Intraday Market Thoughts Archives

Displaying results for week of Mar 25, 2018Signals Within the Wild Ride

US dollar strength on Tuesday morphed into risk aversion. The yen was the top performer while the Australian dollar lagged. The Asia-Pacific calendar is light. A new JPY trade has been posted for Premium subscribers. End of month and end of quarter flows will likely enforce USD corrective action ahead of the Easter Holiday long weekend. انتهاز الحركات التصحيحية (فيديو للمشتركين فقط)

Ashraf warned about yen strength late last week and that unfolded in the latter stages of trading on Tuesday. It has been a harrowing time for intraday traders with some major swings hitting.

The confluence of trade jitters, tech/privacy worries and month-end came together all at once on Tuesday. The S&P 500 fell by as much as 61 points at the lows after gaining 20 points at the highs in a brutal whipsaw.

USD/JPY was sucked lower down to 105.38, erasing what had been a strong start to the day for the dollar. But the overall USD corrective action has forced the pair towards 106.20s as indices attempt to get back in the green.

The dangers of trading at month/quarter end are well known but the swings in the past four trading days have been especially violent. Note the consistent pattern risk aversion in late Jan, Feb and now March so far this year. For the S&P 500, it's critical that it stays above the 200-day moving average, which is currently at 2587.

A worrisome signal emerges from bonds as 10-year yields fall below recent support, reaching six-week low at 2.77%. That could help to accelerate USD/JPY towards the targets that Ashraf has highlighted.

For what's next, continue to watch for headlines on trade but note that tech is increasingly driving the broader market as well. Moody's downgrade of Tesla's, Goldman Sachs' downgrade of Apple's iPhone sales and Facebook's ongoing privacy jitters has accelerated the sector into sell mode.

Risk Trades Roar

A softened tone from China sparked a complete reversal of Friday's worries in a massive rally for stock markets. The New Zealand dollar was the top performer while the yen lagged. The Asia-Pacific calendar is light but new RBNZ governor Adrian Orr may make comments has he takes up the role. Below is the weekly video for Premium subscribers, shedding light on the remaining 7 trades.

What a difference a weekend makes. Chinese Premier Li Keqiang promised China would open up further and eliminate technology transfers along with balanced trade. Signs of a concession towards the US sparked a massive reversal in risk trades and the biggest one-day rally in US equities since 2015.

The S&P 500 gained 70 points, or 2.7%, to 2658 in a jump from the 200-day moving average. FX wasn't quite as euphoric as yen crosses climbed around 1% but they weren't as negative on the way down either. The drop and reversal underscores how sensitive the market is to trade at the moment. It's overshadowing nearly everything else.

Despite a diminished threat of a trade war, the US dollar still suffered on most fronts. Technically, the euro broke above the March high to the best since Feb 15. Cable climbed to the highest since Feb 1 and is approaching a cluster or resistance around the 2018 highs.

Easing Risk Aversion

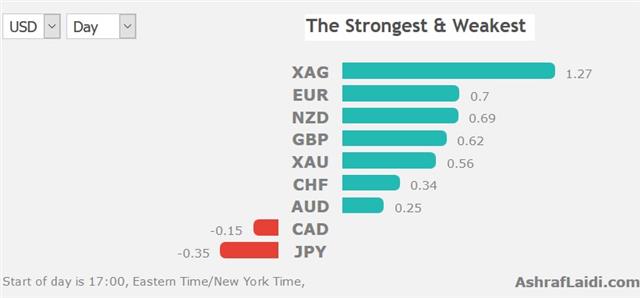

Now that the S&P500 has touched its 10% correction point from the year's highs, indices are rallying in concert for the next correctiove wane higher. We head into the new week with markets increasingly skittish about trade before activity winds down ahead of the Easter Holiday. CAD was the top performer last week while the AUD lagged in a rare divergence of commodity currencies. CFTC positioning data showed further shift away from the US dollar. The USDJPY Premium short was closed for 150-pip gain, while 3 other USD pairs remain in progress.

China is preparing to hit back at US tariffs, by targeting agriculture in a battle that market participants fear will escalate. There is talk the PBOC could cut the reserve requirement ratio and/or weaken the yuan. The S&P 500 fell 6% last week including a 2% decline on Friday.

In a move that got far less attention, oil climbed nearly 6% last week. Early on Monday a rocket attack from Yemen killed at least one person in Riyadh. Fears will undoubtedly continue to rise with John Bolton taking over as Trump's top national security advisor.

One good sign heading into the new week is that Monday's economic calendar is light around the globe.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +133K vs +146K prior GBP +24K vs +8K prior JPY -22K vs -80K prior CAD +25K vs +19K prior CHF -8K vs -7K prior AUD +18K vs -1K prior NZD +20K vs -3K prior

These were some of the more-dramatic moves in memory, especially in the yen. A race to the exits is something we've consistently warned about during to fall to 105.00 from 113.00 at the start of the year. The shifts into the pound and the commodity currencies are also notable but the main takeaway is that specs are less-enthusiastic about the dollar.