Retail Traders' Hastiness

In the early hours of last Wednesday, XAUUSD jumped $120 to $4888 before slumping $130 to $4755, causing many to "call" the start of gold correction. Less than 24 hrs later, gold jumped to $4960. Yesterday (Monday evening Europe) many rushed to call the top in gold & silver. Indeed, yesterday, silver had soared more than £13 or 11%, the highest percentage daily rise since 17th September 2008, the day of the Lehman Bros Collapse. On Monday, XAGUSD dropped to 101.92. Where is it now? 112.67

The greater fallout will surely come. Will it be after Wednesday's FOMC decision?

So what did I tell our WhatsApp Bdcst members? See below: as long as the Gold/Silver ratio did not extend to 40, silver will remain on the rise. Why 40? I explained it in 4 of the last 8 posts sent in this newsletters in the written and video form.

From Silver to Yen

No, I will not tell you that Silver hit $110 and gold broke $5000 because I already warned several times over the past 4 weeks how and why it will happen in videos charts and writing. Instead, we need to talk about the Japanese yen, which dragged USDJPY by 1.7%, the biggest daily percentage decline since August. The reason? The NY Federal Reserve mentioned on Friday the possibility of assiting Japan in stabilizing yen weakness by selling yen. In the United States, the Treasury Department is responsible for setting currency policy and would authorize any intervention, which is then typically carried out by New York branch of the Federal Resereve, which is responsible for international monetary affairs of the US central bank such as currency swaps and facilities to manage dollar liquidity during periods of sharp currency swings such as 11 September 2001, the crisis of 2007-2008 and Eurozone crisis of 2009-2011. The high profile times the Federal Reserve assisted the Bank of Japan in selling yen to stabilise a soaring USDJPY rate were was in June 1998 and March 2011.

The chart below shows yield differentials (US minus Japan 10 yr yield) have dropped sharply as a result of soaring Japanese yields, but USDJPY has not followed lower. Will USDJPY follow lower? Will it retest the 151 trendline support? Our WhatsApp Bdcst Group members already know what I think. It will be a busy week (earnings, Fed and more chatter from Japan).

Gold or Silver?

A 3 minute video explainer about silver's inevitable $100 oz breakout, road to $150, what's beyond $5000 oz gold and how far can the 200-DMA extensions go? Video here.

40 on the Mint Ratio

Trump's Golden Hit

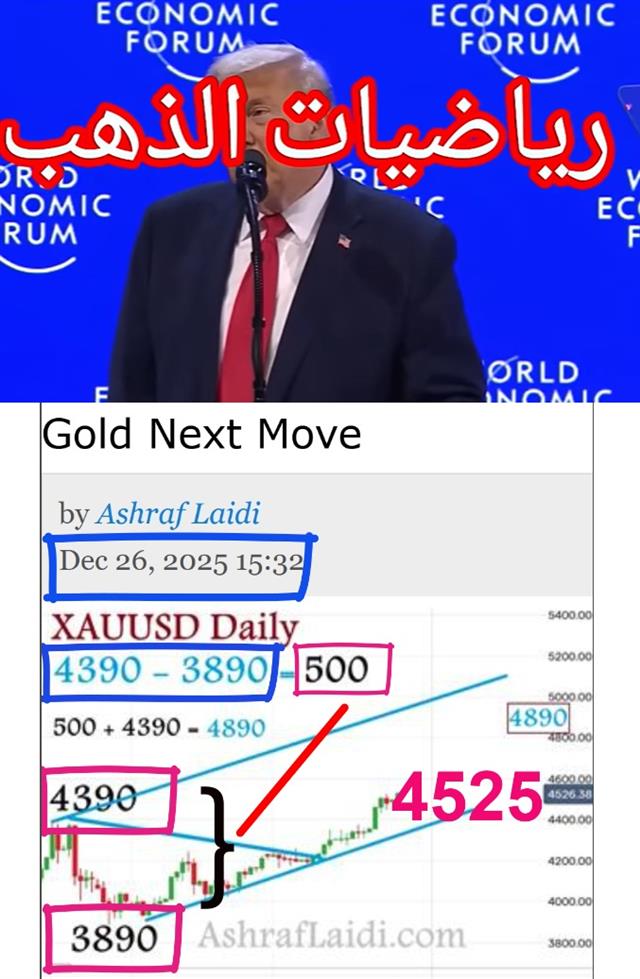

Here is 90-second video on gold's movements during Trump's speech in Davos. The apparent deal struck with Europe over Greenland has helped stocks and weighed down on metals. Gold fell more than $100 after reaching the $4890 target first mentioned 4 weeks ago. I still own my nulcear and rare earths stocks, such as CCJ, OKLO, TMC and UAMY as well as the semiconductor derivative plays, but also diversified to non tech such as AIR, APG, BBIO and others. After having united Europeans over Greenland resulting from his threatsm, Trump is now shifting towards gradually dividing Europe by prompting nations to compete for positioning over rare earths. China will also likely revert to its aggressive policy and rare earths will likely benefitl. The Maths Reminder on XAUUSD is in this video.

Archives