Intraday Market Thoughts Archives

Displaying results for week of Apr 19, 2020Bouncing Appetite after Gilead Flub

Risk risk appetite re-emerges on a combination of US Covid-19 infections hitting their slowest pace in three weeks, China reporting no deaths for the ninth day and the announcement from the US House of Representatives passing a $484 billion package to aid small businesses and hospitals. The news helped offset a selloff late Thursday following an FT report indicating that Gilead's Remdesivir drug hadn't been helpful in a Chinese study on the virus. Our Dow30 trade was stopped out, leaving 5 trades open.

Weak UK retail sales (-5%) and poor US durable goods figures (-14) earlier were shrugged by indices.

A series of soft Eurozone PMIs were capped by an indecisive European summit in a combination that weighed on the euro. The eurozone services PMI was just 11.7 compared to 22.8 expected and you would hope that would send a strong message to European leaders that more needs to be done. If ever there was time for fast action, it's now. The eurozone structure is so slow-moving that another summit ended with positive words and no action. There's talk it could take until 2021 until there's a broad eurozone relief package.

EURUSD remains somewhat buffered by broad US dollar weakness, attempting to hammer out a positive candle after 4 straight daily declines. Also not a potential double top on the daily USDX.

Video Open to Everyone

Many English speakers visiting my website asked why do Arabic speakers get so many free videos. So how about a Ramadan gift to non-Arabic speakers? I am opening access to today's Premium Video for everyone to watch & hopefully benefit. Good luck. Full Video

حاملات النفط و الأداء في القطاع النسبي للنفط

أشرف العايدي المدير التنفيذي لشركة انترماركت استراتيجي، يشير إلى أن القطاعات التي تصيبها أزمات، تحتاج عادة ما بين 5 إلى 6 سنوات لتعود وتنتعش مجددا، ضاربة المثال بفقاعة قطاع التكنولوجيا في 2001 وأزمة البنوك في عام 2008، متوقعاً أن يتكرر السيناريو نفسه في القطاع النفطي. المقابلة الكاملة

Skewed or Realistic Perspective?

There is a heavy slate of economic data in the day ahead and that may offer a clearer picture of the real pain from the virus. Markets look to the 5th release of Covid-19-era jobless claims, set to produce a total of +22 mln in the US.The Australian dollar was the top performer Wednesday while the euro lagged on speculation about a larger QE program. There are currently 6 Premium trades, 1 in the red, 1 flat and 3 in the green.

توسع صفقات المحفظة (فيديو المشتركين)

Perspective is a fluid item and it's always skewed by the person delivering it. What COVID-19 has done has divided the working world into two camps: Those who have lost their jobs and those who haven't.

The problem with perspective is that nearly all the voices we hear: newscasters, economists, market participants, scientists and politicians haven't lost their jobs. That's created an echo chamber in financial markets that makes it easy to suspend disbelief in the pain of the unemployed employed world.

What about the third class of workers? Those in suddenly-precarious jobs. That uncertainty mixed with the fear of the virus is a powerful force and nearly impossible to understand but we suspect it's underestimated. We mention this ahead of the 5th release of Covid-19-era jobless claims from the US, set to produce a cumulative total topping 22 million.

Eventually the data will tell the story. Some measure of short-term pain is priced in but long-term changes are extremely difficult to forecast. The day ahead features a few data points that will begin to clarify a murky picture starting at 0600 GMT with German GfK consumer confidence. That's followed by Markit manufacturing and services surveys for France, German, the UK and USA.

At 1230 GMT, the weekly US initial jobless claims report will be another reminder of the staggering job losses from the virus. The consensus is for another 4.5m losses, following 5.245m a week ago.

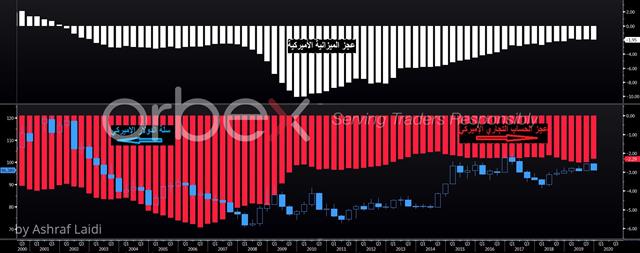

خمسة أسئلة عن مصير النفط

هناك العديد من الأسئلة حول الكآبة التاريخية في أسعار النفط. سنحاول هنا الإجابة على خمسة منها. ما مدى سوء حالة المعروض؟ ما سبب صعوبات تخفيض الإنتاج الأميركي؟ الميزانيات أم الأرباح؟ من الفائز الأكبر؟ ما هو التأثير على الدولار الأمريكي؟ التحليل الكامل

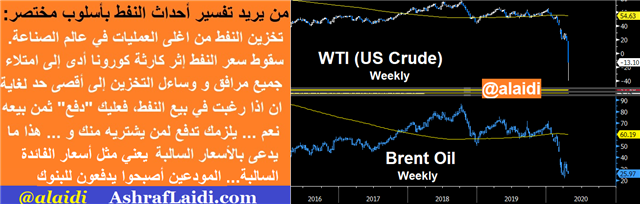

Oil Implodes, Currencies Next?

The June oil futures contract for WTI closed above $11 today from a low of $7, one day after the May contract collapsed to an unprecedented negative $40.30. As for Brent oil, it hit an 18-year low of $17.51. Questions arise whether Brent will find the same fate as WTI, despite less challenging geographical considerations regarding its supplies. The difference from yesterday is that US indices began to feel the hit from oil, falling 3% across the board. A story that fell through the cracks was the RBNZ leader saying he was open to debt monetization. The big question right now is whether central banks and governments can counteract the demand shock. US coronavirus deaths topped 45k on Tuesday, doubling in a little over a week as total cases exceeded 800k. A 6th trade for the Premium Insights subscribers was posted issued with 3 supporting charts and notes. All 6 existing trades are currently in the green (please make sure to refresh the trades matrix)

Ashraf's tweet above give an idea about not only Trump's attempts to use bailout money to assist the oil industry (a big no-no among Democrats), but also some Senators' early efforts to force Beijing into importing more US oil.

We have warned repeatedly for weeks here and here that supply of crude outstrips demand and, unlike some other commodities, crude is very difficult to transport and store. That means excess oil is a nuisance and you can find yourself in a position where you need to pay someone to take it away.

Even knowing all that, a plunge to -$40 is beyond shocking. A few cents negative would have been understandable, but this was a sign of leveraged longs forced to liquidate in an illiquid market. The drop extended further out into crude on Tuesday and June crude fell to $6.50 as the USO ETF tried to pare down holdings that exceeded 30% of open interest at the start of the day.

Can central banks and governments can counteract the demand shock?

Stimulus sums right now are astronomical and on Tuesday the US Senate passed another $500B bill with the President saying that even more is in the works.It's the same story everywhere and no one is even offering a pretense at how it will be paid back. On Tuesday the RBNZ said out loud two words we once thought we would never hear: “debt monetization”. He said he was open minded on directly monetizing debt.The reality is that there is no other way out of the fiscal holes that governments are digging, it's more a matter of the mechanics of it. But however it's done it's undoubtedly good for hard assets and precious metals.

USD bulls may see less reasons for concern if oil's implosion means prolonged deflationary powers. And if deflation does become a problem, would it be a fear factor for gold? Is thet even possible when desperate central banks are monetizing governments' debt?

Oil Hit -37 as Oil Tourists Targeted

And it finally happened. US oil prices crashed below zero for the first time in history as plummeting demand alongside insufficient supply cuts sent storage costs soaring. The result: Oil sellers had to pay buyers to unload US fuel, sending WTI to -$37.63, from $18.30 on Friday. A new trade for the Premium Insights was issued earlier today.

One of the side-effects of the virus shutdowns are the number of people who are trading. Volumes are skyrocketing and they're also being concentrated in a small number of assets, often hyped on online message boards. Much of the new money is chasing volatility and in the past few weeks they've discovered it in oil.

A week ago -- after the OPEC+ agreement, we warned here and here that the market was still far too oversupplied. WTI futures opened 8% higher in a move that lasted mere minutes as real money swamped it and crude finished down 25% on the week. The reality is that supply continues to far exceed demand.

Yet retail traders have for some reason convinced themselves that crude will rise, probably because of a sharply higher forward curve. The front month is at $20 but it's at $35 six months out; perhaps they think that's an easy trade. The reality is that the negative roll in oil ETFs is devastating.

Whatever the reason, investors are piling into oil ETFs unlike ever before. The open interest in USO is up to nearly 900 million shares compared to around 120 million normally. The ETF owns a full 27% of the open interest in June WTI futures. The fund has realized it now has a problem and changed its mandate on Friday invest 20% of funds in second-month futures.

Moreover, we fear the same money sloshing around in hot tech stocks is skewing the market. That will be especially prevalent in a huge week of earnings that starts Monday with IBM but also includes Netflex (Tues), Tesla (Wed), Amazon (Thurs) and American Express (Friday) among many others.