Intraday Market Thoughts Archives

Displaying results for week of Feb 11, 2018USD & Gold Questions...& Answers

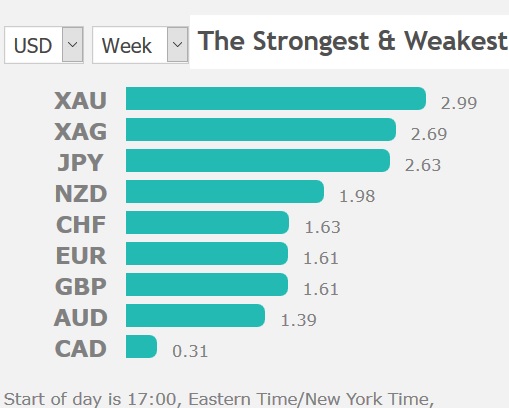

All currencies gained versus the US dollar this week, but gold and silver came on top. Both metals achieved the exploit of rallying against all currencies, even against the advancing yen. Full analysis.

تكوين القيعان في المؤشرات

نراقب ونقارن تكوين القيعان على مؤشرات الداو و الاس ان بي. الفيديو الكامل

كيف ولماذا تحوط صناديق التقاعد اليابانية يساعد الين

هل سيتدخل بنك اليابان المركزي ويحاول إبطاء وتيرة قوة الين؟” ما هي "كاري ترايد"؟ كيف ولماذا تحوط صناديق التقاعد اليابانية يساعد الين؟ كيفية استخدام مؤشر الين لسلة العملات التحليل الكامل

USD, Fed, Deficit & Gold

Why is the US dollar sustaining fresh selling despite expectations of 3-4 Fed hikes this year? Does the budget deficit matter for FX? And one more look at gold. Watch the full GKFX video.

No Love for the Dollar

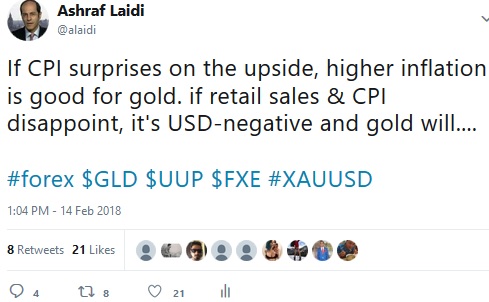

The US dollar has been a dog for more than a year but the trade on Valentine's Day showed just how unloved it is. The dollar was a major laggard despite strong inflation data while commodity currencies soared. Australian jobs numbers are up next. A 2nd Aussie trade has been issued today to gear up for Aussie jobs figures due at 19:30 ET, 00:30 GMT/London, one of the trades is long AUD other is short AUD with the idea that both will move towards target over time based on the relationship between the cross currency relationship. Gold and silver were the stars of the day. Here is my reasoning 20 mins prior the release of US CPI & retail sales on why gold should rally regardless of the outcome.

All eyes were on US inflation numbers Wednesday as worries about inflation derailing corporate earnings and growth continue to circulate. The worst happened as CPI rose 0.5% m/m compared to +0.3% expected. Core numbers were equally hot.

The dollar shot higher on the headlines in 50-80 pip moves across the board but the highs were within moments. From there the US dollar embarked on an epic reversal that included a rally in cable to 1.40 from 1.3800 and in the euro to 1.2455 from 1.2275.

Part of the story was a dismal retail sales report. It was down 0.3% compared to the +0.2% consensus. Holes were also poked in the high CPI number because of a handful of jumps in odd categories.

Stock markets also made a major turnaround with the S&P 500 finishing 36 points higher after falling 40 points in the aftermath of the CPI print. Despite that and despite a march in US 10-year yields to 2.91%, USD/JPY finished at a 15-month closing low, breaking a major support level.

On a technical basis alone, the dollar is looking increasingly dismal. Wednesday's trade was a clear sign of how the market has lost faith in the dollar. We will continue to watch for a shift in the dollar-selling paradigm as US 10-year yields rise to 3% and beyond but the price action Wednesday spoke volumes.

One trade that will be in particular focus in the hours ahead is AUD/USD with the Aussie employment report due out at 0030 GMT. The consensus estimate is for a +15.0K print following a +34.7K rise in December. A strong number would put AUD/USD back on a path to the January high of 0.8130.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Employment Change | |||

| 15.3K | 34.7K | Feb 15 0:30 | |

How High for the Yen?

In order to determine what part of the decline in USDJPY was driven by yen strength rather than USD weakness, it is more appropriate to analyse the yen's trade-weighted index for a more accurate view on the currency's secular performance. Full Analysis on how far it can go.

USD/JPY on the Brink

Yen strength spilling from the US session into Wednesday Asia combined with broadening USD weakness sent USDJPY to 107, on the brink of breaching the 1 1/2 year trendline support. Japan's Q4 GDP slowed to 0.5% y/y from 2.2%, disappointing expectations of a 1.0% reading. The rout in risk trade followed by the latest rebound hardly put a dent in the trend of US dollar weakness, especially against the yen. The Premium short USDJPY trade hit its final 107 target for a 250-pip gain. The Premium video for the upcoming trades is found below.

Yen Mystery?

Based on interest rates and the carry trade, this pair shouldn't be struggling. Japanese 30s pay just 0.8% and the BOJ hasn't given the slightest hint about raising rates. So what's the driver?A big one is investment. Japan has been a no-go zone for a generation due to languishing growth but also due to better potential elsewhere. Now investors are giving Japan a fresh look as the economy shows small, budding signs of growth. Along with that, equity valuations in Japan are cheap.

Ashraf reminded us 3 weeks ago on the reasons to JPY strength and why it would persist.

So long as the weak-dollar paradigm extends and global growth shows signs of life, a steady trickle in the yen could continue. Note also that specs are heavily short the yen and could be forced to start covering if USD/JPY embarks on another leg lower.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Prelim GDP Price Index (y/y) [P] | |||

| 0.0% | 0.0% | 0.2% | Feb 13 23:50 |

My London Seminar on Feb 22

Time for another seminar at GKFX's London HQs. Delving into charts and fundamentals can give mixed signals, but only a few charts are sending a clear message. Find out my favourite trading ideas in currencies, metals, indices and ETFs. Thursday, 22nd of February at 7 pm. Book your seat now.

Calm Returns, Where to Watch

Just as bloogers and analysts began writing about Monday's sharp market rebound, indices around the world are back in the red, yet off their lows. One relationship that's increasingly taking hold is the inverse relation between indices and the US dollar. Interestingly, USD remained weak despite the overnight sell-off in Tokyo and early Europe. JPY, EUR and CHF are the strongest, while GBP backs off its highs following stronger than expected inflation data. 120 pip gain was locked in the EURUSD trade.

إلى أين الارتداد؟ (فيديو للمشتركين)

One clue on whether Monday's bounce will last was in the announcement of a White House infrastructure plan. It surely faces a tough test in Congress but it highlights the administrations priorities; or more aptly, the lack of an emphasis on deficit reduction.

It came along with fresh White House projections which are undoubtedly optimistic and still foresee a nearly $1 trillion deficit next year. With the potential for more stimulus in the pipeline and continued high military spending, the bond market is beginning to worry about debt issuance.

US 10-year yields ticked another basis point higher Monday to 2.86% and as high as 2.89%. There is a sudden focus on borrowing levels and it seems almost inevitably that some type of shudder – small or large – will hit stocks once 3% is breached.

A pair of big drivers towards or away from that level is likely on Wednesday with US CPI and retail sales data.

Can Equities do it?

A tentative turn to the upside late on Friday will be tested in the days ahead but even if sentiment stabilizes, a big challenge awaits. Gold, silver and the Aussie are the best performers as yields push higher alongside risk appetite. Ashraf is watching 2676 on the SPX and 24706 on the Dow for today's close. Tune in for today's webinar on volatility. CFTC positioning was remarkably steady despite the turmoil. And here is a chart below that very few have mentioned.

The S&P 500 gained nearly 40 points on Friday and traded 100 points off the lows in a small positive sign at the end of the worst week for global equities in years. Ultimately, the backdrop hasn't changed and the global economy is in fine shape. That was reflected in the general indifference of the FX and bond market. Looking to the week ahead and beyond, it will be bonds that steal the spotlight. The key event is Wednesday's release of US CPI and retail sales.

Despite all the turmoil, US 10-year yields finished the week at 2.85% -- the highest since the end of 2013. Aside from risk aversion, the climb took place despite tumbling commodity prices. A rise to 3% is likely and it's sure to create jitters in the junk bond space and broader markets. Is it a threshold for fear? Probably not but 3.5% might be a spot where negative feedback kicks in.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +141K vs +149K prior GBP +28K vs +32K prior JPY -113K vs -114K prior CAD +40K vs +33K prior CHF -20K vs -20K prior AUD +14K vs +13K prior NZD +3K vs +3K prior

The above numbers only reflect the close through Tuesday but underscore the lack of real concern in FX despite the turmoil in stock markets.