Intraday Market Thoughts Archives

Displaying results for week of Jul 11, 2021Precarious Positions

A number of risk-sensitive charts are showing persistent softness and holding precariously above support. Whether that's because of delta worries, a Fed mistake or something else the market is seeing in the economy remains unclear.

The technical message is beginning to crystalize though. On Thursday, it was USD/CAD stretching to a three-month high above 1.26, with the 200-DMA at 1.2627.

Another message came from AUD/USD, which is less than two-dozen pips above the lows of the year despite a jobs report that knocked unemployment down to 4.9% versus 5.5% expected.

We can't rule out that thinned liquidity and demand for Treasuries is behind the move (something Jeff Gundlach highlighted) but the moves have already stretched far enough and for long enough to make that implausible. Moreover, yen crosses are also creaking with EUR/JPY threatening a convergence of support near 129.50.

The main equity indexes have held up so far but perhaps that only adds fuel to a potential risk-off fire. Moreover, the breadth of equity gains has been extraordinarily narrow and confined to big-cap tech, a sector that benefitted early in the pandemic. More broadly, the Russell 2000 is where it was in February, while the Nikkei 225 is barely higher on the year.

The elephant in the room remains the bond market and yields on Thursday fell back towards the recent lows, making the recent rise look more like a dead-cat bounce.

So while there are plenty of reasons for optimism, discretion is the better part of valour, particularly in a July market.

Looking ahead, the willingness to spend of the post-pandemic consumer remains a major question and we will get two data points Thursday in retail sales and consumer confidence. In the breakdown of sales, look for spending on restaurants for a clue on pent up demand.Transitory Doubts Creep In

Wednesday was busy on the news front. The Bank of Canada tapered by $1b, which was the consensus and bumped up growth forecasts but didn't pull forward rate hike expectations and the result was a drop in the loonie.

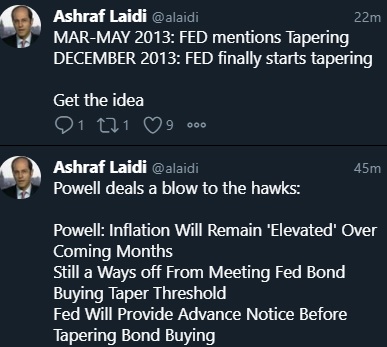

In the US, Powell helped out risk assets by repeating that inflation will ease. He also said that reaching the standard of 'substantial further progress' is still a ways off and that there will be plenty of notice before policy changes.

On the fiscal front, Democrats began to roll out a $3.5 trillion infrastructure program and that should eventually breathe new life into the reflation trade.

For now through, pricing was choppy with the dollar giving back much of Tuesday's gains as Treasury yields backpedaled.

All sides of the market continue to struggle with the inflation question and that was evident in central banker comments. The bravado about transitory inflation forecasts has been replaced by an increasing number of caveats. MACKLEM said supply chain bottlenecks will prolong temporary inflation, prompting tighter vigilance. POWELL said recent prints on inflation were unexpectedly high but that the baseline remains the same. The Fed's Beige Book said that while some contacts felt that pricing pressures were transitory, “the majority expected further increases in input costs and selling prices in the coming months.”

In the UK, RAMSDEN took a harder line. The BOE hawk said he envisions tightening sooner than before.

One market signal that's worth keeping a close eye on is gold. It rose $20 Wednesday after a week of unchanged prices and is now flirting with the 200-day moving average.

Friday's US retail sales data will be a key input on the strength and willingness to spend of the consumer.بين الداو جونز والناسداك

ما بين الداو جونز والناسداك، ما هو المؤشر المناسب للبيع أو الشراء؟ وأيهما أفضل للبيع أثناء تراجع العوائد ولماذا؟ الاجابة في الفيديو

Macklem vs Powell vs Orr

US June CPI rose 5.4% compared to 4.9% y/y expected in the largest rise since 2008. Core and monthly numbers were similarly strong and the initial reaction in the market was a higher dollar.

As the minutes ticked by though, the dollar strength began to fade. Part of that was market participants picking apart the report. The jump in used car prices is undoubtedly transitory. They rose another 10% in June for a 45% y/y increase – a shocking number no doubt but that rise won't continue and there are already signs that used cars will be a drag on CPI in the months ahead.

There were other quirks too, including energy and some durable goods. In all, 6 items accounted for 55% of the increase in June. As that was digested, the US dollar gave back its gains, even completing the round trip against the pound, kiwi and aussie.

There are lingering concerns though. Rent inflation has risen in consecutive months in what could be a long-term tailwind for inflation.

The dollar got a second lift on a 30-year bond auction. The yield at 2.000% was much higher than 1.976% expected and that triggered a second rally in the dollar and a continued selloff in bonds that pushed 30's to 2.05%.

The price action looks a bit like bonds reversing the recent gains or pricing in higher inflation. As yields ticked up, stocks also ticked lower.

In the day ahead, we will get the BOC decision and Powell testimony. For the BOC, a taper is in the cards and a strong consensus has emerged around $1B, which would reduce weekly purchases to $2B. Also keep a close eye on forecasts as inflation is likely to move higher and confidence in the recovery may rise. That's because recent lockdowns didn't weight on growth as much as expected and vaccination rates are now just shy of 80%.

For Powell, the main message of transitory inflation is unlikely to change but he may offer more on the taper timeline. On Tuesday, SF Fed President Daly offered an early hint at a taper timeline for late 2021 or early 2022. That fits with market expectations but a reiteration from Powell would firm up the sequencing.Inflation Data Will Be a Test

SEE YESTERDAY'S 10-YEAR YIELD CHART HERE as1.40% becomes the new ceiling.

Monday's price action offered more evidence that last week's test of nerves was passed. US equities started soft but soon gained momentum, in part due to rising yields. The 10-year auction yield was 0.3 bps below expectations and that briefly caused a ripple in rates and USD/JPY but it was soon brushed aside.

Commodities and commodity currencies showed some resilience as well with oil shrugging off earlier losses. Copper has quickly become a forgotten market but it's held steady at historically-high levels over the past month.

Looking ahead, there's the scope for considerable volatility following the release of the June US CPI report. It's expected to edge back to 4.9% from 5.0% y/y in May and whether or not it can get under a 5-handle will largely determine the kneejerk reaction.

Beyond that, the details of the report will be critical. The market has a good idea of what components of CPI will be shrugged off by the Fed – used autos, travel, durable goods – and which ones may not be: owners equivalent rent, some services.

It will be key to watch the bond market reaction. After the surprise jump in May CPI, yields on the long end of the curve fell. The implication is that higher rates now may force the Fed into a policy error and doom long-dated bonds to sub-2% returns. Conversely, we will be interested to see the market reaction to a lower-than-expected reading because if it provides cover for the Fed to be patient, it could mean higher yields.New Supply is Coming Home

It will be a slow start to the week in G10 FX on account of a multitude of hangovers in London.

The economic calendar is generous to football fans with little on the agenda in terms of economic data. The event to watch will be the 1300 GMT sale of 10-year notes.

One of the theories about the drop in yields last week was a lack of new supply due to quirks on the Treasury calendar and the looming debt ceiling. That will be relieved with $38B on sale in a reopening followed by $24B in 30s on Tuesday.

Recent sales have been strong but that was +15 bps ago. Whether it's lower or higher yields, expect the sale to set the tone for the week.

The other move that caught markets off guard last week was China's cut to the RRR. To be sure, officials foreshadowed the move but most China-watchers thought they were teeing up a move in late summer. For the real economy, a sooner move and one that delivers it to all banks (rather than rumored small banks) is undoubtedly stimulative. The risk is that it hints at panic or an economy that's slowing too quickly. So far the market reaction has ben positive but the Chinese consumer has been surprisingly sluggish and that could eventually spook global markets.