Intraday Market Thoughts Archives

Displaying results for week of Aug 27, 2017Sizzling Canada & NFP Rumour Trade

Canada posted its best half in 16-years as Q2 soared above expectations. The Canadian dollar was easily the top performer on the day and USD/CAD suffered further on late USD selling ahead of nonfarm payrolls, which is the main highlight in the day ahead as the calendar turns to September. We will also take a look at seasonals. 2 new Premium trades have been issued in USD and GBP pairs.

Canadian GDP rose 4.5% q/q annualized in the second quarter, far above the +3.7% consensus in the best quarter since 2011. It builds on +3.7% growth in Q1. The details of the data were just as positive as consumers, business investment and trade all expanded along with incomes. Compared to a year ago, GDP is up 4.3% and all the forward-looking metrics point to another decent quarter for Q3.

That will certainly draw the Bank of Canada's attention ahead of the Sept 6 meeting. The odds of a hike rose to 41% from 26% in the aftermath of the report. USD/CAD fell nearly 2 cents and could fall much more if a hike comes and is coupled with a hawkish statement.

The US also got some good news as personal income rose 0.4% in July compared to 0.3% expected and the Chicago PMI was slightly higher. But other indications were negative. Pending home sales fell 0.8% as signs mount of a rut in housing. In a sign that inflation pressures aren't building, the core PCE price index fell to 1.4% annualized from 1.5% in July.

Mnuchin & Data Rein in USD

The dollar fell about 75 pips across the board in the latter half of the day. Part of the blame was heaped on Mnuchin for saying a weaker dollar was better for trade but focusing on that line alone took his words out of context.What's more likely is that month-end flows depressed the dollar. There is also abundant talk about how August non-farm payrolls consistently underperform. They've missed the consensus on the first reading in 16 of the past 20 years including an average of 48K in the past six years.

We get the sense, however, that it's a well-known seasonal hiccup and that most traders may be selling USD on the rumour of a soft report. In turn, they could cover when the data hits, even if it's weak.

Quick hits:

The Chinese yuan remains the least talked about story in FX. It was easily the best performing currency in August, followed by the Swiss franc and euro. The New Zealand dollar lagged badly.Most major stock markets were up in August but less than 1%. Factoring in FX changes, the Nasdaq and Italian MIB were top performers.

At the start of August we warned it was tough month for the pound. Cable fell 2% and only the New Zealand dollar fared worse than GBP.

We also warned that gold was a winner in August. It gained more than 4% en route to the highest levels since November 2016.

On Aug 1, we highlighted that August was a poor month for AUD and fell in 10 of the past 12 Augusts. That continued and it had been down as much as 2.3% mid-month but recovered to finish down 0.7%.

Finally, we warned about consistently high volatility in August and that was definitely the cast as the VIX jumped as much as 68% before fading to just a 3.3% gain at month end.

We will have September seasonals in the days ahead.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final Manufacturing PMI [F] | |||

| 52.5 | 52.5 | Sep 01 13:45 | |

| ISM Manufacturing PMI | |||

| 56.5 | 56.3 | Sep 01 14:00 | |

| PMI Manufacturing | |||

| 55.5 | Sep 01 13:30 | ||

| PMI Manufacturing | |||

| 60.3 | 60.9 | Sep 01 7:30 | |

| PMI | |||

| 51.0 | 51.1 | Sep 01 1:45 | |

| Eurozone Final PMI Manufacturing [F] | |||

| 57.4 | 57.4 | Sep 01 8:00 | |

| Italy PMI Manufacturing | |||

| 55.4 | 55.1 | Sep 01 7:45 | |

USD Extends Bounce on Data

Tentative signs of a turnaround turned into something more concrete Wednesday as the US dollar rally continued on strong data. The USD was the top performer while the Swiss franc lagged. USDX finally regains its 200-week MA, a triple bottom beckons, USD jobs around the corner and a potential Draghi jawboning is less than 10 days away. Seems like the perfect USD play. Ashraf's special-edition Premium video on how to play the USD stabilisation.

We wrote yesterday about the positive signs in the US dollar but worried that it hadn't come with any upper-tier data. That changed Wednesday on strong growth and jobs numbers. Q2 GDP was revised to 3.0% from 2.7% on strong corporate profits and consumer spending. The ADP employment report hit a 5-month high at 237K compared to 185K expected.

On the political front, speculation also mounted that relief funding from Hurricane Harvey will make it easier to raise the debt ceiling, at least for a short time. Trump also focused on corporate tax cuts in a speech in Missouri.

The moves in the dollar were substantial. After rising as high as 1.2070 a day ago, EUR/USD sank to 1.1881 and finished on the lows. The commodity currencies were also hit hard late in the day as AUD/USD fell a full cent from the highs in an outside reversal. USD/CAD was one of the reversals we highlighted yesterday and that pair posted its best day in four weeks, climbing 120 pips.

The loonie will stay in focus in the day ahead with Canada delivering the first report on Q2 GDP. Expectations are for a sparking 3.7% reading but the risks are to the downside after soft current account numbers Wednesday.

A full slate of data is up beforehand including the China official PMIs, Australian private sector credit, speeches from the BOJ's Masai and RBA's Harris. That's followed by German retail sales, French CPI, Eurozone CPI, a speech from the BoE's Sanders, the US PCE report and the Chicago PMI among others.

It's safe to say that the summer lull is over.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (m/m) | |||

| 0.1% | 0.6% | Aug 31 12:30 | |

| Chicago PMI | |||

| 59.6 | 58.9 | Aug 31 13:45 | |

| Germany Retail Sales (m/m) | |||

| -0.6% | 1.1% | Aug 31 6:00 | |

| Eurozone CPI Flash Estimate (y/y) | |||

| 1.4% | 1.3% | Aug 31 9:00 | |

| France Prelim CPI (m/m) | |||

| 0.5% | -0.3% | Aug 31 6:45 | |

US Dollar Makes a Stand

Whether it is just a month-end wobble or something more, the US dollar deployed a robust Tuesday reversal on positive economic signs. The Swiss franc was the top performer Tuesday while the yen lagged. Japanese retail sales are up next. Our Premium short in #EUROSTOXX50 hits the final 3380 target following the 3520 entry. Gold and silver hit their final targets yesterday. The upcoming moves will be discussed in the next Premium video due out in Wednesday Europe morning.

هل انتهى التصحيح؟ (فيديو للمشتركين فقط)

USD/JPY struggled early on Tuesday after North Korea launched a missile test that crossed Japanese airspace. The pair fell to a four-month low of 108.27 but later reversed higher to 109.90 – a 12-day high. It was a similar story across the board as the risk trade quickly faded and the dollar captured a bid. That was despite US 10-year yields falling to the US election.

The reversals in gold, USD/CAD, cable, USD/JPY and elsewhere muddle the picture. Quietly, EUR/JPY also rose to the highest since January in a break of the eight-week range. Whether the daily candle in gold is a true doji or gravestone doji remains to be seen. Ashraf's Premium video will shed more insight tomorrow.

USD strength emerged after the Conference Board's August consumer confidence rose to 122.9 compared to 120.7 expected. It was the second-best reading since 2000 and was driven by the 'current conditions' index, which is more reliable than the 'expectations' index because the latter has become more of a political-happiness gauge.

It's far too early to claim any kind of US dollar turn. Washington and the Fed are likely to be near-term headwinds. In addition, even the technical reversal is tenuous. Aside from USD/JPY, the US dollar basically finished flat.

The days ahead will be key as non-farm payrolls draw closer, but before that we have the ISM and ADP.

Looking ahead, Japanese retail sales are due up at 2350 GMT and expected to rise 1.0% y/y, a slowdown from the 2.2% pace in June. That's not likely to be a market mover but the rest of the day has some high-tier data including German CPI, ADP employment and the second look at Q2 US GDP.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (y/y) | |||

| 1.1% | 2.2% | Aug 29 23:50 | |

| FOMC's Powell Speaks | |||

| Aug 30 13:15 | |||

| ADP Employment Change | |||

| 186K | 178K | Aug 30 12:15 | |

Gold, yen overshoot on Korean Missiles

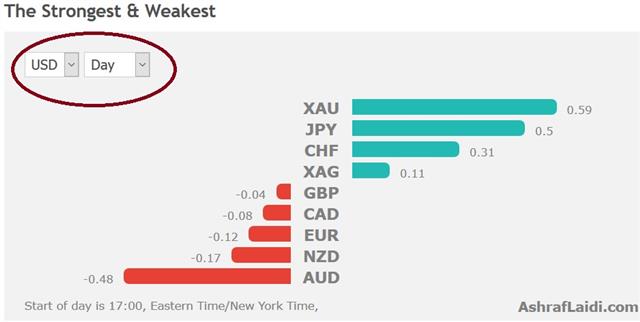

Just as Hurricane Harvey was grabbing the headlines by further damaging USD bulls via ongoing dilution of hopes for a Fed December hike, safe-haven assets shot up after on news from Japan that N. Korea has launched a missile in the direction of Japan, passing over the island of Hokkaido and landed about 1000 km from East Japan. Both Premium longs in gold and silver hit their final targets -- (XAUUSD from 1222 entry to 1300 final & XAGUSD from 15.90 entry to 17.50 final). The chart below shows the strongest and weakest currrencies/metals since 10 pm London.

Earlier on Monday, gold confirmed its technical break as it climbed $20 to $1311, before pushing to $1324 following PyongYang's missile strikes. The initial gold was Hurricane Harvey. The loss of economic activity due to the storm will hit Q3 GDP and cloud the picture on growth and inflation for months. That makes the Fed less likely to hike in December. With Draghi also reluctant to curb QE, gold is signaling more-dovish global central banks.

Earlier, the Chinese yuan jumped to start the week while the Shanghai Composite broke above a major triple top in a pair of moves that didn't get much attention. For the yuan, it was the ninth consecutive gain and a 14-month high. There can be little doubt that Beijing is allowing the currency to strengthen. The renminbi could be headed for another bout of turbulence if the reports out of Washington are true.

They say Trump is hell bent on slapping some kind of tariff on China as he attempts to score points on trade. The machinations of FX moves in China are always tough to decipher. For stocks, there has been good news for corporate earnings but the two-day, 2.7% rise is tough to justify on fundamentals. Technically, however, the break is compelling and the index is now less-than 9% from the 2015 highs.

Harvey to Cloud Outlook

Hurricane Harvey went from a tropical storm to what will likely be one of the most damaging storms in history. The rains are expected to last through Wednesday and the scenes in Texas already point to a massive calamity that will cloud forecasts for many quarters. The euro was the top performer last week while the New Zealand dollar lagged. CFTC positioning showed specs making bigger bets on the euro against the pound.

Harvey was a Category 2 storm when markets closed Friday but grew to a rare Category 4 storm when it first made landfall a few hours later. After pounding southwest Texas the system then went back out to sea and is now working its way up the coast to Houston where scenes of incredible flooding are already underway.

It's far too premature to assess the scope of the damage but much of the oil refining in the area is offline and may stay that way all week. The result will be a squeeze on gasoline prices. Oil is a more-tricky trade because imports are cut off. The kneejerk reaction when markets open may be to bid up prices.

Economically we suspect the storm will surpass the damage from Sandy and may even rival Katrina. Those storms skewed growth lower immediately but led to stronger GDP during the rebuilding. The impossible task is knowing just how much is related to the storm and how much was unrelated. That uncertainty will be another reason for the Fed to hold off hiking in December and maybe beyond.

Other weekend news included some tidbits from Jackson Hole. Kuroda warned GDP won't continue at 4%, which isn't a surprise to anyone.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +88K vs +79K prior GBP -46K vs -32K prior JPY -74K vs -77K prior CHF -2K vs -1K prior CAD +51K vs +51K prior AUD +60K vs +60K prior NZD +22K vs +25K prior

The euro longs remain near the most extreme levels since 2011 while specs are increasingly convinced that Brexit is going to hit harder than thought a few months ago.