Intraday Market Thoughts Archives

Displaying results for week of Oct 02, 2016اشرف العايدي على سي أن بي سي العربية

Pound's 6% Flash Crash

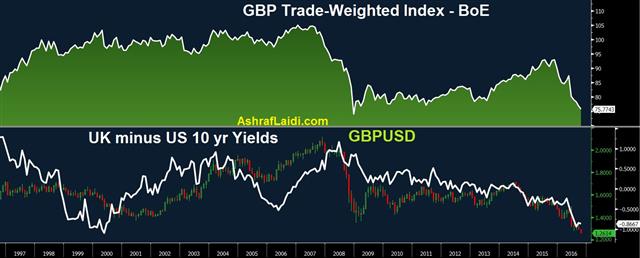

Sterling collapsed by 6% in less than 5 minutes at 19:07 Eastern Time (0:07 London) on a combination of renewed reports of Hard Brexit demand by French president Francois Hollande and thin liquidity in early Friday Asia hours ahead of the much anticipated US jobs report. The Financial Times reported that Hollande said at a dinner in Paris that the EU should approach the UK's decision to leave the EU with “firmness”, adding that there “…must be a threat, there must be a risk, there must be a price”. Ashraf's interview with CNBC on GBP's plunge.

Hollande's statements followed remarks by German Chancellor Angela Merkel in urging European business leaders to be firm during Brexit negotiations with British counterparts so as not to compromise single market principles of freedom of movement. On the UK front, reports that PM May's Wednesday speech alluding to the negative implications of low interest rates raised speculation that she is at odds with the Bank of England's policy of ultra-low interest rates. Expectations that WhiteHall could shift away from monetary policy to looser fiscal policy escalated after her May's policy chief referred to the use of large infrastructure spending at the December Budget statement.

While we do not rule out the possibility of a human (Fat Finger) error in amplifying sterling's sharp slide, we do not consider it to be the only reason. We grew accustomed over the past 6 weeks with sterling's reaction to increasingly frequent weekend reports that EU officials would want to expedite negotiations with the UK regarding Brexit. The most recent trigger to GBP selling emerged on Sunday following PM May's decision to launch Article 50 in March. A Hard Exit would reduce the likelihood of any sweet deals to the UK, including the rising possibility that banks based in the UK would no longer retain the privilege of “passporting”, enabling them to do business in Europe.

GBPUSD fell to as low as $1.1841 from $1.2600, while one electronic trading platform reportedly recorded $1.1378. Whether $1.30 becomes the new “Hard Resistance” remains to be seen. We added a new trade following GBP's slide to the Premium Insights as we near the US jobs report.

GBP call on CNBC - June 27, 2016

GBP call on Bloomberg - July 11, 2016

| Act | Exp | Prev | GMT |

|---|---|---|---|

| FOMC's Mester Speaks | |||

| Oct 07 16:45 | |||

| FOMC's George Speaks | |||

| Oct 07 19:00 | |||

| France Gov Budget Balance | |||

| -80.8B | Oct 07 6:45 | ||

Dollar Breaking Out?

The USD dollar march continued on Thursday as it broke critical levels as economic data continues to improve. USD was the top performer while the pound sterling lagged yet again. Japanese labor cash earnings are due up later. Has it really broken? Or is this Dec 2015, Jan 2016 or Jul 2016? A new Premium tradd will be released shortly before the US jobs report.

The good news kept coming for the US dollar on Thursday as initial jobless claims fell to the lowest since April at 249K compared to 256K expected. The four-week moving average is now at the lowest since 1973 in what will look like a flashing red signal on wage inflation to the Fed hawks.

The buck climbed on all fronts with USD/JPY breaking above the 100-day moving average and touching 104.16 at the high. It was the eighth day of gains for the pair.

Similarly, cable continues to get beat up as it extended the break below the Brexit lows and down to 1.2601. The big figure is holding the line so far but it's basically unchartered territory for the pair as it plumbs the 31-year lows.

Technically, the US dollar is making some serious strides. It took out the 200-day moving average against the Swiss franc and Canadian dollar. The New Zealand dollar also fell below the 100-dma.

Gold fell below the 200-dma and is battling support in the 1250 zone which is the combination of the late-June low and the 38.2% retracement of the rally since December.

What's keeping the dollar bid? One is a growing sense that no matter who wins the election, a dose of fiscal stimulus is coming. The data is also solid and Friday's non-farm payrolls report may raise the probability of a hike.

Finally, the euro slid after the ECB's Constancio categorically denied this week's report about ECB tapering. The euro fell a half and is now near the Sept lows. Watch for comments from Draghi on the weekend.

On the upcoming calendar are releases from Australia and Japan. Up first at 2230 GMT, it's the Australian AiG performance of construction index. The prior reading was 46.6. It's unlikely to be a market mover but we keep a close eye on the sensitive construction industry for any surprises.

At 0000 GMT, the focus shifts to Japan and the August labor cash earnings report. The consensus is for a +0.4% y/y rise following the +1.4% y/y climb in July. The drop in the pace is another sign of the seemingly impossible challenges faced by the BOJ.

Looking to next week, note that China returns after Golden Week celebrations. Perhaps that will spark a bid in gold as it flirts with key support near $1250.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Labor Cash Earnings (y/y) | |||

| 0.5% | 1.2% | Oct 07 0:00 | |

| AIG Construction Index | |||

| 51.4 | 46.6 | Oct 06 22:30 | |

اشرف العايدي على قناة العربية

USD/JPY Nears 100-DMA

A strong ISM non-manufacturing index put a fresh focus on the November FOMC meeting as a hike possibility. The Swiss franc was the top performer one what looks like it could have been soft intervention while the yen lagged. Australian trade balance is due up next. A new action has been released with a charts note on our existing gold trade for Premium members.

فيديو للمشتركين: "ما بين تقاطع الذهب و الدولار؟" -- الصفقات الحالية و المتوقعة

The ISM non-manufacturing index rose to the best level since April as it rose to 57.0 compared to 53.0 expected. The employment component was especially encouraging as it rose to 57.2 from 50.7. The one-month jump was the most since 1997. The US dollar rallied in the aftermath, especially USD/JPY. The pair broke above the downtrend since Jan yesterday and continued above the Aug high and is now testing the 100-day moving average at 103.76. That will be critical in the day ahead.

The not-so-good news on jobs was in the ADP employment report, which was at the lowest since April. Private jobs were at 154K compared to 165K expected.

In the grand scheme of things, that's a minor miss and jobs are still strong enough to please the Fed. Given the economic strength, there are fresh questions about a November Fed hike. The market is pricing in a 23.6% chance of the Fed moving 6 days before the election.

Making a move so close to the voting date would prove once-and-for-all that the Fed isn't motivated by politics but it could monumentally backfire if it roils markets and affects the outcome.

Oil also continued higher in the sixth day of gains. The catalyst was the weekly storage data as it showed a fifth straight surprise draw. We wonder whether recent changes in some data collection and recognition from the EIA are a factor but also note that it's usually at this time of year that stockpiles bottom. So far $50 is capping WTI gains.

Looking ahead, the focus is on Australia in the day ahead and the August trade balance report. The consensus in the 0030 GMT report is for a A$2300m deficit. It would take a miss of 400m or more to jar the market.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Trade Balance | |||

| -2.32B | -2.41B | Oct 06 0:30 | |

| ADP Employment Change | |||

| 154K | 166K | 175K | Oct 05 12:15 |

ECB Taper on Table, Gold off it

A report that the ECB is considering taper bond purchases sparked a round of confusion in euro trading Tuesday. The US dollar was the top performer in a volatile session while the yen lagged. New 31-year lows in GBPUSD and gold breaking below 1300 were the other big stories of the day. Japan's services PMI from Nikkei is due up later along with Australian retail sales. Last night's Premium Insights pre-RBA trade has been filled as it nears the Aussie retail sales.

The ECB is thinking about tapering bond purchases, according to a Bloomberg report. The question is: when?

The euro jumped nearly a cent on the initial headlines on the impression that the tapering could start in 10 million euro increments as soon as December. Later, the gains were halved on the idea that the ECB is more talking about theoretically tapering when the time is right.

The story itself seems to swing both ways. They highlight that the ECB is running out of assets to buy (true) and wants to put pressure on governments to reform (true) but don't explicitly say when the ECB might consider tapering.

Naturally, the ECB denied it but even the denial only went half-way. They said the ECB didn't discuss tapering at the Governing Council meeting. But the Bloomberg story stated that tapering was later discussed. The market remains skeptical, but tapering now (and maintaining the size of the balance sheet) would fit in with the more-optimistic tone from the ECB. Anyone who watched the last 2 ECB press conferences would notice that Draghi's message is "we've done enough & it's time for the national governments to fill the slack". Extending the duration of asset purchases beyond March 2017 is the most that the ECB could do. Expanding the size of the program was considered unsustainable due to the issue of scarcity. After today's taper story, QE expansion is pretty much out of the question.

Aside from the ECB story, markets were volatile on Tuesday and the US dollar caught a strong bid against the yen and commodity currencies despite another rally in oil prices. Bonds and stocks sold off at the same time.

The dollar gains came in spite of the IMF lowering its US growth forecast this year to 1.6% from 2.2%. USD has shown time and again that it's tough to hold down. USD/JPY broke above the downtrend since May and is approaching the 100-day moving average at 103.76.The yen may react later to the Nikkei services PMI at 0030 GMT. The prior reading was 49.6.

The more-important release is Australian August retail sales at 0030 GMT. The RBA held yesterday but it didn't add much to AUD/USD. The consensus is +0.2% m/m.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Final Services PMI [F] | |||

| 51.9 | 51.9 | Oct 05 13:45 | |

| ISM Non-Manufacturing PMI | |||

| 53.1 | 51.4 | Oct 05 14:00 | |

| Eurozone Spanish Services PMI | |||

| 54.8 | 56.0 | Oct 05 7:15 | |

| Eurozone Final Services PMI [F] | |||

| 52.1 | 52.1 | Oct 05 8:00 | |

| Retail Sales (m/m) | |||

| 0.2% | 0.0% | Oct 05 0:30 | |

| Eurozone Retail Sales (m/m) | |||

| -0.1% | 1.1% | Oct 05 9:00 | |

سجل لويبينار الغد قبيل تقرير الوظائف

Cable at 30-Year Low, RBA Next

Fears of month-end flows as the drivers of last week's moves dissipated as they continued at the start of the new week and month. CAD and AUD were the top performers while the pound lagged badly. The RBA decision is due up next. The Premium GBPUSD short was closed at 1.3045 for a 245-pip gain. A new separate trade has just been posted ahead of the RBA decision. The Premium video will be uploaded momentarily after this post.

The Brexit talk from Theresa May continued to drag down cable on Monday and it finished 130 pips lower on the day. Importantly, the sellers broke below the August low and the pair closed at the worst level since 1985. All the remains now in terms of support is the July intraday low of 1.2798 and it's less than a half-cent away. Expect stops if and when it's broken.

In terms of economic data to start the week, it was mixed. The ISM manufacturing index was at 51.3 compared to 50.3 expected. On the downside, August construction was at -0.7% compared to +0.3% along with a downward revision to July data.

The construction spending number led to negative revision to Q3 GDP estimates in another sign that 2016 may be the worst year for US growth since 2009. Add in the election uncertainty and potential for market turmoil in the aftermath and the chance of a Fed hike before year-end dwindles.

Still, the market is finding it difficult to get away from the US dollar. At the moment, the idea both candidates and parties will increase spending is gaining traction. That helped to push up Treasury yields Monday and underpinned a modest dollar bid in New York trading.

The RBA decision is next on the calendar at 0330 GMT. None of the 28 economists surveyed by Bloomberg foresee a move in rates and the market is pricing in just a 3% chance of a cut. Instead the focus is on the Nov and Dec meetings when there is a roughly 25% chance of lower rates priced in. The risk is that Lowe offers a less-dovish tone. His comments in Parliament suggest more of a focus on macroprudential policies rather than rate cuts. If that's confirmed, AUD could get a boost in the hours and days ahead.

| Act | Exp | Prev | GMT |

|---|---|---|---|

| AIG Performance of Manufacturing | |||

| 49.8 | 46.9 | Oct 02 22:30 | |

مقابلتي مع سي ان بي سي العربية

أهم أحداث الأسبوع في الأسواق

بالإضافة إلى بيانات الوظائف الأميركية و الكندية يوم الجمعة القادم، قرار المركزي الأسترالي و مبيعات التجزئة الأسترالية ستصدر في منتصف الأسبوع. و نتوقع الإسترليني ستتأثر من مؤشرات القطاع الخدمات و الصناعي. لمعرفة اليوم والتوقيت لكل هذه الأحداث، الرجاء مشاهدة الرابط/الفيديو

May Sets Day For Brexit, Tankan next

The pound fell in early trading after May confirmed rumors that Article 50 will be invoked in Q1 2016. The Canadian dollar was the top performer last week, while the yen lagged. The Japanese Tankan is due next. UK PM May confirmed told the BBC that she will invoke the clause to leave the EU by the end of March and strongly re-committed to leaving the union. The pound opened down 70 pips on the news to touch 1.2903. A new trade was issued a on Friday afternoon and accompanying 10-minute video was posted to back it up. Our sterling short remains in progress.

That was perhaps an overreaction. Last month, the EU's Tusk relayed that May told him it would be invoked early in the year and similar chatter has spilled out of Parliament.

If anything, the large market reaction emphasizes the lack of buyers for the pound. The Q1 confirmation from the PM herself is negative news but the depth of the selling underscores the sentiment on the pound at the moment. It's even further shown by the large jump in speculative GBP shorts in the CFTC report.

Another currency that has struggled lately is the Canadian dollar. It touched a five month low last Monday then bounced 150 pips to close out the week. That recovery may sound good but consider the outstanding string of good news for CAD in that time: Oil rallied 5%; Canadian GDP was at 1.3% in July vs 1.0% exp; the S&P 500 recovered to finish the week higher; Trump struggled, suggesting fewer NAFTA risks.

We can't rule out that quarter-end flows suppressed the loonie last week (and skewed other markets), so we will be watching closely in the days ahead.

On the calendar, look for early-week moves in the yen. An Abe advisor essentially confirmed that Kuroda will be turfed in 19 months at the end of his term. That may just be politics and an effort to make him a scapegoat for the failures of Abenomics but it adds some uncertainty to what his predecessor's playbook will be.

In the short-term, the closely-watched Tankan survey for Q3 is due at 2350 GMT. The consensus is for a +7 reading for large manufacturers, down from +6 in Q2.

AUD traders should also note that Sydney and Melbourne moved their clocks one hour forward on the weekend.

Commitments of Traders

Speculative net futures trader positions as of the close on Tuesday. Net short denoted by - long by +.EUR -76K vs -85K prior JPY +69K vs +59K prior GBP -88K vs -59K prior CHF -6K vs +8K prior AUD +15K vs +7K prior CAD -12K vs +16K prior NZD -7K vs -8K prior

| Act | Exp | Prev | GMT |

|---|---|---|---|

| Tankan Manufacturing Index | |||

| 7 | 6 | Oct 02 23:50 | |