Intraday Market Thoughts Archives

Displaying results for week of Aug 17, 2014Yellen’s neutrality sufficient for dollar bulls

Market reactions are driven by not only the outcome of a data release, report officials' remarks, but particularly by the prevailing expectations leading to these events. Thus, none of Yellen's balanced remarks would have particularly been hawkish or positive for yields and the US dollar, had it not been for the predominant expectations for a dovish speech. Yellen's remarks provided a boost for the dollar, without dragging down equities. Full piece & charts.

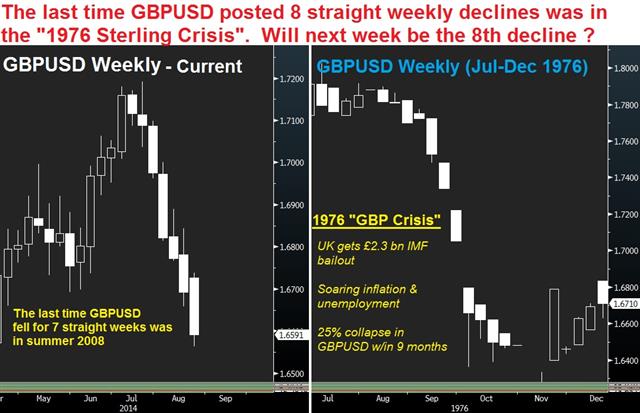

GBPUSD Pattern Recalls 1976 Crisis

This week, GBPUSD will post its 7th straight weekly decline, which would be the longest losing streak since summer 2008, when Bank of England intensified its easing campaign. If GBPUSD also falls again next week, it will be the EIGHTH consecutive decline, something not seen since the 1976 sterling crisis.

Sometimes it’s Best to Bet on Second Place

The reason that betting on the second best performer in a trend is that the hot money tends to flood into the leader. In this case it's the US dollar and on some metrics that move is beginning to look overdone. When the inevitable correction comes, second best is the safe place to be.

On Wednesday, the US dollar continued to outperform following the FOMC minutes. The knee jerk came on headlines that said “many” Fed officials said job gains could bring a sooner rate rise. The market generally moves on the headlines and looks deeper later. The actual text was more nuanced saying that “if” progress toward objectives was quick “it might” be appropriate to hike sooner.

In any case, the market voted for the US dollar, sending USD/JPY to 103.85 (near the April high) while the euro and cable continued to trace out cycle lows.

We argued for US dollar strength early in the week but the market will now laser in on Yellen's speech and the dollar bulls sitting on profits are likely to head to the exits.

AUD/USD is one spot a retracement could materialize but in the short-term the risks come with the HSBC China PMI at 0145 GMT.

Barring a surprise from the 51.5 consensus there's a base in the Australian dollar that could last. Stevens' comments yesterday basically ruled out a rate cut and removed the threat of intervention. If risk assets continue to rise the carry trade could also give the Aussie a lift.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Markit Manufacturing PMI (AUG) [P] | |||

| 55.7 | 55.8 | Aug 21 13:45 | |

| PMI (AUG) [P] | |||

| 51.5 | 51.7 | Aug 21 1:45 | |

| Eurozone Markit PMI Composite (AUG) [P] | |||

| 53.4 | 53.8 | Aug 21 8:00 | |

| Eurozone Markit PMI Manufacturing (AUG) [P] | |||

| 51.4 | 51.8 | Aug 21 8:00 | |

| Eurozone Markit Services PMI (AUG) [P] | |||

| 53.6 | 54.2 | Aug 21 8:00 | |

Dollar Beginning to Break Out, Stevens Next

We wrote yesterday about the lack of enthusiasm for Yellen's speech and overall complacency on the Fed. An overwhelming consensus of analysts sees nothing but endless calls for patience and slow steps to raising rates. The consensus is so clearly dovish that we argued there is little risk in betting on a more hawkish stance and stronger dollar.

That's part of what happened on Tuesday as the US dollar broke out of a recent period of consolidation against the euro and continued to punish the pound following 7 weeks of declines in cable. The next shoe to drop could be USD/JPY as it flirts with 103.00.

All eyes were on the CPI report heading into the session but prices rose 2.0% y/y as expected and other measures were also in-line. Instead the market shifted focus to a strong housing starts which rose to 1063K compared to 969K expected. That gave traders a reason to buy the dollars and technical breaks accelerated the moves into one of the better days for the US dollar in months.

On Wednesday the market will turn to the FOMC minutes but the focus in the coming hours shifts to Australia where Stevens appears in the House of Representatives for his semi-annual grilling at 2330 GMT. It should be fairly easy for him to commit to a wait-and-see approach but he's an off-the-cuff sort of leader so be ready for anything.

The other main event is at 2350 GMT when Japan releases trade data for July.| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA's Governor Glenn Stevens Speech | |||

| Aug 19 23:30 | |||

| Housing Starts | |||

| 1.093M | 0.969M | 0.945M | Aug 19 12:30 |

| Housing Starts (m/m) | |||

| 15.7% | 8.6% | -4.0% | Aug 19 12:30 |

| FOMC Minutes | |||

| Aug 20 18:00 | |||

Managing EURAUD

EURAUD sustains its 3rd consecutive quarterly decline, which is the longest losing streak in over four years as Aussie data defy the waning warnings about China, the RBA gives up on talking down its currency and the ECB enters negative interest rates. The lack of viable safehaven alternatives in FX has increasingly paved the way for commodity currencies such as CAD and AUD. But has the RBA had enough? Will RBA governor Stevens reiterate his usual pessimism in order to stall the Aussie's latest bounce in his speech tonight? Or will today's Aussie confidence figures trump any impact from the Governor? We could also go on about the importance of Thursday's release of the flash August services and manufacturing PMIs from the Eurozone. Since we opened two Premium shorts in EURAUD more than 4 weeks ago, a net of 180-pips has accumulated in both trades. The key with these trades is not only determining the correct direction, but also managing stops carefully. Full details of these trades and today's charts are found in the Premium Insights.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| RBA's Governor Glenn Stevens Speech | |||

| Aug 19 23:30 | |||

UK CPI Eases Carney's Job

The latest soft inflation data as well as the earnings figures couldn't have come at a better time for the Bank of England's MPC members wishing to dampen expectations of early tightening. Here is what it means for GBP.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (JUL) (m/m) | |||

| -0.3% | -0.2% | 0.2% | Aug 19 8:30 |

| CPI (JUL) (y/y) | |||

| 1.6% | 1.8% | 1.9% | Aug 19 8:30 |

| Core CPI (JUL) (y/y) | |||

| 1.8% | 2.0% | Aug 19 8:30 | |

The Yellen Fears Have Faded

The two main US events this week are the FOMC minutes and Jackson Hole but nearly no one is worried about a surprise from the Fed Chair. Reading preview after preview, a clear consensus has emerged – Yellen will continue to preach patience and downplay jobs gains.

We agree that's the most likely outcome but a strong consensus is a dangerous thing. Throughout the summer we argued that markets were underestimating Yellen's will to stay dovish but now it might be the opposite.

It's clear the Fed has begun taking baby steps toward raising rates. If Yellen maintains the tone of the FOMC statement the downside risk for the US dollar and bonds is minimal but if she's more hawkish – even if it's a misinterpretation – the upside in the dollar could be considerably more.

In the meantime, it's clear that concerns about Russia/Ukraine are fading. The headlines have less shock value despite no signs of peace. The Ukraine confirmed that 1,200 rebel fighters crossed into the country and that will surely mean more trouble while Russia has almost abandoned all pretense of neutrality.

In the hours ahead the focus will be on AUD and NZD. At 2245 GMT New Zealand's quarterly PPI numbers are out and the inflation expectation survey is out at 0300 GMT. The RBNZ signaled a wait-and-see approach but signs of inflation could get the market excited about hikes again.

For the Aussie, look to the 0030 GMT release of the RBA minutes. For more thoughts on AUD and NZD, check out Ashraf's latest Premium Insights.| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (JUL) (m/m) | |||

| -0.2% | 0.2% | Aug 19 8:30 | |

| Core CPI (JUL) (y/y) | |||

| 2% | Aug 19 8:30 | ||

| CPI (JUL) (y/y) | |||

| 1.8% | 1.9% | Aug 19 8:30 | |

| RBA Meeting's Minutes | |||

| Aug 19 1:30 | |||

| Producer Price Index - Input (Q2) (q/q) | |||

| 0.7% | 1.0% | Aug 18 22:45 | |

| Producer Price Index - Output (Q2) (q/q) | |||

| 0.8% | 0.9% | Aug 18 22:45 | |

| RBNZ Inflation Expectations (Q3) (y/y) | |||

| 2.4% | Aug 19 3:00 | ||

Revisting AUDNZD

We bring back AUDNZD to the Premium signals after each of our last two trades in July and March hit their final targets at 180 pips and 300 pips respectively in the cross. Nearing 8–month highs, AUDNZD may be reaching another top as RBA Governor Stevens is set to speak later this week? Or, will the Aussie break on through the 1.10 ceiling as New Zealand fundamentals deteriorate? We weigh these forces against the Aussie's volatile tendencies during falling equities. This trade as well as the AUDNZD Premium trade are in order ahead of Wednesday's semi-annual testimony and the Westpac leading index. Meanwhile, our GBPUSD and GBPAUD trades remain in progress ahead of Tuesday's UK CPI. Full details of trades & charts are found here.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (JUL) (m/m) | |||

| -0.2% | 0.2% | Aug 19 8:30 | |

| Core CPI (JUL) (y/y) | |||

| 2% | Aug 19 8:30 | ||

| CPI (JUL) (y/y) | |||

| 1.8% | 1.9% | Aug 19 8:30 | |