Intraday Market Thoughts Archives

Displaying results for week of Sep 11, 2016Revealing the Mystery Charts

The ensuing Head-&-shoulder formation in the 3 Mystery Charts posted earlier in the week broke its neckline on Friday. Other developments in similar markets have also broken key trendlines. We reveal the idendity of the Mystery Charts in our latest video for Premium subscribers, highlighting the implications for global equity indices and FX markets. The 23-minute video covers 12 overlay charts, including coverage of our existing trades in indices, USD and JPY crosses.

Retail Letdown, USD Swings

A soft August US retail sales report crushed what was left of hopes for a rate hike next week. The big question now is whether or not the Fed will act before year-end. The Australian dollar was the top performer while the euro lagged. New Zealand consumer confidence is up next.

The key control group of the US retail sales report posted - 0.1% in August compared to the +0.4% expected. That was compounded by a one-tick downward revision to the July data. The weakness was broad-based and it initially sent the US dollar the lows of the day. But once again the dollar bounced back. This time it took less than 20 minutes to recover the losses as the market was magnetized to the dollar. However as the day wore on, slow dollar selling resumed.

Part of the reason for the dollar confusion was because a mountain of US economic data was also released Thursday. The Philly Fed was strong at +12.8 vs +1.0 expected while the Empire Fed was a touch soft at -1.99 vs -1.00 expected.

Generally, the tone was on the soft side and that won out later as business inventories, industrial production and PPI were slightly below expectations.

Despite all the news, the magnitude of market moves were small. The Australian dollar continued its reversal following the jobs data and climbed to 0.7515 from 0.7475. USD/CAD was on the defensive after failing to break the July high and reversing on a bounce in crude oil prices. The 1.3253 level will be a key one to watch in the day ahead.

With the Fed focus ebbing, that gives the BOJ room for the spotlight. At the moment, headlines consistently hint that policymakers aren't on the same page. The WSJ was the latest and there is a growing changes that Kuroda may disappoint and send USD/JPY below 100.00.

We will watch for continued leaks in an otherwise quiet Asia-Pacific session. China is on holiday and the lone indicator on the calendar is the 0100 GMT release of September ANZ consumer confidence.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| -0.1% | 0.3% | -0.4% | Sep 15 12:30 |

| Business Inventories (m/m) | |||

| 0.0% | 0.1% | 0.2% | Sep 15 14:00 |

Ashraf on BNN Earlier Today

Ashraf on BNN discusses the BoE vs Brexit warnings, rising yields and the BoJ's JGBs rumblings. Full interview.

USD Consolidates, Big Day Ahead

The US dollar gave back a portion of its recent gains on Wednesday while oil sank despite a bullish inventory report. The kiwi was the top performer while CAD and USD trailed. New Zealand GDP and Australian employment are up next. The Premium long in EURGBP was closed with 120-pip gain ahead of Thursday's UK retail sales and BoE decision before reconsidering entry. Then a big US data day on Thursday.

Economic data was light on Wednesday with US import prices at -0.2% vs -0.1% expected as the lone date point.

Oil inventories grabbed headlines and sent crude oil pop-and-drop. Stockpiles contracted by 559K barrels compared to 4000K expected. That's the second week in a row of drawdowns after last week's +14m surprise.

Like last week, which was skewed by Tropical Storm Hermine, oil initially rallied 80-cents but later reversed and finished near the lows at $43.65. USD/CAD was taken along for the ride as well as it did a lap between 1.3140 and 1.3200.

What prevented USD/CAD from rising higher was a broad-based US mini-slump. The euro climbed to 1.1270 from 1.1220 and cable recovered from a two-week low of 1.3135 to 1.3230 – a session high.

Overall, it was more a day of consolidation than any kind of trend. That will change in the day ahead starting with some key releases in Asia-Pacific trading, building to the BOE and then US retail sales.

Up first is Q2 New Zealand GDP at 2245 GMT. The consensus is for a 1.1% q/q rise and 3.6% y/y. New Zealand is one of the few bright spots in the global economy and those solid growth rates will underscore an RBNZ on the sidelines and the long-term potential for kiwi gains. In the short-term, however, risk related to poor market sentiment remain and many market participants believe the RBNZ will cut in November.

Next is Australian August employment at 0130 GMT. The Aussie was quiet in Wednesday trading in a 0.7450 to 0.7500 range. That range is highly likely to break on the jobs report. The consensus is for 15.0K new jobs and an unchanged unemployment rate at 5.7%. Look for a bounce back in full time jobs after a 45.4K decline last month.

The market is pricing in around a 35% chance of an RBA cut by year-end and this report will be one of the things that sets the stage for the tenure of new Governor Philip Lowe.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP (q/q) | |||

| 1.1% | 0.7% | Sep 14 22:45 | |

| Core Retail Sales (m/m) | |||

| 0.3% | -0.3% | Sep 15 12:30 | |

| Retail Sales (m/m) | |||

| -0.4% | 1.4% | Sep 15 8:30 | |

| Import Prices (m/m) | |||

| -0.2% | -0.1% | 0.1% | Sep 14 12:30 |

| Employment Change | |||

| 15.2K | 26.2K | Sep 15 1:30 | |

A New Mystery Chart

Can you guess the mystery charts below? The daily chart highlights a potential Head & Shoulder formation, the weekly suggests a failed inverted H&S with neckline resistance turning into a potential double top and finally the monthly is underlined by negative stochastics. Does this unidentified market appear bearish enough for you? Does it deserve shorting? It's not a currency pair, commodity, equity index or a ratio of any sort. I shall reveal the identity of this market to our Premium subscribers the upcoming update, and weigh its implications for our next trades.

Eroding Confidence

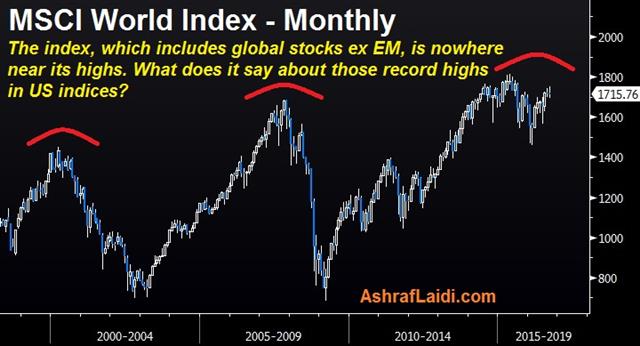

Markets shouted warning signs about central banks and the global economy Tuesday; we take a closer look. The US dollar led the way while the kiwi lagged. Japanese industrial production revisions and Australian consumer confidence highlight a light Asia-Pac calendar. The Premium English video has been posted earlier this morning, focusing on the growing divergences in US equity indices and the widening gulf between US and German indices. The FX and metals trades are also discussed in the video.

عودة مخاوف الأسهم تغير ميدان العملات (فيديو للمشتركين فقط)

The move in markets Tuesday was more worrisome than on Friday. What drove fears Friday was the worry that the Fed was about to hike rates.

But Brainard yesterday put those concerns largely to rest.

So the renewed selling in stocks, bonds and everything-but-the-dollar is especially concerning. At best, there are worries about the Bank of Japan allowing long-term bond yields to rise could cause short-term dislocations. Or perhaps the worries are about some other rumored BOJ policy change next week that could be seen as a mistake.

At worst, markets may be losing confidence inentral banks and the global economy. Oil fell Tuesday on an IEA report talking about the continued oil glut but what escaped the larger economic discussion was that a big piece of the reason for continues oversupply is signs of soft demand in India and China.

Christine Lagarde also highlighted Tuesday that 2016 will be the fifth consecutive year of sub-3.7% global growth. A sense is spreading that this may be as good as it gets. Aside from Brexit, there have been minimal exogenous shocks to the global economy and yet strong growth remains a rainbow in the horizon almost everywhere.

Then again, it's foolish to draw conclusions based on one day of trading. Cheap money has kept the party going on this long and Brainard's speech proved once again that central bank leaders have no appetite for pain.

Or maybe they do and that's what the BOJ decision next Wednesday will show. Some of the rumored policy changes are hardly simulative. If that's the case then expect more of the same market moves on the realization that central banks have hit a wall.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (m/m) | |||

| 0.0% | 0.0% | Sep 14 4:30 | |

| Industrial Production (y/y) | |||

| 6.3% | 6.2% | 6.0% | Sep 13 2:00 |

| RBA Assist Gov Debelle Speaks | |||

| Sep 14 9:50 | |||

Brainard Dressed for the Season

'Tis the season of high volatility and today's speech from Fed Gov Brainard will surely kick off those alternate +2% -2% daily changes in US indices, typical of Sep-Oct season. The core of Fed doves stuck back against the idea of a September hike with an aggressively dovish speech from Brainard Monday. The dollar slipped as the rate rise odds fell. Chinese data is due up next. Some clients to Ashraf's Premium Insights have queried why Ashraf takes profit in trades before their stated target. Today's 239-pt rebound in the Dow is one explanation as why the short entry in the Dow at 18580 was closed at 18180 on Friday, despite having stated a target at 17700.

Brainard left no doubt about where she stands after her speech. She laid out a one-sided case for leaving rates unchanged and waiting months to re-evaluate. The comments carried extra weight because the speech was announced last-minute and they were the final words before the Fed's blackout period.

The dollar dropped a half-cent across the board initially. On some fronts the losses were recovered but commodity currencies and cable maintained the gains. The stock market applauded another commitment to cheap money and the S&P 500 jumped 1.5%.

The implied probability of a Fed hike in September fell to 22% from 26%. The only piece of major economic data left before the FOMC is retail sales on Wednesday but even in the event of a strong report, it's difficult to envision the odds rising above 30% and hiking with anything lower risks shocking markets and undermining confidence in the Fed at a time when a Presidential candidate is attacking Janet Yellen.

Our focus is now on December and whether or not they will hike then. But that will have more to do with economic data then communication on Sept 21.

Looking ahead, the focus on the Fed has been justified in the past week but there's a risk of tunnel vision. The BOE is Thursday and the BOJ next Wednesday before the Fed. China has fallen to the back pages of the business section but it's always a danger.

We will be eyeing Beijing in the hours ahead with the release of August industrial production at 0200 GMT. The consensus is for a 6.2% y/y rise, which is a slight improvement on the 6.0% y/y pace in July. At the same time, the August retail sales report is forecast to show a 10.2% y/y rise.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (y/y) | |||

| 6.2% | 6.0% | Sep 13 2:00 | |

أهم الأحداث هذا الأسبوع

يعرف هذا الاسبوع با"لاسبوع البريطاني" لأن 2 بيانات مهمة ستصدر من المملكة المتحدة---التضخم، الوظائف و مبيعات التجزئة. شهادة قرار البنك الانجليزي ستصدر يوم الخميس، في نفس اليوم الذي سيصدر فيه 5 بيانات مهمة من الولايات المتحدة. و لا تنسوا بيان الوظائف الأسترالية. لمعرفة متى و أي ساعة إصدار تلك البيانات، الرجاء مشاهدة فيديو الأسبوع.

Market Buckles Under Fed Pressure

The 'sell everything' rout in Friday's trading sets the stage for a dramatic start to the week with all eyes on the Fed's Brainard. The CFTC weekly positioning report showed a rise in kiwi longs. Japanese machine orders are next. On Friday, Ashraf's Premium Insights closed the short DOW30 trade at 18180 for 400 pt gain.

The S&P 500 fell 2.45% Friday, US 10-year yields rose 7.5 bps, oil fell 3.6% and the US dollar jumped on Friday.

The message is nervousness. The market anticipated that Fed hawks would signal patience on hikes but Rosengren – who is a voter -- warned about the potential for an overheating economy Friday on the heels of similar comments from Williams late in the week. That was tempered by Governor Tarullo, who said we wants to see evidence of inflation first but the market had already hit some kind of tipping point and there was no stopping the moves as virtually all markets finished at the extremes.

For money managers, it may be a matter of risk/reward. Fed funds futures are pricing in a 30% chance of a hike and if that's accurate, the pain of getting caught out may have overwhelmed the rewards of Yellen holding off for another month.

Onto Brainard

The market also tends to send messages and this was the final opportunity to put some pressure on the Fed. Speakers Monday include Lockhart and Kashkari but the main event will be at 1715 when Governor Brainard speaks. She's a dove and it's the last time for the core of the Fed to send a signal. If she's hawkish in any way, the kicking and screaming from markets will continue.Before that, Asia-Pacific trading includes Japanese July machine orders. The consensus is for a 2.9% m/m drop but that comes following an 8.3% gain.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -93K vs -82K prior JPY +54K vs +64K prior GBP -90K vs -92K prior CHF +1.4K vs +8K prior AUD +39K vs +43K prior CAD +21K vs +22K prior NZD +6.1K vs +1.8K prior

There's finally some movement into New Zealand dollar longs. The volatility in the market over the last year killed the appetite for the simple carry trade. The bad news is that the kiwi fell 1.7% in the past two days of trading. Otherwise, there isn't much to take away here.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Machinery Orders (m/m) | |||

| -2.8% | 8.3% | Sep 11 23:50 | |

| FOMC's Brainard Speaks | |||

| Sep 12 17:00 | |||