Intraday Market Thoughts Archives

Displaying results for week of Oct 16, 2016Ashraf on Markets, Trading & Learning

Ashraf's interview with Sylvain Asimus of Market Tutors on trading markets and the importance of learning. Full interview.

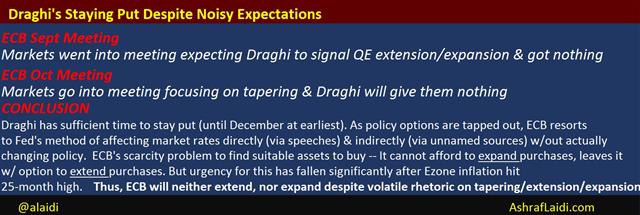

Draghi Firmly Neutral

ECB's Draghi reiterated the ECB discussed neither tapering, not extending QE. Despite repeating the usual line of considering to extend purchases beyond their planned expiry date, Draghi calmed restless reporters & traders who seem to expect that something must be done (taper or extension) at each meeting. But as we indicated long ago, Draghi's message has been: "Eyes off, ears off. Turn your expectations towards national governments as we're tapped out". Below is the note published 1 hour before the ECB decision. A new Premium trade has been issued moments ago, partly boosted by a DragonFly Doji. A trade was also issued earlier this morning, 1 hour after the Clinton-Trump debate.

The Poloz Plan, AUD Employment & Debate

Central bankers walk a fine line where a surprise can often stimulate an economy but a shock might destabilize it. Reading between the lines, the Bank of Canada seems to be setting something up for the near future. The Australian dollar was the top performer Wednesday while the pound lagged. The Fed's Dudley and Australian employment are due next. A new Premium trade shall be issued ahead of tonight's Presidential Debate between Clinton & Trump.

مخاطر الصفقات حول الوظائف الأسترالية، حوار كلنتون-ترامب و لقاء المركزي الأوروبي

As we expected, the BOC didn't downgrade its forecasts as much as feared or offer an outright dovish tilt in the statement. That sent USD/CAD a cent lower to 1.3000. The surprise came later when Poloz said they “actively discussed” more stimulus. It led to a reversal in USD/CAD and eventually to a session high 1.3137 as oil climbed on another tighter inventory report.

The strategy for the BOC is to hint that a hike could be on the table without making any promises. One of the lessons of the past couple years of central bank decisions is that doing exactly what you've promised can backfire. When central bankers clearly foreshadow a hike, the market expects it then prices in even more. The result is for markets to end up unimpressed.

A surprise, on the other hand, can help to trigger the animal spirits and grab headlines. The risk is that markets are overly surprised and worry the central bank sees yet-undetected problems or that the central bank appears sloppy and loses credibility.

Poloz walked that line in the past and delivered a surprise rate cut in 2015 that helped to stimulate the economy, weaken the currency and he managed future expectations by calling the move 'insurance' against future trouble.

In all likelihood, he's setting up something similar for early 2016. The BOC is clearly not in neutral mode but it judged that market pricing of only a 14% chance of a cut in January was closer to 'shock' than 'surprise' so he offered the hint about an active discussion on cutting.

The risk is that he's shown his hand because the market has seen it before and markets will now begin to aggressively price in a hike and drive USD/CAD higher. What might make that difficult is that oil is trading at the highest since July 2015.

What could give the US dollar a tailwind is the Fed. Dudley is on the agenda at 2345 GMT and could offer hints on a December rate hike. However, the topic of the speech is NYC economic history so it's equally likely to be a dud.

One thing on the agenda that's sure to move markets is the Australian employment report for September at 0030 GMT. The consensus is for a +15K rise but watch the full/part-time breakdown. Technically, AUD/USD broke and closed above the key 0.7700 level Wednesday. That's the highest close since April although several intraday peaks in the interim were higher, with the highest at 0.7756. That's a level to watch through the data.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Dudley Speaks | |||

| Oct 19 23:45 | |||

| Employment Change | |||

| 15.2K | -3.9K | Oct 20 0:30 | |

Ashraf on BNN Earlier Today

Ashraf's interview on BNN about European earnings and the latest spin in Pre-Brexit negotiations. Interview.

Cable Corrects, China GDP Next

A bump higher in UK inflation led to a climb higher in the pound on Tuesday it what could be the start of a retracement. The euro was the laggard on the day as it continues to struggle to make or hold gains. The focus is on a trio of Chinese data releases later, including GDP. The latest video for Premium subscribers, focusing on the existing trades ahead of the US presidential debate, UK and Aussie jobs and ECB conferece has been posted and sent.

UK CPI ticked above expectations at 1.0% compared to the +0.9% consensus but the higher result tapped into market angst about higher inflation due to a weak pound. The larger theme that could give the pound a lift is talk and speculation about softening the Brexit and the uncertainty around legal challenges.

On the day, cable climbed 110 pips at touched 1.2300 at the high from a low of 1.2171. That's a small bite out of the fall in the past two weeks but it illustrates how any good news from here could lead to some short covering in the crowded GBP-short trade. On the upside, even a recovery to 1.26 or 1.28 would change almost nothing in the underlying trend of GBP weakness.

In economic data Tuesday, US CPI met expectations at 1.5% y/y. It remains below target and inflation is not a main factor driving the Fed.

The lesser-touted release on the day was Canadian manufacturing sales, which were up 0.9% compared to +0.3% expected. That's notable because the BOC decision is on Wednesday. The stronger data fits in with a great Canadian jobs report and upbeat GDP. The market is short CAD but with oil strong, the government spending and data beating estimates, the risk is that Poloz returns to his usual optimistic self and boosts the loonie.

Before that, the focus shifts to China where Q3 GDP data is due at 0200 GMT. The consensus is for 1.8% growth q/q and 6.7% growth y/y. Those numbers may be skewed lower by the latest trade numbers, which were far slower than expected. If that's the case, watch out for risk aversion in Asia and Europe. Along with GDP, numbers on Sept retail sales and industrial production are due. Sales are expected up 10.7% y/y and industrial production forecast to rise 6.4%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Gross Domestic Product | |||

| 6.7% | 6.7% | Oct 19 2:00 | |

| CPI (y/y) | |||

| 1.0% | 0.9% | 0.6% | Oct 18 8:30 |

| Manufacturing Sales (m/m) | |||

| 0.9% | 0.3% | 0.1% | Oct 18 12:30 |

ويبينار الاربعاء قبل الحوار

ندوتي الاربعاء قبيل الحوار الحاسم الاربعاء الثامنة مساء مكة. موعد الحوار بين كلينتون وترامب احجز مكانك

Another Dull Bounce, Debate Looms

Like on Thursday, there was an attempt to beat back dollar strength but once again it was lackluster. The New Zealand dollar was the top performer while the pound sterling lagged. One spot to watch in the day ahead is leaks related to the US election. NZD is firmer after Q2 CPI slowed to a higher than expected reading. A 3rd NZD trade has been issued on NZD.

Last week we wrote about the inability for any asset to sustain a bounce against the US dollar. It was underscored on Friday as the dollar rallied with EUR/USD hit especially hard. Monday was a similar story.

The US dollar sagged but it was such a small move compared to recent gains that it only highlights the firm hands buying dollars. One catalyst was the Empire Fed as it fell to the lowest since April at -6.8 vs +1.0 expected. Industrial production met estimates at +0.1% m/m.

A speech from the Fed's Fischer didn't touch on the current outlook for monetary policy but highlighted a growing Fed theme: That beyond a December hike, rates will stay low. He said a small overshoot in employment wouldn't be a problem. Coming from a sometimes-hawk like Fischer, it's notable.

An out-of-the-box theme that could grab headlines in the day ahead is Wikileaks and the US election. Internet for Julian Assange was cut off at the Ecuadorian embassy and the organization said contingencies have been activated. Assange has said the most-damaging leaks to Clinton were coming last and there is the potential he could upend the election.

New Zealand CPI slowed to 0.2% y/y and q/q vs exp 0.0% q/q and 0.1%.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.2% | 0.0% | 0.4% | Oct 17 21:45 |

Yellen Still a Dove

A Friday speech from Janet Yellen didn't offer any hints on a December hike but it underscored that rates will be very slow to move higher so long as she leads the Fed. The Canadian dollar was the top performer last week while the pound sterling lagged. Yen longs were scaled back in the weekly CFTC report. On Friday, we took profit in our AUDNZD trade and were stopped out in our long EURCAD (before the latter rebounded on oil's decline). There are 11 Premium trades currently open, 6 in currencies. 2 in metals, 1 in energy, 2 in equity indices.

Early-week moves in the forex market are minimal after most major markets finished Friday close to flat. The key metric in the US retail sales report was the control group and it rose 0.1% compared to +0.4% expected. Today starts with Eurozone CPI and US industrial production.

Yellen's speech on Friday underscored a growing Fed admission: Confusion. She highlighted that the relationship of inflation to the jobs market is weaker than historically but it isn't clear why. It was generally a theoretical speech but she said that the ideal policy may be to stay extra-accommodative in recoveries.

Her comments highlight the uncertainty about the path of rates in 2017 if the Fed hikes. The FOMC started out 2016 forecasting four hikes and it will likely settle for one. Next year, Yellen is likely to chart a more-cautious path.

On the weekend, the Japanese press highlighted that the BOJ is likely to downgrade its inflation forecast at the Nov 1 meeting. What's not clear is what tools the BOJ could deploy next to counteract it.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.

EUR -93K vs -82K prior JPY +46K vs +69K prior GBP -95K vs -98K prior CHF -9K vs -3K prior AUD +26K vs +24K prior CAD -12K vs -14K prior NZD -8K vs -8K prior

Yen longs were scaled back, likely in a slow reaction to the break to the highest levels since late July in USD/JPY. The push higher in Treasury rates is an under-reported factor and chatter about a reverse Operation Twist will add fuel to the trade.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Fischer Speaks | |||

| Oct 17 16:15 | |||

| RBA Gov Lowe Speaks | |||

| Oct 17 21:10 | |||

| Eurozone ECB President Draghi Speaks | |||

| Oct 17 17:35 | |||

| CPI (q/q) | |||

| 0.0% | 0.4% | Oct 17 21:45 | |

| Eurozone Final CPI (y/y) [F] | |||

| 0.4% | 0.4% | Oct 17 9:00 | |

| Industrial Production (m/m) | |||

| 1.3% | 1.5% | 1.5% | Oct 17 4:30 |