Intraday Market Thoughts Archives

Displaying results for week of Apr 02, 2023Revisions Slowing the Slowdown

Slowing the Slowdown

The pullback in unemployment rate should be temporary. Here is why: Accelerating job layoffs as well as the latest upward revisions in weekly jobless claims should lead to growing momentum in jobless claims and the unemployment rate. Layoffs announcements do not translate to an immediate loss of jobs as it takes up to two or three weeks from the announcement before actual Jon's are lost. Employers will then have to pay severance pay, which could take another 2-3 weeks. Only then, will laid off workers be able to file for unemployment benefits (jobless claims), assuming they would do so. All of this reinforces the reality of the delay between announcing layoffs and actual loss of jobs.Don't forget the other economic reality-- Companies decide to cut jobs at the later stage of the economic cycles, i.e. well after the slowdown emerges in aggregate demand and manufacturing/services activity. Jobless claims could go from +220K to +270K within 2-3 weeks --just as the unemployment rate can jump from 3.5% to 4.0% by end of Q2.

And guess what? The pace of such developments will be rocky thanks to the phenomenon of revisions. Economic data tend to deteriorate in a non-linear fashion. Yesterday was a case in point—jobless claims appeared to have fallen, only after the prior figure was revised sharply higher, but traders focused on comparing the latest data point with consensus expectations. This is a typical aspect of evolving recessionary data—especially when media and traders' attention is placed on comparing actual vs expected data, while negative revisions of prior data points are deteriorating after the fact. Things tend to “happen fast” in markets, while macro developments tend to be interrupted, or slowed down by data adjustments and revisions, until USDJPY is below 127, 10-yr yield reaches 3.00% and gold breaks $2070.

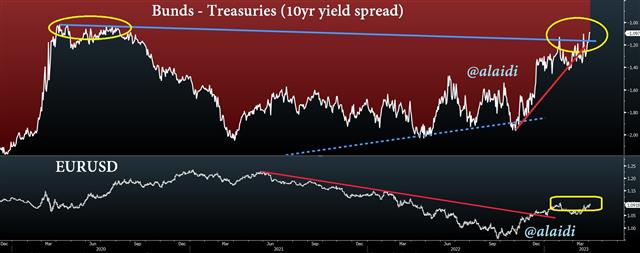

Bunds Treasuries Spread Breakout

When Yield Spreads Failed in FX

See how EURUSD remained steady in spring-winter 2020 despite the Bunds-Treasuries spread falling. The reason was related to the fact that USD was sunk by trillions of fresh central bank liquidity, even as US yields were starting to stabilize relative their German counterpart. Other examples of the yield spread's ineffectiveness was during 2002-2004 –when a rising EURUSD rode on the back of an implicit USD-depreciation policy from the Treasury as well as the start of the commodity boom.

When Yield Spreads Worked in FX

As for the classic examples when Bunds-Treasuries yield spread proved effective in predicting EURUSD, these were in 2000-2002 and 2011-2017.

Looking ahead, the Bund-Treasuries 10-yr yield spread appears to be breaking above the trendline resistance (upper right corner of chart). Yet, the spread needs to ascend further towards the -0.50 territory (when bund yields are -0.5% below treasuries) in order for $1.10 to hold and build up for $1.15. The warning becomes the following: Once/if the break into positive territory (spread goes above zero%), the FX implications, could be significant (in propsects and in speed) for EURUSD due to algos deploying new buy orders, on such massive Global Macro developments. As for the fundamental triggers, they could include: i) New evidence of weakness in US labour markets; ii) signals of Fed pivot (definite pause in hikes); or even iii) Japan nearing the end of YCC. Think deeply about the last one, as it's not straightforward.