Intraday Market Thoughts Archives

Displaying results for week of Sep 10, 2017Tightening Back on the Agenda

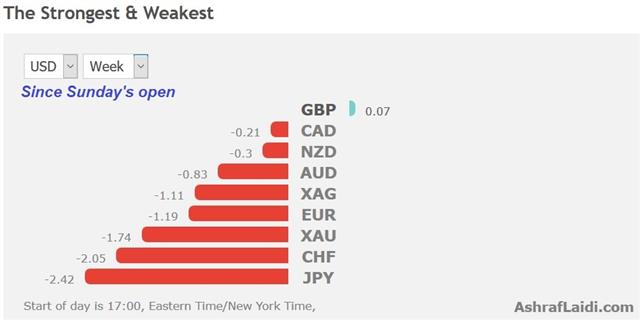

Global coordinated monetary policy tightening is back in play after a hawkish shift and the BOE and a bump in US fortunes. The pound soared after the MPC while the New Zealand dollar lagged. The Asia-Pacific calendar is light later but there are rumors of a North Korean launch. Our Premium long in GBPUSD hit its final target for 230 pip gain.

بين الاسترليني و الدولار (فيديو للمشتركين فقط)

The MPC said some withdrawal of stimulus is likely in the coming months in a move that came as somewhat of a surprise. The pound climbed 150 pips on the headlines and added another 50 when Carney revealed he too thinks the possibility of a hike has “definitely increased.” Cable ran to 1.3400 in a fresh cycle high and finished at the best levels of the day.

The US dollar caught a bid early in the day after CPI rose 1.8% compared to 1.7% expected. Not long after the data, the questions started to mount. Wage numbers were soft and it appeared inflation was boosted by an unusual jump in shelter prices.

Chatter about a weak retail sales report on Friday also did the rounds, in part due to skews from Hurricane Harvey. Finally, Mnuchin sounded a worried note no growth late in the day that contributed to USD/JPY selling down to 110.25 from a high of 111.04.

Finally, Bitcoin fell 13% after China announced it will shut all local exchanges by the end of the month. It last traded at $3348.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| 0.5% | 0.5% | Sep 15 12:30 | |

Tax Titillation Drives Dollar

There are few things a market likes more than a tax cut but that's what was dangled on Wednesday and the US dollar bulls bit hard. USD was the top performer again while the New Zealand dollar and euro lagged. Interestingly, US stocks were muted. Australian employment and Chinese industrial production are due up next. A new USD trade has been posted ahead of a busy 2 days of BoE decision (MPC minutes, US CPI and retail sales).

The great promise of the Republican win 10 months ago was a tax cut, but the market lost faith after the Obamacare repeal failure general disarray the White House. The dollar suffered as a result.

Hope wasn't lost. Mnuchin and Cohn have been quietly working on the details and now the effort has begun. Trump's across-the-aisle efforts to raise the debt ceiling have some thinking the equation has changed. He will meet with top Democrats for dinner later today where he will talk more about tax reform. The aim is to have a plan ready for September 25 and a report today said Trump was insistent on a 15% corporate tax rate.

That talk kept the US dollar momentum going as it rose to 110.69 against the yen and sent EUR/USD below 1.1900. Along with soft UK wage data, the strong dollar also helped to retrace all the cable gains from Tuesday. At the moment, a tax break is the best hope for a sustained dollar rebound. It will be a treacherous path but we will be watching closely.

On the near-term calendar is a speech from the RBA's Debelle at 2315 GMT but the main event comes at 0130 GMT with Australian jobs for August. The market isn't sure which way the RBA is going to go but a beat on the +20.0K would make it easier for the RBA to embrace a hawkish bias.

Continued strong signs from China would also be welcome. August industrial production is expected to rise a solid 6.6% y/y with retail sales up 10.5% y/y. That split shows how China is successfully shifting to a consumer-led economy, at least so far.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (y/y) | |||

| 6.6% | 6.4% | Sep 14 2:00 | |

| RBA Assist Gov Debelle Speaks | |||

| Sep 13 23:15 | |||

| Employment Change | |||

| 17.5K | 27.9K | Sep 14 1:30 | |

عودة الدولار الكندي القوي

يعود الدولار الكندي إلى عاداته القديمة — أقوى عملة بين عشرة العملات الاكثر تداول في العام الماضي و كذالك الأقوى منذ بداية النصف الثاني من العام الحالي المقال الكامل

USDCAD 11700 or 12700 ?

CAD is the strongest among top 10 currencies since the start of the second half of the year as it is was the strongest of all 2016. Where to next? Full piece.

Pound Soars, USD Gains Further

A surprise rise in UK inflation put a BOE hike back on the table while the US dollar bounce continued. The pound was the top performer while the yen lagged. Japanese PPI and the quarter business conditions index is due up next. Our GBPUSD Premium trade is +200 pips in the green, while the GBPJPY was stopped out due to combination of rapid JPY weakness and run-away GBP strength. A new Premium video focusing on yesterday's new trade balances time and price.

The pound showed what a sliver of inflation can do after CPI rose 3.9% y/y compared to 3.7% expected on Tuesday. Cable climbed 120 pips and GBP/JPY rose nearly 250 pips. The rally in GBP/USD broke the August high and 1.3298 was the best in nearly a year. Wednesday's UK jobs figures could help sway Thursday's MPC voting from 2 to 3 hawkish dissenters.

The BOC showed what can happen to a currency when a central bank changes gears and the suspicion in markets is that Carney may finally get to hike rates. The BoE's OIS market is now pricing a 35% chance of a November hike, climbing to 44% in December.

In economic news, US JOLTS job openings were at 6.17m compared to 6.00m expected in another sliver of good economic news for the United States. The main drivers of dollar strength continued to be relief about Irma and momentum.

USD/JPY is now flat on the month after a brutal start, but more broadly it's a mixed picture. The dollar is struggling to hold gains against the euro and cable begins to gain momentum.

Looking ahead, the Asia-Pacific calendar sports a few highlights including Japanese PPI for August. It's expected to rise a healthy 3.0% when it's released at 2350 GMT. In a release at the same time, the MoF's survey of large manufacturers for Q3 is forecast at +5.0 from -2.9.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| JOLTS Job Openings | |||

| 6.17M | 5.96M | 6.12M | Sep 12 14:00 |

الإسترليني: ماذا بعد تحقيق الهدف؟

الإسترليني: ماذا بعد تحقيق الهدف وكيف سيصوت بنك إنجلترا هذا الأسبوع؟ شاهد الفيديو الكامل

USD & Indices Rally after Hurricanes

US and global indices rallied across the board as fears of widespread damage from Hurricanes Harvey and Irma have ebbed slightly. Lack testing activity from Pyongyang also helped appease markets. The Hurricanes will weigh on Q3 GDP by 0.3%-0.4%, while the rebuilding boost may lift Q4 to as high as 3.5% from an expeccted 2.0% in Q3. Our DAX short was stopped out. A new Premium trade has been issued with detailed charts highlighting a crucial analog.

USD/JPY soared 150 pips to 109.50 from a Friday's low of 107.36 on Friday. The bounce brings the pair back above a few critical support levels, including the April low of 108.13. That one will be critical in the day ahead.

Estimates to the Hurricanes damage range from as high as $200 billion to $50 billion but in order for both storms to surpass the magnitude as a percentage of GDP as that reached in 2005, their combined damage would have to exceed $220 billion.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +96K vs +87K prior GBP -54K vs -52K prior JPY -74K vs -69K prior CHF -2K vs -2K prior CAD +54K vs +53K prior AUD +65K vs +67K prior NZD +15K vs +19K prior

The overall moves were modest, likely as the market hunkered down ahead of the BOC and ECB, but the increase in the euro net long was enough to push it to the highest since May 2011.

Formation spéciale Bitcoin DEMAIN à 20h00 hrs Paris

Qu'est-ce que le bitcoin et les crypto-monnaies ? Est-ce la valeur refuge du 21ème siècle ? Les facteurs les plus importants influencant la valeur des crypto-monnaies Décryptage et perpectives des crypto-monnaies Inscrivez-vous ici