Intraday Market Thoughts Archives

Displaying results for week of Jun 30, 2019قبل و بعد بيانات الوظائف

إليكم الفيديو التحليلي عن السيناريوهات المحتملة لبيانات االوظائف الاميركية و الكندية. الفيديو الكامل

Rehn's Panic, Jobs Reports Next

Just a few words on the ECB before we cover the jobs report. Ollie Rehn, Finnish central bank governor laid out the ECB's path forward in the clearest terms yet and it could virtually ensure the ECB will ease. What's increasingly difficult to understand is the set of signals that has central banks so concerned (more below). US and Canada jobs are due up next. The Video for Premium subscribers is posted below, laying out the key technical constraints for the USD.

Markets were relatively quiet on Thursday but Rehn – Once an ECB hawk – told Boersen Zeitung that easing is needed now. He talked about forward guidance, cutting the ECB's deposit rate or resuming QE. The call was so direct and dovish that was it bordered on alarmist. In late May, Rehn said the base case was to wait longer before raising rates because there was a soft path.

In terms of economic data, there is nothing blatant to justify such a dramatic shift. It's clear this is all about the bond market. German yields are now below the ECB's deposit rate of -0.40% all the way out to 10 years. Yields have fallen dramatically, including in Italy where they have fallen more than 200 basis points since October. Yield curves everywhere are inverted.

The ECB is terrified about falling inflation expectations in markets. Easing at this point sounds like a done deal and the market is increasingly convinced that the BOE will follow and that China-US trade talks have solved nothing.

One line of thinking is that central banks know something we don't – maybe that Trump is going to ramp up the trade war against Europe. But history has shown that central banks are rarely privy to special knowledge and the Fed certainly wasn't when it was hiking in December.

There seems to have been a sea change on inflation views along with a bond-buying mania. To combat it, the ECB is willing to risk diving deeper into experimental policy to perhaps push up inflation a few ticks. Is that risk worth the reward? It's tough to see how it is.

Onto US and Canada Jobs

The day ahead will be a big one in terms of sorting out how the underlying US economy is performing. US non-farm payrolls are forecast at 160K and that leaves the market in a delicate spot. If jobs are higher than 200K, then expect a USD rally along with risk aversion as Fed cuts are questioned. If jobs are below 100K and earnings come in within expectations, expect a USD slump along with risk aversion on fear of an economic slowdown. The question becomes: "Would a string jobs report mean no July rate cut or only a 25-bp cut instead of a 50-bp cut?". Ashraf gives his assessment before answering this in today's Premium video.

In Canada, meanwhile, the country is close to the best jobs growth in a decade over the past 3, 6 and 12 month periods, while its Citi economic suprise index is at multi-decades high. Canada unemp rate seen at 5.5% from 5.4%, while Canada payrolls expected at 10K from 28K. A soft report will be brushed aside while one above the +10K consensus will emphasize that Canada is a rare spot of economic acceleration. Traders may also consider USDCAD longs in the event that US data exceeds expectations as that would weigh on risk appetite, especially if Canada jobs fail to beat.

Sunny Signals Defy Dissonance

US indices hit new highs on the sunny premise that lower interest rates are a question of when rathen than if, and more importantly bright prospects from Trump-Xi summit shall iterrupt the global easing cycle. Can the dissonance last? The Australian dollar was the top performer while the pound lagged. US markets are closed on Thursday for Indepedence day Holiday. US and Canada jpbs figures follow on Friday. A new set of charts & analysis was updated for the GBPUSD Premium trade.

US stocks hit record highs on Wednesday while Treasury yields hit cycle lows. The message is that the economic outlooks is improving but also that interest rates will fall. Or that the trade war will ebb but that inflation risks remain remote.

Economic data Wednesday showed a US economy that might be slowing, but not dramatically. The ISM non-manufacturing index was at 55.1 compared to 56.0 expected. The Markit services PMI – which ostensibly measures the same thing – rose to 51.5 compared to 50.7 expected.

On the jobs front, the ADP employment report was a disappointment at 102K compared to 140K expected but initial jobless claims remain near generational lows at 221K compared to 223K expected.

Barring a slump in the data or trouble in the economic data, it's tough to square the data with signals pointing to lower rates at the Fed, BOE and ECB. The risk in the weeks ahead is that the Fed tries to reel in cut expectation. That would hurt risk trades. Alternatively, the economic data could turn lower and that would also weigh on stocks and yen crosses. Ashraf tweeted (see above) on the possibility of some threatening action from Trump in the event that the Fed does not cut rates later this month. And if markets are rallying ahead of easing, how would the market react if rate cuts do not come on time (this month) or not at all?

For the moment, the US is taking a long weekend but on Friday non-farm payrolls could throw everything into disarray. The consensus is for a +160K reading with unemployment steady at 3.6%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final Services PMI [F] | |||

| 51.5 | 50.7 | 50.7 | Jul 03 13:45 |

| ISM Non-Manufacturing PMI | |||

| 55.1 | 56.1 | 56.9 | Jul 03 14:00 |

| Challenger Job Cuts (y/y) | |||

| 12.8% | 85.9% | Jul 03 11:30 | |

تسييس البنوك المركزية يحمّس الذهب

سجل الذهب من قبل يومين أكبر ارتفاع يومي له منذ أن صوتت المملكة المتحدة لمغادرة الاتحاد الأوروبي في الاستفتاء الذي أجري قبل ثلاث سنوات. ما وراء هذه التذبذبات العنيفة في الذهب و ما أهمية إستيعاب تلك العوامل من قبل المتداولين. التحليل الكامل

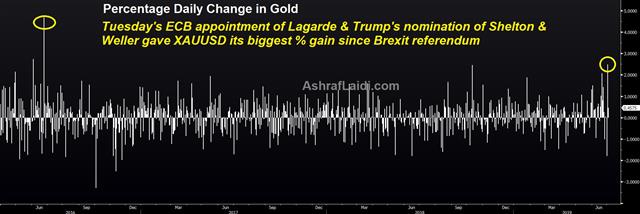

Gold Cheers Global Central Bank Raid

The politicization of major central banks reached a new level to the benefit of gold as European leaders made a surprise announcement to nominate IMF leader Christine Lagarde to lead the ECB, while Trump nominated Weller and Shelton to the Federal Reserve Board (both favouring easy monetary policy). This gave gold its biggest % gain since the Brexit referendum (more here). The pound remains weak across the board after BoE Governor Carney highlighted increasing downside risks in a further sign of a global easing cycle. US ADP disappointed with 102K vs exp 140k, US trade deficit widened to $55 bn and jobless claims fell by 8K. We turn to the key services ISM at the top of the hour ahead of Thursday's Independence Day Holiday and Friday's US jobs report. The events of late Tuesday in metals helped answer several subscribers' questions on why Ashraf went long silver on Monday.

Carney's comments echoed Powell's and Draghi's warning about trade risks and make it increasingly likely that we're in a global easing cycle. Gold responded with a $30 rise while the pound slumped to the lowest since June 18, taking out the 61.8% retracement of the June rally in the process.

In the bigger picture, the market has given back most of the Trump-Xi truce bounce. US Treasury yields are fractionally above cycle lows, oil sank 5% and USD/JPY has completely given up the week-opening bounce. Part of that is the US announcing fresh tariffs on Europe. The new action covers a relatively small $4B in goods but it's a sign of what's to come. Meanwhile, bond yields around the pursue their collapse.

Another sign of what's to come is increasing politicization of central banks. Europe didn't do itself any favors on that front by nominating France's former finance minister to lead the central bank. Those criticisms could make her less-inclined to push the monetary policy envelop if/when the time comes for more Eurozone easing. It will also make the central bank an increasing lightning rod within and outside of the eurozone.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Challenger Job Cuts (y/y) | |||

| 85.9% | Jul 03 11:30 | ||

Solid Manufacturing Spotlight Back on Fed

A surprisingly solid ISM manufacturing index presented traders with a looming conundrum on Monday. The US dollar was the top performer on the first trading day of the month. Today, GBP is down across the board on weaker than expected construction figures. The focus now shifts to the Fed's John Williams speech on Tuesday. A new trade has been issued on Monday with 3 supporting charts and notes.

A series of poor regional numbers failed to predict the national manufacturing survey from the ISM on Monday. It was at 51.7 compared to 51.0 expected. The contraction in the prices paid component may provide luster for the doves. The commentary suggested the Mexican trade kerfuffle at the start of the month weighed and that's something that's since been reversed. The better China news will also add a lift this month.

The US dollar was higher ahead of the data but continued to strengthen after it. Nonetheless, equity markets gave back some gains after the data. The issue for risk trades is that if the good news mounts, it will change the plan of attack for the Fed. It already appears wholly unlikely the Fed will cut by 50 basis points at the end of the month, despite the market pricing in a 15% chance of it.

More importantly is the message from the Fed speakers in the weeks to come ahead of the Jul 31st decision and later in the year. In the day ahead we will hear from Williams and Mester, both of whom are scheduled to talk about the economy. Will they refer to an insurance cut, or will receding uncertainty keep the bid under the US dollar. A detailed analysis about the Fed was issued in Monday's Premium trade.

Looking at July more broadly, the seasonal trend over the past decade has been US dollar weakness, particularly against the yen and commodity currencies. It's also the best month for the S&P 500 and FTSE 100.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Williams Speaks | |||

| Jul 02 10:35 | |||

US-China Truce & Portfolio Adjustments

Indices rally aggressively after the US delayed the $300 bln in tarrifs on China, while USD shorts were partly unwound with the help of quarter-end portfolio rebalancing, extending into metals and energy. Leaks last week spoiled the surprise of a US-China trade truce and that stunted the early market move. The Canadian dollar was the top performer in June while the US dollar lagged. CFTC positioning data showed a rush out of CAD shorts. Canada is on holiday today. A new Premium trade will be issued later in the day (after the NY open) and could be from the mysterious chart below. Can you guess it? The June manufacturing ISM is next.

Thursday's South China Morning Post report on the Trump-Xi meeting proved to be entirely accurate. It included the two important parts of the deal: 1) That Trump won't hit China with any additional tariffs while they negotiate and, 2) That a blockade on sending US technology to Huawei will be lifted.

At the market open risk trades popped but they quickly faded afterwards, leaving yen weakness as the only notable change. It's obviously good news for the global economy that the meeting didn't end in a blowup but there was some hope for a firm timeline for no new tariffs. The fuzzy extension means markets will remain one tweet away from a trade war flare up.

Perhaps more importantly, the Fed is back in play. The FOMC is already committed to the July cut but it could quickly be re-framed as an insurance cut and that cause a re-think on the three additional cuts that are priced in over the coming year.

What could put the Fed back on the path to deeper cuts would be more weakness in economic data. The June US regional manufacturing surveys have been dismal so far and on Monday the ISM reports on its national manufacturing survey. The economist consensus is 51.0 but after the Chicago PMI tumbled to 49.7 from 54.2 on Friday, the market will be braced for a sub-50 reading.

Also note that Canada is on holiday Monday and that could leave the suddenly-sizzling CAD vulnerable to illiquidity.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -56K vs -52K prior GBP -59K vs -53K prior JPY -10K vs -17K prior CHF -16K vs -15K prior CAD -15K vs -38K prior AUD -66K vs -65K prior NZD -24K vs -24K prior

The relentless march of upbeat Canadian economic news finally forced shorts out as USD/CAD hit a seven-month low. The momentum continued on Friday after a strong GDP print and an upbeat BoC business survey. Also note that Canada is on holiday Monday and that could leave the suddenly-sizzling CAD vulnerable to illiquidity.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final Manufacturing PMI [F] | |||

| 50.1 | 50.1 | Jul 01 13:45 | |

| ISM Manufacturing PMI | |||

| 51.3 | 52.1 | Jul 01 14:00 | |

| PMI | |||

| 49.4 | 50.1 | 50.2 | Jul 01 1:45 |