Intraday Market Thoughts Archives

Displaying results for week of Jul 30, 2017USD Exhales

A strong US jobs report, a dovish BoE, cautious RBA and USDX successfully avoiding to break below its 200-WMA. Is this the positive confluence USD bulls have been waiting for? Better than expected 209K Jul NFP reading, strong 0.3% m/m in wages and 2.5% y/y were in line or better than expectations. More strikingly positive, the unemployment rate fell to 4.3% from 4.4% as the participation rate rose to 62.9% from 62.8%, further confirming the tightness of US labour markets. The market probability for a Dec Fed rate hike rose to 42% from yesterday's 38%, while odds of a September hike remained little changed at 5%. FX trading will go into snooze mode for the rest of month, with rumblings about Jackson Hole conference and the odd macro figures drawing attention. A new charts note on EURUSD has been posted to our premium subscribers.

Dollar Digs its Own Grave

Yesterday we wrote about potentially negative consequences of trade disputes on the US dollar, today it was soft economic data and more Russia drama hurting USD. The pound was the laggard on the day while yen led the way. US and Canadian jobs reports are up next. After closing out of the Premium cable long at 170-pip gain just ahead of the BoE decision, we opened a long above the prevailing price, which was not filled. The trade was cancelled and a new one was issued.

It's rarely one thing that sinks a currency. All the reasons to sell the US dollar would evaporate if growth was at 3%. Through the first half of the year, it's been at a 2% pace and the remainder of the year is a question mark.

One forward-looking indicator is the ISM non-manufacturing index but it stumbled on Thursday to 53.9 compared to 56.9. That set off another round of US dollar selling. Still, USD/JPY buyers made a stand at the weekly low and it bounced… at least until a few hours later when reports revealed Russia special prosecutor Robert Mueller had gathered a grand jury.

The last thing that's really propping up the dollar is the Fed. Despite a slightly more cautious tone at the Fed, the core of the FOMC is close to Williams who on Wednesday said he expects another hike this year and three more in 2018. If that happens the dollar will easily erase the last few months of losses.

The easy path to make that happen via tax reform and infrastructure spending. The problem now is that time is running out on the debt ceiling, and that will eat up more political capital, while the Russia story continues to eat up the remainder.

Still, the US economy has showed remarkable resilience despite Washington's best efforts for years and could do it again. A big signal will come Friday in the non-farm payrolls report. The consensus is 180K new jobs but the market will be almost-entirely focused on average hourly earnings, which are forecast up 0.3% and 2.4%. If those miss, the Fed and markets may begin to lose patience.

A central bank on the opposite side of the spectrum is the Bank of Canada. Canadian jobs data is also due Friday and expected at +10K. The consensus has consistently been too cautious and the numbers have beaten expectations in 10 of the past 11 months, often by a large margin. Another strong report could light another fire under CAD.

Trade and Tribulations; BOE Next

The backbone of Trump's electoral promise was a better deal on trade and in the days ahead he faces the first real tests of that part of the agenda. The euro was the top performer Wednesday while the Swiss franc lagged. GBPUSD edged up on higher than expected services PMI. The BoE decision, quarterly Inflation Report and Carney testimony are next. The Premium trades will close the GBPUSD long at 170-pip gain ahead of the BoE and issue a contingent order just before the release momentarily.

تركيز على الإسترليني و اليورو (فيديو للمشتركين فقط)

Reports on Wednesday said the White House could take trade actions against China as soon as this week. This action will target intellectual property rights and could mean unilateral duties. Any day, Trump's administration could also launch protectionist measures on steel. Combine that with the scheduled start of NAFTA negotiations next week and the worries begin to pile up.

What's worse is the targets of Trump's ire likely sense weakness in the White House and an opportunity to work with Congress to circumvent the President. Add it all up and it increasingly leaves a razor-thin margin for success with plenty of opportunities to crank up risk aversion or hurt the US dollar.

The momentum against USD continued Wednesday with the euro topping 1.1900 and cable shaking off a poor construction PMI to touch 1.3250.That data point will likely help to keep the BOE on the sidelines Thursday but the market will be closely watching the vote. The big question is whether Andy Haldane join hawks Saunders and McCafferty to vote for a hike and produce another 5-3 surprise. That kind of momentum may force Carney into signalling higher rates in the near term.

Even if the votes don't swing, there is plenty of scope for a hawkish surprise in the Minutes, GDP revisions, CPI revisions or Carney's speech. Technically, cable continues to chew towards the Sept 2016 high of 1.3444.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final Services PMI [F] | |||

| 54.2 | 54.2 | Aug 03 13:45 | |

| ISM Non-Manufacturing PMI | |||

| 56.9 | 57.4 | Aug 03 14:00 | |

| PMI | |||

| 51.5 | 51.9 | 51.6 | Aug 03 1:45 |

| Eurozone Spanish Services PMI | |||

| 57.6 | 58.4 | 58.3 | Aug 03 7:15 |

| Eurozone Retail PMI | |||

| 53.2 | Aug 04 8:10 | ||

Ashraf's Bitcoin Idea on RV TV

Ashraf Laidi, CEO of Intermarket Strategy, applies a technical currency strategist's view to trading Bitcoin, to identify the best entry point for the cryptocurrency. Full analysis on Real Vision TV.

None Wants a Strong Currency

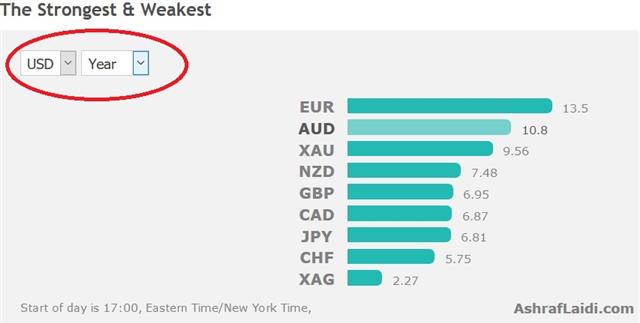

The RBA statement on Tuesday highlighted the conundrum at central banks – they're feeling better about growth and inflation but don't want a higher currency. Lowe did his best to salt in some jawboning and AUD/USD fell in the aftermath of the decision but the decline may have been less about his anti-AUD comments than the RBA's forecasts. NZD is falling fast in early Wednesday Asia after NZ Q2 employment contracted 0.2% q/q vs expectations of +0.8%.The chart belows shows all currencies are up vs the USD so far this year, with the euro the strongest, franc the weakest and silver the weakest metal, well underperforming gold.

US data were neutral to negative. June core PCE price index held at 1.5%. July manufacturing ISM slipped to 56.3 from 57.8, with prices paid up to 62 from 55.0 and employment off to 55.2 from 57.2. June construction fell 1.3% vs expectations for a rise with net downward revisions, which means a negative contribution to the Q2 GDP revision.

The RBA statement said a stronger Australian dollar would restrain growth and inflation. It's not as strong as previous comments that explicitly warned of the perils of a high currency but it still helped to set a cap on the Aussie. It means that if AUD/USD rises further, rate hikes will be pushed out further, thus suggests the RBa's reaction function.

The other standout in the RBA statement is downcast commentary on wage inflation. Lowe made several references to low wage growth and said it will continue for a while yet.

A widening gulf between central banks may be growing -- Some have grown tepid on wage growth, despite all the traditional signs of a tighter job market. That's a reflection of a change in global dynamics, offshoring and automation. Other central banks believe it's only a matter of time until wages pick up, as the traditional rules kick in.

Since the same factors are in play everywhere, both sides can't be right. What strikes us is that forecasting low wage growth may be more effective in restraining FX than jawboning. The risk is that if you're wrong about wages, you might have an inflation problem. That's a risk worth taking or at the very least, it may mean more central banks take a wait-and-see approach.

Such a collective shift to the sidelines could have the greatest impact on FX, weighing particularly on currencies with the most tightening priced in. That said, we don't see signs of strong or shifting rhetoric on the wage inflation debate just yet.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Prelim Flash GDP (q/q) [P] | |||

| 0.6% | 0.6% | 0.6% | Aug 01 9:00 |

| Eurozone Spanish Unemployment Change | |||

| -66.5K | -98.3K | Aug 02 7:00 | |

Ashraf on Real Vision TV

Ashraf Laidi, CEO of Intermarket Strategy, is a highly regarded currency strategist and he expertly blends the technical and fundamental rationales to make the case for renewed impetus for the euro against the dollar. Outlining the policy lag between the Fed and the ECB and the protectionist rhetoric coming out of the US, Ashraf also has an interesting counterpoint on the relative moves of the dollar and gold. Filmed on July 18, 2017, in London. Full Interview for RV TV members.

ندوة اليوم قبل المركزي الإنجليزي

سيركز الاستاذ اشرف العايدي على قرار المركزي الانجليزي الحاسم المنتظر يوم الخميس اثر إرتفاع التضخم و احتمالات رفع الفائدة. - انخفاض الفارق بين الأعضاء الذين صوتوا لصالح لرفع الفائدة و الذين صوتوا لصالح عدم تشديد السياسية النقدية يوضح الجدل حول موضوع سحب السيولة. - ما هي إستراتيجيات تداول الاسترليني مقابل الدولار و الين؟ احجز مقعدك

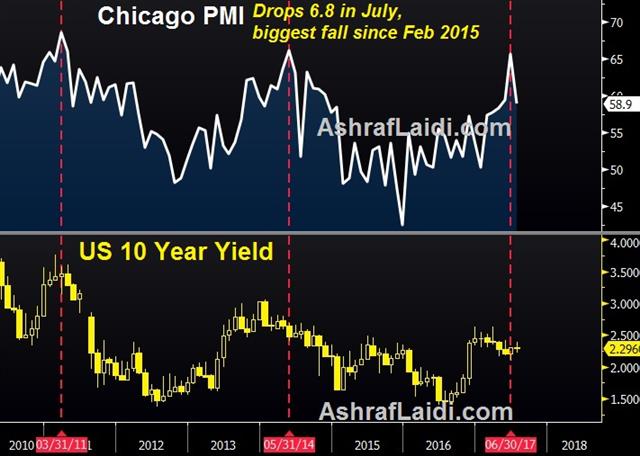

August Seasonals get a Glance

The momentum and the seasonals diverge as we head into August. The loonie as the top performer in July as the Swiss franc lagged. A big week for data and central banks awaits. Just earlier, the Chicago PMI fell to 58.9 in July from 65.7, posting its bioggest decline since Feb 2015. Prending Home Sales rose rose 1.5% vs an exp 1.0%. Friday's Premium USD trade has been filled and is in progress. Ashraf's Bitcoin webinar this evening is at 8 pm London.

The July story was liftoff in central bank hike expectations as signs of global growth emerged. There are no obvious signs that it will be derailed this time but we're reminded of the many times in the past where it seemed growth was going to turn a corner only to stumble later.

In recent years, August has been a challenging month due to Chinese policy shifts and risk aversion. Seasonally, there are warning signs. AUD/USD has fallen in 10 of the past 12 Augusts and the average decline over the past decade is 1.05%. The RBA could set the tone in its Aug 1 decision.

Seasonal patterns are hit and miss but at the start of July we warned that it was the worst month for USD/JPY and the pair fell 1.5%. On the flipside, oil defied July seasonal weakness but the pattern continues in August and September.

Another seasonal pattern (and another central bank) to watch is pound weakness. August is the worst month on the calendar for cable in the short and long term.

Meanwhile, gold has some momentum and a seasonal tailwind as the August average gain over the past decade is 2.2%.

Ultimately, many of these patterns will need help from a bout of risk aversion so we will be watching all the usual and usual suspects.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +91K vs +91K prior GBP -26K vs -16K prior JPY -121K vs -127K prior CHF -2K vs -4K prior CAD +27K vs +8K prior AUD +56K vs +51K prior NZD +35K vs +36K prior

The market was a bit wrong-footed on sterling this week as it gained across the board. With the BoE coming up this week and US/CA jobs to follow, expect more moves ahead. The other story continues to be CAD as specs shake off the sting of the wrong-footed bet against the loonie and pile into longs. How far can the pendulum swing before the BOC gets cold feet about rate hikes?

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Chicago PMI | |||

| 58.9 | 60.8 | 65.7 | Jul 31 13:45 |

| PMI | |||

| 50.5 | 50.4 | Aug 01 1:45 | |