Intraday Market Thoughts Archives

Displaying results for week of Jun 24, 2018Year's 3rd Biggest Daily Gain

Today maybe a sleepy end-of-month and end-of-quarter day with traders enjoying the sun/beach as the World Cup takes its day off, but EURUSD posted its 3rd biggest daily percentage gain of the year. Sceptics will say the move is insignificant due to end-of-quarter-rebalancing but there is more to USD move than seasonals. The 1st estimate for Eurozone June CPI hit the ECB's 2.0% target, but even as the core CPI slipped to 1.1%, higher energy prices and cheap euro will make an ECB rate hike before next summer inevitable, something that I mentioned on the day of the ECB 2 weeks ago here, but finally stated today by FX journalists following the figures. The Fed's preferred inflation target hit 2.0%, but the US central bank has repeatedly spoken of a symmetric approach to inflation.

The July 4th holiday will coincide with world cup quarter finals, but soon after the US June jobs report will be released, alongside its Canadian counterpart. Meanwhile, odds of a Bank of Canada rate hike next month have spiked to 87% (from 53% earlier in the week) after persistent oil rally and Poloz's insistence that the central bank is indeed feeling less "cautous" despite Trump's ongoing threats at NAFTA.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone CPI Flash Estimate (y/y) | |||

| 2.0% | 2.0% | 1.9% | Jun 29 9:00 |

Has Cable Been Punished Enough?

On the final day of week, month, quarter and half year, equity indices are paring their earlier gains after a report on Trump considering pulling the US out of the World Trade Organisation. EURUSD rallies on flash CPI hitting the ECB's 2.0% goal (despite core remaining at 1.0%). On the day, euro leads all major currencies higher against USD, with the yen the only loser vs the greenback. The week wraps up with the US PCE report. US May core PCE price index and Canada's April GDP are due out at 8:30 ET (13:30 London). A new note updating the USDJPY Premium trade will be issued and sent after the core PCE data.

Cable Bottom?

Comments from the BOE's Haldane on Thursday underscored how the tables have been turned in cable; but have they finally turned enough? The Canadian dollar was the top performer on the day and the strongest on the week as markets wised up to Poloz's comments . In mid-April cable had just touched the highest since Brexit as the market was readying for a May interest rate hike. It was trading just shy of 1.44 then Carney hinted at some soft spots in the economy in an interview with the BBC. The weakness was real as a series of economic data points missed expectations and the pound crumbled down to 1.3050.Shortly after it hit that low, which was the worst level since November, BOE chief economist Andy Haldane said they would have hiked in May if not for the poor data but that the overall stance was unchanged. He emphasized minimal slack in the economy.

In his view at least, nothing has really changed. If the data begins to turn then it will be right back to Plan A. So is the more than 1300 pip decline in the pair justified? Certainly there have been some Brexit setbacks to compound it but nothing particularly damaging. The US dollar is also higher across the board since the slide began but that accounts for only half the decline in cable.

There's an argument that this is enough and with cable now testing support at the lows near 1.3000 from Q4 last year and the 2016 trendline support (see chart above), we will be watching very closely for signs of a bottom in the near-term. Certainly, there haven't been any yet with the pair in a non-stop slide but it's a theme worth watching.

The US dollar side also merits close scrutiny. Fed centrist Bostic talked about slowing the pace of hikes on Thursday and that could be something we hear more about. Much will depend on today's May PCE report. Core inflation is expected to tick up to 1.9% from 1.8% and headline to 2.2% from 2.0% but we're nearing the apex of the one-off factors that are boosting prices. Keep a close eye on personal income and spending as well, both expected up 0.4%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone CPI Flash Estimate (y/y) | |||

| 2.0% | 2.0% | 1.9% | Jun 29 9:00 |

| Final GDP (q/q) [F] | |||

| 2.0% | 2.2% | 2.2% | Jun 28 12:30 |

| GDP (m/m) | |||

| 0.0% | 0.3% | Jun 29 12:30 | |

أشرف العايدي على سكاي نيوز العربية

مقابلة أشرف العايدي على سكاي نيوز العربية مع نور الدين الحموري عن : تذبذبات المؤشرات؛ الإسترليني، اليورو، العوائد و الذهب الساقط. (شاهد المقابلة)

Poloz Punts, USD Loses Grip

USD struggling to preserve its earlier gains of the day after some data disappointments (see below). Before we preview today's key speech from Bank of England's Andy Haldane (14:30 London), let's cover overnight speech by Bank of Canada's Poloz. The market initially interpreted comments from BOC Governor Poloz as dovish but he offered reason to think otherwise at a later press conference. The US dollar was the top performer and the New Zealand dollar lagged and touched a one-year low after the RBNZ decision to hold rates unchanged. A new index trade has been issued for Premium trades based on the same system as the last 2 trades.

A speech from BOC Governor Poloz was the highlight of the day and USD/CAD was held near 1.3300 in anticipation, despite another jump in oil prices and a broad rise in the US dollar. The talk was his last opportunity to clarify the outlook ahead of the July 11 decision.

After he spoke, the odds of a hike initially fell to 50% from 60%. The comments were mostly focused on BoC communication style and there wasn't much on the upcoming decision, but he did highlight a series of downside risks which will 'figure prominently' in deliberations. That's what sparked a rally to 1.3380 from 1.3310.

However, Poloz hosted a press conference later with a different tone. He said the BOC's narrative of growth and gradual hikes appears to be correct and that “one data point” below expectations – presumably retail sales – won't throw them off course. He also said the BOC won't consider trade hypotheticals in its decision.

All told, there was the clear impression that Poloz hadn't yet made up his mind on what's coming July 11 and that he's fine with the market unsure about what will happen. If anything, he endorsed that kind of volatility as a good thing.

Overall, he seemed to be leaning towards hiking. His final comments were much more explicit and that was reflected in a USD/CAD dip back to 1.3329. With some time to digest, it could fall even further but that might depend on how the USD dollar develops next.

USD is struggling to hold on to its earlier gains of the day after downward revision in US Q1 GDP to 2.0% from 2.2% and a 9K rise in US jobless claims.The USD was boosted on Wednesday by a smaller goods trade deficit and a large upward revision to April core durable goods orders. That sent the euro and pound within striking distance of the June lows.

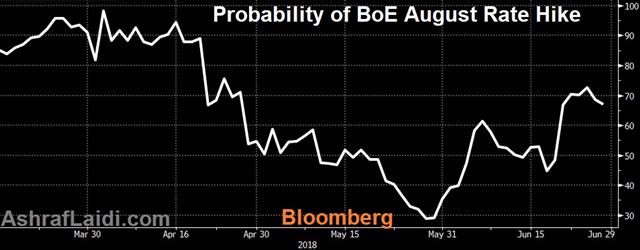

BoE's Haldane speech at 14:30 London will be crucial in swaying expectations of an August rate hike following his surprising vote in favour of a rate at last week's meeting. Odds of an August rate hike aere at 67% compared to 73% last week and 45% two weeks ago. GBPUSD is testing key support at 1.3050, while EURGBP broke above its 200-DMA for the first time in 4 months.

Elsewhere, the RNBZ held rates at 1.75%, as expected. The statement once again had a nod to possibly moving rates up or down and also highlighted trade tensions. Most of the weakness in NZD/USD came before the meeting in a broad-USD bid but the statement caused the break of a double bottom near 0.6800 and a fall as low as 0.6784 before a quick rebound. Technically, it will be a critical chart to watch on the weekly close.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Bostic Speaks | |||

| Jun 28 16:00 | |||

| Core Durable Goods Orders (m/m) | |||

| -0.3% | 0.5% | 1.9% | Jun 27 12:30 |

بين الاسترليني و اليورو

كيف يؤثر الهبوط الحاد في اليوان الصيني على أسعار الدولار و العملات الرئيسية؟هل تتعمد الصين إضعاف اليوان لترد على تعرفة ترامب الجمركية وتحمي صادرتها ؟ماذا يخبرنا التحليل الفني عن أزواج اليورو و الإسترليني مقابل الدولار ؟ (الفيديوالكامل)

USD up on CNY Rumblings

How is oil rising despite a rally in the US dollar? The greenback gained from a better tone on trade Tuesday while oil jumps on reports of tougher Iran sanctions. This may well be related to the latest selloff in the Chinese yuan, which is set to post its biggest weekly decline against USD since January 2016. Could Beijing be resorting to currency devaluation in the US-China trade war? Don't forget BoC's Poloz speech this evening (15:00 Easten, 20:00 London) for signs on his latest thoughts on monetary policy following last week's dismal data and this month's surprisingly hawkish statement twist.

When China's currency tumbles, we tend to see a selloff in in global equities, commodities and a higher US dollar. Oil was the exception due to US State Dept story mentioned below. The selloff in equities dragged down bond yields, consquently lifting the yen.

The oil headline driver on the day was a report, citing a State Dept. official that said the US wants allies to cut Iran oil exports to US allies to zero by November 4. That's a much harsher and firmer policy than under previous sanctions when buyers were given repeated 6 month extensions so long as they progressively lowered Iranian imports by 20%. In turn, WTI crude jumped nearly 4% to $70.70, the highest in a month.

The rise in oil had little effect on USD/CAD because of apprehension about Poloz's speech late on Wednesday. The pair chopped around 1.3300. The Australian dollar fell down to 0.7360 as copper prices slipped again. The CADJPY trade in the Premium Insights remains in the green, as a new indices trade is currently being reconsidered.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Quarles Speaks | |||

| Jun 27 15:00 | |||

Trade War Tell

Global equity indices attempt to recover from Monday's selloff but US index futures dip back into the red, while USD attempt to stabilize after Monday's losses. A trade war wouldn't spill blood but it would certainly turn markets red and on Monday we got a small taste but the White House reaction showed there is little appetite for more. The Premium Insights closed Friday's DAX short with a 290-pt gain on Monday as the DOW30 found support at the all-important 200-DMA, while the SPX500 stabilized at the 55 & 100 DMAs.

بين المؤشرات و الدولار (فيديو للمشتركين)

US equity indices fell by more than 2% on Monday after a pair of reports in the WSJ and Bloomberg suggested Trump was preparing to roll out investment restrictions on Chinese companies, barring them from investing in US technology.

That set a negative tone for the week but it was a slow burn in equity markets with worries eventually turning to aggressive selling. That prompted the White House to send out two top deputies, Mnuchin and Navarro, to deny the stories. Markets finally bounced when Navarro took the airwaves shortly before the equity close to say no investment restrictions are planned. That also sparked a 50 pip rally in USD/JPY.

For the moment, there is no sorting through the confusion although it's abundantly clear that the White House is preparing some kind of action to prevent IP transfers. At the same time, China's Xi reportedly told global CEOs on the weekend that China was no longer going to turn the other cheek and was ready to strike back.

Actions remain more important than words -- Trump's stock market priorities are seen through his decision to send Mnuchin and Navarro to alleviate markets. He measures himself on approval ratings and the DJIA. Navarro was on CNBC.The message here is that the White House may want to be tough on trade but the overriding priority is to keep markets elevated. Perhaps Trump thinks he can have it both ways but if push comes to shove, it will be markets that win out.

That might help to explain why the FX and bond markets were so sanguine even as stock markets were routed.

كاس العالم و وسيولة الاسواق

هل يقل نشاط التداول في السوق المالية خلال بطولة كأس العالم لكرة القدم؟(التحليل الكامل)

Pass Poloz the Pepto

Policymakers at the Bank of Canada surely spent the weekend with a case of indigestion after a pair of weak data points raised major questions about a July hike. The Swiss franc was the top performer last week while the Canadian dollar lagged. CFTC positioning data showed euro longs finally bailed as some major shifts took place. After closing the DAX short late last week at 360-pt gain, we re-opened a new short at 12560. The index is currently at 12390. Two yen longs are also in the progress. It will be another light week of data but more is awaited on the trade front.

The BOC rate-hike signal in the May statement was a mistake almost the moment it was delivered. Just a day later, the US hit Canada with tariffs and Ottawa is poised to retaliate at the end of the month.

What had looked like a surefire Bank of Canada hike is now priced at just 54% after Friday's weak domestic data compounded trade problems. Retail sales fell 1.2% compared to a flat reading expected while CPI was at 2.2% compared to the 2.6% consensus.

Thankfully, the hawkish May statement still had a nod to data dependence but that may be an embarrassing card to play. At times, the whims of the economy and to send clear signals are beyond the foresight of a policymaker, but this isn't one of those times. The Bank of Canada threw caution to the wind by removing the word caution from the statement and pre-committing to a hike now he will be faced with a difficult decision heading into Wednesday's speech at 15:00 Toronto (20:00 London). He can double down and continue to signal a hike with the risk that trade and the economy could worsen before the July 11 decision. Or he can backtrack, emphasize economic data, and climb down.

At the speech, Poloz will need to send some sort of signal because no one wants to go into the BOC meeting with the odds near 50/50.

In weekend news, the PBOC lowered the RRR for some banks, adding about 700B in liquidity that they've mostly directed banks to use to covert debts into equity. That comes after Shanghai stock markets hit an 11-month low Friday.

Emerging markets are also in focus as Turkey's election looks to be a win for Erdogan.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +36K vs +88K prior GBP -19K vs +11K prior JPY -36K vs +5K prior CAD -14K vs -15K prior CHF -32K vs -37K prior AUD -43K vs -15K prior NZD -16K vs +7K prior

Euro longs have been stubbornly holding on for the past two months but the June 14 ECB meeting finally sent them packing in large numbers and the net long as now at the narrowest since April 2017. It's part of a big shift throughout FX that includes selling in sterling, yen and the antipodeans.