Intraday Market Thoughts Archives

Displaying results for week of Oct 10, 2021New Gold Video فيديو خاص عن الذهب

Onto Retail Sales, PBOC Emerges

Copper is a particularly notable economic barometer and it's turned sharply higher in the past week, rising to $4.63 from $4.25, and hitting the highest since May. It comes on a broader reflation trade (ex bonds) and improving risk sentiment.

Perhaps that's all there is to it but it's worth keeping a close eye on China at the moment. It's more of a question of 'when' they add more stimulus rather than 'if'. There was chatter of a cut in the RRR or a fresh MLF on Friday and that's been percolating for a few days.

If China turns on the taps, it will add another leg to the commodity currency rally, particularly against the yen. We've highlighted those crosses recently and they continued to break out with CAD/JPY busting an old triple top from 2017, 2018 and 2021 on Thursday in a rally to the best levels in six years.

At the same time, we're gaining confidence daily that covid is in terminal decline. Of course, there's always the chance of another wave and we've not virologists but cases are falling almost everywhere at the moment and vaccination continues to rise.

On Friday, the US reports on September retail sales. We see this as somewhat of a free call option. The consensus is -0.2% m/m and +0.4% on the control group. Those are modest numbers but September was a challenging month for covid. If the data undershoots, it will likely be brushed aside or further push yields down. While if it's stronger it will point to a ready-to-spend consumer ahead of the holidays.Flattening Curve & Real Yields Hit USD

US PPI rose 0.5% in September, posting the smallest increase of the year. US CPI was slightly firmer than expected at5.4% y/y compared to the 5.3% consensus but it was the real weekly earnings component that drew attention as it climbed 0.8% m/m compared to 0.2% previously. Initially, that led to a 20-30 pip rise in the US dollar but as the day wore on that faded. That extends a trend of choppiness this week.

Part of the reason for the decline was a surprisingly low yield in a sale of US 30-year bonds as the issue was 1.3 bps below what the market was expecting. With that, US 30s have fallen 13 basis points from Friday's high. It's no surprise that's dragged down the US dollar, at least in the short term.

The Fed minutes didn't inspire much in terms of price action, but did outline a Fed staff scenario of $15B monthly tapers starting in November or December. Both scenarios would take result in and end to the process in the middle of 2022, something Fed officials have flagged in comments.

Yen Descends, Inflation Up Next

Yen weakness continues with multiple crosses breaking key levels. USD/JPY continued to fresh three-year highs, sustaining the bid even as stocks slipped and 30-year yields fell 6 bps.

It's clear that rising global yields and yen crosses move in tandem but a better question is why both are climbing. That two main drivers are rising inflation worries and ongoing supply bottlenecks, which are feeding back into each other. Add in the ongoing energy price shock and there's a strong case for the reflation trade.

One unheralded factor is that covid appears to be subsiding globally. Another wave of the virus was baked into global growth projections but optimism is rising that we've seen the final thrust – at least outside of China and the antipodeans which remain at high risk due to limited natural immunity.

Whatever the driver, the charts of yen crosses are increasingly convincing. CAD/JPY on Monday rose to the highest in three years and is now threatening the 2018 high.

Looking ahead, the US CPI report is due out at 1230 GMT and expected to show year-over-year remaining at +5.3% with core remaining at +4.0%. If you recall back to last month, core inflation undershot expectations and it briefly weighed on the US dollar. That victory lap for team transitory didn't last long though as the dollar quickly resumed its climb.

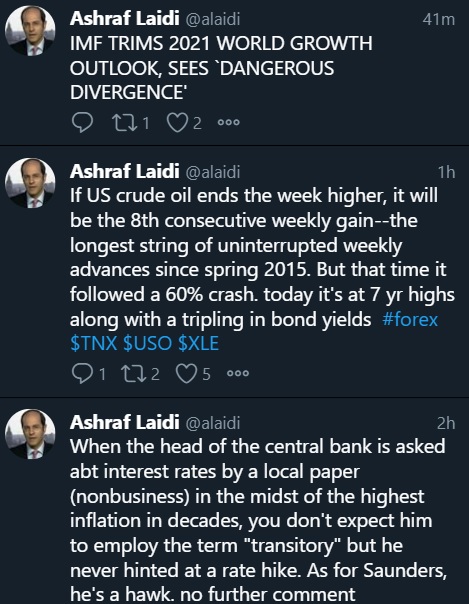

The Slow Disintegration of Team Transitory

Central bank comments are increasingly littered with caveats. On Monday, ECB chief economist Lane tried to lay out how wages could rise in a one-off without leading to inflation. He called price rises 'mostly transitory' but warned they are in the early stages of an energy shock.

In the US on Sunday, the Fed's Daly – an ardent dove – warned that if bottlenecks continue and spending remains high, there will be more inflation. Given that economies continue to reopen and there's a glut of US savings, that's a fair bet.

The FX and rates market is increasingly signaling that team transitory is losing. The latest axis is the yen, which is the traditional low yielder. The implication of strength in yen crosses is that rates divergence is coming. Given the big breakouts, including USD/JPY hitting a seven-year high on Monday, the implications are clear.

It's been a slow transition for the Fed but the doves are now clearly on the backfoot and supply chain problems aren't easing.

A release that's sure to spark more chatter is the August JOLTS report, which could show a record 11 million job openings. There is good reason to be skeptical of this report. Companies have taken to spamming job ads and using algorithms to screen resumes. It's the proliferation of an 'always hiring' policy that's simply a search for low-wage workers. In any case, policymakers still believe in it and so does the market.

The other event to watch will be the 10-year Treasury sale. The cash market is at 1.62% with little standing in the way of a return to the 2021 high of 1.78%.Big Oil, Big Implications

Lebanon offered a glimpse into the growing global energy crisis on the weekend as the entire country was plunged into darkness for 24 hours on the weekend. It's an increasingly complex situation as the nation struggles to cover and secure diesel for power plants.

Weekend reports also highlighted the growing coal shortage in India as two Northern states suffered rolling blackouts.

Households and companies in both places and elsewhere are frequently turning to diesel-powered generators to supplement or supply power. With natural gas prices at extraordinarily high levels, there is also large scale switching to oil when possible.

As a result, oil demand may be recovering more quickly than anticipated. On Friday, US oil hit $80 for the first time since 2014 and it continued higher early on Monday. Technically, there are blue skies on the chart up to significantly higher levels. The economic knock ons from that are negative and inflationary but for now the beneficiaries are oil-exporting currencies.

Notably, one level to watch is $86.90 in Brent. Unlike WTI, the global oil benchmark hasn't broken the 2018 high and still has $3 to go. A break of that level would confirm (or block) a genuine breakout. Meanwhile, Saudi Arabia is not exactly in a hurry to temper the windfalls of rising oil at a time when it's seeking diverse sources of revenue.

In Monday's broader trade, the trend of yen weakness appears to be gathering steam. It's an acknowledgement of the global reflation trade and rising yields.