Intraday Market Thoughts Archives

Displaying results for week of May 13, 2018Bond Breaks Out, CAD Data Next

The bond market continues to break down as US 30-year yields broke a major resistance level Thursday. Sterling was the top performer after some Brexit related news denials and confirmations, while the yen lagged. Key Canada CPI and retail sales data are due later today. 1 CAD Premium trade remains open.

The US 30-year yield has tried to break above 3.25% at least once in each of the past three years and consistently failed. That level also represents a long-term technical downtrend since the 1980s. On Thursday, the yield touched at high of 3.2545% compared to the 2015 high of 3.2546%. A break might open up a test of the 2014 highs near 4% and could signal a monumental shift in markets.

USD/JPY may already be signaling what will happen next. It rose for the fourth day on Thursday and posted the second close above the 200-day moving average. The US dollar was also lent some support from the economic calendar with the Philly Fed hitting 34.4 vs 21.0 expected.

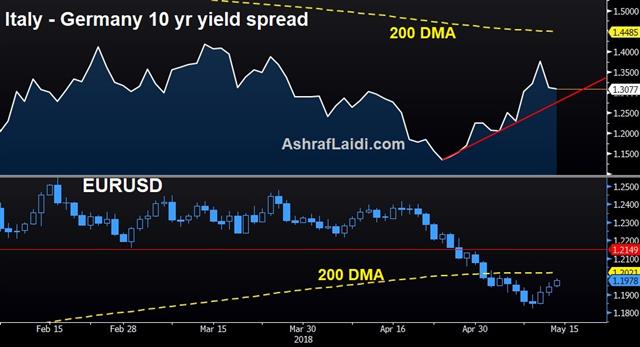

EURUSD drops below 1.1800 after Italy's 5-Star Movement and far-right League published their joint government program, promising an escalation in govt spending that will re-awaken tensions with the European Union's budget criteria.

GBPUSD rose by a full cent to as high as 1.3580 in early Thursday on reports that the UK will stay in the EU Customs Union beyond 2021. The currency later fell after the reports were denied. Finally, sterling stabilized when the UK announced it would remain tied to EU customs union until the Irish border question is solved.

Later today, a critical set of datapoints from Canada is due as the final installments of top tier data before the Bank of Canada decision at month-end. CPI and retail sales are out at 8:30 EST, 12:30 GMT, 13:30 BST.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (m/m) | |||

| 0.3% | 0.3% | May 18 12:30 | |

العملة التي لا يمكن إيقافها

على الرغم من كل الاهتمام بإرتفاع الدولار الأمريكي، إلا أن نظيره الكندي لا يزال أقوى عملة أداء منذ بداية الشهر وبداية الربع السنوي. وقد وصلت المفاوضات لإنقاذ اتفاقية التجارة الحرة لأمريكا الشمالية (نافتا) إلى طريق مسدود دون عقد اجتماعات محددة. مع ذلك، لا يزال الدولار الكندي هو الأفضل أداءً (تحليل كامل)

Unstoppable Loonie

Despite all the attention commanded by the US dollar, its Canadian counterpart remains the strongest performing currency since the start of the month and the beginning of the quarter. NAFTA negotiations have reached a new impasse but the loonie remains the top performer on improved pipeline politics. Full analysis.

داخل الداو جونز و الذهب

ماهي الخمسة أسباب الرئيسية وراء تراجع مؤشر الداوجونز ؟ و ماذا عن علاقة الداو جونز بأسعار اونصة الذهب ؟ كيف يمكنك فهم العلاقات بين الازواج سواء كانت طردية أم ايجابية و تحويلها لمراكز تداول رابحة؟ الإجابات في الفيديوالتالي

USD/JPY Breaks 200-DMA

The US dollar cracked some tough resistance levels on Tuesday after a solid retail sales report. The dollar was the top performer while the kiwi languished once again. Japanese GDP and Australian wages are due up next. A new Premium trade was issued for the Premium trades, citing 5 reasons and 2 charts for the trade. It is discussed in detail in the weekly video.

US retail sales showed that the dollar bulls don't need particularly great economic data to continue the latest run, just numbers that are solid enough to keep 3-4 Fed hikes this year in play. The main retail sales headlines met estimates but revisions to the March numbers higher meant for a stronger report overall.

The USD reaction was dramatic as the euro, sterling, New Zealand dollar and gold broke to fresh medium-term lows. Perhaps the most-important technical move was in USD/JPY as it climbed above the May high and the 200-day moving average including a close above those levels. That break came in tandem with a rise in US 10-year yields above the 2011 high of 3.05%.

The damage in EURUSD remains deeper than the rally in USDJPY so far as the latter seeks to confirm the break of its own 200D-DMA. Uncertainty around Italy's upcoming govt is weighing on EUR.

Looking ahead, a related market to watch is the 30-year yield. Twice this year it has tried to break above major resistance in the 3.22%-3.25% range and failed. It's now making a fresh attempt and if it breaks, bond gurus like Gross and Gundlach are saying it's a watershed for a bond bear market – and perhaps a USD bull market to go with it.

Expect continued big moves in FX in the day ahead. Data up next includes the second look at Q1 Japanese GDP and the Australian wage price index for Q1.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| 0.3% | 0.5% | 0.4% | May 15 12:30 |

| Prelim GDP (q/q) [P] | |||

| 0.0% | 0.4% | May 15 23:50 | |

| Eurozone Flash GDP (q/q) | |||

| 0.4% | 0.4% | 0.4% | May 15 9:00 |

| Wage Price Index (q/q) | |||

| 0.6% | 0.6% | May 16 1:30 | |

Consumer Crunch Time

The US dollar got back in gear in New York trade Monday to halt three days of declines. The pound was the only G10 currency to lead the US dollar while the New Zealand dollar lagged again. Chinese retail sales and industrial production are due up next. Due Tuesday is the UK jobs report with earnings in focus. (فيديو للمشتركين) هل حان وقت الشراء؟

The euro stalled ahead of 1.2000 on Monday and then sank back to 1.1936 to finish narrowly lower on the day. The dollar stumbled early in the session but finished strongly as US 10-year yields came within a fraction of 3% once again.

Looking at the bigger picture, this week will be all about the consumer. It starts with Chinese data at 0200 GMT where retail sales are forecast to rise 10.0% y/y in April which is a slight slowdown from 10.1% in March. That report is out at the same time as industrial production, which is forecast up 6.4% y/y. The strengthening of the consumer and deceleration of industry is the backbone of what China hopes to achieve in the decade ahead.

In the US, better signs from the consumer are overdue. The highlight on the economic calendar this week is the April retail sales report. It's forecast to rise 0.3% m/m with the control group up 0.4%. Sky high consumer confidence along with tax cuts were expected to fuel a consumer boom this year but it hasn't yet materialized. If US spenders can crank it up, that bodes well for the dollar.

Canadian retail sales are also due up Friday. A turn for consumers more broadly would help to get the synchronized global growth story back on track and relieve pressure on emerging markets while potentially super-charging commodity prices.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| 0.5% | 0.2% | May 15 12:30 | |

China-US Dealmaking Underway

Signs of a thaw on trade between the US and China could help risk appetite to start the week. Last week, the Canadian dollar was the top performer while the kiwi lagged. Yesterday, Trump commented on progress in the US-China trade talks (more in that below). Euro pushed higher after remarks from ECB's Francois Villeroy de Galhau (Bank of France) indicating euro area's economic slowdown is temporary and that accelerating inflation will resume over the upcoming months. Also weighing on USD were statements from Fed's Loretta Mester that the jump in March may not persist.

Trump tweeted that he had instructed the US Commerce Dept to ease up on a parts blockage against Chinese phone company ZTE. It wasn't clear what Trump may have gotten in return but it could be progress on North Korea or something on trade. In any case, it's a small sign of better relations.

Late Friday, there were reports that Mexico has begun its annual oil production hedging trade. The Ministry of Finance will spend the next six months locking in 2019 production in what's billed as the world's biggest oil trade. News that it was starting led to some late selling in crude Friday. The decision to lock in prices near the $70s would be more beneficial than last year's sales under $50 per barrel.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +121K vs +121K prior GBP +9K vs +26K prior JPY -5K vs -1K prior CAD -33K vs -19K prior CHF -33K vs -19K prior AUD -6K vs -7K prior NZD +13K vs +17K prior

The two notable moves were to cover sterling longs and to sell the Swiss franc. The spec market as obviously caught offside in GBP longs and was forced to cover when Carney and the economic data made a U-turn. The shift into franc shorts might represent more optimism for equities and higher bond yields elsewhere. The SNB is miles away from a hike into positive territory.