Intraday Market Thoughts Archives

Displaying results for week of May 17, 2020Three Big Questions

FX and indices remain reluctant to break out of recent ranges as the euro, loonie, gold and the major indices were drawn back lower in Friday Asia & EU before stabilizing in the US session. We await some catalyst to break the recent ranges or reinforce them. As market volumes wind down ahead of the long weekend holiday in the US and UK, it's a good moment to outline the three major themes that will shape the future. And here is a chart from Ashraf illustrating the near perfect symmetry in stock market volatility achived by authorities.

1) US-China relations

On Thursday US Senators announced a bill that would sanction China over Hong Kong and that was quickly met by Beijing promising counter-measures. The news hurt broad sentiment and pulled the euro back below 1.10.It's now almost a certainty that the path of US-China relations will be increasingly antagonistic. The only question is how quickly and severely it deteriorates. Much of the prosperity and disinflation of this century has been a result of moving production to China for cheap labour and minimal regulation. Disentangling the supply chain doesn't necessarily undo that regime due to the availability of several other low-cost regions. One possible risk is that China and the US carve up the world into separate spheres in a 'with us or against us' battle. China's recent spat with Australia suggests it's not in a rush to make friends but top officials have repeatedly praised globalization and said it will continue. We're less sure but there's no reasonable path where this isn't a drag on global growth for the 2020s.

Interestingly, Emerging Markets strategists are feeling in the mood-- Citi EM team recommends buying EM FX as economies re-open, deeming them to be with the mist upside potential after the Covid-10 slump. Goldman Sachs went as far to say "buy the world's worst stocks because rebound is coming". And GMO told clients to buy the riskies of the risky: Argentina Debt.

2) The virus

We still know so little about the virus, from how many people have fought it off without symptoms to whether it can re-occur. Anti-body surveys have been over 20% in New York but are near 5% in hard-hit parts of Europe. There is no scientific consensus. The timeline and potential for a successful vaccine remains deeply uncertain. More importantly is a short-term read on how consumers will react. On Thursday, Starbucks said store sales were back to 80% of pre-COVID levels but is that a true sign of demand? Or a sign that small coffee shops don't have a drive-thru?3) The great loosening

Austerity is dead. Voters won't vote for it and politicians are increasingly enthusiastic about spending. We're undoubtedly entering an era of deficit spending but it's unclear how aggressive governments will be, or can be. At the same time, central banks have shifted to a regime where they will keep rates low until inflation has hit, or likely exceeded targets. This is a dangerous game that ends in inflation and currency debasement but Japan has demonstrated that it can go on for years before the costs are clear.All three are big, ongoing changes and add deep layers of volatility and uncertainty that we don't see reflected in markets. That won't last but for now markets are taking comfort in cheap, easy money as a remedy for everything.

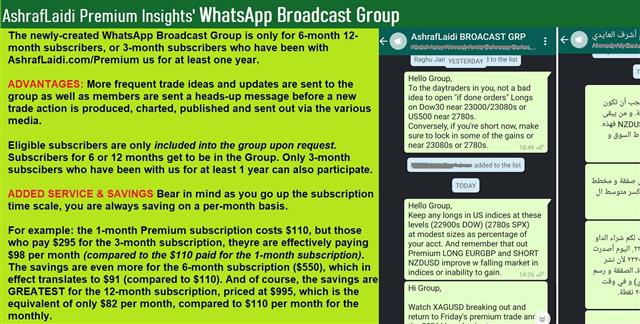

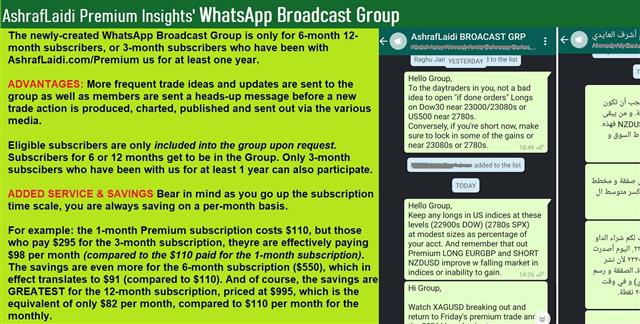

About our NEW WhatsApp Broadcast Group

Retail Traders Forcing the Issue

3% +(-) days in indices are becoming rarer by the day as authorities do their utmost to keep some sort of normalcy...in the markets. If reopening the economy is considered to be a near equivalent to monetary easing, then what would it be if the $2.2 trillion stimulus package voted on by the House of Representatives is passed by the Senate? US Treasury Secretary Mnuchin appears confident it will pass, saying “there is a strong likelihood we will need another bill”. The Fed certainly agrees. Meanwhile, Monday's announcement by Germany and France to announce a €500bn EU recovery fund, coincided with the EURUSD's jump on the same day. As much as these developments are considered to be positive for the markets, given the macro realities of 20%-bound unemployment rates, the US and EU stimulus policies are just enough to prevent indices from breaking key support levels (2740s SPX and 23000 DOW30) and US 10-year yield resistance of 0.76%. That is not stopping traders from forcing the issue (more below).

اذا كانت هناك صفقة واحدة، ماذا سأختار؟ (فيديو المشتركين)

Don't Force the Market

A common mistake from retail traders (and a recurring error of mine during 2009), especially those who feel they missed this year's selloff (or the 30% rally) is to continuously expect the next 5% down-day at each and every minor pullback. Yet, it's crucial to not become too complacent. The last sentence implies a serious balancing act in the face of stark negative macro data and active sector rotation among sectors, keeping the major indices afloat. So far, we have had winning trades in DOW30 on the long and short. But it's not getting any easier.During the 30 mins starting today (Thursday) at 14:20 Eastern Time (New York) or 19:20 London, indices took a turn to the worse, but avoided touching the session lows of late Thursday morning Eastern time. The selloff was mainly driven by energy and technology. As we enter the final hour of trading, I expect SPX and DOW30 to retest the lows, if not then, at the futures session pre-Asia open. The key for Forex traders is to figure out, which pairs to trade and how to manage them. Currently, 5 of our 6 open our Premium Insights trades are in the green, with NASDAQ100 trade 40 pts in the red. There are 2 in FX, 2 in commodities, 1 index and 1 crypto.

Join our VIP WhatsApp Broadcast Group

GBP Hit as BoE Re-ponders Negative Rates

The pound reversed an early gain on Wednesday after the BOE said it would ponder negative rates. GBP lagged on the day while the kiwi led for the second day. The day ahead features several key US sentiment surveys and weekly initial jobless claims.The pound gave back gains after BoE governor Bailey said negative rates were under "active review", making him the 2nd official to open the possibility on the subject, less than one week after he struck down the idea. Cable had traded as high as 1.2285 and pulled back 55 pips in the aftermath. EUR/GBP rose. After 6 weeks of false breaks and hesitancy, the EURGBP Premium long finally broke out intermediate resistance --currently 150-pips in the green. The Premium video below focuses on metals and indices.

Bailey was clear that they're simply exploring the issue, but by repeatedly floating the idea, it begins to send that message that something is coming and they risk painting themselves in a corner or whipsawing the market.

Moreover, the suspicion is that openly talking about it is a real hint. Delving into the possibility and logistics of it is something a central bank should do in private before putting it out there.

The flipside of that messaging was demonstrated by the Fed and BOC Wednesday. The FOMC undoubtedly has been discussing the idea but there was no mention of it in the April 29 minutes, except to highlight that a survey of dealers showed they're not expected. The BOC's Lane offered a 'never say never' line but that 0.25% was the lower bound.

Other market-moving news was a Senate bill that will make it tougher for Chinese companies to list, or stay listed on US exchanges. That was coupled with more aggressive anti-China talk from Trump on twitter. It was a reminder that US-China relations are crumbling.

In any case, the fundamentals of the market remain extremely difficult to navigate and the technicals are improving. AUD/USD rose above its recent range to a two-month high, oil rose for a fifth day, stocks rose. Looking ahead, EUR/USD is threatening the key 1.1020 top and USD/CAD is threatening a break of the post-pandemic low.

In terms of news, the day ahead is expected to feature another 2.4m US jobless claims but despite the breaktaking losses so far, the market has paid no attention to this release. On the flipside, global PMIs have been stronger than expected this week and next up are the US services and manufacturing surveys from Markit. A beat would put the market to a different kind of test. If the market cheers better news, it could add fuel to the fire for risk assets.

Vaccines Vex, Inflation to Fall

Risk trades on Tuesday brushed up against the range tops but retreated late in the day on second thoughts about COVID-19 vaccines. The New Zealand dollar was the top performer Tuesday, while the yen lagged on the BoJ's announcement to go deep in leverage (more below). Several inflation reports are due on Wednesday. Gold and silver made a convincing rebound, highlighting their well preserved trendllines. NASDAQ100 continued to try and fail in regaining the February gap, ditto for DAX, while SPX and DOW30 couldn't get near the April highs. Each of the 6 Premium trades are currently in the green. While everyone is cheering silver, here is one of the charts Ashraf sent out on May 8th to Premium subscribers, 6 days before XAGUSD posted its biggest jump in 6 years. The 6-month 55-MA breakout cycle appears too obvious...after the fact.

A Statnews report highlighting the lack of data in Moderna's purported successful vaccine trial undid some of the optimism about the vaccine from Monday. Some of that stems from a secondary equity offering the company did on Monday after shares rose 20%.

More importantly, the intraday reversals on that news underscored the recent range tops on a number of fronts including AUD/USD, USD/CAD, USD/JPY and US stocks. Those all continue to be a better gauge of where markets are heading than uneven news flow.

On the fundamental side of things, Powell didn't add anything new and other Fed officials joined in on his campaign urging congress to spend more.

It was a different story in Europe, where Germany and France joined together to announced aspirations for a grant program that could be as large as 500 Bn euros, which is larger than rumored. More details will emerge next week but, as always, the reaction in the euro was half-hearted. It initially made a solid move then backtracked owing to the usual doubts about the ability to execute and the long timelines.

In Japan, it was a different story as the BOJ moved up the timeline for its meeting to Friday. Local reports said the BOJ will add leverage for a business lending program. That sparked a broad slump in the yen and helped to boost gold.

Looking ahead, the top data to watch is inflation in the UK, eurozone and Canada. Price rises everywhere are expected to slow dramatically in year-over-year terms and in Canada they're forecast to turn slightly negative. The issue at the moment is measurement and interpretation. Due to stockpiling, shortages and the crushing drop in energy, the picture about what's next isn't clear. Still, at face value the numbers will clear the way for more easing, including potentially negative rates from the BOE.

In the longer-term, the enormous growth in deficits spending and money supply will make inflation a defining feature of the decade and a critical debate.

Gold & Silver Holding as Long as This Happens

The elusive R continues-- Epidemiogists are seeking to determine the R value – the effective “reproduction number” at which a virus spreads, economists are looking to estimate the depth and length of the current Recession and equity strategists are racing to ride the latest Rotation in sectors. Today, US stocks posted their biggest gain since early April on a combination of improved prospects of an effective vaccine from US biotech player Moderna. That's the fundamental explanation. What about the technical/quantitative explanation? (see below). Meanwhile, metals pulled lower but gold & silver remain well above their medium term trendline support as long as i) FedFunds are still pricing negative rates later this year and; ii) real rates are negative (10-year yield minus inflation). Thursday's Premium long in the DOW30 hit its final target at 24380 for 1120-pt gain. A new Premium trade has been issued shortly after the cash close, backed by 2 charts and 4 explanatory notes.

So why did we choose to take the long in Thursday when markets were still bleeding from Wednesday's losses? Some of the answers are related to the Gold/SPX ratio, sector rotation in the 1st 45 minutes of NY cash trading and consistent technical in major USD pairs. In summary, there were plenty of signs showing eroding momentum in Wednesday's selloff, which were consistent with metals' behaviour and intermetals technicals.

So far, we have 6 open Premium trades, all of which are in the green, led by XAUUSD and XAGUSD, bought at 1690 and 17.50 respectively.

From year-to-date to 5 days-to-date

Year-to-Date, technology is the only sector in the green, followed by health care (XLV) and consumer discretionary sectors (XLY) barely in the red. The worst sector remains energy. The situation of the past 5 trading days, however, appears starkly different. Economically sensitive sectors such as materials (XLB) and industrials (XLI) are in the lead along with energy, while defensive sectors such as healthcare and consumer staples are the worst performers (XLP). The untouchable Technology sector (XLK) is the 8th worst performing sector out of the major 11 sectors, reflecting the pause in tech, to give way for XLB, XLI.How long can we rely on fed funds futures signalling negative rates by year-end to help indices?

What's Special about the WhatsApp Broadcast Group?

And regarding Thursday's DOW30 trade, the regular Premium clients made 1120 pips if they got in at the entry til the final target, but members of our NEW WHATSAPP BROADCAST group made +1300 pts as they got the heads up before the trade was published. The same story with last Friday's silver trade, when I announced to the Broadcast Group that i'd be issuing a long in XAGUSD. By the time the trade was written, charted and published, silver had moved. And the same applied to last week's NZDUSD short trade.