Intraday Market Thoughts Archives

Displaying results for week of Jan 09, 2022USD Bears May Wait a Bit More

The not-so-soon warning on USD decline is backed by the weekly DXY chart near 94.90s.

Finally, the daily and weekly charts of the Asian Dollar Index (provided by Bloomberg-JPMorgan) indicate a robust ascent with an imminent break to the upside. The importance of the ADXY lies in its close correlation with gold, especially during those confusing phases when DXY and XAUUSD moved in tandem. For an explainer on ADXY and XAUUSD, watch from 25:10 mins of this video.

داخل رياضيات الذهب

Shorts Beware

The surge in US bond yields is helped by the broadening cacophony from FOMC members expressing the need to catch up on their price stability mandate. Most challenging for bonds (positive for yields) is the prospect of simultaneously raising interest rates and quantitative easing (Fed selling of bonds after completing the taper process). Beware that a close above 15700 would qualify as a breach below the 100-DMA, but still respect a minor horizontal support—regardless of the candle wick.

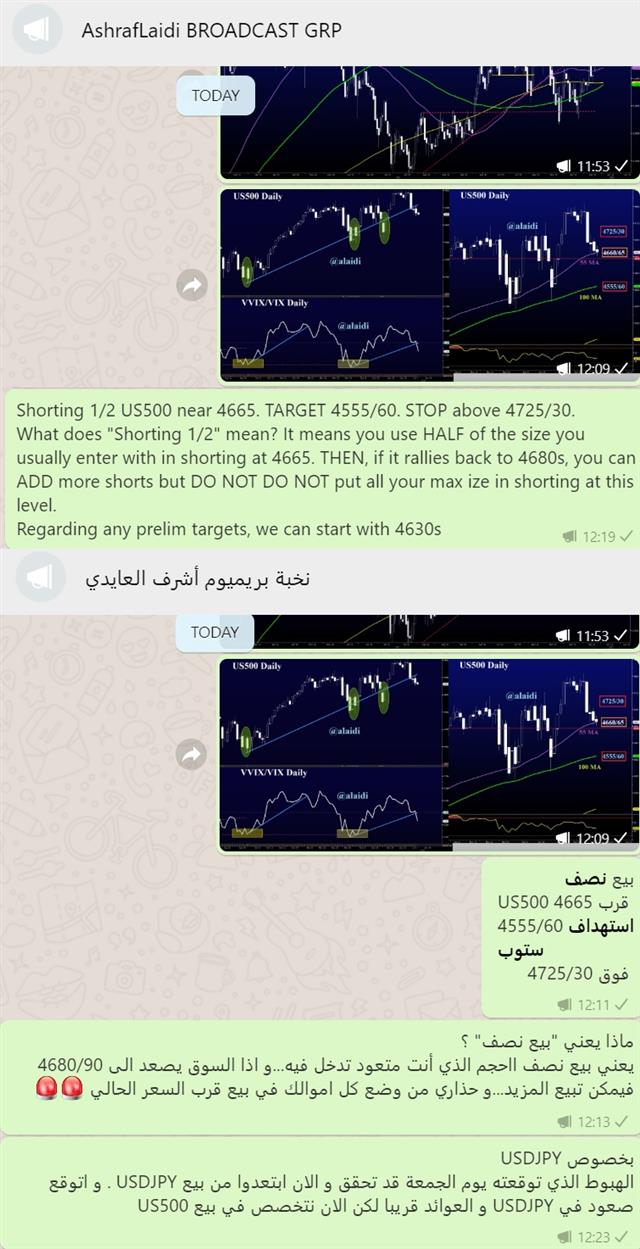

The snapshots below show our messages to the WhatsApp Broadcast Group, where we shorted SPX near 4665, targeting preliminary 4630s and 4560s. Whether the index extends to its 100-DMA remains to be seen. Don't forget also we're close to the 10% correction territory, where algos buyers start to wake up. It's only Monday and the chorus of FOMC speeches scheduled for the week is suggests the lows are not yet in, but not necessarily far way. Stay tuned.