FX Performance Since the Storm

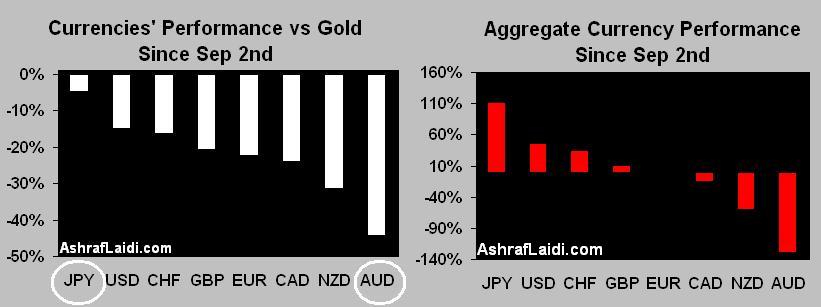

The charts below show the performance of major currencies as measured against gold and each other, since September 2-- two weeks before the makets' plunge.

The relationship between slumping world equities, record high TED spreads (LIBOR minus T-bill) and multi-year highs in low-yielding currencies is bolstered by a break in confidence across the equity, credit and foreign exchange markets. Our Thursday morning piece sent to clients titled "Sterling Still the Major Loser" preceded further losses in the currency as GBPUSD broke to 5-year lows at $1.6784. Sterling also slumped against the Swiss franc, hitting 12-year lows at 1.900 as the Swiss franc also flexed its low yielding safe haven muscle alongside the Japanese yen. But the yen fared exceedingly better than the Franc, hitting 3-year highs against the franc at 86.53 yen, a 7% rise for the yen this week and an 18% increase from its June record low. Aside from favoring JPY and CHF against GBP, AUD and NZD, using USD as a low yielding play against GBP and AUD remains the preferred short-term play especially as a hedging short USDJPY positions.

Dissecting Currency Performance Since September 2nd

The charts show the Japanese yen as the best performing currency since September 2, which is about 2 weeks before the surge in volatility. The left chart shows currencies performance as measured against gold, with the yen showing the least decline at -4% and the Aussie the greatest decline at an astounding 44% loss against the metal. The yen is followed by the dollar and Swiss franc, while the worst performing Aussie is followed by the New Zealand dollar and the Canadian dollar, all of which are typical commodity currencies. The chart on the right shows the returns of each currency against an aggregate of 7 other currencies, also showing similar performance.

The reason the dollar has outpaced the lower yielding Swiss franc in overall performance partly reflects the unwinding of dollar-selling positions accumulated over since mid September, as well as funds disposal of positions in emerging market assets.

The complete break in the once positive correlation between gold and the Aussie owes to the escalation in the unwinding of carry trades at the expense of high yielding currencies, which coincided with a refuge to the safe haven metal. Thus, unlike in past conditions of strengthening economic fundamentals when rising gold moved in tandem with the metal-dependent Aussie, todays conditions are characterized by reduced risk appetite, money flowing out of high yielding currencies to the benefit of safe haven yen, Swiss franc and gold. Equity markets are increasingly being dominated by liquidators as fund managers accelerate selling to meet or avoid margin calls and hedge funds clients pile on their redemption requests. In an environment where 5%-8% daily losses in major indices are a back-to-back occurrence, the modus operandi mainly is characterized by players seeking an exit, or speculators buying volatility, rather than traders seeking value.