Intraday Market Thoughts Archives

Displaying results for week of May 17, 2015What Data Will Yellen Depend On?

If the Yellen-Fed had a single refrain this year it would be data dependency but at some point policymakers need to look at the numbers and decide. The pound was the top performer Thursday while USD and CAD lagged. The Fed's Williams and BOJ decision are due later. Both of our adjusted EURUSD and GBPUSD neared their final targeta as was confirmed in this week's Premium ideas and charts. EURGBP was stopped out.

Data dependency is more of a question than an answer. Since the Fed has hammered home the point about waiting for good news to hike, the numbers have been almost uniformly soft. It was underscored once again on Thursday with the Philly Fed at 6.7 compared to 8.0 expected, the Markit PMI at a 14-month low, existing homes sales at 5.04m vs 5.23m expected and initial jobless claims fractionally soft.

The US dollar shrugged off the numbers and only took a small step back after 3 days of strong gains but that could change if Yellen indicates some uneasiness at a speech on Friday. If the Fed wants to be data dependent, at some officials have to accept the data for what it is rather than reaching for excuses.

If Yellen indicates less confidence in the outlook the dollar will slide but she's also likely to be careful not to raise alarm bells. Either way, the chances of a September rate fall with every soft economic report.

One person who will almost assuredly brush off the economic data is the Fed's Williams in a speech at 2300 GMT. His San Francisco Fed authored the latest report question Q1 seasonal adjustments. That rhetoric has gone a long way toward the USD bounce this week and don't expect him to back down. In any case, the speech may be a bust because the title indicates it will focus on financial reform.

Up later is the BOJ decision. There is no set time but it's usually out at 0230-0330 GMT. There virtually zero chance of a change in rates or QE but there was chatter on Wednesday about upgrading the economic outlook and that's something that will severely diminish the chance of further QE this year and boost the yen.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (MAY) [P] | |||

| 53.8 | 54.5 | 54.1 | May 21 13:45 |

| Markit Manufacturing PMI (MAY) [P] | |||

| 54.5 | 54.1 | May 22 13:45 | |

| FOMC's Williams speech | |||

| May 21 23:00 | |||

| Initial Jobless Claims (MAY 15) | |||

| 274K | 271K | 264K | May 21 12:30 |

| Continuing Jobless Claims (MAY 8) | |||

| 2.211M | 2.231M | 2.223M | May 21 12:30 |

| Philadelphia Fed Manufacturing Survey (MAY) | |||

| 6.7 | 8.0 | 7.5 | May 21 14:00 |

Intermarket convergence: bunds, oil, USD, EUR

Ahead of Friday's IFO,Draghi/Yellen speeches, here is the latest technical picture in intermarket dynamics. FX, OIL, BOND CHARTS & ANALYSIS

Five Days of Gains for USD/JPY

US trading was generally lackluster ahead of the FOMC minutes as traders analysed, and perhaps over-analysed, the contents of the report. The dollar initially slumped on headlines saying many Fed officials saw a June hike as unlikely but that was quickly discounted because the market had priced virtually zero chance of a June hike.

As a result, the US dollar fell about 30 pips across the board only to recover. One overlooked part of the report was an upgrade in medium-term Fed growth forecasts. Along with persistent talk that Q1 softness was seasonal, that could make a September hike more likely than markets anticipate.

That said, the Minutes are dated and what Fischer and Yellen say in the next two days, not to mention economic data, is far more important than Fed commentary that's three weeks old.

Yet even more important is price action and the US dollar has quietly strung together a great series of gains. USD/JPY catches our attention because it continued to rally on Wednesday even after a report in Nikkei suggesting the BOJ could raise its economic outlook today after strong GDP revisions yesterday. It would be the first hike in the outlook since 2013 and severely degrades the possibility of BOJ easing this year.

If that report out to be true, it could cause knee jerk selling in the pair but it may be an opportunity to buy in anticipation of a breakout. USD/JPY has been stubbornly solid during the recent period of USD weakness and if yields continue to rise, it will benefit.

Another event to watch in the hours ahead is the HSBC China manufacturing PMI at 01:45 GMT. The consensus is for a slight improvement to 49.3 from 48.9. We warn that trading AUD on Chinese data has been tricky in the past few months. Bad data is quickly discounted and AUD often rallies on the prospect for more Chinese rate cuts.Beyond Fed Minutes, on to Yellen’s speech

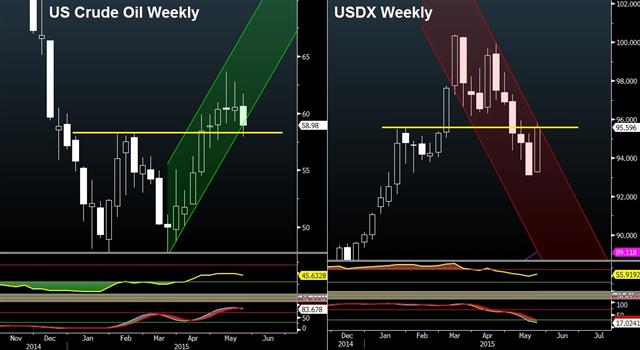

The ensuing juncture between the resurging US dollar against the shaky EUR, AUD, NZD on one hand, and oil's gradual stabilisation above the key $58 on the other will witness more clarity into Fed Chair Yellen's Friday speech than from today's release of the April Fed minutes. Full charts & analysis

Look beyond Fed Minutes into Yellen’s speech

The ensuing juncture between the resurging US dollar against the shaky EUR, AUD, NZD on one hand, and oil's gradual stabilisation above the key $58 on the other will witness more clarity into Fed Chair Yellen's Friday speech than from today's release of the April Fed minutes. Full charts & analysis

US Bulls Pounce on Good News

US housing starts were at a 1.135m pace in April compared to 1.060m expected in the best report in seven years. The reaction was immediate with the US dollar jumping 30-40 pips across the board and it continued to rally through US trading.

The start of this week has been one of the best two-day periods for the dollar since the start of the year. It was aided by incompetent managers at the ECB allowing a market-moving speech in private that publicly revealed 10 hours later. In it, the ECB's Coeure said bond purchases could be accelerated in the next two months and then pared back due to low July/August liquidity. EUR/USD tumbled as low as 1.1117.

The Canadian dollar was down for a second day as oil prices fell more than 3%. Poloz didn't have any surprises and generally retained his rosy outlook for later this year.

The positive US momentum may continue if the FOMC minutes retain an relatively upbeat outlook but the critical releases for the US dollar are on Friday with CPI, durable goods and a speech from Yellen.

In the shorter term, the focus shifts to a speech from the RBA's Lowe at 2315 GMT. The RBA has probably communicated all it intends to and is comfortable on the sidelines for now. At 2350 GMT, Japan releases preliminary GDP for Q2 and a slight improvement to 1.6% from 1.5% is expected. Later reports on Australian consumer confidence and skilled vacancies are unlikely to move AUD.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Evans Speech | |||

| May 20 7:00 | |||

| GDP Annualized (Q1) [P] | |||

| 1.5% | 1.5% | May 19 23:50 | |

| GDP (Q1) (q/q) [P] | |||

| 0.4% | 0.4% | May 19 23:50 | |

| GDP Deflator (Q1) (y/y) [P] | |||

| 3.6% | 2.4% | May 19 23:50 | |

| Eurozone CPI (APR) (m/m) | |||

| 0.2% | 0.2% | 1.1% | May 19 9:00 |

| Eurozone CPI - Core (APR) (y/y) [F] | |||

| 0.6% | 0.6% | 0.6% | May 19 9:00 |

| Eurozone CPI (APR) (y/y) [F] | |||

| 0.0% | 0.0% | 0.0% | May 19 9:00 |

| Housing Starts (APR) | |||

| 1135K | 1015K | 944K | May 19 12:30 |

| Housing Starts (APR) (m/m) | |||

| 20.2% | 9.6% | 4.9% | May 19 12:30 |

| FOMC Minutes | |||

| May 20 18:00 | |||

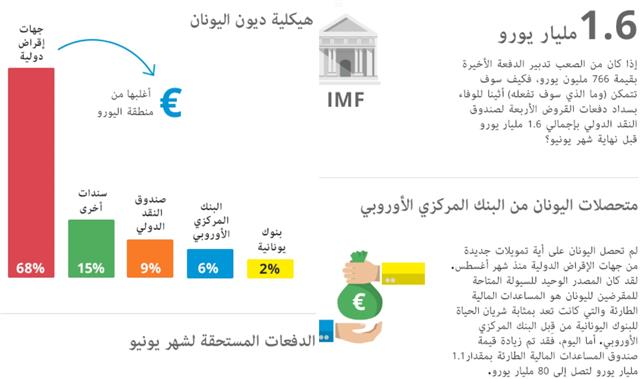

أزمة الديون السيادية اليونانية

كيف و متى سيتم السداد؟

ما الذي سوف تحصل عليه اليونان بعد السداد في يونيو؟

متحصلات اليونان من البنك المركزي الأوروبي

كل التفاصيل هنا

T-Bonds Burn, RBA Minutes Next

Bond divergence was a bigger story than just bond weakness on Monday. The US dollar was the top performer while the Canadian dollar lagged. Ashraf took a closer look at the loonie ahead of a speech from Poloz. The RBA minutes are due later.

The direction of the bond market in recent weeks has been a major driver but what was notable on Monday was the divergence. Bund yields were up 2.5 basis points while 10-year Treasury yields were up 9 bps.

This might be the start of a new stage for bonds. In the rout, everything was being thrown overboard but now market participants are looking through the wreckage to decide what's worth keeping. Ultimately, the ECB is still buying 60 billlion euros of bonds per month and that may keep bund yields pinned, at least relatively.

That was the driver Monday as EUR/USD fell to 1.13 from 1.14. Still, it's only one day and the market had little else to chew on. Economic data was limited to the NAHB housing market index at 54 compared to 57 expected.

Greek news continues to improve with Tsipras saying a deal is 'very close' and reports that the EU is ready to compromise.

The focus will shift from New Zealand to Australia in the day ahead. Yesterday, the kiwi plunged on housing curbs; something we warned about in yesterday's IMT. Australian dollar traders will focus on the release of the RBA minutes at 0130 GMT. Many of the views from the central bank were clarified in the Statement on Monetary Policy but this could be another opportunity to warn of downside risks and jawbone.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA Meeting's Minutes | |||

| May 19 1:30 | |||

| BoC Governor Poloz Speech | |||

| May 19 15:45 | |||

| RBA Deputy Governor Lowe Speech | |||

| May 19 21:15 | |||

| NAHB Housing Market Index (MAY) | |||

| 54 | 57 | 56 | May 18 14:00 |

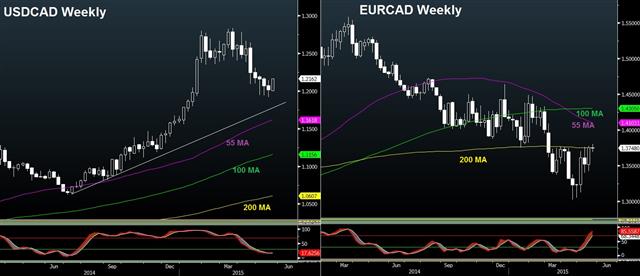

USD/CAD jumps ahead of Poloz speech

USDCAD posts its biggest daily gain in 2 months ahead of key Poloz speech . Full charts & analysis.

Tonight's Ashraf Webinar

Ashraf's webinar on USD cycles and the current EURUSD leg starts today at 15:00 ET (20:00 BST/London). Registration link

Greece Defiant, More NZ Housing Curbs

Greece will be back in focus this week as leaders continue to drive a hard line ahead of a summit May 21-22. The euro was the top performer last week while the kiwi lagged. CFTC positioning showed euro shorts remaining resilient. There are 5 Premium trades currently in progress, including EURUSD, GBPUSD and NZD. Full trades and charts are found here.

Greece refuses to compromise on labor and pension reform and that sets up a headline-heavy week but it's clear that the market is less-concerned about Greece unless a near-term default or Grexit is on the table.

On the weekend, New Zealand Fin Min English unveiled a second round of housing curbs designed to tax home-flippers and make it more difficult for non-resident buyers.

The moves increase the likelihood of RBNZ rate cuts later in the year. House prices remain hot but the underlying economy is cooling and that left the central bank in a conundrum. The latest targeted measures will allow the RBNZ to cut without worrying about fueling the housing boom.

One event to watch early in the week is RBA Deputy Lowe, who speaks at 2330 GMT.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR -179K vs -190K prior JPY -24K vs -31K prior GBP -31K vs -25K prior AUD +5K vs +1K prior CAD -4K vs -10K prior CHF +10K vs +5K prior

Euro positioning remains stubbornly short and that still means an ugly squeeze is possible. One event to watch in the week ahead is a speech from Yellen on Friday. If she downgrades the economic outlook, it could spark a rout in the pair.

The other notable move is that commodity FX positioning is now neutral for the first time in months. It shows just how reluctant traders are to pay to hold short-AUD positions.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Fed's Evans Speech | |||

| May 18 6:00 | |||

| RBA Deputy Governor Lowe Speech | |||

| May 17 23:30 | |||