Intraday Market Thoughts Archives

Displaying results for week of Apr 13, 2014Bonds Shrug Off Risks, Dollar Higher

A better tone on Ukraine pushed up Treasury yields after all parties agreed separatists would exit government buildings. USD was the top performer while NZD lagged. The day ahead is likely to be extremely quiet with many markets closed for Good Friday.

A prevailing school of thought headed into the weekend was that risk trades might suffer on fears of a Ukranian flare up over the long weekend. Instead, leaders emerged from four-party meetings with a conciliatory tone. The largest impact was in the Treasury market where 10 year yields moved up 9 basis points – the most since the FOMC decision on March 19.

Higher yields fuelled US dollar buying across the board. The correlation with yields and USD/JPY is notable and with Kuroda opening the door to further easing on Thursday, the upside is considerable. Dollar buying was also supported by the Philly Fed at +16.6 compared to +10 expected. Initial jobless claims were at 304K versus the 315K consensus. Most of this week's economic data was dollar positive, especially retail sales and CPI.

The euro was particularly soft after Mersch warned of the growing likelihood of cuts due to the higher euro and a Reuters source said Weidmann was open to QE in the right circumstances.

One currency that kept pace with the US dollar was the loonie after Canadian CPI was higher than expected. It's the second month of strong inflation numbers and talk of rate cuts is dwindling.

The key for the next stage of growth in North America is business investment. Corporate earnings are a spot to watch and so far it's a mixed bag as companies continued to wait for better signs of growth before putting cash to work.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (m/m) | |||

| 0.6% | 0.4% | 0.8% | Apr 17 12:30 |

| Core CPI (y/y) | |||

| 1.3% | 1.3% | 1.2% | Apr 17 12:30 |

| CPI (y/y) | |||

| 1.5% | 1.4% | 1.1% | Apr 17 12:30 |

| Continuing Jobless Claims (APR 4) | |||

| 2.739M | 2.795M | 2.750M | Apr 17 12:30 |

| Initial Jobless Claims (APR 11) | |||

| 304K | 315K | 300K | Apr 17 12:30 |

| Philly Fed Business Conditions | |||

| 26.6 | 35.4 | Apr 17 14:00 | |

| Philly Fed Employment | |||

| 6.9 | 1.7 | Apr 17 14:00 | |

BoC Highlights CAD Vulnerability

The pound was the top performer while the yen lagged as risk trades strengthened. Later, Kuroda and several second-tier releases highlight the calendar.

USD/CAD rose about 40 pips following the Bank of Canada decision. The BOC maintained a slight dovish bias but there was nothing in the statement that screamed to buy the pair. If anything, across-the-board higher inflation forecasts due to rising energy prices and a softer loonie were a reason to sell USD/CAD.What stood out was the BOC emphasis that a pickup in exports and business investment is required to spur a sustainable recovery. The thing is, Poloz has been looking for that since he started at the bank and it hasn't come.

The BOC has expressed befuddlement and trend. All the elements are there, they say, but it's just not happening. Higher competition and offshoring help explain the export weakness but slow business investment is a problem in all developed countries.

Central banks have been wrong about investment for awhile and if it never truly materializes, all trades based on higher interest rates are at risk.

The Fed was also in the spotlight but Yellen revealed very little. The market was worried about hawkish commentary like we saw after the FOMC but there was nothing to hint a higher rates. She pointed to data and said downside risks to inflation are her chief concern.

The Beige Book noted a consumer spending pickup and that's a key factor for the near-term US outlook. Without spending (and business investment) sustainable new jobs will never materialize.

Up next, at 0000 GMT, BOJ leader Kuroda speaks and could offer some dovish hints. That's because the Japanese cabinet is rumored to be downgrading its economic assessment today for the first time since 2012. That's often seen as a precursor to central bank action.

At 0130 GMT, the quarterly business conditions index from the National Australian Bank is due. The prior reading was 8.

Bullets Fly in Ukraine, Unto China GDP

The trade has been to ignore Ukraine until the bullets started flying, well on Tuesday they began to fly and it caused a bout of risk aversion. The US dollar was the top performer while the yen lagged. Chinese GDP is a major risk in the hours ahead.

Tuesday was a busy day in markets. The initial focus was on US CPI (slightly high) and the Empire Fed (soft) but quickly shifted to Ukraine. On the weekend, pro-Russia separatists captured about a dozen government buildings in Eastern Ukraine. The government pledged a military response and delivered it by retaking an airfield.

Reports suggested 11 men were killed in the operation and a Ukrainian general said it was only the first step. Putin responded that the crisis had been “sharply escalated” and said the actions were unconstitutional.

The yen rallied as the headlines tricked out, sending USD/JPY down to 101.50 and EUR/JPY to a one-week low.

A turnaround began when Nikkei reported that Japan's government will downgrade its economic assessment on Thursday for the first time since 2012. The move could be the first step towards further easing.

USD/JPY rebounded back to 101.90 and it was assisted by a turnaround in US stocks. The Nasdaq touched the lowest since November but reversed to close slightly higher.

The Australian dollar was soft as commodities slumped. The World Gold Council reported on gold stockpiling for the shadow banking system in China and that sparked a quick $40 drop in gold. The government cracked down on similar stockpiling in copper last year, leading to a persistent selloff.

The focus will remain on AUD in the hours ahead with China set to report on industrial production, retail sales and Q1 GDP – all at 0200 GMT. The consensus is for 1.5% q/q growth, which is a modest 6% annualized pace. The collapse in trade numbers at the start of the month could be a negative but the trade balance was strong and that may add an upward bias. Any miss will immediately hit the Australian dollar and it could prove to be a lasting move.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (MAR) (m/m) | |||

| 0.5% | 0.6% | Apr 16 13:15 | |

| Industrial Production (FEB) (m/m) | |||

| -2.3% | 3.8% | Apr 16 4:30 | |

| Industrial Production (FEB) (y/y) | |||

| 10.3% | Apr 16 4:30 | ||

Good Isn't Good Enough For USD, RBA Minutes Next

The limp US dollar reaction to the upbeat retail sales report highlights the divergence between market and economist expectations. On Monday, the Australian dollar was the top performer while the euro lagged. The RBA minutes are the highlight in Asia-Pacific trading.

Headline retail sales rose 1.1% in March, the best month since Sept 2012 and beating the 0.9% consensus. The previous month was also revised to +0.7% compared to +0.3% originally reported. The market more closely watches the control group and it painted a similar picture up 0.8% compared to 0.5% expected. There weren't any caveats in the report but the dollar couldn't take advantage, rising 15-20 pips and then fading. USD/JPY rose above 102.00 then slipped back to 101.70. EUR/USD and cable fell to session lows but wouldn't go any further.

If the dollar can't rally on good news, especially as it comes off a rough week, it's tough to envision a push higher. A key spot to watch is bonds. The 10-year Treasury chart is similar to USD/JPY and a break below 2.57% from the current 2.63% is an inflection point to watch.

The largest move on the day was in the euro but it was largely on the open. The catalyst was jawboning from Draghi but strong words are no replacement for action and the market doubts his sincerity, at least in the near term.

The focus switches to the Australian dollar lately with the minutes of the April RBA meeting due at 0130 GMT. The minutes could highlight the more-optimistic shift from Stevens & Co. Comments about investment and housing inflation could grab headlines and fuel AUD gains.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (MAR) (m/m) | |||

| 1.1% | 0.8% | 0.7% | Apr 14 12:30 |

| Retail Sales (ex. Autos) (MAR) (m/m) | |||

| 0.7% | 0.5% | 0.3% | Apr 14 12:30 |

| BRC Retail Sales Monitor - All (MAR) (y/y) | |||

| 1% | -1% | Apr 14 23:01 | |

| CPI (MAR) (m/m) | |||

| 0.2% | 0.5% | Apr 15 8:30 | |

| Core CPI (MAR) (y/y) | |||

| 1.7% | Apr 15 8:30 | ||

| CPI (MAR) (y/y) | |||

| 1.6% | 1.7% | Apr 15 8:30 | |

Ashraf in Poland this week

Join Ashraf for 3-hour seminars in Warsaw Sheraton Hotel (Wednesday) and Krakow (Thursday). Registration link here: http://t.co/eyJ8wr6clm Simultaneous translators will be available.

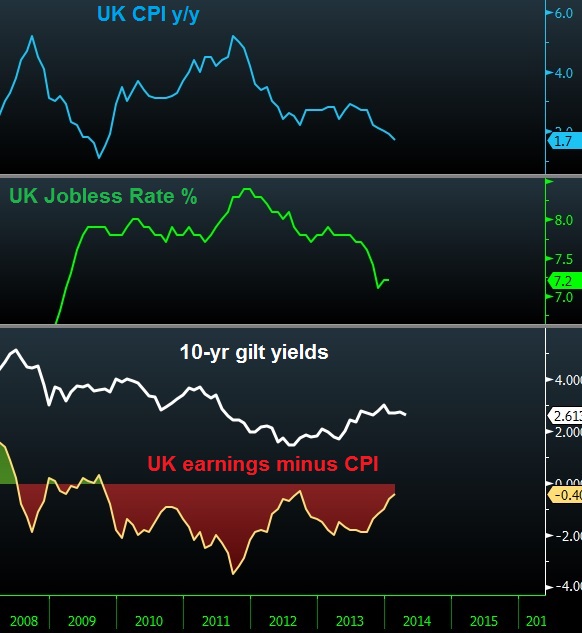

Sterling to cheer positive wage growth

This week's release of UK inflation and unemployment data may finally reveal that wages are above the standard of living for the first time in almost 5 years. What it means for sterling in charts & complete analysis.

Draghi's Jaw Breaks Euro Run

Jawboning from Draghi and tensions in Eastern Ukraine are the main focuses of the new week. The euro is down a half-cent in early trading with the dollar slightly stronger across the board. UK house price data is an early indicator to watch.

Draghi made a strong attempt to talk down the euro on the weekend and so far it's working. The euro rallied to 1.3886 from 1.3705 last week despite mild hints of unhappiness from the ECB. Draghi stepped up the rhetoric on the weekend, saying “The strengthening of the exchange rate would … require further monetary policy accommodation.”

Trading is thin early in the week but the euro is about a half-cent lower at 1.3842.

Other market pressure could come from Ukraine where bullets flied on the weekend and pro-Russia militias captured police and state security headquarters in Slaviansk. A small number of men were injured or killed on both sides and Ukraine's president said he will launch a military counterattack against the militias unless they lay down their arms on Monday.

If the threat proves true it will mark an escalation in the conflict and raise fresh questions about a Russian invasion. It would also be a good reason for the 'risk off' tone from last week to extend.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.- EUR +23 vs +33K prior

- JPY -87K vs -88K prior

- GBP +46K vs +34K prior

- AUD +3K vs -4K prior

- CAD -34K vs -37K prior

- CHF +11K vs +14K prior

- NZD +20K vs +18K prior