Intraday Market Thoughts Archives

Displaying results for week of Dec 15, 2013Gold Bugs Squashed By Taper

Gold and silver prices broke down on Thursday, nearing the lowest levels of the year. The Canadian dollar led the way higher in the biggest post-FOMC bounce while the kiwi lagged despite strong GDP data. The Asia-Pacific week winds down with a quiet calendar.

Some traders were looking for a continuation of dollar strength on Thursday, others were looking for a retracement but the market delivered neither. EUR/USD stalled ahead of 1.3700 on a modest rebound and then sagged back to 1.3655. USD/JPY was challenging the post-Fed high of 104.36 but soft US economic data halted the rally and the pair traded in a tight range down to 104.10.

Three pillars of expected US economic strength for 2014 are manufacturing, employment and housing and there were questions about all three in economic data. The Philly Fed was at +7 compared to +10 expected, initial jobless claims rose to the highest since March at 379K compared to 336K expected and existing home sales slipped to 4.9M versus the 5.02M consensus. The numbers are far from game changers but could be seeds of doubt in the rapidly improving consensus about 2014 US growth.

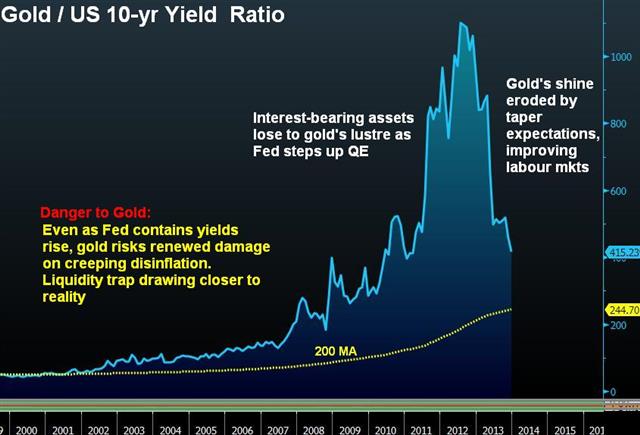

The big move on the day was in the gold market as prices fell $30 to $1189. The spike low in late June was $1180 and below that support thins. The breakdown Thursday easily cut through the Dec low of $1210, the mid-June low of $1208 and the psychological $1200 level.

The long-term gold rally was built on expectations for inflation, deficits, the potential for economic calamity and money printing. All of those factors are in decline and if/when gold breaks $1180, it will continue to decline as well.

One event to watch for in Asia is the BOJ's announcement of its monetary base target for 2014. The consensus is 270trillion yen. The tight range in USD/JPY could also be shattered by a move in the Nikkei 225.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| GDP Annualized (Q3) | |||

| 3.6% | 2.5% | Dec 20 13:30 | |

| GDP Price Index (Q3) | |||

| 2.0% | 0.6% | Dec 20 13:30 | |

| Existing Home Sales | |||

| 4.90M | 5.03M | 5.12M | Dec 19 15:00 |

| Existing Home Sales (m/m) | |||

| -4.3% | -1.5% | -3.2% | Dec 19 15:00 |

| Continuing Jobless Claims | |||

| 2,884K | 2,780K | 2,790K | Dec 19 13:30 |

| Initial Jobless Claims | |||

| 379K | 334K | 369K | Dec 19 13:30 |

| Jobless Claims 4-Week Avg. | |||

| 344K | 330K | Dec 19 13:30 | |

| Philadelphia Fed Manufacturing Survey (NOV) | |||

| 7.0 | 10.0 | 6.5 | Dec 19 15:00 |

Ben Tapers, Tinkers & Leaves

The Federal has successfully integrated the "price stability" component of its dual forward guidance into traders' psyche by further delinking tapering of asset purchases from tightening conditions in the bond market. Unemployment was Fed's Priority in 2013. Inflation will be Fed's Priority in 2014. Charting Gold vs Yields

Fed Tapers, Dollar Ends Higher

After months of speculation Bernanke finally delivered a taper with a $10 bn reduction in monthly purchases. The market reaction was completely disjointed but eventually dollar strength took hold, leaving impressive technical patterns in EUR/USD and USD/JPY. The pound held onto the best performance of the day after the earlier jobs report while the yen lagged badly. Early in Asia-Pacific trading, New Zealand GDP beat expectations.

This is the beginning of the end. The Fed finally took its foot off the gas pedal, only slightly but it's a powerful signal that the era of money printing will end one day.The FOMC cut monthly asset purchases by $10 billion a month to $75 billion in a somewhat surprising decision. The Fed acknowledged to stronger economy and Bernanke said FOMC members expect continued improvement in the jobs market.

For the doves, the Fed strengthened forward guidance saying it won't tighten until unemployment falls 'well below' 6.5%. Bernanke also emphasized risks from disinflation but opted not to draw a line under prices as some analysts had expected.

Overall, it's probably the most hawkish surprise ever from the Bernanke Fed. That isn't saying much but after a wild hour of nonsensical trading the US dollar finally found a footing and made substantial gains.

The most important move was against the yen. USD/JPY erased three days of declines and surged more than 150 pips from the lows to a fresh cycle high at 104.36 and the first close above the May high.

EUR/USD is less straightforward but the rise to a fresh two month high followed by a 125 pip drop to 1.3675 forms a bearish engulfing candle and a potential double top.

Another spot of weakness was AUD/USD as it slumped below the August bottom to a cycle low and to 0.8820. What might be different about the Aussie is that it's headed for a ninth-consecutive week of declines so some kind of bounce is due.Then again, the New Zealand dollar had every reason to bounce after the Q3 GDP beat expectations with a 1.4% q/q rise compared to 1.1% expected. NZD/USD climbed to 0.8255 but quickly slumped back to 0.8193 in a sign of USD dollar strength.

The rest of the Asia-Pacific calendar is quiet.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Gross Domestic Product (Q3) (q/q) | |||

| 1.4% | 1.1% | 0.2% | Dec 18 21:45 |

| Gross Domestic Product (Q3) (y/y) | |||

| 3.5% | 3.2% | 2.5% | Dec 18 21:45 |

Why This FOMC is Different From Sept

Tomorrow will mark exactly three months since the Fed surprised the market with no taper. This time the market is ready for anything. On Tuesday, the yen was the top performer while the Australian dollar lagged. Japanese trade balance is part of a light Asian calendar ahead of the Fed decision.

The market can change in the three months. The September 18 FOMC decision was a 'close call' not to taper and the December 18 decision will probably be the same but there is one big difference. This time traders are far less confident in any outcome. The market whipsawed after the last decision as confused traders hit the panic button. This time look for a measured, sustained response.

The lack of confidence in the FOMC was evident on Tuesday. The main trade was to fade what has worked recently; that meant declines in yen crosses, stocks, gold and shortcovering in bonds. An attempt was also made to knock down the euro but, once again, it rebounded from the dip to 1.3723 up to 1.3770. The resilience of the euro has been a major theme in 2013 and the lack of a taper could mean EUR/USD ends the year at the highs.

One trend that didn't pare back on Tuesday was weakness in the Australian dollar. The Aussie has fallen for eight consecutive weeks and is on the way to making it nine after a break below 0.9000 for the first time since August. Aside from broad risk aversion, one reason for AUD/USD selling was an upcoming speech from RBA Governor Stevens. His early comment don't contain an additional AUD jawboning, he says the FX rate has behaved as expected by declining.

Another interesting move ahead of the Fed was a drop in EUR/CHF as the pair broke below 1.22 for the first time since May. The market has little doubt in the credibility of the SNB to hold the 1.20 floor so the downside risks are minimal.

Other events on the calendar include November Japanese trade balance at 1850 GMT. Expectations are for a 1.35 trillion yen deficit but the important part will be growth in imports and (especially) exports. The consensus is for an 18% rise in exports and 21.4% y/y rise in imports.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Adjusted Merchandise Trade Balance (NOV) | |||

| ¥-1,072.457B | Dec 17 23:50 | ||

| Merchandise Trade Balance Total (NOV) | |||

| ¥-1,319.5B | ¥-1,090.7B | Dec 17 23:50 | |

| Imports (NOV) (y/y) | |||

| 21.4% | 26.1% | Dec 17 23:50 | |

| Exports (NOV) (y/y) | |||

| 17.9% | 18.6% | Dec 17 23:50 | |

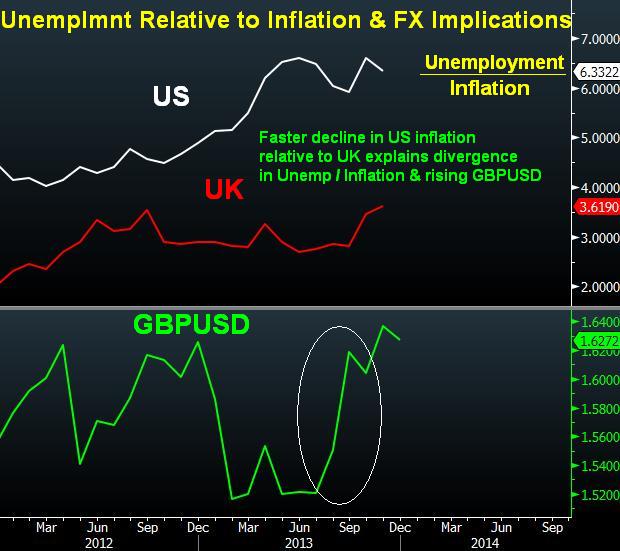

Dissecting Unemployment vs Inflation: UK vs US

Since QE3 began in September 2012, US inflation fell 35% while US unemployment fell by only 11%. See the same values for the UK and what it means for Fed/BoE policy and FX. Full charts & analysis here

Cautious Market Ahead of The Fed

A boost in risk trades did little to spur movement in FX on Monday. The Swiss franc was the top performer while the Australian dollar lagged. The upcoming minutes of the December RBA meeting are another chance for Stevens to talk down the Aussie.

The euro topped out at 1.3799 in European trading Monday as sellers ahead of the big figure and the annual high of 1.3832 capped the move. The resignation of Asmussen from the Bundesbank could mean a more hawkish replacement but the market will wait and see. At the moment, FX traders are reluctant to push the recent ranges ahead of the FOMC meeting but that could change with several key releases before the Fed including UK and US CPI as well as German economic sentiment surveys.

Stock markets made a rapid turn in Asian trading and that continued early in New York. S&P 500 futures were down 15 points in Asia but the market closed 11 points higher. The German DAX bounced from support to gain 1.7% on upbeat PMIs.

The better risk appetite might have been a chance for the Aussie bulls after 8 weeks of declines but there was little-to-no buying. In truth, the correlation between AUD and stocks has broken down to nearly nothing in 2013 and this was yet another example.

Economic data was mixed. The Empire Fed was at +1 compared to +5 expected and the Markit PMI was at 54.4 compared to the 55.0 consensus. On the upside, November industrial production rose 1.1% compared to 0.6% expected.

On Friday, former Fed vice chair Kohn said he would wait to taper and that gave the market more confidence. Gold rallied as high as $1252 before sinking back to $1241.

Up later, at 0030 GMT, the minutes of the December RBA meeting will be released. In the statement, Stevens called the Aussie 'uncomfortably high' and his anti-AUD comments last week sent AUD/USD near the cycle lows. The comments were partly misinterpreted but proved the power of jawboning with the momentum. Watch for more of the same in the minutes.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (NOV) (m/m) | |||

| 0.2% | 0.1% | Dec 17 9:30 | |

| Core CPI (NOV) (y/y) | |||

| 0.9% | Dec 17 9:30 | ||

| CPI (NOV) (y/y) | |||

| 2.2% | 2.2% | Dec 17 9:30 | |

| CPI (NOV) (m/m) | |||

| -0.1% | -0.1% | Dec 17 10:00 | |

| CPI (NOV) (y/y) | |||

| 0.9% | 0.7% | Dec 17 10:00 | |

| CPI - Core (NOV) (y/y) | |||

| 1.0% | 0.8% | Dec 17 10:00 | |

| ZEW Survey - Economic Sentiment (DEC) | |||

| 60.2 | Dec 17 10:00 | ||

| ZEW Survey - Economic Sentiment (DEC) | |||

| 55.0 | 54.6 | Dec 17 10:00 | |

| Manufacturing PMI [P] | |||

| 54.4 | 54.9 | 54.7 | Dec 16 14:00 |

| Services PMI [P] | |||

| 51.0 | 51.5 | 51.2 | Dec 16 9:00 |

| Services PMI [P] | |||

| 54.0 | 55.5 | 55.7 | Dec 16 8:30 |

| Industrial Production (m/m) | |||

| 1.1% | 0.5% | 0.1% | Dec 16 14:15 |