Intraday Market Thoughts Archives

Displaying results for week of Jun 14, 2015Ashraf Speaks at London Panel Tomorrow

Ashraf will speak for 1 hour at tomorrow's London Traders Conference organized by Rob Booker. Rob starts at 9 am, followed by Brenda Kelly. Ashraf starts at 1 pm. Charts & Trades will be discussed. REGISTRATION LINK

Aside From the Euro

The non-stop headline risk in the euro has made for a messy playing field so we look at two non-euro trades and where they might be headed. The Australian dollar was the top performer Thursday while its kiwi cousin lagged. Japan is in focus later. There are 3 Premium trades in progress, all of them long trades. EURAUD is in a loss, whole the other two trades remain in the green.

We've seen and heard almost everything from Greece in the past 6 years so we won't draw any conclusions prematurely. A dozen important headlines landed Thursday but, looking ahead the most important one is how the EU/ECB/IMF respond to a fresh Greek proposal.

Even if we did know the outcome, the euro may prove to be a difficult trade. Aside from the euro, two things stand out in the market at the moment.

The first is the latest incredible run from cable. It has now risen in 8 of the past 9 sessions in a non-stop 670 pip rally. In the short-term, it's surely overdone but 1.6000 will be increasingly magnetic and there is forever the possibility of a squeeze.

The second is oil. Market chatter surrounding oil has gone dim and rather than focusing on a hyper-analysed trade like Greece, we can focus on oil. The market is undoubtedly oversupplied. Respected Saudi oil minister Al-Naimi said Thursday that his country has an addition 1.5 to 2 million barrels per day of idled production.

Technically the roughly $57-$62 range has persisted for nearly two months. It won't last. Various intraday breakouts have failed so a breakout might not be clean but when it happens, it's likely to last at least $5 and potentially much more.

In the short term, USD/JPY briefly touched a three-week low on Thursday but a better Philly Fed led to a US dollar bounce. The zone around 122.50 will remain pivotal.

The BOJ monetary policy statement is due at some point in the session along with a speech from Nakaso but the bigger event is the May dept store sales at 0430 GMT. For the first time in years, the yen is showing signs of increasing sensitivity to economic data so we will be watching upcoming releases closely.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Mester speech | |||

| Jun 19 16:00 | |||

| BoJ Deputy Governor Nakaso Speech | |||

| Jun 19 6:30 | |||

| Philly Fed Manufacturing Index | |||

| 15.2 | 8.1 | 6.7 | Jun 18 14:00 |

| BoJ Monetary Policy Statement | |||

| Jun 19 | |||

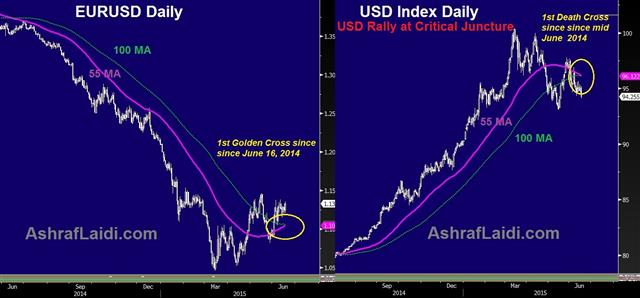

USD Death Cross, EURUSD Golden Cross

Another way to grasp the latest US dollar tumble is to keep in mind the following:

As expectations of a 2015 Fed hike grew increasingly cemented in the market, traders demanded a higher bar of positive US data performance, especially as macro-normalisation in Europe transitioned into outright progress. Not only most US figures failed to show a sufficient upside surprise since end of April, but business surveys and inflation data from Europe revealed evidence of progress from the ECB's QE program.

In Jan-Mar, the greenback soared to decade highs against most currencies on the possibility that the Fed would raise interest rates in 2015. In yesterday's FOMC announcement, the USD sold off due to bigger than expected downgrade in 2015 GDP growth (revised to 1.8-2.0% from 2.3-2.7% in March), as well as lack of clarity with regards to the pace of future Fed hikes.

Although 15 of 17 FOMC officials expect lift-off to begin this year, FX markets require a faster pace of subsequent rate hikes in order for the US dollar to regain the momentum it once had when the possibility of a 2015 rate hike were sufficient for the rally.

The US dollar rally has now reached critical levels on both fundamental and technical grounds.

Fundamentally:

- Bank of England will likely have at least two hawks dissenting against the monetary policy status quo by end of summer due to persistent improvement in jobs and earnings figures, as well as anticipated rise in inflation data.- Rising chances that Eurozone CPI will overshoot the ECB's 0.3% y/y projection, with 0.8%-0.9% as the more likely year-end figure—should sway the German-US yield spread further near positive levels from the current -152 bps.

- Increased resistance inside the Bank of Japan's policy board over stepping up monthly further asset purchases will stand in the way of further yen weakness, especially if US and European bourses are rattled by the simultaneous threat of disappointing US earnings season and persistent chatter of 2015 Fed lift-off.

Technically, the ensuing Death Cross formation in the US dollar index, and Golden Cross in EURUSD (occurring when key measures of short-term trend exceed longer-term trends) is taking place for the first time since almost exactly 365 days. The developments are backed by important resistance levels in GBPUSD and EURUSD, while USDJPY tests key 122.30 support foundation.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Germany PPI (MAY) (m/m) | |||

| 0.2% | 0.1% | Jun 19 6:00 | |

| Germany PPI (MAY) (y/y) | |||

| -1.1% | -1.5% | Jun 19 6:00 | |

No Hints of Hikes From Fed

It wouldn't have taken much to convince markets that hikes were coming sooner but the Fed delivered nothing and dollar bulls were beaten up. The USD finished as the day's worst performer while the pound continued to soar. Another busy day is coming up. A new Premium trade was opened today. The Premium cable long from June 8 long at 1.5370 hit its final target of 1.5670. EURUSD long at 1.1105 us 225-pips in the money. EURCAD and AUDNZD are also in progress.

The bias in the market was overwhelmingly evident as the hours ticked down toward the FOMC decision. USD/JPY climbed to 124.30 from 123.40 and the dollar held a strong bid as the minutes ticked down.

When the statement hit it was a complete reversal. The US dollar fell around 40 pips right across the board. The commentary was bland, offering no more than a slightly more upbeat tone on jobs and household spending. There was no hint on rates.

Many were focused on Fed forecasts, including the quarterly dot plot but there was a decided shift lower with 7 of 17 Fed members now below 0.50% for year-end. There's a good chance that 5 or 6 of the 10 Fed voters are in that group.

The final blow to the dollar came when Yellen said in the press conference that the Fed is waiting for 'more decisive data' before hiking. That sent the dollar another 40-50 pips lower across the board. Cable climbed a full cent as the May highs broke. The comment was the clearest sign that the Fed hasn't seen enough to be convinced of a September hike.

Where now? What happens in EUR/USD is likely to drive the next dollar move. The rise to 1.1359 today is the fifth test of 1.14 in the past month. Euro shorts have been steadfast but a Greek default is all-but-certain now and sellers haven't regained the upper hand. A squeeze above 1.14 could be harsh.

Greek headlines will continue to carry weight but Athens already said no proposals are coming in the day ahead. Instead, the SNB decision, UK retail and US CPI will be major events.

But first, at 2245 GMT, New Zealand CPI is expected to rise 0.6% q/q. A downside surprise would probably be overlooked by the market because the RBNZ has already cut rates but a strong number spark an outside rally because it argues against further rate cuts.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Eurozone CPI (MAY) (y/y) | |||

| 0.3% | 0.3% | 0.3% | Jun 17 9:00 |

| Eurozone CPI - Core (MAY) (y/y) | |||

| 0.9% | 0.9% | 0.9% | Jun 17 9:00 |

| Eurozone CPI (MAY) (m/m) | |||

| 0.2% | 0.2% | 0.2% | Jun 17 9:00 |

UK Jobs, BoE, Sterling & Yield Spreads

Today's UK jobs figures powered the pound across the board as average weekly earnings growth (excluding bonuses) shot up to a six-year high of 2.7% in the three months to April y/y, exceeding market expectations for a 2.1% rise. Substracting the 0.1% level of inflation, real earnings come in at 2.6%, also the highest since 2009. If wage gains persist on their upward trend, then wage cost inflation would follow, forcing the gilt market to price more aggressive expectations for a BoE rate hike.

With regards to the release of the Bank of England's BoE minutes, the usual hawks continued (likely to be Weale & MacCaferty) continued to deem their vote to hold rates unchanged as “finely balanced”, which raises the probability of seeing 1-2 dissenting voters (in favour of a rate hike) by end of this summer. Private economists are calling for rates to be lifted by Q1 2016, while Short sterling contracts are pricing a full chance of a 25-bp rate hike June 2016 versus August 2016 prior to this morning's release of the jobs and BoE minutes.

On the yields spread front, UK-US 10-yr spreads have bottomed out from a key support, now eyeing the 200-DMA, a break of would will pave the way for the top of the diamond formation.

Finally, our long GBPUSD entry at 1.5360 on June 8th, hit the final target of 1.5670. A new Premium Insight trade will be added this afternoon to the existing 3 long trades.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Average Earnings excluding Bonus (APR) (3m/y) | |||

| 2.7% | 2.5% | 2.3% | Jun 17 8:30 |

| Average Earnings including Bonus (APR) (3m/y) | |||

| 2.7% | 2.1% | 1.9% | Jun 17 8:30 |

Cable Streak Continues, Fed Next

Ranges were tight Tuesday but a few trends held up. Cable was higher for the sixth time in seven sessions and finished near the highs of the day at 1.5646. The euro fell to 1.1205 in early US trading as Greece caused some worries but, once again, dip buyers appeared to bid the pair to 1.1245.

The top news item was US housing starts and it was mildly disappointing at 1039K compared to 1090K expected but it was coupled with positive revisions and building permits jumped to the highest since the crisis.

The kiwi hit some selling as dairy prices fell another 1.3% in the latest Fonterra auction but ranges in the commodity currencies were narrow.

Most of the market chatter surrounded the Fed. Economists view September as the most-likely date for a hike but the Fed Funds market only sees that as about a 65% probability. The chatter about the liftoff date is deafening but the pace of hikes and communication on the economy is equally important.

Look for the dot plot to indicate a slower pace of hikes and a lower terminal top. That will go some ways towards mitigating anything that's especially hawkish in the statement. However, the Fed has grown comfortable with data dependency and that tone will almost-certainly continue.

Before the Fed, the focus is on Japan and May trade balance at 2350 GMT. An adjusted trade balance of 184B yen is expected but growth in exports is equally important. The consensus is for a 3.0% y/y rise.

The big surprise of the first half of 2015 has been the strength in the Japanese economy. Economists remain skeptical but another strong trade report would help quiet the critics and may spur modest yen buying.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Adjusted Merchandise Trade Balance (APR) | |||

| ¥-208.68B | Jun 16 23:50 | ||

| Merchandise Trade Balance Total (APR) | |||

| ¥-226.0B | ¥-53.4B | Jun 16 23:50 | |

| Exports (APR) (y/y) | |||

| 3.5% | 8.0% | Jun 16 23:50 | |

| Building Permits (MAY) | |||

| 1275K | 1100K | 1140K | Jun 16 12:30 |

| Housing Starts (MAY) | |||

| 1036K | 1100K | 1165K | Jun 16 12:30 |

Euro Passes Another Test

As a Greek default creeps closer, the euro continues to creep higher. US traders sent the euro 80 pips higher on Monday despite a steady stream of troubling news on Greece. The RBA is in focus later. The Each EURUSD and GBPUSD Premium longs are now +250 pips in the money, each, while AUDNZD is +30 pips in the Premium Insights.

At some point, there is no fighting the price action. Greek news is undoubtedly bad and late in the day, Varoufakis confirmed Athens won't be presenting any new concessions in a last-ditch meeting Thursday. That condemns Greece to default unless its creditors pull a total about-face.

In a sign that's unlikely, various reports have emerged about quickening preparations for a Greek default and potential capital controls. It has looked bleak in the past but in seven years of writing about Greek drama, it's never been this bad. It would take a small miracle to avoid a Greek default now.

At the same time, the euro just doesn't care. There is something to be said about unloading an anchor from the Eurozone and that might be how the market takes it. The euro is creeping back toward 1.14 once again it what would be the fifth test of that zone. That kind of price action is hard to deny.

That said, EUR/USD bears have two massive potential catalysts this week in Greece and the Fed. If those don't reignited the downside, it may be a quick rush to the exits in a move that could send the euro quickly higher.

Economic data added to the US dollar's problems Monday as it fell 80 pips against the euro and pound. US May industrial production fell 0.2% compared to a 0.2% rise expected. The Empire Fed was at -2 compared to the +6 consensus. On the flipside, the NAHB housing market index beat expectations and matched the best reading since the crisis.

Looking to Australia, the RBA's Debelle speaks. Yesterday, Kent talked down the AUD with some success but it proved to be fleeting as AUD/USD hit session highs in US trading at 0.7777.

Debelle speaks at 2155 GMT but the larger event is at 0130 GMT with the RBA minutes. They're likely to confirm a wait-and-see approach but any fresh bias could cause an AUD move. Also keep an eye on copper prices as they rebounded in US trading after a drop.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (MAY) | |||

| -0.2% | 0.3% | -0.5% | Jun 15 13:15 |

| NAHB Housing Market Index | |||

| 59 | 56 | 54 | Jun 15 14:00 |

| RBA Meeting's Minutes | |||

| Jun 16 1:30 | |||

40-Month Cycle in USDJPY

When USDJPY hit the 125.86 high earlier this month, it was its highest level since June 2002. The 65% climb from the February 2012 lows of 76.03 lasted took 40 months to occur, matching the duration of the 85% rise from April 1995 low to this month's high. The factors behind the latest rise and those prevailing in the late 1990s are similar; i) rapid declines in Japanese interest rates; ii) deteriorating Japanese growth; iii) relative improvement in US economy and iv) expectations of higher US rates ahead.

The 45% increase in the US-Japan 10-year yield spread to 1.98% earlier this month was triggered by improved US jobs figures and recurring weakness in Japan's business survey and GDP data. But the US-Japan 10-year spread failed to break its 100-week moving average on a combination of US data disappointment and broadening selling in global equities, feeding into the yen's safe haven role, highlighted by its low yields. The latest USDJPY cycle may well take an additional one or two months before breaking below 116 as the Bank of Japan policy board sees further divisions with regards to expanding monthly asset purchases and the Federal Reserve comes to terms with the 'market' realities of raising rates, albeit as small as 25 bps.

Greek Talks Fail, Euro Falls

Ahead of the weekend, Juncker said he wanted an agreement before markets re-opened. Many market participants assumed both sides were grandstanding and would finally compromise this weekend. Those illusions are now shattered.

"One can discuss a gap, but this is an ocean" an EU source cited by Reuters said. Greece owes 1.8B euros to the IMF at month-end. Even an agreement today would have been a tough deadline due to the lack of time for technical work and time for national parliaments to vote.

In short, unless Greece can scratch together more money (doubtful), time is up and Athens will default. EU Ministers meet July 18 but that's likely to be a meeting about what to do when Greece defaults, not a deal.

The euro is a half-cent lower at 1.1216 in early trading. It's been resilient in the past week but this will be a major test. We'll closely watch Greek markets, Bunds and the European open.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -138K vs -165K prior

JPY -116K vs -86K prior

GBP -28K vs -26K prior

AUD -14K vs -13K prior

CAD -14K vs -1K prior

CHF +10K vs +8K prior

In three weeks, the yen net short position jumped by nearly 100k contracts. The rush into the trade was what left the market vulnerable to the quip from Kuroda last week about the yen not falling further. Risk aversion leaves USD/JPY at risk of falling further.