Intraday Market Thoughts Archives

Displaying results for week of Feb 17, 2019FOMC Minutes Conflicted, AUD Dumped

The FOMC Minutes played out largely as expected but the market may be focused on the wrong things. The Aussie maintains its volatile ways, losing against all currencies after having risen initially on a strong jobs report before falling off on Reuters reports that China has banned coal imports from Australia. A new trade action was issued on the Premium index trade.

Early on Wednesday, we warned about the FOMC Minutes sending conflicting signals about the positive domestic outlook and negative signs abroad. That same paradigm unfolded as the commentary singled out soft Chinese and European growth multiple times while underscoring a solid view at home.

More importantly, the Fed signalled its intention to halt the unwinding of its balance sheet later in the year. “Almost all participants thought that it would be desirable to announce before too long a plan to stop reducing the Federal Reserve's asset holdings later this year.” This triggered interpretations that any USD positives or risk-off effect from the Fed's selling of its reserves would stabilise (possibly in the 2nd half of the year) when the unwinding dissipates.

The US dollar climbed about a quarter-cent across the board after the Minutes but this news alone is unlikely to be the spark of a new dollar rally.

One tidbit that could have a more-lasting effect came from equipment manufacturing giant Caterpillar who highlighted 'very strong' demand from China. The company has good visibility into global trends and also had one of the earliest warnings in April 2018 about slowing global growth.

Elsewhere, Fitch warned it could downgrade the UK by shifting it to ratings watch negative in an unusual move outside of the regular EU-mandated ratings schedule. The initial reaction was a hiccup lower in GBP but the statement outlined that a cut from AA would only come on a no-deal Brexit or a deal that hurts UK economic prospects.

In other Brexit news, Spain's foreign minister said the UK and EU were hammering out a deal in an interview that lifted the pound. That partly faded on skepticism that he had inside information. After all, everything from EU-UK negotiations has leaked for months. We doubt they would be able to keep that much progress under wraps.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Employment Change | |||

| 39.1K | 15.2K | 16.9K | Feb 21 0:30 |

ثلاثية الذهب والدولار واليوان

تابع الفيديو الأسبوعي الحصري لخبير الأسواق العالمية أشرف العايدي واكتشف معنا خصائص ثلاثية الذهب والدولار واليوان. الفيديو الكامل

Williams Confirms Neutral Pre Minutes

The US dollar fell across the board on a combination of Yuan-related comments (see below) from US officials and statements from influential NY Fed's John Williams tweaked the FOMC message on Tuesday in a hint that policymakers believe they are already at neutral. Today's FOMC Minutes should reveal more on the shift to neutral. A new USD trade has been issued on Tuesday night in line with the indication in Monday's Premium video. Currently, 8 of the 9 existing trades are in the green. The video also details why we confirmed our EURUSD long on Friday when the pair was at 3 month lows.

Williams on Tuesday said rates are already at neutral. That's a slight shift from earlier communication. It's a further sign that policymakers will be in no rush to hike and that the next move could be lower. Importantly, policymakers are increasingly pointing to risks abroad as a justification to wait. That means that even months of positive US economic data may not be enough to put the Fed back on a hiking path.

The dollar sagged throughout the day and risk assets rallied along with gold hitting a 10-month high. The pound was the top performer on hopes for some kind of progress on Brexit ahead of May's meeting with EU officials tomorrow. There was also talk that the Malthouse compromise is alive once again.

In trade talks, the US was said to press for a stable yuan. That's a tough thing to ask for because the Chinese currency continues to strengthen and is anything but unstable. At most this should probably be seen as a pledge to halt any quick yuan declines under any circumstances. Still, it's a boost to broader emerging market currencies and an idea that China can work with.

Looking ahead, the pound will remain in focus after the rise above the 200-day moving average on Tuesday. A poor outcome from May's meeting could send it right back below 1.2900. Meanwhile, the Fed Minutes risk sending conflicting signals on positive domestic signs contrasted with worries about growth abroad.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC Meeting Minutes | |||

| Feb 20 19:00 | |||

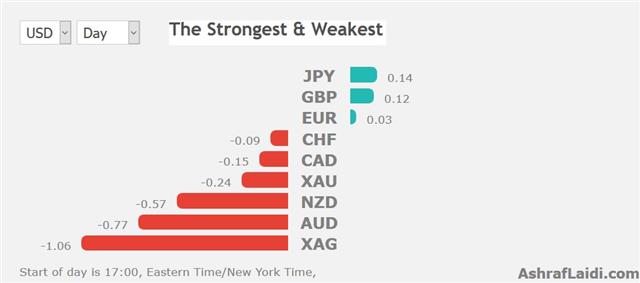

Gold Hits 1330, USD Firms

US-China trade talks resume in Washington today with the aim of striking a comprehensive deal ahead of the March 1st deadline. A sharp slowdown in auto sales sparked fresh worries about the Chinese economy Monday but the holiday-thinned market shrugged. Gold and silver are the only gainers versus the US dollar while all major currencies are down against the greenback. Another round of UK economic data is due as parliament continues to fray. The Premium video below discusses the updated EURUSD charts and analysis, GBPUSD, DAX, SPX, VIX and USDCHF.

Metals are supported by the premise that as long as gobal economic data shows no support for fresh policy tightening as inflation remains neutral. Energy prices are also pushing higher, while the Premium OIL long deepens in the green.

UK Jobs growth for December pushed higher, adding 167K for the quarter, while pay growth rose 3.4% for the year further exceeding the level of inflation at 2.1%.

Chinese auto sales fell a staggering 15.8% in January in the seventh consecutive decline. The drop underscores the challenges that policymakers face in re-stoking demand. Much of the risk trade rebound in the past six weeks has been based on the belief that Beijing can re-ignite growth with easing but that's no guarantee.The drop in sales stoked speculation of further easing and that helped to boost gold to a 10-month high and oil to a three-month high on Monday. The question then becomes: When will China's stimulus program start to to show up in the data?

The market brushed off the worries in early trading after Trump touted progress on a trade deal. At the same time, there is growing fear the US will pivot to a battle with the EU starting with auto tariffs. The Dept of Commerce is due to report on national security concerns as a justification for tariffs but the White House may keep the recommendation secret for now.

In the UK, seven Labour MPs quit the party over a shift leftwards, Brexit policy and other grievances. In the big picture it's a further fragmentation of the traditional parties, which are both struggling with internal divisions on Brexit. In the smaller picture, this may free up a handful of Labour MPs to support May's deal rather than face a hard Brexit. Cable certainly wasn't bothered as it rose 40 pips to start the week.

نراكم في دبي الخميس القادم

يسعدني بلقائكم في دبي يوم الخميس الموافق 21 فبراير/شباط - بملتقى التداول مع شركة إف إكس سي أم من 1:30 ظهراً إلى 6:00 مساءا في فندق دوسيت ثاني ـ تفاصيل التسجيل للمحاضرة