Intraday Market Thoughts Archives

Displaying results for week of May 10, 2015A Hidden Sign for US Dollar?

Most headlines focused on a soft PPI inflation report for the US on Thursday but a hidden data point may have sent a different signal. The euro was the top performer on the day while the Australian dollar lagged. Comments from Kuroda are due later. There are 5 Premium trades currently in progress, including EURUSD, GBPUSD and NZD. Full trades and charts are found here.

The Fed is steadfast that good growth and inflation will return to the US but PPI didn't show any price pressure in the pipeline. Ex-food and energy, it rose just 0.8% compared to 1.1% y/y expected. That was contrasted by a third consecutive upbeat initial jobless claims report at 264K compared to 273K expected.

But looking ahead, one statistic was buried in the headlines and shows the Fed may eventually be proven right. Business investment has been dismal for the past 8 months and once again disappointed in March data. The best proxy for the metric is durable goods orders non-defense ex-air and the initial report showed it down 0.8% in the month compared to +1.0% expected.

A week later it was revised to -0.1% in the factory orders report. On Thursday, it was revised again – this time to +0.6%. February orders were earlier revised to +2.8% from +1.7% as well so what had looked like an extremely disappointing period was actually strong.

It's especially important because it's one of the best forward-looking indicators. It's still too soon to fall back in love with the US dollar but if a few US indicators begin to beat expectations, the market may quickly realize that a September rate hike is possible.

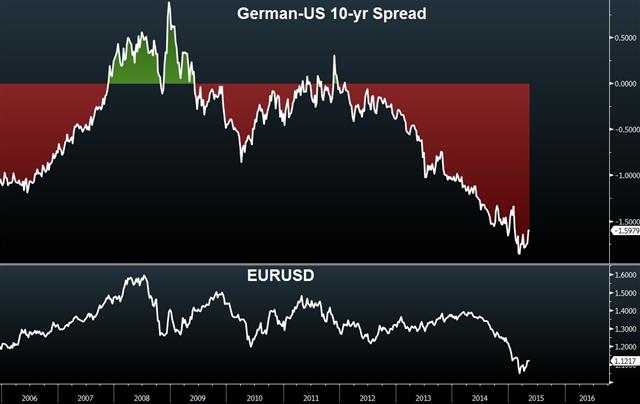

In the shorter term, however, the focus remains on the euro and Bunds. Yields were lower and that stalled a rally to a 2.5 month high of 1.1445 in EUR/USD but even after a hiccup down to 1.1350, buyers returned to push the pair to a close above 1.14. It's another sign that long-term shorts are looking for the exits.

Looking ahead, the yen was quiet in US trading but that could change with Kuroda on the docket at 0340 GMT. He recently hinted at the BOJ missing its inflation target but was steadfast that it didn't require a change in policy. Japanese PPI is also due at 2350 GMT.

Bund-euro Dynamics and Intermarket Response

German bund yields and the euro pressured in late London trade as ECB president Draghi reiterated in a speech at the IMF that asset purchases will go “as long as needed.” And here is the question for next week.

Cracks in Foundation of USD Rally

A weak retail sales report sent the US dollar to fresh correction lows on a number of fronts. The Australian dollar was the top performer on the day while USD lagged badly. Japanese machine tool orders are due later. Ashraf issued issued a new EURUSD Premium trade with 3 new charts in addition to our existing trade. GBPUSD trade also remains +100-pip in the money, AUDUSD short was stopped out and NZDUSD remains in progress.

The year started out with market watchers extremely optimistic about US growth this year, especially relative to its developed-market rivals. When a relatively colder, snowier winter hit the United States it was seen as a minor setback. A similar spell of weather hit a year earlier warnings the US was slowing turned out to be false. Very few people lost faith in 'strong US & USD' story, including the Fed.

One of the foundations of the trade was that consumers would be spending more. Jobs were growing and the cherry on top was that lower gas prices would offer an extra boost. But the consumer is AWOL. March retail sales excluding autos, gas and building supplies were flat compared to +0.5% expected. It was the fifth consecutive month of softer-than-forecast retail sales.

Even worse, weather can no longer take the blame in April and analysts are struggling to find an excuse. At the same time, the US dollar trade is extremely crowded, particularly against the euro. After the data on Wednesday, USD fell 70 pips against the euro, yen and pound then continued to fall later.

What might be the most-worrisome signal of all was the Bund and Treasury yields only fell for moments after retail sales before the selloff resumed and then accelerated to fresh extremes. In the day ahead, watch the euro closely as it pushes up against the May high of 1.1392. A break could set off yet-another violent squeeze.

In the immediate term, traders will look to economic data from Japan. The machine tool orders report is due at 0600 GMT and is expected to show a healthy 14.9% rise in April. Still, it's not likely to be a market mover.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (Q1) (q/q) | |||

| 1.7% | May 13 22:45 | ||

| Retail Sales ex Autos (Q1) (q/q) | |||

| 1.5% | May 13 22:45 | ||

| Machine Tool Orders (APR) (y/y) [P] | |||

| 14.6% | May 14 6:00 | ||

USD hit by another data miss, gold, silver push up

The recurring disappointment in US retail sales (5th consecutive month below consensus expectations) gives reason for concern over the increasingly consumer-dependent US economy, particularly with the continuous lack of windfall gain to demand from improving weather and falling oil prices in early Q2. The notable reaction in currency markets is highlighted by the speed at which traders sell USD on each and every US data miss. Full charts & analysis

Bonds stabilize, RBNZ goes prudential

Bonds continues to drop on Tuesday then promptly reversed and that capped euro gains. The Australian dollar was the top performer while the US dollar lagged. Early in Asia-Pacific trading, the RBNZ announced curbs on home lending in Auckland, we look at what it means.

Bonds continue to be the driver throughout markets, led by the bund where yields rose to 0.74% before falling back to 0.67%. The euro crested at 1.1282 and then sagged with yields back to 1.1215.

Economic news was light. Greece made its payment to the IMF, taking the drama there off the frontburner. In the US, the JOLTS report slipped to 4994K compared to 5108K expected, underscoring the jobs slowdown in March. That was balanced by hawkish comments from the Fed's Williams who said he preferred raising rates 'a bit earlier' and said he was more confident in inflation returning to 2%.

In early Asia-Pacific trading, the RBNZ released the financial stability report and introduced tougher mortgage rules in the capital effective in October. The accompanying statement referred, once again, to the NZD trading “above its sustainable level.” But the kiwi rallied because it didn't include the previous reference to NZD strength being “unjustified.”

Our take is that the targeted measures relating to the housing market give the RBNZ breathing room to cut rates without fear of stoking overvaluation in Auckland housing. NZD/USD rallied to 0.7400 from 0.7350 but we see this as a sign that a rate cut is likely. Combined with the possibility of more bond market volatility; the kiwi remains vulnerable.

Looking ahead, RBNZ Governor Wheeler appears in Parliament at 0110 GMT. In other central bank news, the BOJ's Sato speaks at 0245 GMT.

Onto German and Eurozone GDPs

If €766mn was hard to obtain for Greece, then how (and what) will Athens do meet the four loan repayments to the IMF–totalling €1.6bn—by end of June? Euro traders now take a break from Greece to monitor Wednesday's release of German and Eurozone Q1 GDPs. Full charts & analysis.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone GDP s.a. (Q1) (q/q) [P] | |||

| 0.3% | May 13 9:00 | ||

| Eurozone GDP s.a. (Q1) (y/y) [P] | |||

| 0.9% | May 13 9:00 | ||

| Germany GDP s.a (Q1) (q/q) [P] | |||

| 0.7% | May 13 6:00 | ||

| Germany GDP n.s.a (Q1) (y/y) [P] | |||

| 1.6% | May 13 6:00 | ||

| Germany GDP w.d.a (Q1) (y/y) [P] | |||

| 1.4% | May 13 6:00 | ||

What to do if the bond rout continues

The bond market has been in a bull market for more than 30 years but this could be the end. The pound was the top performer Monday while the kiwi lagged. Australian housing data and the Federal budget are due later. A new GBPUSD Pemium trade was issued.

Friday's soft non-farm payrolls report barely left a dent in the bond market rout. The long end is leading a push higher in yields throughout most of the globe.

The catalyst for the final push lower in sovereign yields was ECB QE and it contributed to driving Bund yields as low as 0.08% but signs of better growth in Europe and the Fed preparing to hike, traders have stampeded out. Bund yields rose another 6 bps Monday to 0.61% and T-note yields climbed 13 bps to 2.28% -- the highest close of the year.

Blips in bonds have been part of the landscape for as long as the bond bull market has been taking place. With the ECB continuing to buy, this isn't likely to be a V-shaped turnaround but it may dominate trading in the weeks ahead.

The fall in the kiwi was widely blamed on rate cut expectations Monday but the move in OIS was only about 4 basis points. The larger driver was the unwind of the carry trade and that's a trade that can gain considerable momentum.

It's also important to note that USD/JPY rose Monday even as stocks fell. Although sovereign yields may rise in many advanced countries they're unlikely to move as significantly in Japan with the BOJ holding such a large portion of supply. That divergence could be the source of another led in the USD/JPY rally.

The euro may also be a beneficiary with many carry trades funded in euros. We noted yesterday that CFTC positions still show significant EUR shorts and those remain at risk. Ultimately, the market believes ECB buying will cap European sovereigns but bund rates back up to 1% would still cause considerable pain.

In the hours ahead, the Asia-Pacific trading calendar isn't particularly busy. The lone notable release is Australian housing finance at 0130 GMT. Home loans are expected up 1.0%.

Later, the Australian government is expected to deliver a simulative budget and that may be mildly supportive for AUD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Home Loans (MAR) | |||

| 1.0% | 1.2% | May 12 1:30 | |

Pound ralllies ahead of QIR, NZD battered on rate calls

GBP is the biggest winner in Monday trade, clawing further gains following the Tories' s overwhelming Election victory, while the US dollar lost most of its post-China rate cut gains. The NZD was the biggest loser as summer rate cuts by the RBNZ becomes a credible scenario. Full charts & analysis

China Cuts Rates, Euro Shorts Unsqueezed

China cut deposit rates on the weekend after CPI numbers fell short of estimates. The Australian dollar is slightly higher at the open in response; last week the pound led while the kiwi lagged. Weekly CFTC positions showed some radical changes – except in crowded euro shorts.

China cut rates for the third time in six months on the weekend. The one-year lending rate was lowered a quarter-point to 5.10% with the deposit rate cut by the same amount to 2.25%. The moves came after April CPI was at 1.5% y/y compared to 1.6% expected.

The PBOC has used a variety of tools to stimulate the economy in the past six month but the most-powerful is cutting the Required Reserve Ratio, which was undertaken in February. The Shanghai Composite rallied nearly 50% after the Feb 4 RRR cut before stumbling 5.3% last week.

The “economy faces relatively large downward pressure,” the PBOC said. “The overall inflation level is low, the real interest-rate level is above the historical average, for which there was room to use the interest-rate tool.”

Those comments indicate more easing could be coming. With rates still above 5% and the RRR relatively high, the PBOC has plenty of ammunition.

Traders will have a chance to digest have a light slate of economic data. The lone notable release is Australia NAB business confidence at 0130 GMT. The prior was +3.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -190K vs -198K priorJPY -31K vs -5K priorGBP -25K vs -34K priorAUD +1K vs -27K priorCAD -10K vs -21K priorCHF +5K vs +1K prior

Australian dollar shorts cleared out after the RBA rate cut in a sign that traders believe the RBA easing cycle is in a medium or long-term pause. What jumps out is how little the Aussie was able to rally last week given that change in sentiment. It may be a signal about the amount of residual selling pressure.

What really grabs our attention was the rush into yen shorts. There was no clear catalyst for the shift and USD/JPY remains well-within its recent parameters.

Even that lack of worry among euro shorts (although they may have been squeezed later in the week), shows that by-and-large, dollar bulls remain confident.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| NAB's Business Confidence (APR) | |||

| 3 | May 11 1:30 | ||