtailed) is boosting the euro and dragging German and European equities.

The argument that any ECB tapering would not hurt stocks on the grounds that assets proceeds would be reinvested does make sense, but may not stand to weigh on the euro due to the somewhat converging US-Ezone policy paths. In fact, as long as the tepid performance of hard US data makes no case for H2 Fed hike and German-US 10 year spread breaking above its 6-year trendline resistance, the euro reward tend to be more material than the impact on European indices.

Despite Draghi’s Best Efforts

The euro sent a powerful signal on Thursday as it surged to 23-month highs despite continued dovish rhetoric from Draghi. EUR was the top performer while sterling lagged. Politics are also back on the trading agenda. A new EUR trade & charts analysis was issued before the ECB press conference. Both the Arabic and English videos are posted below for subscribers.

هل فاتك قطار اليورو؟ (للمشتركين فقط)

Days like Thursday make it tough to explain currency moves but also make the underlying market dynamics clear. The ECB didn't make any meaningful changes to its statement. References to the size and duration of QE programs were unchanged and that initially sent the euro slightly lower.

Fast-forward to the press conference and a rally in the euro took hold that extended as high as 1.1658 from a low of 1.1479. Was it something Draghi said in the press conference? Hardly. He was clear the governing council was unanimous about no changes to forward guidance and he continued to preach patience.

At best there was some of the big picture optimism we warned about but it came in a small dose as he said that incoming information confirmed that the strengthening of the economy is broadening. That was balanced by a warning that underlying inflation had yet to show convincing signs of a pickup. His words were carefully chosen as to avoid any hawkish signals and a repeat of the Sintra speech fallout. He failed, nonetheless.

So while there was no clear catalyst for the gain, it is inevitable that QE will be curtailed further this year. The aggressive euro buying points to the underlying demand for EUR. It cruised through resistance at the 12-month high and finished the day with a strong bid. Ultimately, the market senses that a shift in Draghi's tone is inevitable and euro buyers have jumped into the race before the starting pistol.

At the same time, some of the EUR/USD strength Thursday also came from the other side of the trade. The US dollar sold off on a report that the Trump-Russia investigation had broadened to include his business deals. In the past, though, those type of politically-driven market moves have faded.

Draghi's Five Year Itch

Today's s ECB decision will be the five-year anniversary of Draghi's defining speech and it would be a perfect opportunity for him to write a new chapter “Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough,” is what Mario Draghi said on July 26, 2012. A new tactical EUR trade idea will be issued moments before the ECB press conference.

That July 2012 speech marked the bottom of the eurozone crisis and EUR/USD climbed 1100 pips in the next six weeks. It's known as the “whatever it takes” speech and we suggest you read it. Not because of its place in central banking history, but because it's an example of how clearly and directly Mario Draghi can communicate.

“The euro is like a bumblebee,” he said, talking about how it looks like it shouldn't be able to fly. He speaks candidly and frankly. Contrast that with 2017 Mario Draghi who painfully avoids saying anything that would indicate higher rates or a higher euro. He has been in a battle against disinflation that's muzzled his eurozone-cheerleading instincts.

But after five years, the questions about the sustainability of the euro have fallen to the backburner. Deflation is no longer a looming. Optimism is in the air.

At Thursday's ECB meeting, the market and virtually every analyst is expecting more of the same from Draghi. More cautious words. More attempts to keep a lid on the euro. Subtle signals. A central bank running scared about the disinflationary damage of a 500-pip euro gain.

What he should do is reach for another metaphor and rip off the band-aid. The wounds in Europe are healed and at some point, sending a message of renewed optimism may be as powerful as holding down the currency.

That's probably more likely to come at the September ECB or at Jackson Hole but it's a risk on Thursday as well. The market is focused on the details of ECB policy but the 'whatever it takes' speech wasn't about details, it was about something much bigger. If (when?) Draghi reaches for that broad brush again, he could paint another masterpiece. Be prepared.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone ECB Press Conference | |||

| Jul 20 12:30 | |||

The Pre-ECB Pause

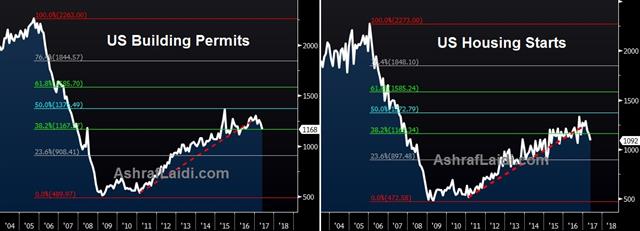

A quiet FX session in Asia and Europe ahead of ECB Thursday following another round of USD damage on Tuesday. Draghi may shed more light on the likelihood of signalling QE reduction, but he is also due to speak on the topic at next month's Jackson Hole symposium. US June housing starts and building permits are due next (see charts below). We revisit yesterday's UK CPI figures below. There are 8 Premium trades in progress: 4 in FX, 2 in metals and 2 in indices.

On Monday, we wrote about how the small USD bounce was a tell i.e a sign that it remained weak. Tuesday proved that to be true as the dollar fell hard across the board in Asian and European trade. It hit multi-month lows against EUR, AUD, CAD in a sign that the breakdown is continuing.

The same appeared to be underway in cable but the trade reversed when UK June CPI was flat compared to a 0.2% rise expected. Core measures also missed. In the aftermath, cable fell to 1.3005 from 1.3100. Despite the broad shift to more hawkish policies, no one is facing a genuine inflation problem. Even in the UK, where it's running above 2%, it can almost entirely be explained by FX rather than wages.

Equally fascinating was that Carney brushed off the soft data in an interview with Sky News. He said it didn't change the big picture on prices. The confusing bit is that he's been on both sides of the big picture. He's said inflation will only be temporarily above target but he's also been hawkish. That sets up a resolution when we hear from the BOE again. They will get a look at consumers first with the retail sales report due Thursday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (m/m) | |||

| 0.4% | -1.2% | Jul 20 8:30 | |

USD Bounce as Telling as the Fall

The US dollar bounced on Monday but the small rebound could be a tell on where the market is going. The Swiss franc was the top performer while the Australian dollar lagged. The day ahead will offer clues on who might follow the BOC with a rate hike. A new Premium short has been issued, based on the charts/patterns below. The identity of the chart has been revealed to Premium members via a new trade.

Every currency has a bad day at times. Even in the less-volatile era of 2017, currencies are beaten up. When those days come – like they did for the US dollar on Friday – how the currency recovers is often more telling then the bad day itself.

The US dollar was broadly higher in light trading Monday but the gains were small compared to Friday's thrashing. It edged up about 30 pips across the board and a bit more against CAD and GBP, but those were the two that made the most headway last week. GBP traders await this week's CPI (Tuesday) and retail sales (Wednesday) figures for more clues on Super Thursday's BoE meeting & Inflation Report.

So the dollar-bounce was modest at best. What does that mean? It shows there is little enthusiasm to own dollars and few dip buyers waiting the wings. But it's not all bad news, at times on Friday the dollar looked like it could crumble. Even when soft Empire Fed data hit on Monday the dollar held its ground.

That means that while the dollar is likely to continue to fall – especially with the lack of data on the calendar – the path won't be in a straight line.

One spot where the dollar is showing more life is against the yen. The stall at 114.50 this month and retracement to 112.50 looks far from fatal and underscores the theme that everyone-is-tightening but the BOJ.

So who will be next to act? We will get some clues in the day ahead with New Zealand reporting on Q2 CPI at 2245 GMT and with the July RBA meeting minutes due at 0130 GMT. Any hints or reasons to raise rates are significant at the moment and the market will be much quicker to react than it was when the BOC signaled higher rates.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.2% | 1.0% | Jul 17 22:45 | |

Ignore FX Relativity at your Own Risk

In January, most of the FX world jumped on the wave of a positive USD outlook based on the easily articulated theory of diverging monetary policies-- that the Fed will be the only central bank tightening and the rest stuck in easing or neutral gear. So what went wrong? Full piece here.

Betting against the Fed & USD

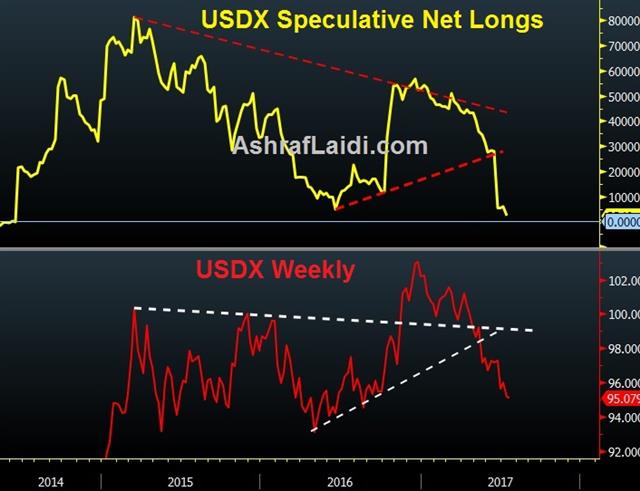

The technical breakdowns in the US dollar after Friday's weak data releases raise deeply troubling questions about the currency. The Australian dollar was the best performer last week while the US dollar lagged. CFTC positioning showed the completion of the CAD-whipsaw. The Premium Insights closed out of the GBPUSD long with 120-pip gain and issued a new set of charts on the pair. A new JPY trade was also added earlier in Friday.

You can indeed fight the Fed. Betting against the dollar this year has been the best FX trade, as it has over the last week. Policymakers' insistence that growth and inflation are picking up has been repeatedly undermined by soft data.

On Friday, retail sales and CPI data missed estimates and the market threw in the towel. The dollar was beaten up across the board and finished on the weekly lows. The lack of buyers at the lows points to more trouble ahead. In addition, a few dollar charts are breaking down. On Friday, cable rose to the highest since September 2016. Remember, the UK is facing political uncertainty, Brexit uncertainty and poor economic data.

NY Fed's Q3 2017 Nowcast GDP forecast remains at 1.8% and Q2 GDP forecast revised down to 1.9% from 2.0%.

Australia has also struggled this year but on Friday broke above a double-top at 0.7750 and finished the week just a handful of pips away from the 2016 high of 0.7835. CAD, EUR and everything else but USD/JPY is also in a precarious position.

Ultimately, it's still tough to bet against the Fed because they're only a few good data points away from raising rates again but the calendar is light until the final few days of July and that argues for more dollar weakness ahead.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +84K vs +77K prior GBP -24K vs -28K prior JPY -112K vs -75K prior CHF 0K vs 0K prior CAD -9K vs -39K prior AUD +37K vs +32K prior NZD +32K vs +29K prior

The deeply misguided CAD-short trade has virtually been erased. The market piled into bets against the loonie on signs of trouble in the Canadian housing market the story proved to be a canard and the Bank of Canada massacred the trade. Ultimately, the market will get long CAD on signs of rising rates but it will need to lick its wounds first.

The other development is the shift to yen shorts. That's something we focused on last week. The BOJ is the only central bank that isn't making growing hawkish shift, and we learned on Thursday that inflation forecast might even be cut. Those shorts are likely in it for the long haul.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.2% | 1.0% | Jul 17 22:45 | |