Intraday Market Thoughts Archives

Displaying results for week of Sep 24, 2017أربعة أسئلة حول زوج اليورو الإسترليني

للمرة الثانية خلال ما يقارب سنة واحدة، يحاول زو اليورو / الإسترليني الوصول لمستوى التعادل 1-1، الأمر الذي سيحتل العناوين الرئيسية التحليل الكامل

4 Questions on EURGBP

Has EURGBP bottomed, or is there more downside ahead? Full analysis/charts.

Is Tax Reform Priced in?

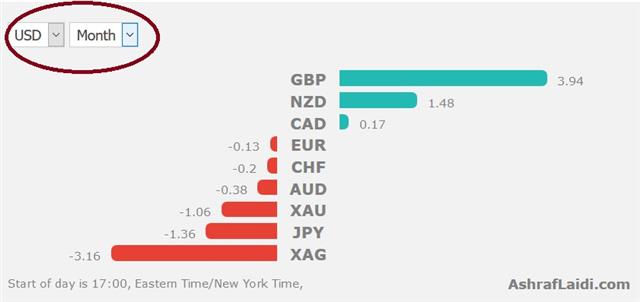

The US dollar struggled to maintain momentum on the heels of the tax announcement as opposition begins to materialize. NZD was the top performer while USD lagged. Japanese CPI is due later. Friday's US core PCE will be key. 5 new charts have been posted to subscribers backing the ongoing DAX30 trade. The chart below is one them.

The greenback has been beaten down for most of the year and finally looks poised for a rebound but the market isn't delivering. The tax proposal gave the dollar a lift Wednesday and sparked a sharp selloff in Treasuries but the momentum faded today.

That was despite a revision higher in Q2 GDP to 3.1% from 3.0%, a small-than-expected good trade deficit and wholesale inventories for August up 1.0% compared to a 0.4% decline expected.

That's all good news but the USD dollar fell around a half-cent across the board. USD/JPY slowly slid to 112.24 from as high as 113.20 in Asian trading. Both EUR/USD and USD/JPY formed minor two-day double bottoms before the turnarounds.

9 months of disappointment for USD bulls is hard to shake off. Friday's critical PCE report will be a major factor in upcoming Fed communication and should be a major dollar story.

The bigger story, however, has to be taxes. The numbers and rates that the administration is floating would be a major dose of stimulus.

The big question regarding tax reform is: What's priced in? Given the healthcare struggles, you would expect some skepticism in the markets but the failure on that front could also help bring Republicans to some sort of compromise.

Perhaps no one wants to bet on Congress and risk another brutal disappointment. We also have to consider the alternative: That a tax cut has already been priced in. Maybe now the market is having doubts because there are so many barriers to a deal, especially with much of the savings going to corporations and high-income earners.

It's tough to believe it's priced in but it's also tough to understand how the dollar can continue to struggle. Perhaps month end flows are skewing the signals. We will watch closely in the week ahead.

In the meantime, Japan is out with a pair of key reports to close the week. Both CPI and employment data are due at 2330 GMT. Even with a rise in CPI to 0.6% (as expected) we struggle to see a shift from the BOJ any time soon.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final GDP (q/q) [F] | |||

| 3.1% | 3.0% | 3.0% | Sep 28 12:30 |

RBNZ Holds, Poloz Will Too

The RBNZ held rates unchanged as largely expected but it was the BOC's Poloz that surprised with a less hawkish message. The US dollar was the top performer Wednesday while the Canadian dollar lagged. The RBNZ left rates unchanged. The Pre-Fed EURUSD Premium short hit its final 1.1730 target for 180-pip gain. A new trade has been issued.

قطار تصحيح الدولار (فيديو من الصفقات والرسوم البيانية للمشتركين فقط)

The RBNZ left the official cash rate at 1.75% and said a lower New Zealand dollar would help the economy. That's a slight downgrade in the jawboning but the main message that monetary policy will remain accommodative for a considerable period was unchanged. Kiwi slipped on the headlines but the overall message was largely priced in.

A central bank that has kept the market off balance has been the Bank of Canada. That's in part because of a lack of communication since the tightening cycle began. The market had been pricing in a 38% chance of a hike in October and a 68% chance of higher rates in December.

That's looking far less likely after Poloz signaled a wait-and-see stance. He said the BOC will proceed cautiously from here while repeatedly emphasizing uncertainties and data dependence. In particular, he highlighted that the BOC wanted to see the effects of the rate hikes, the government's housing measures and the rise in the exchange rate. That's going to take time and means October is off the table, barring a string of great economic data points.

Outside of Poloz, the theme on the day was US dollar strength led by a selloff on Treasuries. Republicans announced some details of the tax plan and that helped stocks along with some minor deficit worries. USD/JPY rose as high as 113.26 before fading to 112.80.

Meanwhile, we had highlighted downside risks for EUR/USD and it fell to 1.1717, a one month low.

Looking ahead, the euro will be in particular focus in the day ahead with German CPI numbers coming up.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Spanish Flash CPI (y/y) | |||

| 1.6% | Sep 28 7:00 | ||

Yellen Leaves ‘Em Guessing

When the newswires can't decide if a speech is hawkish, or dovish then it's probably neither. Differing Yellen interpretations caused a whipsaw in markets Tuesday as the Canadian dollar led the way and the New Zealand dollar lagged. Japanese business confidence and Chinese industrial profits data is due up next. The latest Premium video assesses our the existing trades ahead of this week's tax reform announcement from the White House and barrage of economic data & central bank speak.

Yellen's speech dove deep into monetary but failed to change the maths on a December hike. Her comments were initially reported by Reuters with headlines that tilted dovishly, stressing the uncertainties. A couple minutes later, Bloomberg's main take was Yellen's warning that the Fed should be wary about moving too gradually.

Initially the US dollar fell but it then jumped on the second set of headlines, sending EUR/USD down to 1.1757. Ultimately, the market decided she'd given enough of a hint or commitment to December to move odds of a December hike from 64% to 70%. In the bigger picture, Tuesday was larger a mirror image of Monday. The risk-off trade spurred by worried about North Korea slowly evaporated. Gold fell $16 to erase a $16 gain the day before.

One exception was EUR/USD as it fell for the second day and touched the lowest since Aug 22. The fall broke the neckline of a minor head-and-shoulders top as worries about the German election spread and the US dollar holds a modest bid. In the days ahead, that pair is likely to spot to watch, especially with inflation data from Europe and the US coming up.

Looking ahead to Asia-Pacific trading, the calendar is generally benign. At 0130 GMT, Chinese industrial profits are due. They're coming off a whopping 16.5% y/y gain in July. At 0500 GMT, we will get Japanese small business confidence data, which is forecast at 49.5. Neither is likely to move markets.

One spot to keep an eye on is a Republican primary in Alabama for Senate. The anti-establishment candidate looks poised to knock off an incumbent, who has been heavily supported by the party.

من هزة كوريا إلى برنامج ضرائب ترامب

War Games

North Korea called Trump's recent comments a "declaration of war" and vowed to respond as the rhetoric ramps up. The US replied that Trump's comments were not a declaration of war. The Japanese yen was the top performer, closely followed by gold,while the New Zealand dollar lagged. The BOJ minutes are due later. Watch out for Yellen's Tuesday speech on inflation and monetary policy at 12:45 Eastern (17:45 London time). 3 out of the 5 Premium Trades are in progress.

The words 'North Korea' and 'war' set off algos Monday and a wave of selling in yen crosses. USD/JPY fell as low as 111.48 from 112.15. The Swiss franc and gold also jumped on the headlines and didn't retrace.

The problem with the North Korea story lately is that there is no ebb and flow. You would expect some rhetoric and then something to cool it off but neither side seems capable of diffusing tensions. Instead, the series of insults and threats continues. The comments echoed especially loudly as they emerged during US market hours. North Korea's foreign minister spoke early in New York trade and that meant extra attention in markets. Previously, the main rhetoric was limited to the weekend. Inevitably, the talk will cool down but it's tough to fade the trend at the moment against the risk of a tweet or statement at any moment.

Politics Galore

Separately, politics are dominating markets. Merkel's disappointing election showing and the risk of fractured or failed coalitions in Germany hurt the euro. US Congress is haggling over a healthcare proposal that seems dead and a tax proposal that's still unclear. In Japan, the snap election raises new risks. Brexit is never ending. It's a veritable minefield with tape bombs landing constantly and the threat of real bombs. That makes a good argument for paring risk until there is more clarity.Coming up in Asia-Pacific trading, the minutes of the July 19-20 BOJ meeting will be released but the yen is more-likely to driven by comments from Abe and developments in North Korea.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Monetary Policy Meeting Minutes | |||

| Sep 25 23:50 | |||

Tax Reform Shadows Elections

Angela Merkel wins her fourth term as chancellor but with the lowest victory margin she ever attained over her last 3 previous elections. The euro gapped lower, now testing 1.1850 as it awaits Draghi's speech at 2 pm London time. NZD remains the weakest currency since the start of Monday Asian trade after Saturday's inconclusive election outcome clouds the coalition-building process. CFTC positioning data showed a race away from cable shorts. Japan PM Abe will dissolve the lower house of parliament to call early snap election for Oct. 22, 14 months ahead of schedule. But the week's bigger market driver in FX could be US Congress decision on taxes.

The other story we are watching closely is US tax reform. Weekend leaks suggest the Republican proposal to be released this week includes a corporate tax cut to 20% from 35% and a small business rate at 25% compared to 39.6%. The US tax code is so littered with loopholes that the fall isn't as dramatic as it seems but if it's successful it could still be a big boost to US growth and the US dollar.

More than the details, we will be watching for the reaction from Congress to gauge the likelihood any kind of reform or stimulus will be passed. We will also watch to see if cuts – especially to individuals – are made retroactive to the start of the year. That could mean a quick stimulus.

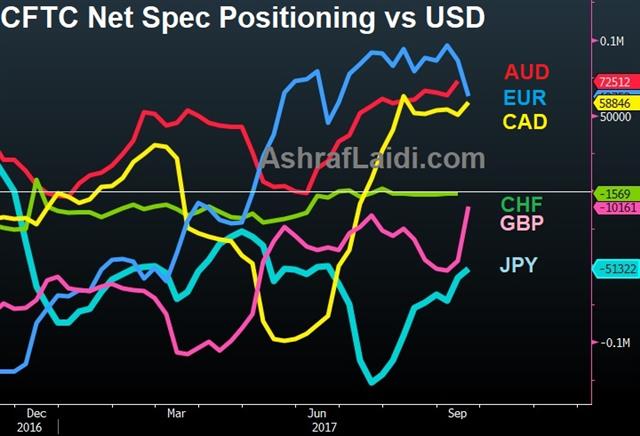

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +62K vs +86K prior GBP -10K vs -46K prior JPY -51K vs -57K prior CHF -1.5K vs -2K prior CAD +59K vs +50K prior AUD +72K vs +63K prior NZD +7K vs +12K prior

It's the second week in a row of fewer longs in EUR and far fewer shorts in GBP. The race out of sterling shorts came after the Bank of England decision and rip higher in the pair. The more-balanced market suggests the potential for quick gains from here is limited. AUD longs are beginning to get crowded but not yet dangerously so.