Intraday Market Thoughts Archives

Displaying results for week of Oct 17, 2021Yields Pause, Metals Jump, Dax Breaks out

Biden relayed on US TV late Thursday that Democratic Sen Sinema said she will block any tax raises at all on corporations or high earners. Perhaps that's a tactic to put pressure on her but it likely means that avenue for raising funds for a reconciliation package is done.

It will likely mean a considerably smaller package but ongoing low taxes will maintain the US corporate advantage and keep money flowing into dollars. We will continue to keep a close eye on what comes next and the potential fallout.

In the bigger picture on Thursday, there was a retracement in yen weakness that ran counter to continued stock market gains and the rise in bond yields. It's likely to be a standard dip after an extended one-way move but it bears watching closely on Friday in case it's foreshadowing a broader market move.

Economic data continues to send positive signals with a strong US existing home sales report on Thursday and a new cycle low in initial jobless claims.

For Canada, the final piece of economic data ahead of next week's BOC will be the August retail sales report. That sector has been a drag in Q3 while the rest of the economy hums. It would take an especially weak print to spoil a hawkish turn from the BOC.US Stimulus Faces Dems Barriers

Two reports on Wednesday underscored how difficult it will be for Democrats in the Senate – where the don't have a single vote to spare – to agree to a reconciliation package.

The first report said Sen Machin had mentioned to Biden the possibility of leaving the party and that he had an exit plan where he would first resign his committee position. The story cited anonymous sources but had enough detail to sound credible, though Manchin quickly and vehemently denied it.

The second report said Sen Sinema had told lobbyists she wouldn't support any tax hikes on higher earners or corporations. That would make paying for the package considerably harder and perhaps doom it. That report was thinner on details and there was no follow up as Sinema rarely speaks to the media.

At this point, it's tough to say that a deal is a big factor in market pricing. The reflation trade has sizzled in the past two weeks alongside commodities. There's a strong sense that the infrastructure portion of the deal will get done with or without reconciliation and that's the main driver for raw materials.

Housing Highlights non-Transitory Inflation

The US NAHB home builder survey rose on Monday to 80 from 76. Comments from large home builders underscore an overwhelming willingness to build, but supply chain issues and inflation make it difficult to price homes before construction begins.

That dynamic is likely why Tuesday's housing starts and building permits data was on the soft side. Starts were flat on single family homes while permits fell 7.7% in a surprise dip.

In the bigger picture, the difficulties in building homes should fuel a longer cycle of home price appreciation as demand outstrips supply. That's inflationary but it's also stimulative and will add to the savings glut in American households. It will likely resolve into stronger global growth and the US filling in some of the gap from a slowing China.

Since the financial crisis, US housing significantly underperformed developed and emerging markets, reflecting the scars from the housing collapse. But these challenges are fading, and pandemic-era shifts are creating secular demand for homes.

Within all this, keep a close eye on lumber prices, which were written off for dead two months ago. The futures market is extraordinarily thin and is outpacing the physical market but at $787 which is well above historical average prices and the August low of $472. Though it's still way below the May high of $1675, the recent trend is up.

US Consumer Resilience & NZ Inflation Surge

US retail sales rose 0.7% in September compared to a 0.2% decline expected. That compounded a 2.5% m/m rise in August. It was an impressive run of spending despite those being two months where covid would have dissuaded some in person spending. Even stripping out food, energy and building materials, sales rose 0.8% to beat the +0.4% consensus.

The initial market reaction was tepid and the dollar was caught in a downdraft into the London fix but in the bigger picture, in underscores the enormous amount of built-up savings during the pandemic and the likelihood of a spending boom – particularly if we've seen the final big wave of covid.

Monday's New Zealand CPI report highlighted the risks around more spending, especially with supply chains so challenged. Q3 prices rose 2.2% q/q compared to 1.4% expected. The year-over-year rise was 4.9%, which was the highest in more than 10 years.

The kiwi rose 20 pips on the headline. That move was tempered by talk of a new covid circuit breaker but the market would be wise to look beyond covid and the vaccination rollout continues.

Monday's US economic calendar features industrial production and home builder sentiment. The later is likely the one to watch because there are signs that housing is picking back up.

8 Bitcoin ETFs Awaiting SEC Approval

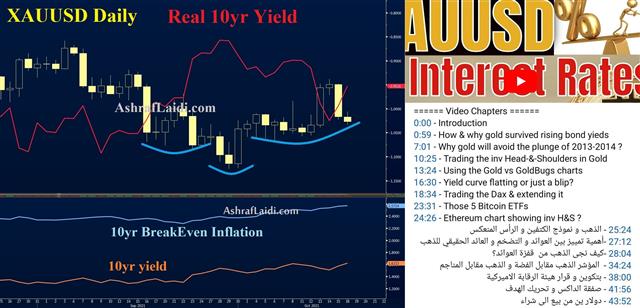

To see the list of 8 Bitcoin ETFs awaiting SEC approval this year, start watching from 23:25 mins of the video يمكن العثور على قائمة ثماني صناديق تداول بتكوين التي تنتظر موافقة من هيئة الأوراق المالية في جزء 38:02 دقيقة في الفيديو