Intraday Market Thoughts Archives

Displaying results for week of Aug 12, 2018Don't Forget CAD & NAFTA

Let's take a short break from the lira and the yuan for a moment and return to the Canadian dollar ahead of today's Canadian CPI. The best performing major currency since the start of July is the Canadian dollar, while the best performing emerging market currency is the Mexican peso. Their common denominator is NAFTA risk. Despote improved tone of negotiations, major uncertainty remains. What's the potential upside for the Canadian dollar if a deal is done? A 3rd Index short was opened for Premium subscribers yesterday and is already in the green.

The implied odds of a BOC rate hike September have been steadily climbing and are now at 24%, rising to 74% in October. With a NAFTA deal a hike by then is a certainty and the likelihood of two hikes before year-end would rise above 50% from 28% currently. The kind of shift into a Fed-like pace of hikes would imply a broad tightening of sovereign spreads and USD/CAD would likely fall to 1.25 from 1.31 currently.

There are upside risks as well. We assume the US would continue with protectionistic measures against Europe and Asia. That would leave Canada and Mexico in the envious position of being able to benefit from stronger US growth while sidelining some of the potential competitors for export orders.

A downside CAD risk that the US-China battle escalates to where it generates global risk aversion and that's something that bears close watching but at the moment it looks like there may be an extended window opening for NAFTA outperformance.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (m/m) | |||

| 0.1% | 0.1% | Aug 17 12:30 | |

ماذا يعني الأبتعاد بين مؤشر الدولار و دولار/ ين ؟

ما هي تداعيات الاختلاف بين ارتفاع مؤشر الدولار الأمريكي وانخفاض الدولار مقابل الين؟ (الفيديو الكامل)

تسجيل ندوة أمس مع إكس تي بي

من فاتته ندوتي من يوم أمس يمكن مشاهدة التسجيل في هذا الرابط بعد إدخال تفاصيلك. كيفية تداول القطاعات و مؤشرات الخوف، إدارة مخاطر المؤشرات و العملات و تفاصيل البونص الخاص. (التسجيل الكامل)

أشرف العايدي على قناة العربية

ازمة عملة او ديون؟ حديث مع لارا حبيب عن ازمة تركيا (المقابلة الكاملة)

Emerging Market Mayhem Morphs

The Turkish lira continued to rebound Wednesday as the 6.00 level gave way but the South African rand led a slide in other emerging market currencies as the US dollar climbed and commodity prices sank. Japanese trade balance and Australian employment are due up next. The Premium trade shorting DAX30 was closed for 300-pt gain at 12120. A trading note was issued, indicating the next course of action.

فيديو المشتركين - كيفية البيع الإستراتيجي

Poor earnings at Chinese giant Tencent set off a wave of worries about emerging markets even as Turkey's currency was lifted by a timely $15 billion direct investment from ally Qatar.

Argentina's central bank sold more than $1 billion set of a fresh round of jitters about emerging markets. Chinese markets fell 2% and other markets were battered. The trouble led to a flight to the yen and a bruising day for commodities that saw copper down 4%, crude oil down 3.2% and gold down another $20 to $1174. The S&P 500 fell 21 points.

Today's US data releases were robust. EM moves overshadowed some top-tier US economic data. US July retail sales rose 0.5% compared to 0.1% expected. The headline showed surprisingly robust vehicle and parts sales despite a poor month for automakers but that was balanced by some other quirks that placed the control group at expectations. The Empire Fed was strong at 25.6 compared to 20.0 expected in another positive sign of the US but industrial production was a tad soft at +0.1% versus the +0.3% consensus.

The news will continue at a fast pace in the day ahead starting with the 2350 GMT release of Japanese trade balance for July. Exports are forecast up 6.3% y/y and imports up 14.2%, leading to a rare deficit at 41B yen.

The highlight of the Asia-Pacific day comes at 0130 GMT when July Australian unemployment numbers are due. The consensus is for no change to the 5.4% unemployment rate as the economy adds 15.0K jobs.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance | |||

| 0.02T | 0.07T | Aug 15 23:50 | |

| Employment Change | |||

| 15.0K | 50.9K | Aug 16 1:30 | |

الأربع عوامل الضارة بالذهب

، تعتبر خسارة الذهب الهائلة لدوره كملاذ آمن في مواجهة عمليات التصفية التي تقودها تركيا في الأسواق الناشئة نتيجة لاربعة عوامل. فأين يأتي الهدف القادم؟ (التحليل الكامل)

US Dollar Muscles Higher

The US dollar put in an impressive performance Tuesday even as the Turkish lira rebounded. The Canadian dollar was the top performer while the euro lagged. UK CPI is due out later but first it's Australian wage data. Besides buying USD, shorting indices seems to be the path of least resistance. A new Premium trade was posted earlier today, backed by the chart below.

The US dollar muscled its way higher against most of the market on Tuesday in an impressive showing. Risk assets were strong and the Turkish lira rebounded 8% but that didn't halt the dollar's advance. Part of the thinking is that the lack of contagion, at least so far, clears another hurdle for the Fed to hike rates twice more this year.

Another line of thinking is that if there is contagion, it's going to hurt European banks and by extension hurt EUR/USD. The euro chart continues to break down and hit a 1.1340 in a drop the lowest since July 2017.

Economic data was limited to import/export prices. US import costs were down 0.1% m/m and exports down 0.5% m/m in a sign that tariffs are still only impacting a small part of the economy.

The Canadian dollar was strong in part due to a comment from fin min Bill Morneau late on Monday that he was cautiously optimistic about a future deal on NAFTA.

Looking ahead, Australian Q2 wage data is due at 0130 GMT. Rate hikes aren't on the RBA's radar at the moment but the jobs market is tight. The consensus is for a 2.1% y/y rise in wages. We think that globally wage numbers bear close watching because there should be some correlation (or not) and that will help to solve many of the Phillips Curve arguments.

A data point that will spark a bigger market moves comes at 0830 GMT when the UK releases July CPI numbers. The consensus is for a 2.5% y/y rise. Note however that lower unemployment in the UK Tuesday was paired with soft wages and eventually Brexit concerns sent cable to a 14-month low of 1.2705. Watch out for more selling even if there's a CPI-inspired bounce.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (y/y) | |||

| 2.5% | 2.4% | Aug 15 8:30 | |

Ashraf on BNN

Ashraf discusses the 4 factors behind Gold's eroding safe haven status on BNN-Bloomberg. Full interview.

No Safety in Gold

Gold attempts regaining the $1200 level after yesterday's break below the key level for the first time since March 2017. European indices are in the red while their US counterparts push higher. UK earnings came in within expectations while the unemployment rate dropped back to 4.0% from 4.2%. Cryptocurrencies resumed their damage as Bitcoin fell 3%, while Ethereum, Litecoin and Ripple fell 5-10%. The Premium short in FTSE100 was closed for 140-pt gain to compensate for the stopped out trade in gold. A new Premium note was issued on indices with the adjusted view for USD and gold in the members' video below.

Instead, it's the US dollar, yen and Swiss franc attracting inflows. Part of that is the better yield of the dollar since the Fed began hiking rates but it also reflects the diminished faith in gold and low inflation prospects. There is some support for gold at the Feb 2017 low of $1180 and it's somewhat oversold after weeks of selling but overall, Monday's drop darkens the picture in the medium term. As long as money continues to flow from EM with significant USD-denominated debt, the USD-play at the expense of gild shall resume, while there is no bump up in inflation expectations.

Emerging markets have stabilized in as the Turkish pushed back up to 6.40 per $1 USD from as low as 6.98 $1 USD. It remains unclear who is holding the potential losses and if Turkey can dig in for a rebound. EM trouble has briefly shifted the focus away from the trade war. That theme is sure to flare up again shortly as NAFTA negotiations chug along.

Macro data resumes on Wednesday with UK CPI and US retail sales, US indus production (Thurs) and UK retail sales (Fri).

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Retail Sales (m/m) | |||

| 0.4% | 0.4% | Aug 15 12:30 | |

Will Turkish Lira Fall Spread Further?

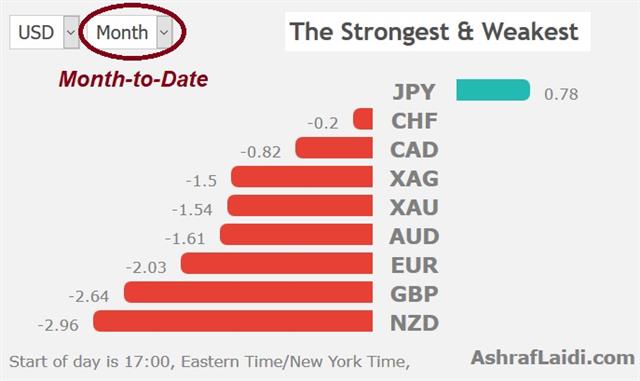

An emerging market economic crisis is nothing new but Turkey is the world's 17th largest economy and the dramatic drop in the currency raises bigger questions. The lira fell another 11% in early trading Monday to 7.15. CFTC positioning data showed more money going into US dollar longs. USDJPY held support at the confluence of the 55-DAY and WEEK moving average, while EURUSD held above its 200-week moving average. The yen remains the strongest of the week and the month ahead of the US dollar, while the franc holds firm. Macro data return this week with UK jobs (Tues), CPI (Wed), US retail sales (Wed), US indus production (Thurs) and UK retail sales (Fri).

Crisis and collapse are words that are too-often used in financial markets and economics but the current situation in Turkey is worth of both. The Turkish lira is down 50% this year and fell by as much as 16% on Friday before an 11% drop early Monday.

The country's large current account deficit (over 5% of GDP) and the inability of the central bank to control 16% inflation has exacerbated capital flight. It's a situation that has many historical parallels and often leads to a run on banks and terrible economic outcomes.

Erdogan on the weekend continued to plea with people not to take money out of the country but that kind of begging only underscores the lack of options. He also hinted at Plan B and Plan C, which sounded like a mixture between capital controls and tighter monetary policy. The problem with a hint like that is that it ensures a stampede to the exits before the banks lock down.

An implosion of the Turkish economy alone may not pose a risk to the global economy but could intensify pressure on emerging market indices. With GDP of about $850B, it sits between the Netherlands and Indonesia in the pecking order. That compares to $360B for Greece at its peak.

Like Greece, the issues isn't the local economy, it's contagion. Emerging markets with some similar strains to Turkey are also under major pressure. Currencies in Argentina, Russia, South Africa and Brazil fell 3-6% last week and most other freely-traded emerging market currencies fell more than 1%.

This is all leading to bids in the traditional safe haven currencies – the US dollar, yen and swiss franc. The most-obvious vector for contagion is via the financial system and European banks may be vulnerable and, by extension, the euro. The yen is higher across the board in early trading.

IMF or Currency Controls?

In our experience, these are some of the most unpredictable events. Yet, considering the looming threat of capital controls, it's not likely to be resolved before it gets worse but watch out for headlines about an IMF rescue. The latter would imply a bailout of as much as $40 bn but would necessitate higher taxes and lower spending, which Erdogan is sure to reject. The 10 Lira mark is considered a possible destination in the event of a continuation of the policy status quo in Ankara.

CFTC Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR +11K vs +23K prior GBP -59K vs -47K prior JPY -63K vs -68K prior CHF -46K vs -44K prior CAD -25K vs -32K prior AUD -54K vs -51K prior NZD -25K vs -24K prior

Dollar bets generally increased but they were pared against the Canadian dollar and yen. What was left of euro longs was probably busted out late last week in the fall below 1.15 and yen shorts are now vulnerable.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Flash GDP (q/q) | |||

| 0.3% | 0.3% | Aug 14 9:00 | |

ندوة خاصة مساء الاربعاء

إثر الأسئلة العديدة التي وصلتني بخصوص منصة إكس تي بي وعن معرفة تداول مؤشرات "الخوف" مثل الفيكس بالاضافة (أو بدل من مؤشرات البورصة) فيمكن إنضمام إلى ندوة يوم الأربعاء مع إكس تي بي - احجز مكانك للندوة

لماذا والى اين للليرة التركية؟

مقابلة اشرف العايدي عن تداعيات العملة التركية في سكاي نيوز العربية (المقابلة الكاملة)