Intraday Market Thoughts Archives

Displaying results for week of Jul 13, 2014On VIX Spike & Stocks-Yields Divergence

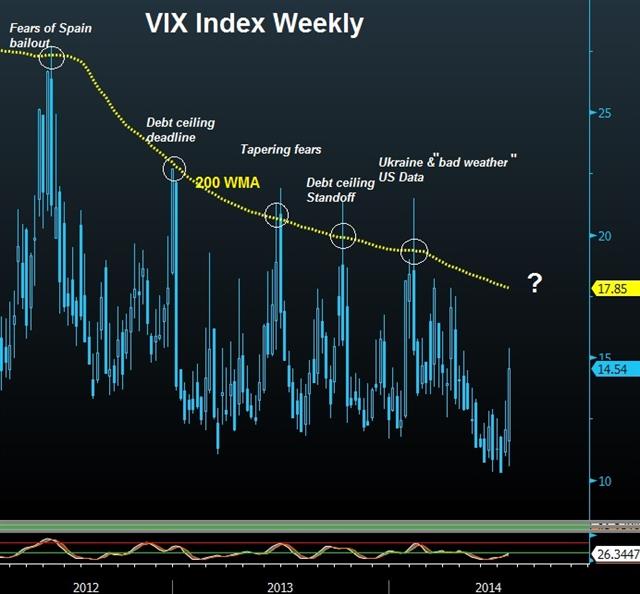

Yesterday's 32.2% spike in the VIX - resulting from the shooting of a Malaysian plane by Ukrainian separatists - was the biggest single day jump in the volatility index since the Boston Marathon bombing & gold' s biggest daily decline 15 April 2013. But what about the stocks-yields divergence? Full charts & analysis

Ukraine Plane Crash: What Happens Next

The tragedy of Malaysian Airlines MH17 will have wide-ranging and potentially long-lasting effects on markets. The initial reaction was a rush to safety and that mean JPY buying while the skid in NZD continued. Data on Japanese departments store sales are due later but the focus will remain on Ukraine and Israel.

Markets have drawn the conclusion that Ukrainian rebels were responsible for mistakenly shooting down the civilian aircraft.

The move will surely turn the public against the separatists and put pressure on Russia to halt support. The key question right now is how Russia will respond but Putin's initial comments blame Kiev and that will do nothing to end the conflict.

If Russian continues to dig in its heels and support the rebels it will be swiftly isolated and the chance of escalating sanctions is significant.

An even greater risk is if Russian direct involvement is proven. The Ukraine has released intercepted audio tapes that purport to show assistance from Russian military officials.

The yen is at risk of breaking out on this story and the Israeli ground assault in Gaza. Markets generally tend to overreact to geopolitical news but this could be an exception, at least for a few more days.

In any case, the story will be the major focus of markets Friday and into next week. What will be overlooked is a fantastic report; the Philly Fed rose to 23.9 from 16.0 expected and new orders rose to the highest since 2004.

The lone slice of economic data in Asia-Pacific trading is Japanese June dept store sales at 0430 GMT. Another event that could get attention is the BOJ minutes at 2350 GMT. Neither is likely to move markets.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Philadelphia Fed Manufacturing Survey (JUN) | |||

| 23.9 | 16.0 | 17.8 | Jul 17 14:00 |

How the BOC is Ahead of the Curve

Welcome to the era of “serial disappointment”. That's the term the Bank of Canada coined to explain the persistent inability of developed economies to accelerate to a +3% growth pace. What makes the BOC unique is that it has abandoned the persistently optimistic projections unlike the Fed and others – it could be a taste of what's to come.

On Wednesday, the loonie was the best performer as traders ignored the BOC hints that it will stay on hold for longer and focused on a change in language that eliminated the chance of a rate cut over the medium term. The New Zealand dollar was the laggard as the bearish scenario we outlined yesterday began to unfold on soft CPI numbers.

Listening to the BOC over the past few months it's clear that Poloz has grown skeptical of the models. Business conditions say companies should be investing but they've been saying the same thing in Canada since 2011 and the spending hasn't materialized.

Now the BOC has eliminated the wishy-washy language on rates and the statement says in plain language – we're in neutral. At the same time Poloz indicated they would remain in neutral until a strong and sustained phase of growth began along with business investment.

What puts the BOC ahead of the curve is that it has now built in deep skepticism into its outlook; it's an endorsement that the “New Normal” is real. It seems almost impossible to us that this would be a 'Canada-only' phenomenon. The country has tremendous advantages in finance, housing and natural resources but is stuck in neutral.

While the BOC now appears relatively dovish because it's essentially pledged to stay on the sidelines longer than the ECB, Fed and BOE, we have to consider that it's just the first in a long line of central banks that will come to the same conclusion about growth.

In the short-term outlook, the calendar is light in the Asia-Pacific region so the focus will be on the latest effort to break 1.3500 in EUR/USD. Yellen may have been dovish but the Beige Book was overwhelmingly positive and Fed hawks will continue to clamour for action. A break lower is almost inevitable, it's just a matter of getting the timing and trade right.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Consumer Price Index (Q2) (q/q) | |||

| 0.3% | 0.4% | 0.3% | Jul 15 22:45 |

| Consumer Price Index (Q2) (y/y) | |||

| 1.6% | 1.8% | 1.5% | Jul 15 22:45 |

UK Jobs, Inflation & Short Sterling Contract

With UK inflation picking back up and unemployment rates staying down, the path of interest rate expectations remains on the rise. Sterling's 3-month interest rate contract (known as short sterling) has declined two-year lows (inversely related to interest rates), nearing its 200-week moving average for the first time since 2008. Full charts & analysis

| Act | Exp | Prev | GMT |

|---|---|---|---|

| ILO Unemployment Rate (MAY) ((3m)) | |||

| 6.5% | 6.5% | 6.6% | Jul 16 8:30 |

Portugal Shadows Yellen, Key NZ CPI Next

A complicated bankruptcy in Portugal dragged down the euro Tuesday, overshadowing Yellen and US retail sales. On the day, the best performer was the pound on high inflation numbers while the loonie lagged on expectations of a dovish Poloz. China GDP and New Zealand CPI are up next.

Markets hate complicated bankruptcies; they despise them when they involve financial companies. A complicated, incestuous bankruptcy in Portugal has traders selling first and asking questions later. Taking a close look at the risks, the problems are likely contained.

The source of the worry is Portugal's second largest bank, Banco Espirito Santo. A company that owned 25% of the bank was forced to sell off 5% at a firesale prices on Monday to prevent a bankruptcy. But today the 49% holder of that parent company, called Rioforte is reportedly headed for bankruptcy.

That headline hit just before Yellen's testimony and sent a shudder through euro traders. The initial kneejerk higher in EUR/USD on Yellen sent the pair to 1.3610 but Portuguese worries later sent the euro down to 1.3562.

No one is sure how deep the problems run because there is yet another parent company of Rioforte and the kicker is that all of them are largely or partly owned by the same family. What's spooked traders is that some very suspicious loans were made to those companies by a telecom company owned by the same family and at the bottom level the bank was advising clients to buy that same debt.

Here's the bottom line for euro traders: It's probably ok if all the parent companies collapse so long as the bank is ringfenced. Shares of the bank are extremely distressed so trouble there is priced in.

Another negative scenario is if the government is forced into bailouts but PM Coelho has practically ruled that out. Baring either of those scenarios, which are low probabilities, the fears will subside.

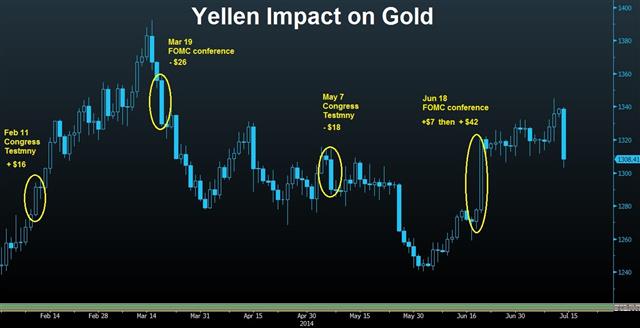

Meanwhile, Yellen's commentary largely followed the scenario we laid out as it mirrored the patient, wait-and-see approach from Lockhart on Friday. We're puzzled why traders continue to position for hawkish comments from the Fed chair.

Looking ahead, China GDP is due at 0200 GMT and expected to rise 1.8% q/q but there could be a downside surprise priced in because of soft trade figures. At the same time, industrial production and retail sales will be released.

The more tradable headlines might be on New Zealand CPI at 2245 GMT. Prices are expected up 1.8% y/y. The kiwi fell hard on risk aversion Tuesday ahead of the 2011 high -- a soft CPI print could mark that level as an interim high.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (m/m) | |||

| 0.2% | -0.1% | -0.1% | Jul 15 8:30 |

| Core CPI (y/y) | |||

| 2.0% | 1.7% | 1.6% | Jul 15 8:30 |

| Consumer Price Index (Q2) (q/q) | |||

| 0.4% | 0.3% | Jul 15 22:45 | |

| Consumer Price Index (Q2) (y/y) | |||

| 1.8% | 1.5% | Jul 15 22:45 | |

| Retail Sales (ex. Autos) (JUN) (m/m) | |||

| 0.4% | 0.5% | 0.4% | Jul 15 12:30 |

| Retail Sales (MAY) (m/m) | |||

| 0.2% | 0.6% | 0.5% | Jul 15 12:30 |

| BRC Retail Sales Monitor - All (JUN) (y/y) | |||

| -0.80% | 1.25% | 0.50% | Jul 14 23:01 |

| Retail Sales (JUN) (y/y) | |||

| 12.4% | 12.5% | Jul 16 2:00 | |

| Industrial Production (JUN) (m/m) | |||

| 0.4% | 0.6% | Jul 16 13:15 | |

| Industrial Production (JUN) (y/y) | |||

| 9.0% | 8.8% | Jul 16 2:00 | |

Sterling Hysteria or Common Sense?

UK inflation hitting 20-month highs backs one of our main arguments to favouring $1.70 GBPUSD since January: Rather than rejecting GBP strength, the Bank of England will use GBP strength in its favour as a means to contain inflation, instead of resorting to interest rate hikes. But is $1.7150 in GBPUSD too excessive? As we approach Wednesday's release of the UK jobs figures, we issue our latest Premium trades on GBPUSD with 3 new charts and update a crucial chart posted earlier in the year, illustrating a rare technical moving average deviation, bearing key parallels with 2007 and 2004.

Market Begging for a Hawkish Yellen

Traders positioned for a hawkish hint from Yellen by buying US dollars, selling bonds and dumping gold on Monday. The Canadian dollar was the best FX performer while the yen lagged. The RBA minutes are the highlight in Asia but all eyes are on Yellen's testimony in US trading and some key European data points.

Last week, traders positioned for a hawkish hint in the FOMC minutes but were left disappointed, will it be the same with Yellen? The US dollar rallied mildly but broadly on Monday and gold plunged more than $30 – two moves that point to another attempt to get ahead of a big turn in monetary policy.

To sustain the moves, the market will need Yellen to talk about sooner rate hikes, rising inflation pressures or a near-target jobs market. If she focuses on a patient approach and slowly hiking rates when appropriate – like Lockhart did on Friday – the market could be disappointed again.

Headlines on Monday did little to jar markets. Draghi largely repeated his ECB press conference in European parliament by saying the ECB is prepared to use unconventional tools if needed and that economic risks are on the downside. The IMF said the ECB should consider QE if inflation remains low.

The euro was higher on the day after embattled Portuguese company Groupo Espirito Santo raised $100 to avoid being forced into default by Nomura. The DAX was the best performer in global stock markets, giving Germans another reason to cheer.

With the World Cup wrapped up, the Australian dollar was the worst performer from kickoff to closing ceremonies. Dovish comments from Stevens were a key reason and the RBA will have another chance to talk down the Aussie with the RBA minutes due at 0130.

Afterwards, the focus will quickly shift to June UK CPI numbers, the German ZEW, US retail sales and Yellen in what could be an action-packed day of trading.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Meeting's Minutes | |||

| Jul 15 1:30 | |||

| Fed's Yellen testifies | |||

| Jul 15 14:00 | |||

| CPI (JUN) (m/m) | |||

| -0.1% | -0.1% | Jul 15 8:30 | |

| Core CPI (JUN) (y/y) | |||

| 1.7% | 1.6% | Jul 15 8:30 | |

| CPI (JUN) (y/y) | |||

| 1.6% | 1.5% | Jul 15 8:30 | |

| Retail Sales (ex. Autos) (JUN) (m/m) | |||

| 0.5% | 0.1% | Jul 15 12:30 | |

| Retail Sales (MAY) (m/m) | |||

| 0.6% | 0.3% | Jul 15 12:30 | |

| BRC Retail Sales Monitor - All (JUN) (y/y) | |||

| 1.25% | 0.50% | Jul 14 23:01 | |

Yellen's Likely Gold Impact

As Federal Reserve Chairwoman Yellen is set to testify to Congress Tuesday and Wednesday, gold traders wonder about the extent to which, she will continue to play down inflation, considering the recent upside surprise figures in CPI and PCE price index. Full charts & analysis

Germany Wins it all, Eyes onto Yellen

Germany concludes the dramatic World Cup with a 4th win of the title at the expense of Germany, 24 years after it last won the tournament, similar to both Germany and Italy, which both won their 4th titles 24 years after they won their 3rd cup. But the violence in Middle East and Ukraine on the weekend has raised geopolitical risks but the economic risks remain low this week. Last week, the kiwi dollar was the top performer while the loonie was the laggard after a soft jobs report.

Geopolitics and the Fed will be the focus in the week ahead. Trouble in Israel, Libya, Iran, Iraq and Ukraine are all in the headlines. At the moment the market is comfortable with the risks but with so many trouble spots, the chance of a Black Swan rises.

The calendar begins the week with Japanese industrial production at 0030 GMT. The consensus is for a 0.5% rise but after last week's terrible machine orders report the market will be on guard for a soft report.

The larger story in the week ahead will be Yellen's Humphrey Hawkins testimony. Last week the market leaned toward a hawkish Fed minutes but was disappointed. The market may try again in the hopes that Yellen will talk about rate hikes sooner, especially after Plosser and Bullard made the case for sooner hikes last week.

But what's most likely is a similar tone to Lockhart on Friday. He said it's too early to make a call on interest rates despite some positive indicators on employment. A big surprise would be that if she repeats his statement that above-target inflation for a short period would be acceptable.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -59K vs -57K prior JPY -66K vs -71K prior GBP +42K vs +50K prior AUD +37K vs +33K prior CAD +10K vs -5K prior CHF -7K vs -5K prior NZD +14K vs +6K prior

The big news is that Canadian dollar traders have shifted to a net long position. The final USD/CAD longs were squeezed out last week and then the pair promptly rebounded higher after the jobs report. The pair is due for a bounce, it's just a question of how high.

The other spot to watch is USD/JPY, the market remains heavily long and a 50-pip fall, to below 101.80 could spark a squeeze as faith in Abenomics falls as quickly as faith in Brazilian football.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (MAY) (m/m) | |||

| -2.8% | Jul 14 4:30 | ||

| Industrial Production (MAY) (y/y) | |||

| 3.8% | Jul 14 4:30 | ||