Intraday Market Thoughts Archives

Displaying results for week of Jan 07, 2018On US Dollar Tumble

The latest tumble in the US dollar can fairly be explained due to a set of reasons, all of which will help to enforce the secular downtrend of the US currency in the year ahead. Full analysis.

داخل التوترات التجارية – كندا والصين

هل سيكون عام 2018 عام الحروب التجارية والصراعات الاقتصادية الدولية؟ يمكن للحقائق التالية أن تجعل هذين التهديدين الممكنين التحليل الكامل

Hello Trade Tensions

China dimissed the Bloomberg "Treasuries" story as "fake news" and the White House denied the US is pulling out of NAFTA. But there's no smoke without fire. Full analysis.

Doves' Blood in Eurozone Water

When the ECB drops a hint of tightening it's like a drop of blood in a shark tank, as the market showed on Thursday. NZD and EUR were the top performers while the US dollar lagged. Japanese current account data will close out the week. A 3rd EUR trade has been issued to the Premium Insights.

The ECB minutes offered a small hint about what's coming next, referring to the area's 'expansion' rather than its continued 'recovery' but that was all it took to send the euro to 1.2050 from 1.1940. In recent press conferences, Draghi has taken pains to keep the currency from jumping but the minutes offered more colour about the “continued robust and increasingly self-sustaining economic expansion” as policymakers contemplate what to do next.

The market is extremely one-sided with net euro longs at the most extreme on record but even this week's three-day, 170-pip decline wasn't enough to shake out any longs.

The stability got a hand from the continued struggles of the US dollar. An extremely strong 30-year bond auction Thursday weighed on the dollar along with a miss on PPI. Friday features the CPI and retail sales reports. Both will be critical for the US dollar and the Fed deciding what to do next.

First, Japanese current account numbers will be released at 2305 GMT. Don't expect a significant market reaction. Instead, watch out for continued reports about bond buying, trade and Bitcoin exchanges.

Video on Yields Run & Indices

In light of the surge in global bond yields, we examine the run-up in German bund yields relative to their US counterpart and the implications for the the DAX and Eurostoxx indices. Full Video.

الذهب، بيتكوين و ريبل

ما هي الوجهة القادمة لأسعار #الذهب بعد تحقيقه ارتفاعات 12% خلال 2017 ؟ ماذا عن أسعار #البيتكوين هل ستواصل تحقيق الأرقام القياسية خلال 2018 مع تحدي عملة #الريبل الفيديو الكامل

China and Japan Stir the Pot

Unexpected moves from the Chinese and Japanese central banks threaten to shake-up the complacency in markets. The yen was the top performer Tuesday while the Swiss franc lagged. Chinese CPI is due up next. The Premium Insights locked in 145-pip gain in the EURUSD short with a detailed explanation on the next move in the pair.

USD/CNY has risen to 6.52 from 6.47 in the past two days and a big reason why might be a tweak at the PBOC. A newswire report said banks were told to adjust their use of the counter-cyclical factor. It was a factor intended to against appreciation at the time. It's worked and the yuan is close to its best levels since 2015. That strength has helped to stall investment outflows from China but with the new shift, they could once again pick up.

Ashraf has mentioned earlier this summer that the PBOC's managed appreciation of the CNY was partly forced by FX outflows into Bitcoin.

The PBOC will remain in focus in the day ahead with PPI and CPI numbers due at 0130 GMT. The CPI is expected to tick up to 1.9% from 1.7% but even with the rise, the low inflation numbers are yet-another reminder that strong growth is no guarantee of jobs.

Another move that is minor on the surface but could have major implications is the BOJ decision to trim about $20 billion of purchases of +10 year bonds. The move was seen as a possible precursor to tightening and it sent US 10-year yields to the highest since March 2017. However, it could simply be a technicality due to the yield-curve control program.

In the short-term, this will put an additional focus on the BOJ and raises the risk of further yen gains. It's complicated by the short window until the Jan 23 BOJ meeting. Look for Kuroda to try to clarify his stance then.

Top Weighs on Euro

EUR/USD is in danger of forming a double top after the failure at 1.21. The New Zealand dollar was the top performer while the euro lagged. Japan returns from holiday Tuesday. There are currently 7 Premium trades in progress, 4 of which are in profit, 2 in a loss and 1 unchanged.

إدارة الصفقات الحالية والمستقبلية (فيديو للمشتركين فقط)

سبعة صفقات مفتوحة حاليا في خدمة المشتركين؛ ٤ في ربح ٢ في خسارة ١ بدون تغيير

EUR/USD slid 60 pips to 1.1960 on Monday in a soggy start to the week. The record net long in CFTC positioning was the talk of the trade and surely made a few longs nervous.

The technicals are another reason to worry as a potential double top coincides with the completed inverted Head-&-Shoulder formation along the September high of 1.2092. The weakness emerges despite upbeat eurozone retail sales and business confidence data.

In the US, there was also a dovish hint from Atlanta Fed President Bostic who said he thinks the FOMC should hike 2-3 times this year rather than 3-4 but his comments didn't have an effect on the market.

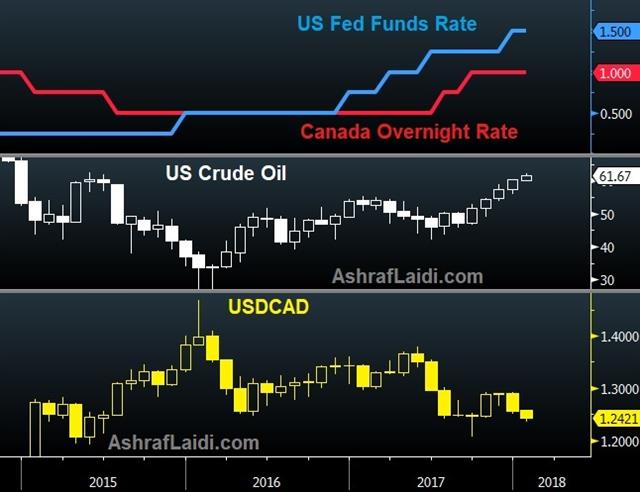

In terms of economic data, the main headlines emerged from the Bank of Canada's business outlook survey. It showed increasing optimism from businesses and a line from the central bank saying that excess capacity has been absorbed, except in the resource sector.

The report solidified calls for a BOC hike next week, with the probability up to 86%. See Ashraf's detailed piece on the loonie & CAD here. What's also more likely is a hawkish statement and a return to the 'sunny' Stephen Poloz from early in his term. If so, the loonie could continue back down to its 2017 lows.

The S&P 500 rallied for a fifth day to another record at 2747.

Looking ahead, Japan returns from holidays and that will put a renewed focus on the yen. The November report on Japanese labor cash earnings is due at 0000 GMT and forecast to show just a 0.6% y/y rise.

Loonie's at it again

The Canadian dollar (loonie) is on a roll thanks to another stellar jobs report from Canada. Most of the country has been locked in a brutal cold spell but Friday's employment data was red hot for the second straight month. Will 2018 prove another winner for CAD? Full analysis.

الخطوة التالية لريبل

الجميع يتحدث عن الريبل والبعض ينوي شرائها , لكن القليل فقط قام بشرائها بالفعل وتمكن من تحقيق الربح بعد ارتفاعها لمستويات ال 3.80 دولار ما هي الخطوة التالية؟ التحليل الكامل