Intraday Market Thoughts Archives

Displaying results for week of Jan 12, 2014Commodity Currencies Look-Ahead

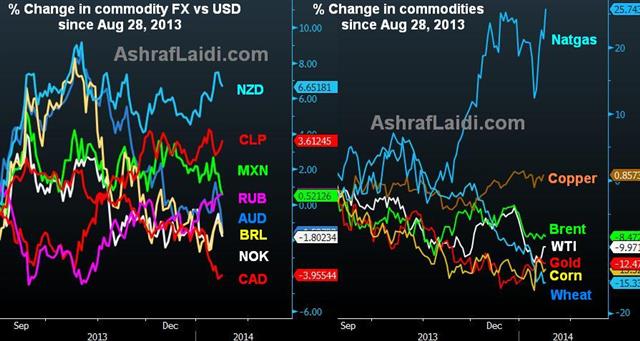

Charting commodities and their currencies - AUD, CAD, NZD, NOK, MXN. Full analysis & charts

A Sigh of Relief on Inflation

The market was searching for a trading theme on Thursday but inflation numbers didn't sound and alarms, at least for now. The Swiss franc was the top performer while the Australian dollar crumbled. Asia-Pacific data is light.

Two ideas held the market's attention at the start of the week. 1) The idea that the economy wasn't as strong as believed because of the disappointing jobs report and signs of weak December consumers. 2) Lingering fears about disinflation.

The solid retail sales report on Tuesday calmed fears about the consumer (although shares of Best Buy fell 29% today on slow Christmas sales). Today it the CPI report hit all the right notes with year-over-year inflation hitting 1.5% compared to 1.0% two months earlier. The report matched expectations across the board.

The market remains unsure where inflation is headed partly because policymakers don't have an idea. On Wednesday, the Fed's Evans called low inflation 'puzzling' and IMF Managing Director Lagarde said leaders need to be ready to fight deflation. Today it was Kocherlakota who called for dovish policies, including more forward guidance and potentially negative interest rates on excess reserves if disinflation worsens.

With the data, deflation worries will be placed on the backburner, allowing the market to focus on US growth.

Trading was light on the day and the general theme was mild USD weakness which was nothing more than a consolidation of the previous two days of USD strength. The larger theme this year is headline-driven trading. The market has been quick to jump on news so far this year and following the tape could be the theme of the year.

That was on clear display yesterday on the awful Australian jobs report. The initial move was swift and decisive but AUD/USD continued lower later and with the technical break to multi-year lows, the downside remains in focus.

NZDUSD Awaits Fed/RBNZ Clash

Will NZDUSD make a fresh push higher, or is the current pullback more than corrective? This month's principal event-risk is out of the way for now (ECB meeting & Fed minutes), making way for earnings release into the next 10 days to take the slack from the data vacuum. But January 29 promises to be a high-volatility day when both the Fed and RBNZ are due to announce policy decisions one hour apart from each other. Last month, RBNZ president Wheeler said "the key rate will probably need to rise 225 basis points (2 ¼%) over the next 2 ¼ years”. The Fed is anticipated to go for another taper. What does it mean for NZD--currently the highest performing currency year-to-date? NZD's neckline support looms near 0.8100, while USD eyes its 55-WMA after bouncing off its 100-WMA.

A Dose of Retail Therapy

Tuesday's rebound washed away Monday's market sorrow but a look at the two-day move is revealing. On the day, the pound led the way while the yen tumbled. The market will have a chance to digest the moves with a virtually empty Asia-Pacific calendar.

Tuesday's trading was nearly a mirror image of the day before. Worries about a slumping US economy were the catalyst to start the week and a soft retail sales report might have cemented the concern. Instead, sales were slightly better than expectations although they were tempered by negative revisions. The slowing trend in sales is a minor concern but a decent report was all that was needed to sooth the fears and send the bears back into hibernation.

Initially, USD/JPY was reluctant to build on overnight gains but a strong open from stocks that led to a 1% gain sent the all-clear signal and the pair marched to 104.27 from Monday's low of 102.86. GBP/JPY erased the 300 pip decline the day before. All the while, EUR/USD was on the sidelines, virtually unmoved.

What's particularly interesting is that despite all the volatility, the main pairs are all virtually unchanged from Friday's close. EUR, CHF, JPY and USD have moved less than 10 pips while GBP is mildly lower. The moves at the margins were in the commodity currencies as AUD and CAD lagged while NZD soared ahead of the field.

One takeaway is underlying demand for the kiwi. In risk off and risk on environments, it climbed higher with ease. Meanwhile, the modest AUD hopes after Monday's rise above 0.9000 were dashed and the Canadian dollar languishes. With USD/CAD now within striking distance of 1.10, we struggle to see the case for a turnaround.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| 0.7% | 0.4% | 0.1% | Jan 14 13:30 |

| Retail Sales (m/m) | |||

| 0.2% | 0.1% | 0.4% | Jan 14 13:30 |

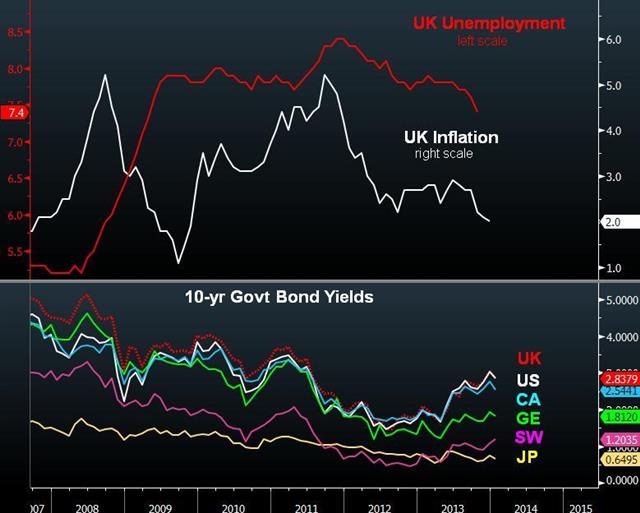

UK Inflation Hit BoE Target

UK December CPI hit the Bank of England's 2.0% target for the 1st time since Nov 2009 when it hit 1.9%. The last time the 2.0% was hit was in April 2006. With inflation at 2.0% (down 61% from 2011 highs) and unemployment at 7.4% (down 24% from 2011 highs), the BoE is the only G7 central bank attaining its inflation target along a clear downward trajectory in unemployment. More analysis

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (m/m) | |||

| 0.4% | 0.5% | 0.1% | Jan 14 9:30 |

| CPI (y/y) | |||

| 2.0% | 2.1% | 2.1% | Jan 14 9:30 |

| Core CPI (y/y) | |||

| 1.7% | 1.8% | 1.8% | Jan 14 9:30 |

What the Market is Whispering

- The drop in bond yields led the latest move, expect the bond market to stay ahead of the curve

- 3% US economic growth this year isn't the sure thing economists claim

- The market doesn't like the Fed's comfort level in the taper timeline, Bernanke/Yellen saying the pace of taper isn't certain would calm nerves

- The only sure thing in a 'risk off' market in 2014 is yen strength

- Dec vehicle sales were the first sign of unexpected US economic weakness

- Non-farm payrolls were the second

- Tuesday is retail sales and a third sign of softness would be tough to ignore

- It's still way too soon to panic, most moves so far this year have simply retraced the low-liquidity moves from Dec 20-31

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR +14K vs +31K prior JPY -129K vs -135K prior GBP +18K vs +23K prior AUD -57K vs -57K prior CAD -61K vs -58K prior CHF +5K vs +11K prior

The market has struggled to build any significant positions in euros because of the lack of consistent trend. The move toward neutral came after the break of the 55-dma but Friday's rebound likely confused traders further.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (DEC) (m/m) | |||

| 0.1% | 0.7% | Jan 14 13:30 | |

| Retail Sales (ex. Autos) (DEC) (m/m) | |||

| 0.4% | 0.4% | Jan 14 13:30 | |

| Electronic Card Retail Sales (m/m) | |||

| 0.6% | 0.6% | Jan 13 21:45 | |

| Electronic Card Retail Sales (y/y) | |||

| 5.5% | 6.7% | Jan 13 21:45 | |