Intraday Market Thoughts Archives

Displaying results for week of Sep 19, 2021Yields Make a Break

The overall price action Thursday was an old-fashioned risk trade with yields, stocks and commodities moving higher together while low-yielding FX dropped. More recently, stocks have moved in the opposite direction of yields so we'll be watching carefully to see if this paradigm holds. Eventually, higher yields will spook stocks but probably not until 1.6-1.7% in 10-years, at the very least.

In terms of economic data, it continues to show ongoing signs of recovery, but at a slower pace. Initial jobless claims rose to 351K from 332K. The Markit services PMI fell to 54.4 from 55.1. It also showed further rises in prices pressures and that's a theme that will undoubtedly return, especially with the ongoing climb in energy prices and rents. There's no sign of any improvement in supply chain bottlenecks and a report from Flexport said 20% of all pacific cargo ships are anchored outside of ports – many in LA or Shanghai – waiting to unload.

At the same time, the market has clearly moved on from Evergrande so those fears are fading. We'll continue to watch China closely for signs of stimulus or a GDP-slowing push for 'common prosperity'.

The bond market now though is signaling a change of theme. The rise in 10-year yields breaks a quadruple top at 1.38% and it settled well above that at 1.426%.

Friday's US calendar is light with only US new home sales, which are forecast at 700K, a slight dip from 708K.See you in Dubai نراكم في دبي

FOMC Consistent with Jackson Hole

The FOMC upped its hawkish message on Wednesday, but the market reaction was mixed in with developments on Evergrande. There is an explanation in the final paragraph on why FX held and indices held up despite seemingly hawkish twist. GBP is up after the BoE showed more optimism in its statement/minutes. The Canadian dollar is the top performer while the yen lagged on the day. Canadian retail sales fell by less than expected and US jobless claims edged up rose to 351K, a little more than expected. A new Premium FX trade was issued ahead of yesterday's FOMC statement. Below is some of our analysis on the Fed's new dot plot, Powell's presser and market reaction.

Wednesday's risk tone grew more positive after Evergrade said it would make an interest payment due this week. A report in AsiaMarkets also said that a bailout is coming. Finally, comments from the RBA's Debelle along with Powell hinted at a conversations with Chinese counterparts and a confidence that problems won't spread.

Understandably, some market participants may not have wanted to react to the China news until after the Fed. The FOMC statement itself was neutral but the 2022 dots moved to show a 9-9 even split on hiking in 2022. All but one dot (from 5) now show at least one hike in 2023 with the trajectory also moving higher.

In his press conference, Powell was surprisingly candid on a taper, saying he expects to support it so long as the September non-farm payrolls report is 'decent'. He also outlined that the taper would be completed around the middle of next year, so long as the economy matched Fed expectations.

All this was more hawkish than anticipated but dollar strength was mild. In bonds we saw the 'policy error' trade kick off again with the long end rallying, pushing down 30-year yields by 5 bps.

Stocks remained comfortable though and that may underscore the push and pull between the Fed and Evergrande.

Ashraf reminds us in this video from 4 weeks ago why the taper will not be poorly received by the markets, in 10:22 mins part of this video.

Video on the Dot Plot فيديو قبل الفدرالي

What to look for in the Dot Plot? ما هواهم جزء من اعلان الفدرالي

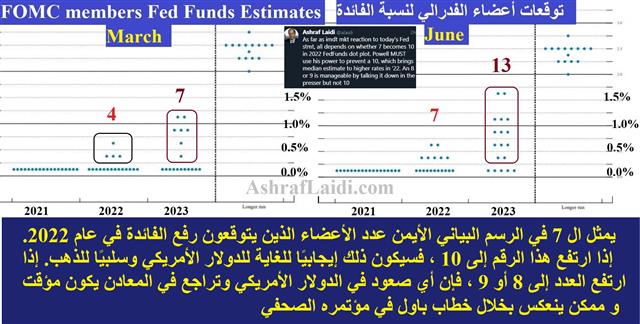

Will 7 Change to 10? Watch out

In reviewing the July 28 FOMC statement and comments from the core of the Fed, it's clear that top officials feel like they don't need to be rushed into pre-committing to a taper. Through their collective comments, the consensus has settled around a Nov/Dec taper announcement, likely in $20B increments.

Powell said at Jackson Hole, cryptically that at the July meeting he thought it could be appropriate to start taper this year. Since then, he said, there has been more progress on employment but also the further spread of the delta variant.

The wording of his comments were somewhat ambiguous and he may see benefits in maintaining that, especially since fresh China growth worries have replaced delta fears, adding a new risk.

The alternative is that Powell and the FOMC would want to strongly pre-commit to a Nov/Dec timeline so as to give the market the ample warning that he's often touted. Given where expectations are, I'm not sure an explicit commitment is necessary, especially because some unforeseen turmoil could force them into a credibility-sapping climbdown.

In practical terms, there's no need to change the language of the FOMC statement. A tweak to this sentence in the second-to-last paragraph is probably sufficient: “Since then, the economy has made progress toward these goals, and the Committee will continue to assess progress in coming meetings.”

That kind of tweak should be largely market neutral but there may be some USD selling as those expecting an explicit taper signal clear out. In his press conference, he could channel Williams who said that assuming the economy continues to improve as anticipated, it could be appropriate to start reducing the pace of asset purchases this year

Like in June, the dot plot may dominate the market reaction. Recall that 7 of 18 members forecast a 2022 rate hike. If just three more shift, that would put the median into 2022. This will also feature the first publication of 2024 dots and they'll offer the first solid hint at how aggressive Fed members plan to be once the hiking begins.Trudeau Holds On, Gold Steadies

Trudeau will remain Prime Minister with a third term but won't have a strengthened mandate. Still, he will have some latitude to reshape the post-pandemic era. Any major pushes towards tax or capital gains reforms remain opaque, but the left-wing NDP said taxing the wealthy more heavily is their top priority if Liberals want their support.

Overall, it will go down as a needless election where Trudeau spent hard-won political capital gained in the vaccine rollout and NAFTA negotiations while getting nothing in return.

History has shown Canadian elections are hardly a factor for the loonie and this was no different as it's outperformed AUD and NZD by 30 pips in the aftermath; most of which is likely due to a bounce in oil prices.

The broader scenario for CAD and markets in general is the uncertainty around China and Evergrande. China's opaque system is ripe for rumors and we've entered a period where markets are especially prone to speculation/volatility. That's a dangerous mix that will keep volatility elevated.

Looking ahead, the strong finish in US equities has stabilized global markets with Hong Kong trading only slightly lower and yields edging up. Some of that is undoubtedly predicated on a more-cautious Fed and the potential for an LPR cut from the PBOC.The Wrong Question on Evergrande

China's second-largest property developer remains in dire straights as the company's bonds trade at extremely distressed levels. There were weekend reports of offers to give investors property in exchange for debt and that employees were told to help fund the company or forfeit bonuses.

The company is undoubtedly in a death spiral. Even if it can find a way out of this, its brand is forever tarnished and that will make raising further funds impossible.

The question everyone is asking is whether this will be China's Lehman Brothers moment; a large firm failing and threatening to bring down the financial system.

That's the wrong question because there's ample evidence that Evergrande isn't the problem, but rather a symptom of a change in philosophy in Chinese leadership. There was a time in China's recent development it would never have let the problems get anywhere near as bad as they are. More importantly, it comes at the same time as cultural crackdowns, censorship, seemingly-targeted attacks on rich tycoons like Jack Ma and official talk of a fresh policy on 'common prosperity'.

So while some well-informed people have convincingly argued that Evergrande doesn't pose systemic risks alone, we fear that China is showing signs of a shift to a new paradigm; one where GDP growth isn't its north star. The inevitable conclusion is slower growth domestically and globally.

Of course, it's all still in flux but we note that all three of the most-read stories on Bloomberg this weekend were about Evergrande. We've been writing about Chinese risks for a month but they're finally now on top of the market's consciousness. Expect it to remain that way through year end.