Intraday Market Thoughts Archives

Displaying results for week of Jan 12, 20205 Near-Term Themes

You probably had your fill of "2020 themes", so why not another? The one spot to watch for a jolt to global growth in ... China. The US-China trade deal removes a major worry for Beijing, which may take action as soon as early next week to enact some stimulus ahead of a week of holidays starting on Jan 24. Officials strongly hinted that another RRR rate cut isn't coming, but they are expected to cut the loan prime rate soon and may take additional stimulus measures on the fiscal side. That would be powerful -- and if they do, I see bright days ahead for the Australian, Canadian and New Zealand dollars.

Inflation watch

A pair of US inflation reports this week were on the low side of expectations but there is a clear trend higher in core measures and wage growth (to a lesser extent). The Fed has confined itself to the sidelines but there is life in inflation. Heading into next month, we roll over some tough comps and that sets a lower bar. I think there's a chance that at some point this year, inflation is a major theme in markets and that sparks talks about central bank hiking.Housing

Central banks haven't been able to spark broad based inflation, but they've been remarkably successful at creating asset inflation. With all the rate cuts last year, an underrated risk is a surprise rise in house prices globally. We're already starting to see signs of tighter market in New Zealand which just posted a 12% rise in house prices. Thursday's home builder sentiment numbers in the US were a bit stronger as well.Oil

US shale oil is not what it appears to be. Every budget that comes out points to less spending this year and the market is laser-focused on return of capital rather than production expansion. Natural gas is worthless in many parts of the US and is being burned off at unprecedented rates. On top of that, the risks for the US election are higher in energy than anywhere else. The market is overly comfortable around $60 but a fall below $50 would create a real reckoning in shale and that has a multitude of knock-on effects, particularly in junk bond.Iran

A week ago we were on the brink of war and now the world has forgotten about Iran. Geopolitics are impossible to price in. You can't price in half-a-war. The thinking now is everyone got to flex their muscles, but a report on Friday said that 11 US soldiers were concussed in one of the blasts. That puts to bed the theory that Iran was knowingly dropping bombs that wouldn't hurt anyone (assuming the report was true). The chance of Iran or Iran-sponsored militias launching attacks remains high and the situation could quickly spin out of control from them.US election

The election is the one risk that everyone can point to and it's undeniable. The world will change on Nov 3 but it's a binary risk and that's tough to price in. At some point there will be a pre-election de-risking but it's tough to say whether that comes in the autumn or sooner. The following remains valid...so far: Trump is staying in the White House as long as a recession or a stock market crash are ruled out.Ashraf in Dubai Jan 22-24

Details of my Dubai seminars تفاصيل عن ندواة دبي

Fear Crushed by Retail Sales & Round 1

The much anticipated US retail sales report exceeded expectations for December and helped bolster risk appetite mainly for US indices (not European), especially as the US & China formalised round 1 of the trade deal. For 2019, US retail sales rose 3.6%, down from 5.0% in 2018. More on this below. Despite growing expectations for BoE rate cut later this month, GBP is the strongest currency of the day. A new trade action/adjustment has been issued to Premium subscribers.

(فيديو للمشتركين) إدارة الين و اليورو و المؤشرات

The phase one US-China trade deal inspired a mild 'sell the fact' type trade but the market largely ignored it. The details of massive pledged purchases of US goods and services had leaked and none of the details were surprising.

US Consumers' Holiday Push

The "Control Group" retail sales series, mostly watched for economists as it excludes food services, car dealers and building materials to give a more accurate sense of demand, rose 0.5% vs exp 0.4%. The overall report was a vital positive surorise after retail giants Target, JC Penney and Koh's reported weak sales and dire guidance.The "Dept Store vs Consumers" argument shall remain for the remainder of the year. After all, Target is a company whose share price had doubled since January 2019, and was expected to report sales growth upwards of 4%. Company shares fell 7% but the bigger concern is that the US consumer isn't as healthy as believed.

The Beige Book also looked at the consumer and said that overall sales were solid but regional commentary showed a mixed picture. Cleveland, KC and Dallas regions were upbeat but New York and St Louis were more pessimistic.

A bigger question is whether that and a 2% growth outlook for this year justifies the elevated mood in markets. The Beige Book survey was mostly after the phase one handshake deal but there weren't any clear signs of an improvement in the mood. Further reason for concern came from aluminum giant Alcoa. In October the company predicted demand growth in 2020 “would come roaring back” after a decline in 2019 but now forecasts just a 1.4-2.4% rise this year. The company is a decent bellwether for industrial sentiment.

Sell the Fact or Sell the Economy?

US December CPI was lighter than expected and that helped to stall the dollar rally. The Swiss franc was the top performer while the New Zealand dollar lagged. UK Dec CPI came in weaker than expected but cable manages to regain 1.30 as USD is sold across the board. Trump added some important reminders with regards to the conditions to the US-China trade deal. More on retail woes below. US PPI and Empire manufacturing are due today, followed by the Fed's Beige. A new trade was issued yesterday, while the Premium Video (5 Trading Points) is posted below for subscribers. There are currently 8 trades open in FX, indices, commodities and crypto.

On Tuesday, US CPI rose 2.3% in December compared to 2.4% expected and the same report showed flat year-over-year weekly earnings growth versus the +0.8% consensus. The dollar sagged after the release and that gave an opening for retracements in the euro and pound.

USD/JPY also stalled at 110. Further selling came on a report saying that the US hadn't agreed to reduce further tariffs in the phase one deal until at least after the election. That sparked some risk off sentiment but it shouldn't have been a surprise. The US already reduced the autumn tariffs when it announced the deal and there were no rumours or expectations of further cuts. Later, Mnuchin said they would review tariffs after a phase 2 deal was signed.

The main risk in the day ahead is a sell-the-fact on the deal signing. However it's almost too-obvious of a risk to materialize. Still, the runaway moves in momentum stocks have us wary.

If there is to be a reckoning it will come on the economic side. The big picture theme for early 2020 is monitoring how businesses investment responds to news of a phase one trade deal. While the deal will be signed on Wednesday, it was announced Dec 13 and that bump should begin to materialize soon. If so, early signs may show up in Wednesday's Beige Book report. It's due out at 1900 GMT and given all the good news that's been priced into markets in the past two months, it's imperative that some positive economic momentum begins to materialize early in 2020 and this release is a good place to start.

Back to Retail Concerns

There are also rumblings about a poor US retail sales report due Thursday, in light of shocking guidance by retailing giant Target. Ashraf mentioned to watch 2 things: the VVIX relative to the VIX, even as the latter remains below 13.0. And, the flattening of the US yield curve as the yield spread between 10 and 2 year yields drops to 22.9.Markets Hesitant as US Makes Nice

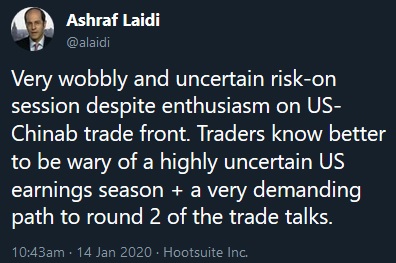

The market has taken comfort in less-hawkish US gestures towards Iran and China but might be mistaking a pause for peace. The Swiss franc was the top performer Monday while the pound lagged. US CPI is due up next. keep an eye on US earnings season and the somewhat hesistant showing in global indices, which were initially as low as -1% earlier in Europe. A new trade was issued for Premium susbcribers, doubling up on a trade opened back in November.

Chinese officials were greeted with a gift as they arrived in Washington ahead of Wednesday's phase one trade deal signing ceremony. The US Treasury removed the 'currency manipulator' designation that was placed on China in August. The initial move didn't fit within the framework of the rules and there were no repercussions but Beijing may see strong symbolism in the move and it sets a positive tone for meetings.

It also set a positive tone for risk assets as the S&P 500 rallied 23 points to a fresh record high. Tech continues to lead the way including China-sensitive Apple. Every tick higher raises the risks of a sell-the-fact trade after the signing. Economic data was light but Fedspeak emphasized that policymakers are firmly on the sidelines.

The Iran front has also cooled but non-stop leaks from US security officials highlight that the assassination of Soleimani was pondered long in advance. That may prompt other Iranian or Iranian-backed commanders to hit first rather than waiting to be targeted.

In both the China and Iran case, the temperature is currently falling but that could easily reverse. Talking tough is a hallmark of US elections and at the very least that will put Iran and China on edge.

Looking ahead, the US CPI report is due at 1330 GMT and expected to show prices up 2.4% on the headline and 2.3% ex food and energy. This report is running much hotter than PCE overall but average hourly earnings rose just 1.1% in the most-recent report. One line that has skewed recent releases is variability in used car prices so the market will be quick to strip that out if it's out of line.

Pound Sags on Rate Cut Talk

The BOE's monetary policy committee member Gertjan Vlieghe made a surprisingly explicit call for a rate cut on Sunday as policymakers lose patience waiting for economic resurgence. NZD & AUD are the leaders on Monday while GBP lags. CFTC data showed futures traders shifting out of US dollar longs. Below is Citi's economic suprise index, highlighting a contrasting performance between the Eurozone and Canada. A new Premium trade supported by 6 charts, was posted on Friday.

BOE external member Vlieghe said over the weekend the next few MPC meetings are absolutely live and that he “really needs to see an imminent and significant improvement in the UK data” or he is going to vote for a cut. The most-recent vote was 7-2 in favor of holding rates steady, as Haskel and Saunders came off the sidelines in favor of a cut. Now Vlieghe says he would join them.

The comments also put a heavy emphasis on a busy UK data calendar this week that began today with disappointing industrial production, before turning to CPI and retail sales later in the week.

On Friday, both US non-farm payrolls and the wage data in the report were soft. That led to some modest dollar selling and gold strength. Note the yield curve as well as falling long-end yields have pushed the 2/10-year spread down 10 basis points since the start of the year to 25 bps.

In contrast, Canadian employment rose 35.2K in December compared to 25.0K expected to cap the best year for jobs in the country since 2007. However the initial loonie rally stumbled in part because of wage growth at 3.8% compared to 4.2% expected. Some risk aversion also crept in late in the day Friday.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -61K vs -74K prior GBP +17K vs +12K prior JPY -12K vs -25K prior CHF -4K vs -6K prior CAD +26K vs +12K prior AUD -27K vs -38K prior NZD -1K vs -5K prior

The theme in all these changes is fading conviction in US dollar longs. That's been a great trade for most of the past decade but there are new questions with the turn of the calendar in an election year.