Intraday Market Thoughts Archives

Displaying results for week of Sep 18, 2016Two Reasons For USD Strength

The two reasons for USD strength are Hillary Clinton and Donald Trump. Oddsmakers give Clinton about a 65% chance to win but Trump has closed in the polls. In this environment, there is no telling what will happen but one theme permeates from both candidates – spending.

The era of fiscal discipline is over in most countries but a divided government in the US has led to a standstill. No matter what happens on Nov 8, the winner will is likely to be handed a window to govern. Despite the usual chatter from the fiscal hawks, expect looser purse strings in 2017 and that's an upside risk to growth and inflation projections.

In the short-term, however, the election isn't yet a main market driver. On Thursday, initial jobless claims were at 252K compared to 261K expected but existing home sales were soft at 5.33m versus the 5.45m consensus.

The mode in markets remained 'buy everything' with stocks, bonds and commodities all picking up where they left off after the FOMC decision. The dollar slipped for most of the day but found a bid later and rebounded a half-cent against the euro. Keep a close eye on yields for a signal about what's coming next.

The economic calendar focuses on Japan as the Asia-Pacific week winds down. At 0030 GMT the Nikkei PMI for Sept is due. The August reading was 49.5. The all-industry index is also on the schedule and forecast to rise 0.2%.| Act | Exp | Prev | GMT |

|---|---|---|---|

| Flash Manufacturing PMI | |||

| 52.1 | 52.0 | Sep 23 13:45 | |

| Eurozone Flash PMI Manufacturing | |||

| 51.5 | 51.7 | Sep 23 8:00 | |

| All Industries Activity (m/m) | |||

| 0.2% | 1.0% | Sep 23 4:30 | |

| Unemployment Claims | |||

| 252K | 261K | 260K | Sep 22 12:30 |

Central Bank Gridlock

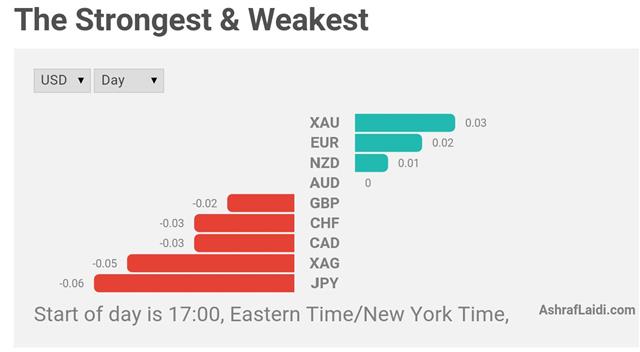

The trio of central bank decision on Wednesday highlighted the hope and skepticism that surrounds major economies. The yen was the top performer while the US dollar lagged. We break down the path forward. The Premium Insights closed the GBPUSD and USDJPY trades at 230 and 250 pips respectively. 2 new trades were posted, one of which has been filled.

The yen strengthened throughout European and US trading to finish at the best levels of the day. The BOJ is betting that locking in JGB rates and promising to exceed the 2% inflation target will be the tonic that finally cures a generation of malaise. The FX market has already voted against it.

USD/JPY is now pushing against some critical technical and psychological levels as it finished on the lows at 100.30. It could get ugly quickly from here if real money follows up the central bank moves by buying the yen on Thursday.

The Fed didn't help by hiking rates, although three dissents and Yellen's comments show there will probably be a hike this year. In the press conference she said that so long as decent job gains continued and there weren't any shocks, surprises or a crisis, a hike is coming before year-end.

On the face of it, that's hawkish but it was combined with some troubling admissions in the longer term. Fed forecasts on growth and inflation were cut and that pushed US longer-term yields, and the dollar lower. Great post-Fed risk appetite also helped commodity currencies outperform USD.

Ultimately, it's proven extremely difficult to keep the US dollar down and sentiment could switch before the weekend.

The final central bank decision was the RBNZ. They too essentially maintained the status quo and combined that with a warning that rates will need to be cut and the NZD is too strong. Initially, NZD dropped a half-cent but it rebounded soon after. The question is: when will the promised cut come? The market had priced in a 50% chance of November but with the RBNZ saying Q3 CPI will rise in the statement, that's less likely.

Overall, the theme of economic optimism for the long-term has dwindled in 2016 yet the belief that inflation will rise hasn't. We ask: Is that compatible? Or is it a reflection of central banks relying on optimism because they don't have any ammunition left?

Looking ahead, the level to watch is 100 and in Asia-Pacific trading, we will be watching for any anti-JPY jawboning from Abe's team.

The Lesson in the USD Trade

A strong market is like a strong trader: The good days are great and the bad days aren't too bad at all. The US dollar lagged to start the week but the damage was minimal in another sign of the latent buying interest. The Australian dollar was the top performer with the RBA Minutes due up next. A few Premium trades will be closed ahead of the BoJ-Fed meetings and new ones will open.

للمشتركين فقط "كسر الكتف الأيمن قبيل المركزي الياباني و الاميركي"

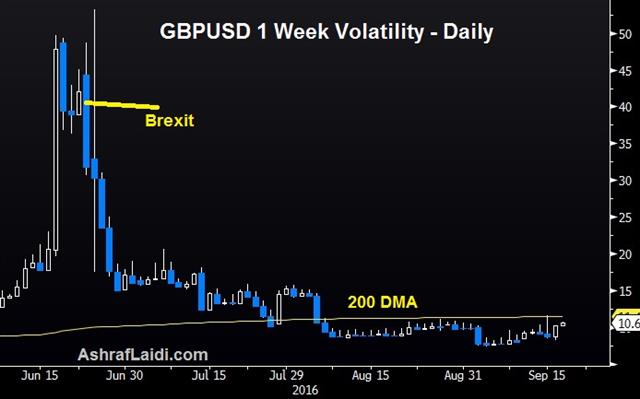

On the other side of the coin is the pound. It posted a terrible day on Friday, falling 240 pips to 1.3000. It was poised for a rebound Monday and was up to 1.3090 in early US trading but the gains slowly eroded to just 1.3030.

It's tough to imagine the dollar bid will evaporate no matter what the Fed does. What's priced in is no move, but some hawkish talk in the statement and Yellen's press conference. Anything less, and we're still likely to see the usual aggressive dip-buying we saw in the dollar after all the weak Sept data re-emerges.

In terms of economic data and news, Monday's trade was light. The NAHB housing market index was at 65 compared to 60 expected in a fresh sign that housing is the best source of US economic strength.

Looking ahead, the RBA Minutes may offer some clarity on the medium-term thinking at the central bank. The market is pricing a 10% chance of a cut in October and a 29% chance of lower rates at year end. This was the final meeting under the leadership of Glenn Stevens and now Philip Lowe will have a chance to put his stamp on the RBA.

With the transition, what's next is especially tricky to sort out. So far, there have been mixed messages, including some cryptic talk from deputy Kent that's been interpreted as a sign that the RBA might be more firmly on the sidelines than we thought. Lowe is also speaking at Parliament on Thursday.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| NAHB Housing Market Index | |||

| 65 | 60 | 59 | Sep 19 14:00 |

GBP Crumbles as Brexit Reality Bites

A trickle of pound selling turned into a floor on Friday as cable flirts with 1.30 again. GBP was the worst performer last week, while the yen topped all currencies. China returns from holiday on Monday as a busy week kicks off. A new Premium Video was issued over the weekend to highlight the latest breakouts in emerging market-related instruments and the unfolding impact on global indices and JPY crosses.

A solid UK retail sales on Thursday was undone by a Bank of England that continues to warn that Brexit pain is coming. That was compounded Friday by reports that Chancellor Hammond has given up on retaining full access to the EU market in Brexit negotiations. In addition, EU President Tusk relayed that Theresa May told him that Article 50 will likely be invoked in Jan or Feb.

None of that is a big surprise but the combination pushed cable 237 pips lower on Friday. It ended very nearly on the lows at 1.3002 and the main drama in early trading will relate to whether or not that level can hold. Or if there is early selling, whether it will be sustained in London.

What complicates the outlook is that the day ahead will be all about positioning. The BOJ and Fed decisions are major risks and flows will be tremendous in the lead-up.

To further complicate things, China returns from an extended holiday on Monday .The economic calendar features Chinese property prices at 0130 GMT. That's generally not a market driver but headline risks are high as Beijing gets back to work. So far, the pressure on the PBOC is minimal and weekend data showed Q3 China business confidence at 51.2 compared to 49.0 in Q2.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -81K vs -93K prior JPY +57K vs +44K prior GBP -83K vs -90K prior CHF +1.3K vs +1.4K prior AUD +36K vs +39K prior CAD +17K vs +21K prior NZD +5.1K vs +6.1K prior