Intraday Market Thoughts Archives

Displaying results for week of Feb 16, 2014Yuan's Unusual Decline Pre-G20

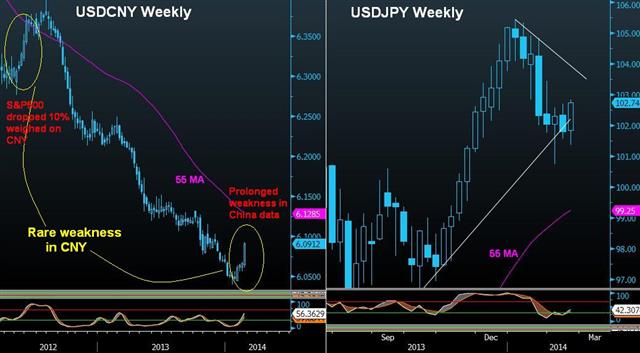

China's yuan is undergoing its highest weekly decline vs. the US dollar since January 2012. It is also the first string of four consecutive weekly declines since May-June 2012, a period coinciding with a 10% sell-off in the S&P500—the last time the US index fell by such magnitude. Why is that and what does it mean?

A Tale of Two Factories

The market is desperate to understand if weather or an economic slowdown is behind the weakness in economic data but the picture is no clearer after a pair of manufacturing surveys on Thursday. The Markit national PMI rose to a four-year high of 56.7 versus 53.0 expected while the Philly-area survey slumped to -6.3 compared the +8.0 consensus, a one-year low.

Initial jobless claims were virtually in-line with the 335K consensus while CPI matched the 1.6% y/y consensus. Negative news came from the China PMI and a sour forecast from Wal-Mart but the market choose to focus on the slice of good news in the Markit report.

USD/JPY rose to 102.40 from as low as 101.67. The S&P 500 rose 11 points to erase the decline from a day earlier.

Another notable moves was the rise in cable. It jumped to 1.6700 after the BOE's Weale said an early rate hike couldn't be ruled out but the pair wasn't able to hold the games and later slumped to a session low of 1.6626. The inability to climb on good news suggests the short-term appetite for the pound is fading but it could also be a case of caution ahead of Friday's retail sales report.

But first, at 2350 GMT, the Bank of Japan releases the minutes of the January 21-22 meeting. The market will be looking for clues on how or when the BOJ could offer further stimulus, especially with the consumption tax looming.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Retail Sales (DEC) (m/m) | |||

| -0.4% | 0.6% | Feb 21 13:30 | |

| Retail Sales ex Autos (DEC) (m/m) | |||

| 0.0% | 0.4% | Feb 21 13:30 | |

| Retail Sales (JAN) (m/m) | |||

| -1.0% | 2.6% | Feb 21 9:30 | |

| Retail Sales ex-Fuel (JAN) (m/m) | |||

| -1.4% | 2.8% | Feb 21 9:30 | |

| Retail Sales (JAN) (y/y) | |||

| 5.0% | 5.3% | Feb 21 9:30 | |

| Retail Sales ex-Fuel (JAN) (y/y) | |||

| 5.0% | 6.1% | Feb 21 9:30 | |

| PMI [P] | |||

| 48.3 | 49.4 | 49.5 | Feb 20 1:45 |

| BoC CPI Core (JAN) (m/m) | |||

| 0.1% | -0.4% | Feb 21 13:30 | |

| CPI (JAN) (m/m) | |||

| 0.1% | -0.2% | Feb 21 13:30 | |

| CPI - Core (JAN) (m/m) | |||

| -0.4% | Feb 21 13:30 | ||

| BoC CPI Core (JAN) (y/y) | |||

| 1.3% | 1.3% | Feb 21 13:30 | |

| CPI (JAN) (y/y) | |||

| 1.3% | 1.2% | Feb 21 13:30 | |

| Continuing Jobless Claims | |||

| 2,981K | 2,970K | 2,944K | Feb 20 13:30 |

| Initial Jobless Claims | |||

| 336K | 335K | 339K | Feb 20 13:30 |

| Jobless Claims 4-Week Avg. | |||

| 339K | 337K | Feb 20 13:30 | |

Can't Ignore the Kiwi

Three weeks remain until the next interest rate decision of the Reserve Bank of New Zealand, which is widely expected to produce a 25-bp hike to 0.75%, the first tightening since June 2010. Milk, poultry and consumer confidence are all pointing higher. Full charts & analysis here.

Loonie Limping Again

Bad weather, trouble in emerging markets and Canadian dollar weakness; Wednesday was a microcosm of the year so far. The pound was the top performer once again and the loonie fell 1.5 cents in US trading. Japanese trade balance is up later.

The bad weather wrangling came after US housing starts fell to a pace of 880K in January, far short of the 950K consensus. It's always a slow month for home building but it was an especially soft reading. A month ago, Fed officials confidently brushed aside notions that soft numbers were anything but weather. On Wednesday, Lacker and Williams both edged away from that position and admitted the persistent weakness could be a problem. It won't be until the Spring that we have a better sense of the economy but numbers for March will be extremely important.

The situation in Ukraine bears watching but late in the day on Wednesday, AP reported a truce had been reached between the president and opposition. That's likely to calm short-term nerves. Earlier in the day, the army chief was sacked and as tensions rose, EUR/USD slipped. That reaction is worth remembering for future reference.

USD/CAD fell to a one-month low in European trading at 1.0910 but it only took two minor headlines to spark a complete turnaround. The first was an M&A story as a Canadian oil company bought some assets from Devon Energy for $3.1 billion. That's a small number and not likely to be the start of a trend.

The second was a 1.4% fall in Canadian wholesale sales compared to 0.4% expected. If you haven't heard about this report it's because it's a lower-tier indicator and it's also very laggy. This was the release for December.

In any case, USD/CAD shot to 1.1080 from 1.0910 after the news. The rebound in the pair came right at the 50% retracement of the 2014 gain and puts a big, bullish engulfing candle on the chart.

Looking ahead, the market will be closely watching Japanese stocks to see if US worries spread. Data will also grab headlines with January trade balance expected to show a nearly 2.5 trillion yen deficit. The good news is that exports are expected to rise 12.7% y/y.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance | |||

| -2,790B | -2,489B | -1,302B | Feb 19 23:50 |

| Adjusted Trade Balance | |||

| -1.82T | -1.56T | -1.26T | Feb 19 23:50 |

| Wholesale Sales (DEC) (m/m) | |||

| -1.4% | -0.5% | -0.2% | Feb 19 13:30 |

| Exports (JAN) (y/y) | |||

| 9.5% | 12.6% | 15.3% | Feb 19 23:50 |

| Housing Starts (JAN) (m/m) | |||

| 0.880M | 0.950M | 1.048M | Feb 19 13:30 |

Ahead of UK Jobs, BoE & FOMC Minutes

GBP attempts regaining the $1.67 figure ahead of Wednesday's jobs figures, which consist of the ILO Dec unemployment rate, seen unchanged at 7.1%; jobless claims seen -20K from -24K and average weekly earnings at 1.0% y/y from the previous 0.9%. Average earnings are equally important and bullish for GBP in the event of a steady increase. Also due at 9:30 GMT is the minutes of the last BoE meeting, which will likely regenerate the Banks' positive assessment and relazed stance towards inflation. Any renewed gains in GBPUSD should be carefully approached ahead of the release of the FOMC minutes, which will re-iterate the case for continued tapering and likely boost the USD.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Average Earnings excluding Bonus (DEC) (3m/y) | |||

| 0.9% | 0.9% | Feb 19 9:30 | |

| Average Earnings including Bonus (DEC) (3m/y) | |||

| 1.0% | 0.9% | Feb 19 9:30 | |

| ILO Unemployment Rate (DEC) ((3m)) | |||

| 7.1% | 7.1% | Feb 19 9:30 | |

| Claimant Count Change (JAN) | |||

| -20K | -24K | Feb 19 9:30 | |

| Claimant Count Rate (JAN) | |||

| 3.7% | Feb 19 9:30 | ||

100% of Dax Shares above their 200-DMA

100% of the members in the DAX-30 index are trading above their 200-day MA, vs. 73%, 79% and 71% for the Dow Jones Industrials Index, S&P500 and FTSE-100 respectively. The 100% breadth is the highest attained since June 2007. More charts & analysis here

Ahead of Tonight's RBA Minutes

This week's release of the minutes from the RBA (tonight), BoE (Wed) and FOMC (Wed) will trigger their share of market volatility as the reactions from the initial announcements are likely to be reinforced. Tonight's RBA minutes will be followed by a relative data vacuum in Australia until the Thursday release of the China HSBC manuf PMI report. Is there a pocket of opportunity for AUDUSD? Last week, AUDUSD broke above its 55-DMA for the first time since November, facing its 100-DMA ahead of the RBA minutes.