Intraday Market Thoughts Archives

Displaying results for week of Dec 13, 2015How the BOJ Could Surprise

With all the drama surrounding the Fed and the ECB this month, the BOJ was the forgotten central bank. There has been no build-up for today's BOJ decision but that might not be the case for long. The story in Thursday trading was the continued march higher of the US dollar. The Premium short in has been closed, locking int over 200 pips.

The BoJ decision has no scheduled time but it's likely to be released between 0230 GMT and 0330 GMT with Kuroda's press conference due at 0630 GMT. The rule of thumb is that the later the BOJ announcement, the more likely it is to be more easing.

Analysts have backed away from calls for more QE this year. In October almost half of economists had forecast some kind of easing but it never came and the BOJ has been upbeat about Japan's prospects – especially after the revision higher to Q3 GDP. For today's decision, only one of 42 economists surveyed by Bloomberg forecasts a rise in QE.

The likelihood is extremely low but Kuroda likes to ease by surprise so today would certainly fit the bill. There have been two data points this week that suggest the possibility of a cut: The first was a surprising drop in trade; Imports and exports both badly missed the market in November trade balance report. It's a signal that yen weakness isn't giving manufacturing the boost that Abe had hoped; The second was the Q4 Tankan. The BOJ has been focused on inflation expectations and they deteriorated in the latest survey.

Arguing against easing has been a quiet, but growing skepticism at the BoJ about the effectiveness of QE. Many rounds of asset purchases haven't had the hoped-for outcome and the government has shifted to pressuring companies to hike wages.

The big surprise in 2016 might be that the BOJ turns away from more easing despite a stronger yen, low inflation and a middling economy.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Lacker speech | |||

| Dec 18 18:00 | |||

Fed Hikes, Dollar Likes

The Fed didn't take quite the gradual, wait-and-see approach that many market watchers envisioned. Only the Australian dollar outperformed the US dollar on the day while the yen was the laggard. Data released in Japan shows the perils of competitive FX devaluation. In Ashraf's Premium Insights, a new EURUSD trade was issued, while the GBPNZD trade was closed with a 385-pip gain. Six trades are now in progress.

After the Hike

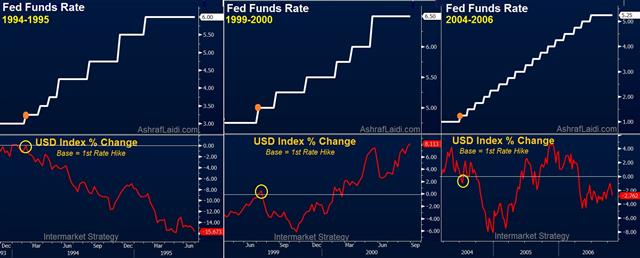

Fed Chair Yellen reverted to a data dependent approach for further hikes but there were signs that officials might be more eager than markets had anticipated. Heading into the meeting, the rates market expected about 2 hikes in 2016. Yellen certainly sounded like she could hike again towards the end of Q1. If growth in the first few months of the year skews higher, possibly due to good weather, the Fed might be lured into prematurely hiking in March and June.The Fed also had the opportunity to tone down hawkish expectations by lowering the dot plot, but the median estimate for 1.375% rates at this time next year – four more hikes-- was held intact. That's what helped to boost the US dollar after the decision and into Asia-Pacific trading.

We warn that dollar longs remain a crowded trade and with year-end looming, a round of profit taking is a high risk.

The other major risk in the day ahead is the implementation of the hike . There are five things to watch. 1) 6:45 am ET on Thursday - The Libor fix 2) 8 am ET - Repo rates will begin to update 3) 9:30 am ET - Rates on commercial paper trade 4) 1:15 pm ET - The NY Fed announces the results of its first overnight reverse repo 5) 8 am ET on Friday - The first post-hike Fed funds effective rate is announced

Dark corners of the internet have long predicted the Fed would struggle on implementation. The Fed should probably be given a few days to smooth out the kinks but markets may have a kneejerk reaction on any signs of stress. We expect the Fed to win out so any overreactions should be faded.

An outlier theme in 2016 might be the inability of countries with weaker currencies to boost exports. Japan reported a smaller trade deficit today but it came on a 10.3% drop in imports. Exports fell 3.3% y/y compared to 1.6% expected. A softer yen might prove not to be the tonic Abe hoped and that may dissuade the BOJ from easing more.

UK Jobs: No pay, no play

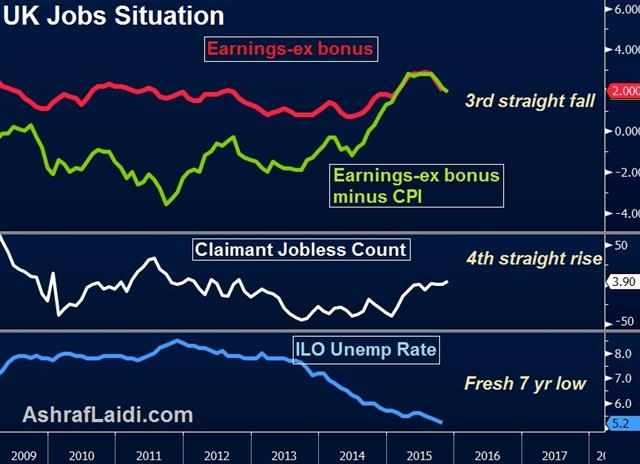

Today's release of the UK jobs figures confirms the suspicions of the doves at the Bank of England, with earnings (pay) growth continuing to decline, joblessness pushing higher for the fourth straight month even as the unemployment rate hit a fresh 7-year low of 5.2%.

Earnings Growth at 7-month Lows

While the front page headlines will be dominated by the unambiguous increase in UK employment – and nearly decade low jobless rate-- GBP traders are concerned with slowing earnings' growth. The average rate of earnings growth (excluding volatile bonus payments) for the three months ending in October slowed to a seven-month low of 2.0% y/y, posting its third consecutive decline. The earnings figure including bonuses also hit seven month lows at 2.4%. The figures are well below the 3.0% that BoE governor Carney said would like to see before considering raising rates.Sterling's decline caught the market's attention in October when a combination of negative inflation figures and stalling business activity eliminated all expectations that the BoE would hike this year. Plummeting oil prices and the delayed impact of the strong pound have made “deflation” a regular term among the mainstream media.

BoE chief economist Andy Haldane stated earlier this month that downside inflation risk was getting worse, four weeks after the BoE made sharp downward revisions to growth and inflation. Haldane added there was evidence that earnings growth was starting to slow, hitting into the very foundation on, which sterling had been rallying for most of Q2.

In addition to a dovish central bank, the UK Treasury has been forced to make prolonged budget cuts across a number of cabinet departments (ministries) as defence obligations back the UK decision to join the allied strikes in Syria.

Such are the dynamics confirming our GBP bias in the Premium Insights, which many clients had questioned back in October, until the tide started to turn against the pound. GBPUSD traders will experience rising volatility arising from today's Fed decision (as well as the usual 1-2 day post-announcement fallout), but clarity continues to remain in GBP crosses.

USD Firm Into The Fed

Across-the-board US dollar buying on Tuesday came in anticipation of a Fed hike but if/when the Fed moves, will the money last? The dollar trailed only the kiwi as the top performer on the day while sterling lagged. The Japanese manufacturing PMI from Nikkei is due later. There are 3 GBP shorts out of the 6 existing Premium trades ahead of tomorrow's other big event --the UK jobs and earnings figures.

US CPI data on Tuesday had mixed messages for the Fed. Headline CPI rose 0.5% y/y, slightly above the 0.4% expected. Core CPI also matched expectations at 2.0% y/y, up from 1.9% in October. On the flip side, wage growth remains in a rut with real weekly earnings down 0.2% in the month compared to flat forecast.

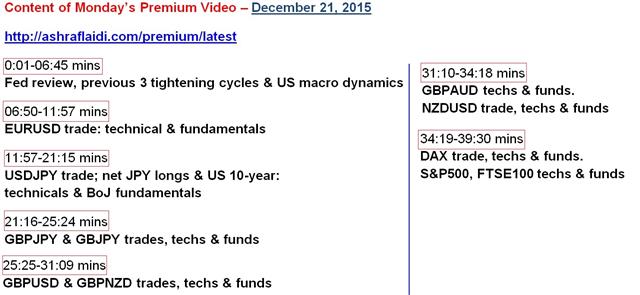

We suspect pre-Fed positioning was more of a factor in the dollar's rise on the day than the data. A steady bid boosted USD by roughly the same 0.65% against the euro, yen, pound and Australian dollar. That kind of broad-based bid highlights potential pre-Fed positioning. The following is the Table of Contnet for this week's Premium Video Analysis.

It may simply be a case of speculative flows looking to capitalize on a jump in the dollar on an expected Fed hike. If so, expect profit taking afterwards unless the Fed is especially hawkish. Aside from the Fed outcome, statement, dots and press conference, we will be eager to follow the technical aspects of the hike.

The FOMC may remove its $300 billion daily cap on overnight reverse repos as it attempts to boost the interest rate on $2.6 trillion of excess reserves at the Fed. Libor, the repo market, bonds and the effective Fed funds rate will all be closely watched and if the rate hike isn't smooth, it may bring turmoil.

In the hours ahead, the Asia-Pacific calendar is light. The lone release of note is the Nikkei Japan manufacturing PMI at 0135 GMT. The prior reading was 52.6.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (DEC) [P] | |||

| 52.7 | 54.0 | Dec 16 14:45 | |

| Eurozone Markit PMI Composite (DEC) [P] | |||

| 54.2 | 54.2 | Dec 16 9:00 | |

| Eurozone Markit PMI Manufacturing (DEC) [P] | |||

| 52.8 | 52.8 | Dec 16 9:00 | |

| Eurozone Markit Services PMI (DEC) [P] | |||

| 54.1 | 54.2 | Dec 16 9:00 | |

| Eurozone CPI (NOV) (m/m) | |||

| -0.1% | 0.1% | Dec 16 10:00 | |

| Eurozone CPI - Core (NOV) (m/m) | |||

| -0.2% | 0.2% | Dec 16 10:00 | |

| Eurozone CPI (NOV) (y/y) | |||

| 0.1% | 0.1% | Dec 16 10:00 | |

| Eurozone CPI - Core (NOV) (y/y) | |||

| 0.9% | Dec 16 10:00 | ||

| Average Earnings excluding Bonus (OCT) (3m/y) | |||

| 2.3% | 2.5% | Dec 16 9:30 | |

| Average Earnings including Bonus (OCT) (3m/y) | |||

| 2.5% | 3.0% | Dec 16 9:30 | |

| Fed's Monetary Policy Statement and press conference | |||

| Dec 16 19:30 | |||

Volatility in High Gear Ahead of the Fed

A heavy round of yen buying an stock selling led to extremely whippy trading on Monday. The moves eventually reversed but it's the kind of volatility that will continue to leave traders on unsteady footing.

Yen crosses followed a similar path. USD/JPY skidded lower from 120.80 to 120.34 in a quick move only to later recover to 120.95.

The euro is showing signs of a minor triple top near 1.1050. The CFTC report highlighted impressive resolve from shorts and they defended that level to push EUR/USD to a flat finish on the day at 1.1000.

Cable was the laggard in a dip to 1.5108 but a strong bid has swept the pound up to 1.5171 in early Asia-Pacific trading. It's tough to link the moves to fundamental news at the moment and that's no surprise given the flows related to year-end and the Fed.

Expect more of the same in the day ahead

In the short term, the Australian dollar will be in focus. It staged a comeback after several days of selling on Monday, finishing at 0.7250 from nearly a cent lower on Friday. The first event to watch will be at 2330 GMT when the RBA releases the minutes of the latest meeting. There wasn't much to glean from the decision but Stevens was optimistic and that may be the tone of the minutes.

The larger event may be at 0200 GMT when the government offers its mid-year economic update and forecasts. The 2015-16 GDP forecast is currently 2.75% and will be cut to at least 2.5% with the following year expected to be lowered to about 3% from 3.25%. The deficit forecast is expected at $38B this year from $35B.| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Meeting's Minutes | |||

| Dec 15 0:30 | |||

أشرف العايدي على قناة العربية

Tankan Firms, CNY Awaits Fixing

A rout on risk assets Friday was triggered by worries about junk bonds with the Fed preparing to hike. Weekend news from another junk fund and China will compete early in the week. Yen traders received a decent tankan survey but await the fixing prices from China in 1 hr from now. There are 7 Premium trades, currently in progress. A new Dax short was opened on Friday, while FTSE short was closed with a 375-point gain. AUDNZD short was stopped out.

The S&P 500 fell 40 points on Friday and the yen surged after a small $789m fund announced it would prevent client withdrawals as it winds down the fund. The inability of investors to access an open-ended fund is a troubling development, especially in an asset class as widely feared as high yield.On the weekend, Stone Lion Capital made a similar announcement. The latest announcement might not carry the same weight because the $1.3B fund invested in distressed debt, which is inherently higher risk.

News that could stabilize sentiment came from China where industrial production rose 6.2% in November year-over-year compared to 5.7% expected. Retail sales were also fractionally stronger than forecast.

As good as the headlines were, the underlying story isn't quite as promising. China's stats agency said base year effects boosted the readings and reported that car sales and manufacturing were especially strong due to a recently-introduced government tax cut.

Earlier this month, the Shanghai Securities News reported the RRR would be cut 50 basis points in December. We remain on guard for a move at any time.

It didn't come on the weekend and AUD/USD started the week flat. Early trades show EUR, GBP and CHF lower with CAD leading the way after hitting fresh 11-year lows on Friday.

Japan's Q4 BoJ Tankan survey showed large manufacturing index was unchanged at 12 from Q3, versus estimates of 11, while the large non-manufacturing index also remaiend unchanged at 25 vs expectations of 23. All firms' capex for 2015 fiscal year, edged up to +7.8% vs expected +6.4%.

Other parts of the report to focus are is the commentary on capex and inflation. The BOJ decision on Friday is the final one of the year. Expectations for easing in the near term have evaporated one slightly better wage and preliminary inflation data.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -172K vs -182K prior JPY -68K vs -75K prior GBP -24K vs -28K prior AUD -34K vs -47K prior CAD -40K vs -39K prior NZD +9K vs +5K prior

The squeeze on euro shorts was nowhere near what most expected. Either that or fresh euro shorts replaced the weak hands after the ECB. It was a similar story when EUR/USD rallied in August. The market is firm and resolute against the euro; it will take more than a few hundred pips to convince speculators that the euro isn't headed lower.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone Industrial Production s.a. (OCT) (m/m) | |||

| 0.2% | -0.3% | Dec 14 10:00 | |

| Eurozone Industrial Production w.d.a. (OCT) (y/y) | |||

| 1.3% | 1.7% | Dec 14 10:00 | |