Intraday Market Thoughts Archives

Displaying results for week of Feb 14, 2021Yields Fly, Industrial Metals Follow, not Gold or Silver

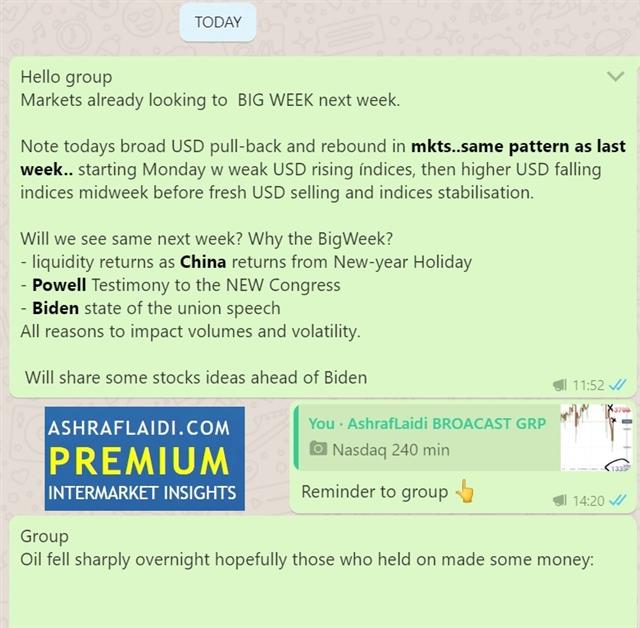

US 10 yr yields hit 1.36%, while REAL 10 yr yields improved to -0.8% from -1% last week, that is the biggest percentage weekly gain since June 2020, few weeks before the peak in gold and silver. Copper, zinc and nickel soared today after Goldman issued a positive note on copper, giving AUD and NZD their biggest % daily jump in over 3 mths. Stocks pared some of their earlier gains, while USD ended lower. Weak US jobless claims report swung the pendulum back towards US stimulus as the interaction of bond yields with other markets continues to dominate. GBP was the top performer while the US dollar lagged. Canadian retail sales fell by more expected. Below is the chart rationale to Ashraf's "short oil call" to the WhatsApp Broadcast Group on Wednesday evening.

US weekly initial jobless claims were much higher than anticipated, rising to 861K compared to 773K expected.

Each week, the numbers are a reminder that millions of Americans are struggling and that's been the consistent message from the Fed and White House. Expect a strong push on that front in the week ahead as the House passes the $1.9 trillion stimulus bill.

The moves are generating high amounts of noise but if we look at the past week, the clear winner is GBP and the clear loser is JPY. It's the same thing month-to-date and year-to-date. That's a trend.

Looking to Friday's trade, Canadian retail sales for December are expected down 2.6% and -2.4% ex-autos. The loonie has been showing some resilience this week and a strong report could boost it to new highs, particularly if oil cooperates.

Tempting Charts & Positive Conflicts

US retail sales blew away expectations on Tuesday, rising 5.3% compared to 1.1% expected. Core measures were even stronger as $600 stimulus checks immediately went to work. It wasn't just a one-month effect either, sales for Nov-Jan were up 4.6% y/y.

That big beat led to higher revisions for Q1 GDP and should drive assumptions higher regarding the $1400 check that's likely to be authorized in the next month.

On that front though, the market is feeling some jitters. The size and contents of the package are still up in the air and flat equities and lower Treasuries yields Tuesday may be reflecting some of that uncertainty.

The dollar tried to break higher but was also reeled in as the market grapples with stimulus, the inflation and the Fed. On the latter front, the Fed minutes didn't sound any alarm bells and there was a consistent message that policymakers believe the anticipated bumps in the months ahead will be temporary.

The commodity and housing markets are telling a different story though. Crude briefly fell on a report about Saudi Arabia bringing back supply in April but it quickly erased the dip and ran to a new high on US inventory tightening. Meanwhile virtually every other commodity continues to run with supplies tight everywhere.

In the housing market, the home builder survey rose to 84 from 83 and remains near all time highs reached late last year. In the day ahead, the US January housing starts report is due. There is a growing risk of a US housing boom with all the knock-on effects that entails. While we agree that much of the inflation in the spring will be temporary, the prices rises in commodities and housing look increasingly durable.مقابلتي مع العريية حول هذا و ذاك

حديث عن احكام رياضيات المالية، العملات و العواءد و التضخم بالإضافة الى الاثيريوم وىالبتكوين الذي وصل رقم

قياسي جديد. المقابلة الكاملة

4 Helpful Charts

US 10-year yields busted through the 1.20% barrier on Tuesday, piercing a double top and promptly running to 1.30%. US 30s broke through 2% in a similar manner.

The moves in bonds kicked off a big bid in the US dollar and USD/JPY hit a 4-month high at 106.00.

The market is increasingly focused on the post-vaccine economy and the likelihood (certainty?) that prices will rise with the surge and demand and against the backdrop of very easy y/y comps.

The trigger this week may have been energy with WTI following Brent above $60 and natural gas prices surging on cold weather. Lumber and metals prices are also at multi-year highs while consumer goods continue to be short supply.

The Fed introduced a new communication angle on Tuesday with SF President Daly saying “unwanted” inflation is not a practical risk and that fear of inflation could cause millions of jobs.

We'd argue that real inflation could unchecked by a complacent Fed cause millions more but that's the debate that will rage in markets in the months ahead.

As for bonds, the break higher leaves little standing in the way of 1.50% in 10s but so far equity markets have taken the medicine without a hiccup.