Intraday Market Thoughts Archives

Displaying results for week of Jan 21, 2018Mnuchin, Draghi & Trump on FX

It was a busy week in currencies related remarks from US Treasury Secretary Mnuchin, president Trump and ECB president Draghi. So what does it all mean and where is the US currency heading? Full analysis.

أمريكا أولا، الدولار الأخير

أن التعريفات التجارية المذكورة آنفا لا تعتبر تهديدا للصناعة الصينية في الطريقة التي تشكل خطرا على الشركات الأمريكية التي تسعى للاستفادة من صعود المستهلكين الصينيين التحليل الكامل

America First, USD Last

Four days after the US government was shut down due to immigration-driven disagreement over extending Federal funding, USD sustains a major blow resulting from protectionist remarks by US Secretary Steven Mnuchin and Commerce Secretary Wilbur Ross. Is there more to it? Full analysis.

Recording of Yesterday's Webinar

If you missed my webinar on "Multi-Time Frame Analysis", please find the full recording here.

Dollar Dam Breaks

US dollar technical support levels crumbled Wednesday in a rout on the dollar that's been building for weeks. The pound was the top performer while the US dollar lagged. New Zealand CPI missed estimates early in Asia-Pacific trade. A new USD trade has been posted to subscribers. Below is the Premium video, highlighting the reasons behind the trade and positioning ahead of Thursday's ECB press conference.

It's gone from bad to worse for USD as the combination of talk from Mnuchin, worries about trade and better prospects elsewhere undermine the currency. The dollar lost more than a full cent against the euro, yen and pound Wednesday. Gold soared to its highest level since summer 2016.

USD/JPY fell to the lowest since September; EUR/USD rose to the best level in three years and the pound climbed 250 pips to the highest since the Brexit vote.

Along with that, commodities priced in US dollar soared with gold and oil hitting multi-year highs.

The trigger was a comment from Mnuchin. As Ashraf pointed out, it was something he had said before, but at the moment every USD-negative tidbit is amplified and the momentum is running away.

Quietly, US economic data has softened as well. Yesterday, the Richmond Fed manufacturing index slipped to 14 compared to 19 expected in January. Today FHFA house price data and existing home sales were both on the soft side.

The big question for central bankers this year will be inflation and Q4 data from New Zealand raised some questions. Prices rose just 1.6% y/y compared to 1.9% expected. The kiwi fell a full cent to 0.7335 on the headlines. Moves in commodity and FX prices will further cloud the global inflation picture.

One person who will desperately try to restrain his currency in the day ahead is Draghi but he faces a tough task. Any hint of less-dovish policy will send the euro skyward.

Woe Is USD

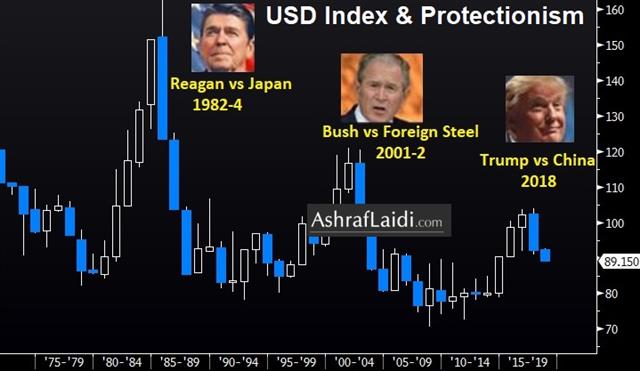

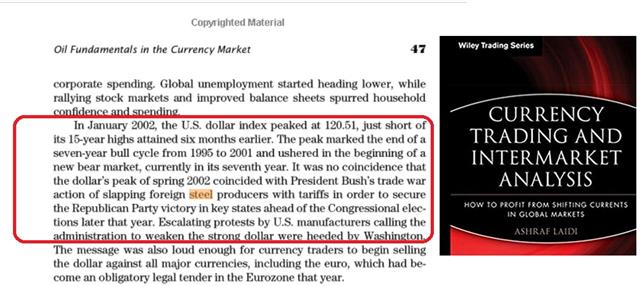

Another day, another dollar decline but this time it was the confirmation of the inevitable: US Treasury Secretary Mnuchin said:"Obviously a weaker dollar is good for us as it relates to trade and opportunities.” Although Mnuchin addressed the benefits of a stable currency, traders and the media rushed to the remarks as a change in policy. Or is it a change. Mnuchin stated the same remarks in April of last year. Is it a surprise that US officials are talking trade war, steel protectioism and USD weakness in a midterm election year? Here is from my book on what happened in 2002--also a midterm year. A new USD trade has been posted to subscribers.

Gold & Silver Video

Gold is $100 above the level from my first video on the topic back in December. We take a look at positioning among speculators, as well technical analysis in assessing the medium term picture for both gold and silver. Full Video.

Ashraf's Wednesday Webinar

Join my Wednesday webinar with GKFX on "Multi-Time Frame Analysis".

- Your forecast may be correct but is it too early (or too late)? - Combine weekly, daily and hourly timeframes to your charting analysis - How news and noise help prices evolve

Wednesday, 7:30 pm London/GMT. Click to register.

IMF Joins the Party, BOJ Next

The global growth story got a big supporter Monday as the IMF upgraded its estimates for 2018 and 2019. The pound was the top performer Monday while the yen lagged. The Bank of Japan decision is next. The Premium Insights closed the EURUSD short at a 200-pip gain. 4 Premium trades remain in progress.

المحافظة على الارباح و الاتجاه (فيديو للمشتركين فقط)

The IMF ratcheted up its growth forecast to 3.9% from 3.7% for this year and next. It was widely anticipated but helps to underscore the upbeat theme that's rampaging through markets and giving a tremendous lift to global currencies.

Another spot that shows the optimism is the Citi economic surprise index. Every major country and region is positive with the US and Europe well high up the scale, except for Latin America trailing behind.

It's increasingly clear that global markets are entering some kind of euphoric phase and that the animal spirits are primed. Ashraf wrote last week about how yen-correlations have disconnected and that's something we're watching closely. At the moment, virtually all global markets are winners but at some point bonds will have to crack if this continues and that will make the FX landscape much more volatile.

One spot bonds are unlikely to crack is Japan as the BOJ attempts to stick to its annual 80 trillion yen in JGB purchases. Kuroda is likely to underscore the status quo in today's policy decision but there is a risk he signals a step away from bond buying or something that will allow Japanese yields to move higher. Recall, the current objective is to keep the yield of the 10-year bond at or near 0%. It is now near 0.1%.

Watch carefully because even the slightest hint may be enough to send USD/JPY down to 110.00 and below. There is no set time but the headlines usually cross shortly after 0230 GMT.

فيديو تمركز العقود الأجلة في العملات

عندما يكون عدد عقود الشراء في اليورو أعلى من عدد عقود البيع هل يجب عليك شراء زوج اليورو دولار ؟ ماذا يعني تمركز العقود الاجلة في العملات ؟ و كيف يمكن للمتداول الاستفادة منه في تداولته ؟ الاجابة في الفيديو الإسبوعي مع خبير الاسواق أشرف العايدي الفيديو الكامل

لماذا الين الياباني ملاذ الأمان؟

لماذا الين الياباني ملاذ الأمان؟ ما هي "الكاري ترايد"؟ ما وراء علاقة الين و العواءد؟ لماذا توقفت العلاقة؟ الاجابة في الرساءل الصوتية عل قناتي في تلغرام للاستماع

Germany Steps Forward, US Steps Back

The German SPD voted to enter coalition talks with Merkel's Christian Democrats, helping lift the euro in early-week trading. The US dollar, meanwhile, is under pressure after Republicans and Democrats failed to avert a government shutdown. CFTC positioning data showed euro longs easing from their record high.

The euro gapped +50 pips higher to 1.2270s at the weekly open as Merkel aims to end the uncertainty in German politics. There is no guarantee of a deal but the SPD delegates voted 362-279 to enter final discussions after a preliminary deal in December.

The news isn't a big surprise and shouldn't be a lasting factor but it's yet-another dose of good news for the euro.

It's just the opposite in the US where Congress delivered a self-inflicted wound in the form of the first government shutdown since 2013. The US dollar is softer across the board early but expect the market to take it in stride. The previous shutdown lasted 16 days and markets shrugged off the effects.

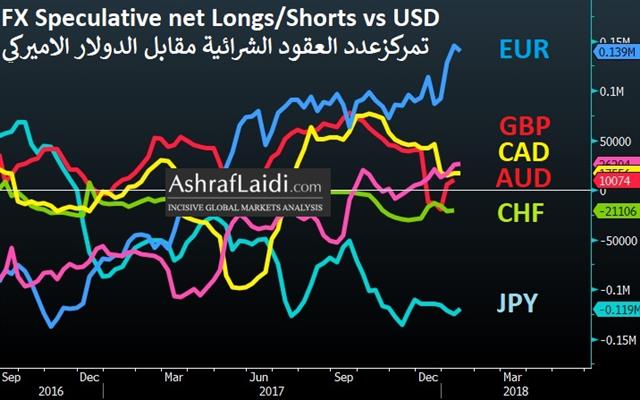

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +139K vs +145K prior GBP +26K vs +26K prior JPY -119K vs -126K prior CAD +18K vs +17K prior CHF -21K vs -22K prior AUD +10K vs -5K prior NZD -8K vs -11K prior

The market is reluctant to embrace cable longs. Despite the impressive run lately, the looming risk of negative Brexit headlines is ever-present. Euro longs edged back from record extremes but overall moves were small.