Intraday Market Thoughts Archives

Displaying results for week of Mar 13, 2016USDX vs Fed's USD Index

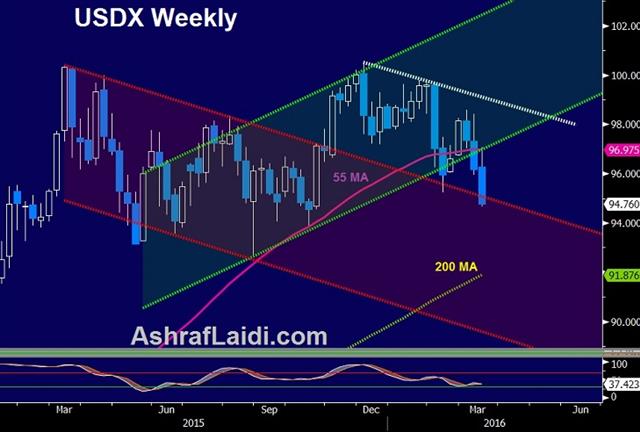

This week's Fed decision to tone down its FedFunds projections closer to those of the bond market sent the US dollar falling by its biggest 2-day decline since 2009. The US central bank finally realizes it is unable to isolate itself in an island of higher interest rate expectations and an appreciating currency as the other major central banks race towards negative interest rates. The Fed is set to leave that Island. Full article.

What Happened at the G20?

The Fed squandered much of its hawkish rhetoric Wednesday and market participants continue to ask 'why?' (as they sell the US dollar). If you look at the recent turns in markets many of them can be traced back to late February. It's no coincidence that's when G20 leaders met in China. GBPUSD was stopped out and EURUSD was closed at a profit, leaving us with 4 Premium trades in progress.

We take a closer look at the events since the G20 ahead of a relatively quiet end-of-week session in Asia-Pacific trading.

The day after the G20 meetings China lowered the RRR by 50 basis points in a surprise move. The government followed that up by loosening property lending and creating a TARP-like program to buy bad loans. Shortly afterwards the ECB unveiled a larger stimulus package than almost anyone expected. The RBNZ surprised with a rate cut and now the Fed has abandoned any pretense of hawkishness. Next week the Canadian government will announce a major stimulative budget

The idea that G20 leaders sat down and decided to do more isn't a conspiracy. Ideas like that are what meetings like the G20 are for.

Alone, each central bank decision can be justified but a pattern is forming and it's one we will continue to monitor.

In the shorter-term, the market continues to reel from the Fed decision. The US dollar slumped across the board and only stabilized after USD/JPY fell to a 15-month low of 110.75 and then abruptly jumped to 112.00. There was talk of intervention but a newswire source said Japanese officials had only called around to try and figure out what happened.

US economic data modestly positive. Jobless claims and JOLTS posted a slight beat while the Philly Fed was strong at +12.4 vs -1.7 expected.

Looking ahead, data on Chinese property prices are due at 0130 GMT. It's followed at 0530 GMT by Japanese department store sales. A speech from the RBA's Luci Ellis stuck to regulatory policy and did not touch on monetary policy or the Aussie.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's William Dudley speech | |||

| Mar 18 13:00 | |||

| Federal Reserve Bank of Boston President Rosengren Speech | |||

| Mar 18 15:00 | |||

| Fed's Bullard speech | |||

| Mar 18 18:00 | |||

Dollar Undone as Fed Fears Market

The Federal Reserve pointed to international concerns as it lowered inflation forecasts and avoided hawkish rhetoric. The US dollar was beaten up on after the decision and the commodity currencies were the best performers. Japanese trade and Australian employment are due later. 2 new trades were issued ahead of the Fed decision, bringing the number of existing trades to 6. Our long NZDUSD trade was stopped out by 4 pips (low at 0.6576 & stop at 0.6580).

Most market watchers were anticipating a hint at rate hikes but instead the Fed sounded extra-cautious. The crowded USD-long trade was battered with the dollar falling 1-2 cents across the board.

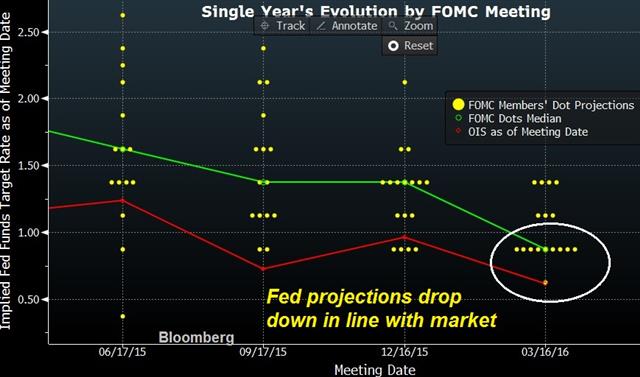

Yellen pointed to a deteriorating growth outlook abroad and said it was largely balanced by easier financial conditions because markets were pricing in fewer hikes. The Fed gave a full endorsement to that view by lowering the dot plot to indicate just two hikes this year, down from four.

Historically, it has been the Fed that's attempted to guide and bend markets but now it's the opposite. The Fed blinked in January because of market turmoil and let the market dictate where rates are headed today. The old mantra from the Fed was data dependency but that is difficult to reconcile with a more-dovish Fed despite great jobs growth in February.

To underscore the point, the Feb CPI report was released a few hours before the FOMC decision. It showed core inflation at 2.3% y/y compared to 2.2% expected. Yellen brushed off higher inflation, saying it was transitory.

The most dovish part of the press conference was a question on the balance of risks. Yellen indicated that there were two camps, those who thought they were neutral and those who thought they were negative. Aside from the dissent of George, it appears as though no convincing case was made for higher inflation. That bore out in the forecasts with PCE downgraded to 1.2% this year from 1.6% and no forecasts rising above 2.0% out to 2018.

Overall, this is the kind of statement that leads to a major rethink of the path of interest rates. The Fed spent much of last year cultivating hawkish bias but has abruptly abandoned it. The good news for the dollar is that other major central banks are more dovish.

So who are the winners? Gold was one on Wednesday, along with commodities and commodity FX.

Kuroda was surely hoping the Fed would spare the BOJ the difficulty of boosting USD/JPY but it was the opposite as it flopped to 112.75 from a cent higher. We get the first look at Japanese trade for Feb at 2350 GMT. Exports are expected down 3.0% y/y with imports forecast down 15.8%.

The major event of the Asia session comes at 0030 GMT when Australia releases Feb employment. After a 7.9K contraction in Jan, the consensus calls for a 13.5K rise. Earlier this week, AUD/USD touched the highest since July and a strong – or even a solid – number could take out the 0.7594 recent high.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Exports (FEB) (y/y) | |||

| -12.9% | Mar 16 23:50 | ||

| Imports (FEB) (y/y) | |||

| -18% | Mar 16 23:50 | ||

| Employment Change s.a. (FEB) | |||

| -7.9K | Mar 17 0:30 | ||

| Fulltime employment (FEB) | |||

| -40.6K | Mar 17 0:30 | ||

| Part-time employment (FEB) | |||

| 32.7K | Mar 17 0:30 | ||

| Unemployment Rate s.a. (FEB) | |||

| 6% | Mar 17 0:30 | ||

FOMC Trumps Politics, For Now

Markets are increasingly wary of hawkish signals from the Fed despite a weak retail sales report Tuesday. The yen was the top performer while the kiwi and British pound lagged. A critical slate of US primary votes take place later, we look at what they could mean for financial markets. A new trade in GBPUSD was issued ahead of Wednesday's UK jobs report and UK Budget.

A main part of the narrative of the recovery in risk assets in the past month was unhinged by a soft retail sales report. Core sales, which exclude autos, gas and building materials, were flat in February compared to a 0.2% gain expected. Alone that's a small miss but it was compounded by a downgrade to the January reading to +0.2% from +0.6%.

The S&P 500 bottomed the day before the January retail sales report on the idea that US consumers were strong and spending. That was underscored by the excellent Feb jobs report. Now, we learn that the US consumer is middling and many questions remain about the health of the global economy.

The FOMC decision on Wednesday is pivotal. A hike is extremely unlikely but markets will attempt to gauge the potential for a June rate rise. Markets are priced nearly 50/50 for that date and could swing based on the Fed statement, projections and dot plot.

Most chatter is pointing towards a hawkish Fed and that's something the BOJ would certainly welcome after the fall in USD/JPY Tuesday.

Another thing to watch in the day ahead is the outcome of the Republican primary races. The vote isn't likely to add intrigue – Trump is way ahead in polls for Florida and Ohio – the story could be how the Republican establishment reacts to him taking a commanding lead. The party is likely to begin to coalesce around Trump but there is a chance they could dig and signal a fight right through the convention.

That's the kind of outcome that would further stoke the flames of discontent in the United States. It would signal some degree of discord and could weigh on risk assets. A similar reaction could also come from another surprise Sanders win in the Democratic race.

In the day ahead, the Fed will certainly be the largest market driver but US political risks won't be ignored for long.

The Bank of Jawbone?

The Bank of Japan attempted to shock markets with negative rates in January but it backfired and the yen jumped. In a sign that markets are unafraid of action at the BOJ decision today, the yen was the top performer on the day while the kiwi lagged. We take a look at what the Bank of Japan will do (or more likely, say) at the meeting. Aussie traders will watch the RBA minutes at 0:30 GMT/London. A new set of Premium trades ahead will be released on Tuesday ahead of Super Wednesday (UK jobs, UK Budget, Fed Decision/Yellen Conference, Aussie Jobs).

فيديو الاسبوع "المؤشرات، الذهب و النفط"

First, there are two numbers to watch with the BOJ decision, which is usually announced between noon and 1 pm Tokyo time. The first is the main policy rate, which was lowered to -0.10% in a surprise move at the January BOJ. Another cut is extremely unlikely and none of the economists surveyed by Bloomberg anticipates it.

Where there is some chance of a chance is in the growth in the monetary base, which currently sits at 80T yen. A handful of economists see a rise to 90T yen.

The reason most don't expect any change isn't the economy. Signs of deflation and non-existent growth continue to mount and the recent strength in the yen isn't doing the outlook any favours. Rather, the BOJ has indicated that it wants to assess the January measures before it makes another move.

The risk is that Kuroda has shown that his favourite tactic is surprise. He used in January to shock markets but the real surprise may have been how badly it floundered as USD/JPY tumbled in the aftermath.

What markets will be looking to assess later today is how eager the BOJ is to act in April, when new appointments add to the dovish BOJ tilt and there is more economic data to evaluate.

In the meantime, jawboning may be the preferred tactic. Kuroda may attempt to use some fresh and strong language to talk down the yen. If he adds any kind of concrete speculation what the BOJ could do next, the yen may decline (ie a USD/JPY rally). Also watch out for a hint the economic outlook could be downgraded.

What may keep the BOJ on the sidelines is hope. Namely, hope that the Fed will do some of the lifting for it with a hawkish statement on Wednesday. Otherwise, they will be hoping that the market chances its mind on negative rates.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Meeting's Minutes | |||

| Mar 15 0:30 | |||

China Fears Flare, AUD Longs Rise

China combined Jan and Feb data in an effort to smooth over Lunar New Year skews but it only helped to highlight the economic slowdown. Industrial production rose 5.4% y/y compared to 5.6% expected. Retail sales rose 10.2%, missing the 11.0% consensus. Steel and aluminum output both contracted over the period as well, underscoring the diminishing market for commodities. There are 4 trades currently in progress in tge Premium Insights after GBPUSD was stopped out and GBPAUD was closed at a gain.

There were better signs in investment and real estate data but the PBOC Governor Zhou said prudent monetary policy is needed not major stimulus. He also took direct aim at one of the major problems facing leaders – capital flight -- saying there is no rush to buy US dollar.

The danger, as we have highlighted in the past, is that China is stoking a property bubble in order to stimulate growth. The value of property sales in the first two months of the year rose 43.6%.

Another factor that could weigh on commodity currencies is Iran, which once again asserted that it won't discuss any efforts to freeze production until it recoups market share.

Japan machine orders are due later ahead of the Tuesday BOJ decision. Australia releases credit card data and Hong Kong factory output could be seen as a proxy for China.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -72K vs -69K prior

JPY +64K vs +60K prior

GBP -49K vs -39K prior

CHF -0.1K vs -1.5K prior

AUD +29K vs +17K prior

CAD -26K vs -30K prior

NZD -2K vs -4K prior

Australian dollar bets nearly doubled. It's a sign of how easily the market can be persuaded to bet on carry. One of the focuses this week will be the large yen net long. The BOJ is undoubtedly irked by bets on the yen and Kuroda may attempt to spook the specs with some strong words. If not, the Fed may go to work for him.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Core Machinery Orders (m/m) | |||

| 15.0% | 2.0% | 4.2% | Mar 13 22:50 |