Intraday Market Thoughts Archives

Displaying results for week of Jan 19, 2014The Years Equities Declined in January

As January deepens losses for most major equity indices, here is a look at the years when US equities, measured by the Dow Jones Industrials index, had a negative January. In fact, the last time we had a negative January was in 2010, when the Eurozone crisis was kicked off and US stocks had a Flash Crash in May. The bust of the technology bubble kicked off in 2000, which also saw a 7% decline in January. Another spectacular year of spectacular losses was 1998, when the Asian currency crisis, coincided with damage in Russia and Brazil, a classic case of emerging markets collapse. Finally, 1990, the year of the Savings & Loans crisis in the US and the 1st Gulf War, started off with a negative January before leading to a 17% decline in Aug-Nov. This analysis does not necessarily imply a decline in the whole of 2014, but 2 or 3 months of sharp declines, including the much-awaited decline of at least 10% from peak to trough in US equity indices.

Risk Battered, Not Beaten

The outlook for risk assets is worsening but we haven't necessarily hit a tipping point. The Swiss franc was the top performer while the Australian dollar lagged and hit a fresh cycle low. A busy week in Asia finishes will a quiet calendar but plenty of attention will be on the plunging Nikkei and watching whether emerging market pain spreads.

Markets have been uneasy this year despite the economic optimism. Stocks have been reluctant to rally and USD/JPY had been trapped in a tight range. The crack in the dam finally came from the Chinese PMI. It missed expectations and set off a wave of worry that grew into a tsunami as emerging markets were washed away.

The worst pain was in Argentina where the peso fell 14% but Turkey, South Africa and Venezuela all came under attack. That sparked a demand for safe assets, boosting gold, bonds and major currencies. As usual, the yen benefitted most but the euro and pound impressively kept pace.

An equally severe round of risk aversion earlier in January amounted to nothing so there's a case for patience here. If USD/JPY and the S&P 500 break through the Jan lows, serious caution is warranted.

One thing that stands out from Thursday trading is weakness in the Australian dollar. The Q4 CPI reading was significantly higher than expected yet AUD/USD couldn't rally. The correlation between US stocks and AUD has also recently flipped so lower stocks today might have been good for AUD/USD (the stock drop didn't hurt CAD or NZD) yet the Australian dollar hit a new low at 0.8732. The inability to rally in different environments is telling.

Economic data added to the malaise in markets. The US Markit PMI was at 53.7 compared to 55.0 expected while initial jobless claims and existing home sales were virtually inline with estimates. In Canada, slightly better retail sales gave the loonie a small bump.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| PMI [P] | |||

| 49.6 | 50.6 | 50.5 | Jan 23 1:45 |

| Services PMI [P] | |||

| 51.9 | 51.4 | 51.0 | Jan 23 9:00 |

| BoC CPI Core (DEC) (m/m) | |||

| -0.4% | -0.1% | Jan 24 13:30 | |

| CPI (DEC) (m/m) | |||

| -0.2% | 0.0% | Jan 24 13:30 | |

| CPI - Core (DEC) (m/m) | |||

| -0.3% | Jan 24 13:30 | ||

| BoC CPI Core (DEC) (y/y) | |||

| 1.3% | 1.1% | Jan 24 13:30 | |

| CPI (DEC) (y/y) | |||

| 1.3% | 0.9% | Jan 24 13:30 | |

| Existing Home Sales (DEC) | |||

| 4.87M | 4.90M | 4.83M | Jan 23 15:00 |

| Core Retail Sales (m/m) | |||

| 0.4% | 0.3% | 0.5% | Jan 23 13:30 |

| Retail Sales (m/m) | |||

| 0.6% | 0.3% | -0.1% | Jan 23 13:30 |

| Continuing Jobless Claims | |||

| 3,056K | 2,930K | 3,022K | Jan 23 13:30 |

| Initial Jobless Claims | |||

| 326K | 326K | 325K | Jan 23 13:30 |

| Jobless Claims 4-Week Avg. | |||

| 332K | 335K | Jan 23 13:30 | |

BoC Greenlights CAD Shorts, China PMI Next

The Bank of Canada took a tiny step toward rate cuts but that was all encouragement the market needed to buy USD/CAD. The loonie was easily the worst performer while GBP continues to lead. Up later is the first look at the Chinese manufacturing PMI from HSBC.

The Bank of Canada rate decision tells us more about the market than the central bank. Many analysts expected a shift toward a dovish stance but the BOC retained a neutral bias. That was plenty for the market as USD/CAD shot more than 100 pips higher to a fresh four-year high at 1.1093. Coming into the year, USD/CAD longs were a trader favorite and the big rally in the pair has transformed curiosity into enthusiasm.

Granted, there were some reasons to buy in the BOC statement. Officials said the Canadian dollar remained strong and Poloz said that balance of risks on inflation tilted 'just a little' toward lower disinflation worries.

One development that's not as dovish as it seems was the BOC's move to lower inflation projections. Cutting those forecasts while retaining a neutral bias allows them to shrug off lower near-term inflation readings without facing pressure to act.

Outside of Canadian dollar trading, volatility was modest in New York hours. USD/JPY remains constrained in a 105.50 to 103.85 range and until that breaks it's difficult to envision lasting moves.

The calendar highlight in Asia-Pacific trading is the Chinese flash private manufacturing PMI from HSBC at 0145 GMT. The consensus is for a four-month low at 50.3 after a reading of 50.5 last month.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Business NZ PMI (DEC) | |||

| 56.4 | 56.7 | Jan 22 21:30 | |

| Interest Rate Decision | |||

| 1.00% | 1.00% | 1.00% | Jan 22 15:00 |

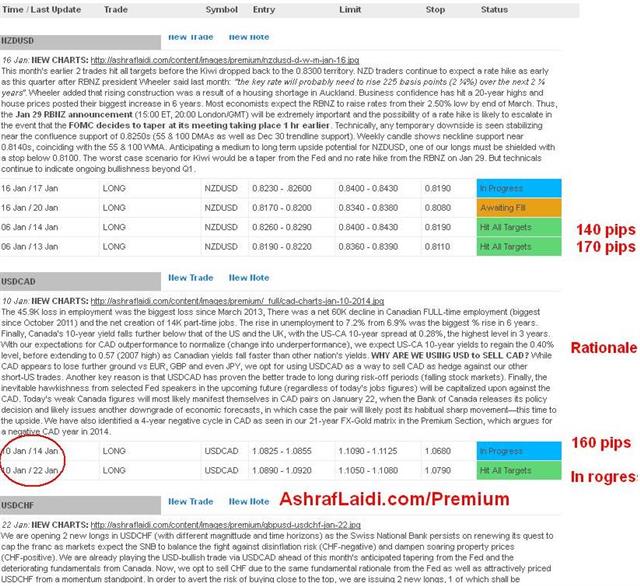

Sample of Existing Premium Trades

Here is a sample snapshot of recently-closed and existing Premium trades. This includes USDCAD, NZDUSD and USDCHF with fudamental & technical rationale for entry/exit/stops. How high can/will USDCAD and NZDUSD go? Links to charts are posted at the top of rationale.

UK Unemployment vs Real Earnings Growth

Our prolonged bullishness in GBPUSD since July continues to be backed by renewed UK upside suprises. The 7.1% figure in UK Nov unemployment is the lowest since March 2009 & 0.3% point decline from October's 7.4% is the biggest monthly drop in 17 years. But the BoE may not rush into lowering its existing 7.0% unemployment threshold. Here is why?

AUD Spikes on CPI, USDCAD Hits 1.10 Ahead of BoC

USD/CAD broke 1.10 on Tuesday, rising to a four-year high ahead of tomorrow's Bank of Canada rate decision, we look at the risks. The loonie was the laggard on the day while the pound led the way. AUDUSD soars by 100 pips in less than 30 mins following the release of stronger than expected Q4 Aussie CPI data, with Y/Y CPI at 2.7% vs exp 2.4% from prev 2.2%.

Yesterday we wrote about the difficulty in betting against the pound as the UK economy shows signs of turning higher. The strength was on full display Tuesday; after the pair slipped to 1.6400, it shot to a one-week high of 1.6485 without any meaningful fundamental underpinning.

Overall US trading was stifled by a snowstorm but the main headlines came from the IMF, which hiked US, UK, Japanese and global growth forecasts. The moves were foreshadowed and had little market impact but underscores rising economic sentiment.

One group who will have to measure the changes in sentiment is the BOJ which ends a two-day meeting today around 0400 GMT. The focus is on how officials will cushion the effect of the sales tax increase scheduled for April. Some believe the BOJ could add stimulus as soon as February. One way to signal that would be to lower the inflation forecast, which is currently at 1.3% for FY2014 and 1.9% for FY2015.

Prior to the BOJ, the focus will be on the Australia dollar, which hasn't broken down the way some analysts anticipated after hitting a three-year low on Friday. One reason is anticipation of Australian inflation data, which is only released every three months.

Rate cuts will also be the focus of the Bank of Canada decision on Wednesday with many marketwatchers predicting the BOC will shift to an explicit easing bias. If they don't it's likely because more optimism about the US economy or a rise in inflation projections due to the softer Canadian dollar. If there's no meaningful shift in rhetoric, look for a retracement in USD/CAD as the crowded long trade thins out.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.8% | 0.5% | 1.2% | Jan 22 0:30 |

| Trimmed Mean CPI (q/q) | |||

| 0.9% | 0.6% | 0.7% | Jan 22 0:30 |

| Weighted mean CPI (q/q) | |||

| 0.9% | 0.6% | 0.6% | Jan 22 0:30 |

| CPI (y/y) | |||

| 2.7% | 2.5% | 2.2% | Jan 22 0:30 |

| Trimmed Mean CPI (y/y) | |||

| 2.6% | 2.3% | 2.3% | Jan 22 0:30 |

| Weighted mean CPI (y/y) | |||

| 2.6% | 2.3% | 2.4% | Jan 22 0:30 |

| CPI Index Number | |||

| 104.80 | 104.00 | Jan 22 0:30 | |

| BoC Interest Rate Decision | |||

| 1% | 1% | Jan 22 15:00 | |

| BoC Rate Statement | |||

| Jan 22 15:00 | |||

| BoJ Interest Rate Decision | |||

| 0.1% | Jan 22 3:00 | ||

21-year Intermarket Charts - 7 indices 11 currencies 14 commodities

The only interactive charting of its kind on global markets to give traders, analysts and market buffs a strong grasp of multi-market patterns in order to understand the past and help anticipate future moves.

-Which currency had the longest period of outperformance? -What is the “January Effect” in currencies and what it means for 2014? -What did USD, JPY and GBP have in common in their relation with gold? -How did the two oil-based currencies (CAD & NOK) perform against each other over the last 21 years? -Which agricultural commodity rallied for the most of number of years -Which index advanced by the most prior to the housing crash (1993-2007)?

Interactive charting by market, instrument and chronological order. CLICK HERE FOR MORE

Kiwi CPI Raises Rate Hike Odds

A US holiday kept a lid on trading to start the week so we take a look at the upcoming calendar. The Australian dollar was the top performer in light trading while the US dollar lagged. NZ Q4 CPI rose 0.1% vs expectations of -0.1%. The y/y rate showed a 1.6% rise, vs the expeced 1.5%.

SKY reported that the IMF will raise its growth forecast for the UK to a healthy 2.4% for this year. The pound has tracked mildly lower since the start of the year but the persistent strength in economic data makes it risky to bet against the pound. Rightmove housing data to begin the week underscored the point with home price gains accelerating to 6.3% y/y from 5.4% in Dec. UK jobless claims, the ILO unemployment rate and the BOE minutes are due this week so risks abound.

The US calendar is very light this week so the focus will remain on earnings. So far, the pattern has been a slump at retailers. Market watchers are questioning whether it's a sign of a slower economy or a shift to online sales.

Another factor to watch is investment. A major theme for 2014 is a pickup in corporate spending, something that can create a virtuous circle of economic growth but on Friday chip making giant Intel announced it will layoff about 5% of its workforce.

Barring a surprisingly soft drop, it's difficult to envision how the numbers could spark a move in the kiwi. Overall, the soft price growth in a strong economy like New Zealand shows the significance of disinflationary forces in the global economy.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| CPI (q/q) | |||

| 0.1% | -0.1% | 0.9% | Jan 20 21:45 |

| CPI (y/y) | |||

| 1.6% | 1.5% | 1.4% | Jan 20 21:45 |

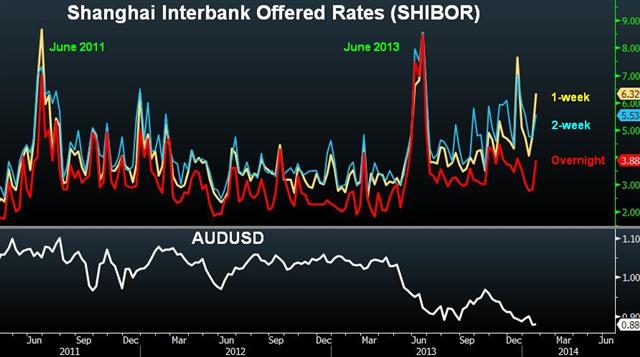

China's Shadow Banking & those Higher Rates

Seven months after we wrote about the Shanghai Interbank Offered Rate (SHIBOR) hitting 6-year highs, rates are it again as China's shadow banking struggles to meet the rush or new credit. See charts & full analysis

EUR Breaks 100dma, CAD Shorts Climb

The euro closed below the 100-day moving average on Friday for the first time since September as a banking rumour proved true. The US dollar was the top performer last week while the Australian dollar lagged. Chinese GDP numbers are due early in the week after officials warned about liquidity.

The euro opens the new week slightly lower as the yen gains broadly. The Chinese central bank urged commercial lenders to strengthen liquidity management and set a reasonable pace on lending in a magazine article. Money market rates jumped last week and Chinese New Year holidays could add further demand for liquidity.

In the immediate term the focus will be on GDP, industrial production and retail sales data due out at 0200 GMT. The pace of fourth quarter growth is expected to be at 7.7% with production rising 9.8% yy and retail sales up 13.6% y/y.

A series of rumors on Friday weighed on the euro. The two main ones were a German sovereign downgrade but that proved to be untrue. The second rumour was trouble at Deutsche Bank and that one proved to be true as they pre-announced a 1.15B euro loss for Q4 on the weekend.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +. EUR +7K vs +14K prior JPY -120K vs -129K prior GBP +11K vs +18K prior AUD -51K vs -57K prior CAD -67K vs -61K prior CHF -3K vs +5K prior

The bout of risk aversion after non-farm payrolls shook a few traders out but once again the bulk of traders showed a firm hand. The awful Australian jobs report came after the data was published but neither AUD nor CAD positions are at dangerous levels.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Industrial Production (DEC) (y/y) | |||

| 9.8% | 10.0% | Jan 20 2:00 | |

| Retail Sales (DEC) (y/y) | |||

| 13.6% | 13.7% | Jan 20 2:00 | |